As Barbour ABI launches its latest monthly Economic & Construction Market Review, Michael Dall presents highlights, including sector and regional statistics with a focus on the residential sector

Economic context

The UK economy continued to improve in February with the three main sectors recording PMI readings of above 50, the level that marks expansionary activity. Revised figures from the Office for National Statistics (ONS) confirmed UK GDP growth in 2013 was 1.8%, down 0.1% from its initial estimate.

The detailed results showed that all three components of the economy improved in 2013 with growth in the dominant service sector 1.9% compared to 1.3% in 2012. Construction grew by 1.3% compared to a decline of 7.5% in 2012. While production declined by 0.3% in 2013, this was not as severe as the 2.5% decline in 2012.

Unemployment was up slightly in the three months to December. However, at 7.2% it is still below the peak level of 8.4% in recent years and expected to fall further in the coming months.

The level of government debt as a percentage of GDP is still significantly higher than pre-recession levels. Public Sector Net Debt now stands at 74.6% of GDP in January 2014, whereas in January 2008 it was 35.7%.

These broad-based improvements in economic performance give confidence that the recovery will be sustained into 2014 and beyond. Other news on the UK economy includes:

- Retail sales in the UK rose by 4.3% in January compared to the previous year;

- The Society of Motor Manufacturers and Traders predicts a boom in car manufacturing in 2014;

- A CIPD survey expects the rate of employment growth to slow in 2014 after its recent rapid increase.

The construction sector’s performance

The latest figures from the ONS show that the construction sector in the UK grew by 1.8% between December 2013 and January 2014.

Comparing output levels with January last year shows an increase of 5.4%. However, the ONS did revise their previous estimate of 0.2% growth in Q4 2013 downwards, to show a decline of 0.2%, meaning the industry lost some of its momentum towards the end of the year. Overall the figures provide further evidence of the improving performance of the industry over the longer term and its impact on wider economic growth.

The housing sector is driving growth within the industry. New private housing increased by 2.3% between December 2013 and January 2014 and 23.4% from the same month in 2013. New public housing was up by 1.4% and 35.2% in the same periods. There was also a sharp increase in the levels of repair and maintenance work in private housing, which increased by 9.6% month on month and 9.4% year on year.

The private commercial sector showed a 2.4% monthly increase but was down by 0.2% on a year earlier. There was also a notable fall in infrastructure between December and January of 2.3% and by 3.2% on January 2013.

The ONS/Barbour ABI New Orders Data for Q4 2013 showed that total order levels increased by 1.5% between Q3 and Q4 2013 but were 4% higher than a year ago. This was almost entirely driven by the housing sector though there were slight increases in the industrial and commercial sectors. This data, combined with the latest ONS output figures, provide a further indication of the improving outlook for the construction sector.

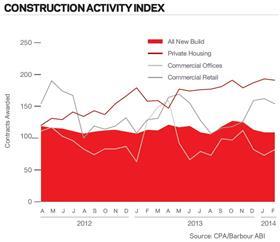

The CPA/Barbour ABI Index, which measures the level of contracts awarded using January 2010 as its base month, recorded a reading of 109 for February supporting the view that activity in the industry remains strong. Private housing was down slightly in February at 191, albeit from a seven-year high in January. The commercial office sector rebounded in February but was still below 2010 levels, while commercial retail was still high, recording a level of 154.

According to Barbour ABI data on all contract activity, February witnessed a fall in construction levels with the value of new contracts awarded at £4.8bn, based on a three-month rolling average. This is a decrease of 13.5% from January but a 15.3% increase on the value recorded in February 2013, an indication of a significant upturn in construction activity in the UK in the past year. The number of construction projects within the UK in February was down 19.2% on last month, but this is 12% higher than February 2013.

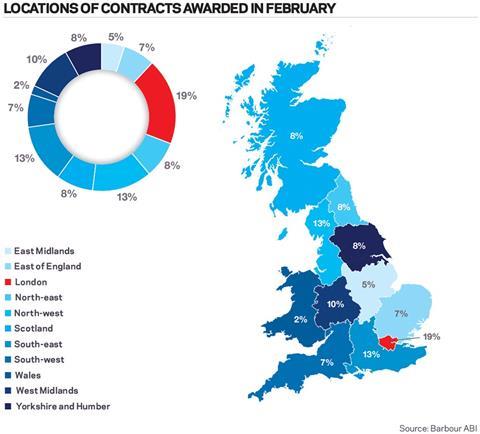

The majority of the contracts awarded in February by value were in London, which accounted for 19% of the UK total. Two major commercial projects in the City of London, the International Press Centre redevelopment and the fit out of the UBS office on Broadgate are the main reasons for this. The South-east was the next most prominent region with the construction of a data centre in Slough accounting for this. The North-west also recorded high levels of activity in February with a waste treatment project in Knowsley and a major residential project in Leigh awarded this month.

Residential had the highest proportion of contracts awarded by value in February with 35% of the total. This demonstrates the continuing strength of the residential sector within the industry. Commercial and retail (16%) and infrastructure (15%) were the next highest sectors this month by value of contracts awarded.

Construction performance by sector

Spotlight on the residential sector

Activity in the residential sector remained strong in February with a total value of contract awards at £1.83bn, based on a three-month rolling average. This is a decrease of 2.3% compared with January but is 72% higher than February 2013, indicating the sharp upturn in activity experienced in the sector over the last 12 months.

Importantly, while the number of units associated with residential contracts awarded increased 1.8% between January and February 2014, based on a three-month rolling average, they were 51.5% higher than February 2013, confirming the scale of the upturn in the market over the last year.

A series of positive news stories demonstrated the continued improvement in the sector’s performance with all the major house builders returning strong results in the past month. The star performer was Barratt Homes, reporting a 162% increase in profit for the six months to the end of December 2013. Bovis and Taylor Wimpey both reported full year profit increases of 39% and Persimmon announced an increase of 49%.

House builders acknowledged these results reflect the role that stimulus packages such as Help to Buy have played in returning such strong numbers, and while the debate continues over these schemes, the evidence of increased profits is strong.

The latest Halifax House Price Index highlighted the extent of the upturn in the housing market, with prices rising by 7.9% since February 2013, the fastest annual increase since October 2007.

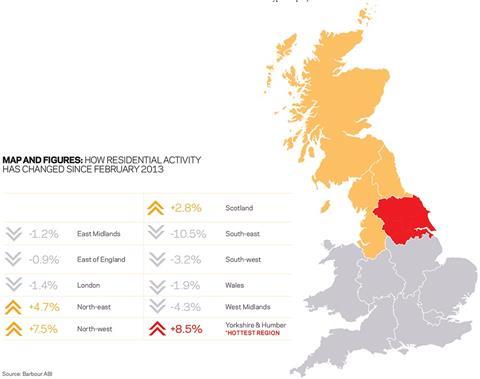

As expected, London is the main location of activity in this sector, accounting for 17.5% of the value of contracts awarded this month, a slight decrease of 1.4% from the same month last year.

The North-west was the other major location of residential development by value in February accounting for 16.1% of contracts awarded, an increase of 7.5% from the same month last year.

The types of projects awarded in the residential sector were dominated by private housing, which accounted for 72% of residential contracts, a 3% increase from the same month last year. Elderly persons/children’s homes was the next most prominent sector accounting for 8% of the contracts awarded, a 2% increase from last year. This was largely attributable to the Earlsdon Park Retirement Village in Coventry which has a contract value of £30m.

Downloads

ECMR MARCH PDF

PDF, Size 0 kb

No comments yet