Forty years of isolation has left Libya desperate for reconstruction and rolling in money. So it’s spending billions on national renewal, and if you’re clever you’ll help it out. Oh, it helps if you like coffee

Colonel Gadaffi knows how to celebrate. This September is the 40th anniversary of the military coup that brought the Libyan leader to power, and to mark the occasion, billions of pounds worth of infrastructure, housing and other construction projects will get under way.

This might appear to be the type of self-aggrandisement one would expect from the world’s longest-serving dictator, but it is also an indication of something more: the long-awaited Libyan construction boom.

Ask most UK construction bosses what they think about Libya and they will tell you they are “looking at it”. It’s easy to see why. If Libya builds even half what is planned, there is enough work to keep many UK firms busy for the next decade. The government has pledged to spend at least $50bn (£33bn) on public works, particularly housing and infrastructure, before 2012. It has $100bn overall earmarked for infrastructure – that’s about seven London Olympics or four Crossrails – and private development is taking off. What’s more, Tripoli’s isolation from the world economy and vast oil reserves means it’s practically unaffected by the global downturn. Oh, and thanks to our part in overthrowing a particularly oppressive Italian regime back in 1948, the Libyans just love the Brits …

Of course, there’s a catch. Libya is not an easy country to do business in. As Philip Warr, founder of surveyor PH Warr, which has just signed its first contracts in the country, says: “People talk of mission fatigue in Libya. They say you don’t fail in Libya, rather you give up.”

So are the rewards worth the effort? Building went to find out how this idiosyncratic market works and how you can crack it.

Land of opportunity

As soon as you hit the ground in Tripoli, Libya’s frenetic capital, the signs of a construction boom – and the need for one – leap out. Tripoli International Airport is a dimly lit, confusing and overstretched place. It is surrounded by cranes as the $3bn project to boost its capacity from 3 million passengers a year to 20 million (see key projects box, below) is already under way. The road into town from the airport passes at least 20 residential tower blocks under construction.

Central Tripoli is a jumble of Italian, Islamic and sixties buildings, almost all in a state of disrepair. Gadaffi looks down on them from billboards all over town, in an array of different outfits and poses – sometimes in military garb, sometimes beaming down in traditional dress and those trademark shades. Beneath the billboards the roads are clogged with traffic; more people own cars in Libya than anywhere else in Africa. There’s no railway or metro anywhere in the country and the traffic is chaotic. Nor is there a postal or sewage treatment system – waste is pumped into the sea. It’s obvious that Libya is crying out for reconstruction.

The first signs that such projects might actually happen came in 2004 when the international embargo was lifted and Libya began opening up to foreign companies and developing an internal private sector. Back then, Building reported that the country was about to start a massive construction programme. We weren’t exactly wrong about that, it’s just that it has been badly delayed. This is partly a result of Libya’s relative lack of experience in procuring and running large projects, a problem the regime tends to exacerbate by replacing those who are failing to make quick enough progress with even less experienced officials. One project manager running a major scheme in Tripoli describes his client as “like a rabbit in the headlights. He’s sitting on billions but hasn’t got a clue what he should be doing with it”.

Unsurprisingly considering the crumbling look of the country, the construction programme covers every sector, from education, housing and healthcare, to bridges, ports and railways, to offices and hotels (see box, below).

Outside the massive public sector, private construction is starting, too. Developers from the UK, UAE, Qatar, Bahrain and Malta are exploring the market and some already have projects under construction. There is immense demand in Tripoli for residential buildings and offices, driven by a 1.5 million population that is growing at 2% a year, rising incomes, the need to renovate dilapidated stock and the influx of international companies and high-earning expats.

Frontier, a research firm with a Libyan office, has found that residential sales and rental prices in the capital increased by 65-70% in 2007/08, rising to 150% in some areas. Meanwhile, office space is vastly undersupplied. With almost no international A-grade stock and less than 100,000m2 of dedicated office tower space, many international companies are renting villas instead. Frontier estimates that at least 400,000m2 of A-grade office tower space will come online between 2010 and 2012.

Breaking in

All this potential work is one thing; winning it is another. Speak to the UK firms that have broken in and one word comes up repeatedly: persistence. Beth Hepworth, research director at Frontier, says: “Face-time is essential here, more than anywhere else in the Middle East. Don’t send emails because Libyans don’t do email. And you have to send your best people.” She adds that some British firms are getting it wrong. “People are coming in too fast and too aggressively – it looks desperate to Libyans so it doesn’t work. Lots of people are making mistakes.”

People talk of mission fatigue in Libya. They say you don’t fail in Libya, rather you give up

Philip Warr, PH Warr

One UK consultant who has worked all over the Middle East and Africa says he believes Libya is the “hardest country to do business in”. Khaldoun Tabari, chief executive of Drake & Scull, which has just launched in Libya, says: “It’s more like Saudi than Dubai. If your only Middle East experience is the UAE, you’re going to struggle here.” This is because business happens slowly, based on relationships, and people are more traditional.

The bidding process is generally less formal than in the UK or UAE. Tabari says: “The bidding process has not been fully defined yet. They have only really been open for business for two years so they are still getting their processes in place.”

Tendering does tend to start with a prequalification process, which will test technical and commercial attributes. After that it is mostly about two things: your fee and whether you hit it off with the client.

Be prepared to come up against corruption, too. The Libyan government claims to be clamping down, but it is still rife. The head of a project management firm who asked not be named says he has been “tested repeatedly” at a couple of the client organisations he’s been dealing with. He has been asked for money in exchange for setting up meetings with senior people and speeding up the process of signing a contract.

With such pitfalls along the way, it is easy to forget that plenty of contracts are being awarded in Libya – and even smaller UK firms can get in on the act. Philip Warr has been flying over on a monthly basis for the past eight months on behalf of his 50-strong firm of surveyors. “It’s been a complete slog, like starting a business from scratch, except harder because you don’t know any clients or how the market works,” he says.

The cost, in staff time, hotels and flights, has been around £200,000 – a big outlay for a £3.3m turnover firm – but Warr now has four deals to show for it, including two hotels and Tripoli Heritage Museum.

Smaller firms can make use of a new service offered by the South East Centre for the Built Environment. SECBE launched an office last month to help companies of roughly 10 to 50 staff win work and negotiate Libyan bureaucracy, from getting visas to paying tax. To become a member of SECBE’s Libya branch costs £13,000.

What you could offer

So what sort of contracts could UK firms go for? John Ellis, SECBE’s business development director for the region, believes opportunities for main contractors are limited. Libya is already packed with them, including firms from Turkey, China and Malaysia. These outfits are already well established, and they have a lower cost base than UK contractors. Ellis says: “It would be tough for UK contractors to come in and compete on price.”

But they could compete in terms of specialist services. Richard Day, Hill International’s project director for the Al Feteh University project, believes that there is an unoccupied niche for firms with expertise in off-site steel fabrication, for example. Ellis adds that contractors with strong expertise in sustainable construction – which is just gaining ground in Libya – and particular sectors, including nuclear, health and aerospace, could also find work.

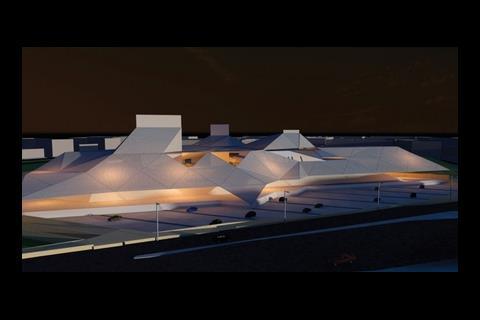

The best opportunities, however, are for consultants of all types: architects, surveyors, engineers, QSs, project and programme managers and environmental advisers. The success some UK consultants are already having in Libya backs this up. For example, Buro Happold is working on plans for Tripoli Greens, the capital’s new government district, as well as eight of the 28 universities that are planned. The firm’s sustainability expertise helped it win Tripoli Greens because it includes an energy farm with renewable elements, water conservation and re-use facilities and waste recycling.

Safety in numbers

Buro Happold does much of its work in Libya as part of the Argus alliance with Arup, Davis Langdon and Keppie Design. Ken Davies, director of Keppie, says: “We formed the consortium because we saw that Libyans would prefer the full package – it was a better sell.”

SECBE is also encouraging firms to team up, as it means there are fewer onerous Libyan contracts to sign and, being new to construction, many Libyan clients would, as Davies says, rather buy an off-the-shelf solution from one or two firms or alliances than create their own package.

It’s more like Saudi than Dubai. If your only Middle East experience is the UAE, you’re going to struggle here

Khaldoun Tabari, Drake & Scull

Accordingly, most projects in Libya are design and build. For example, Hill International is project managing the university programme for client Organisation for the Development of Administrative Centres (ODAC), and Argus has designed its universities up to stage D and is now handing them over to the contractor.

However, there are opportunities to earn more fees once the design-and-build contractors have taken over. Keppie is hoping to continue advising ODAC and Hill on the universities.

But not all firms break into Libya in packs. Cyril Sweett is among those entering the market single-handedly. The firm’s offer in Libya is still something of a one-stop-shop, though. Richard Kingston, the firm’s managing director for the Middle East and North Africa, says: “Offering QSing and project management as a separate service is a hard sell here.” Instead, Cyril Sweett is offering development appraisals, feasibility studies, planning and programming and commercial viability as a single service. Kingston is confident he’ll have a Libya office in the next few weeks.

Whatever your approach to breaking in, by law you will need to do a joint venture with a Libyan company and you will be able to hold up to 65% of the entity. (More details of how to set up a joint venture can be found in an expanded version of this article at www.building.co.uk/middleeast.)

Getting paid

Once you’ve won some work, the good news is that you will get paid. Davies from Keppie says: “Libya is a good place: they pay here.” Once the job going you can probably arrange to be paid in installments. Architects can arrange payments at various design stages.

You can also get between 10% and 30% of your fee upfront from some clients, although others prefer to see some of your work before they make any payment. Davies says Keppie is happy to work on this basis. Also, the advance payment is often placed in a bank account that can’t be accessed without the client’s say so, which does nothing to boost cash flow and can take a long time to set up.

If something does go wrong, there is not much of a dispute resolution system in Libya. A senior member of the community may be called in to arbitrate but Gareth O’Brien, commercial counsellor at the British embassy in Tripoli, says your best bet is to make sure your contract is watertight. “Get a British lawyer and a good Libyan lawyer – we can recommend one – to look over it.” He adds: “There are horror stories of people not getting paid here but it’s no different from the UK.”

You will face other issues though. Expect bureaucracy: a business visa takes six months to come through, for example, and the tax system is complex. You’ll have to pay corporate tax (full details of which can be found at www.building.co.uk/middleeast) and “jihad” tax (a 4% levy on all businesses and individuals used for religious works, such as the upkeep of mosques).

There is also an unwritten rule that you must employ some Libyans. WSP, for example, is working on the 3rd Generation Planning Project, which involves 126 masterplans for the Tripoli region. Peter Engström, WSP’s team leader, says: “It’s not legally required but we have an unwritten agreement to hire a certain amount of trainee planners.”

One of the most appealing things about working here is the reception you’re likely to get from Libyan people. Isam El-basir, a Libyan and PH Warr’s deputy manager for Tripoli, says: “The Libyans love the British.” As well as being one of the rare African countries that we’ve actually liberated rather than colonised, many of Libya’s elite were educated in the UK. And the admiration is mutual. Cyril Sweet’s Kingston says: “People think this is a fundamentalist military state but it’s a lovely place – you see people smoking sheesha, drinking coffee outside cafes. It’s a lot like being in Italy.”

Warr of PH Warr says that Libya is worth the effort. “It feels like pushing a large boulder up a hill. Every time you think you’ve got to the top, you find out there’s more to go, but eventually you’ll hit the peak and the boulder will snowball down the other side.”

Forming a joint venture

You have to do a joint venture with a Libyan partner in order to work in the country. Decision (i.e. law) 443 of November 2006 requires that, with the exception of international oil exploration companies, all foreign companies must form joint stock companies (JSC), in which they can own up to 65% of the shares.

There are horror stories of people not getting paid here but it’s no different from the UK

Gareth O’Brien, British Embassy

Foreign companies must apply to the Secretariat of Economy and Trade in order to register their JSC and if your application is approved, a renewable licence to conduct business in Libya will be issued. The approval process will usually take two to three months, and a licence is normally issued for a five-year term, or for the period that the JC is established (e.g. 99 years).

After registration with the secretariat, the JSC must then register with its local chamber of commerce and, in order to commence work and obtain visas, will be required to register with the Revenue Department, INAS (social security) department, Public Control Board, Manpower (Labour) Office, and Immigration Department.

Once the JSC has been established, it must annually confirm to the Immigration Department that it has a valid contract with a national entity, without which it is not possible to obtain residence permits or visas.

Source: PWC Libya

Tax in Libya

JSC’s are subject to the following Libyan taxes:

- Corporate tax

- Personal tax

- Jihad tax

There is no capital gains tax, no VAT, and no GST in Libya.

The assessment of Corporate Tax is in two stages:

1. Preliminary assessment: Your company must file a tax return annually with the Libyan Revenue Department.

2. Final assessment: After perhaps 12-18 months, and for the accounts for two years, the Revenue Department will conduct an audit of the books in order to determine the final liability to corporate tax for a particular year.

Although corporate tax law is based on the usual "add-back" basis, whereby disallowed expenditure is added-back to declared net profits or losses, current practice is that the Revenue Department raises assessments based on a percentage of turnover - the "deemed profit" basis of assessment. Tax is therefore payable even when losses are declared.

The level of deemed profit applied to turnover varies according to the type of the branch's business activity and would likely be 25% for supervision and 35% for design.

A further 4% on profits is payable for Jihad tax.

Salary declarations must be filed on a monthly basis with the Revenue Authorities. All salaries, wages and benefits-in-kind which accrue as a result of working in Libya are liable to Libyan income tax. You’ll also pay 4% Jihad tax on your salary.

Source: PWC Libya

Postscript

For more on the tax system and forming a joint venture, go to www.building.co.uk/libya

For the latest jobs in construction around the world visit here.

8 Readers' comments