Construction output has a way to go to get back to pre-recession levels; materials prices aren’t going anywhere fast and steel is in free fall.

01/ Key changes

- Housebuilding continues to lead the increase in construction activity but is being well supported by commercial and infrastructure works

- UK construction output is recovering rapidly as the economy improves despite a surprise fall in output in November 2013, which was offset by a 2% rise in December 2013

- 2014 Q4 new work output saw a 3.4% increase compared with 2013 Q3

- Construction materials prices remain subdued during 2013 Q4

- Steel prices continue to fall as global demand lags behind production

- Consumer price index rose by 2% in the year to December, down from 2.1% in November, to hit the government target

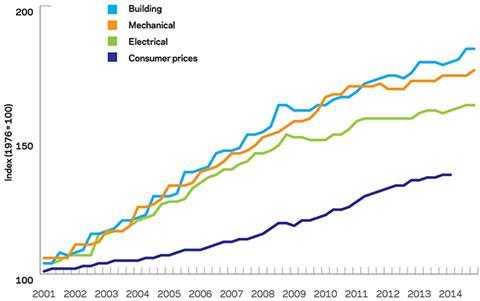

The following chart shows how Aecom’s cost index series reflecting cost movements in sectors of the construction industry have fared since 2000, with the movement of the Consumer Prices Index for comparison.

Percentage change year-on-year (Q4 2012 to Q4 2013)

| % | Direction | |

| Building Cost Index | +1.8 | ▲ |

| Mechanical Cost Index | +1.8 | ▲ |

| Electrical Cost Index | +0.9 | ▲ |

| Consumer Prices Index | +2 | ▼ |

2013 Q4 figures provisional. Consumer Price Index @ February 2014.

Building cost index

There has been a 1.8% increase in the index over the last 12 months with a 0.1% decrease between the last two quarters of 2013.

Mechanical cost index

The mechanical index shows a 1.5% increase over the last 12 months a 0.2% decrease between the last two quarters of 2013.

Electrical cost index

This index shows a year-on-year increase of 0.9%, which is lower than the previous Cost Update published in August 2013, but reflects a 1.3% increase between quarters.

Consumer prices index

The index rose 2% in the year to December 2013, a slight fall from November, and is exactly the government target.

Guide to data

Aecom’s cost indices track movements in the input costs of construction work in various sectors, incorporating national wage agreements and changes in materials prices as measured by government index series. They provide an underlying indication of price changes and differential movements in the various work sectors but do not reflect changes in market conditions affecting profit and overheads provisions, site wage rates, bonuses or materials price discounts/premiums. Market conditions are recorded in Aecom’s quarterly Market Forecast (last published 1 November).

02/ Commodity prices

Adjustment formulae indices, compiled for the Department for Business, Innovation and Skills, are designed for the calculation of increased costs on fluctuating or variation of price contracts. They provide useful guidance on cost changes in various trades and industry sectors and on the differential movement of work sections in Spon’s Price Books.

Over the last 12 months between December 2012 and December 2013, the 60 Building Work categories recorded an average rise of 1.1%, down marginally from the 1.2% reported three months ago.

Of the 60 work categories 43 categories show a price increase and 12 a price fall over the last 12 months, with an average increase of 0.5%.

The largest price increases over the last 12 months have been in the following work categories:

| Dec 2012 - Dec 2013 | % change |

|---|---|

| Concrete: formwork | 3.2% |

| Finishes: painting and decorating | 3.1% |

| Pipes and accessories: copper | 2.5% |

| Waterproofing: built-up felt roofing | 2.4% |

| Ironmongery | 2.3% |

| Finishes: carpets | 2.2% |

| Waterproofing: asphalt | 2.2% |

| Windows and doors: hardwood | 2.2% |

The largest fallers are:

| Dec 2012 - Dec 2013 | % change |

|---|---|

| Raised access floors | -8.9% |

| Finishes: screed | -5.2% |

| Glazing | -3.4% |

| Waterproofing: liquid applied coatings | -2.5% |

| Pipes and accessories: steel | -2.1% |

| Excavation and disposal | -2% |

Materials Materials prices and input costs remain flat, while consumer price inflation falls

03/ Executive summary

- Industry input costs remain flat, with a small rise at the end of 2014 ►

- Industry output prices rise 1% in the year to December ▲

- Construction materials prices and input costs remain subdued ►

- Steel prices continue to decline ▼

- Consumer price inflation falls ▼

- Steel prices continue decline ▼

04 / key indicators

| Consumer prices Oct 2013 | % change | Direction |

|---|---|---|

| Consumer Prices Index (CPI) | +2 | ▼ |

The annual rate in December fell to 2% from 2.1% in November.

Industry input costs

The total input price rose by 0.1% following a fall of 0.7% between and November 2013.

| % change | Direction | |

|---|---|---|

| Materials and fuels purchased by manufacturing industry | -1.2 | ▼ |

| Materials and fuels purchased by manufacturing industry excluding food, beverages, tobacco and petroleum industries | -1.6 | ▼ |

Key price movements over the last 12 months to December have been:

| % change | Direction | |

|---|---|---|

| Fuel | +4 | ▲ |

| Home produced materials | +1.2 | ▲ |

| Imported parts and equipment | -2.8 | ▼ |

| Imported metals | -10.1 | ▼ |

Industry output prices

Seasonally adjusted construction output estimates for November 2013 indicate a fall of 4% when compared with October 2013. Factory gate inflation now stands at 1% and has been reducing since July 2013.

| % change Oct 2012 - Oct 2013 | Direction | |

|---|---|---|

| Output prices of all manufactured products | +1 | ▲ |

| Output prices of manufactured products excluding food, beverages, tobacco and petroleum | +1 | ▲ |

Construction output continues to rise at the start of 2014 with the latest Purchasing Managers’ Index rising to 64.6, which is above the neutral 50 value which represents growth, for the ninth successive month.

| Metal prices | % change Jan 2013 - Dec 2013 | Direction |

|---|---|---|

| Copper | -10.4 | ▼ |

| Aluminium | -14.6 | ▼ |

| Lead | -8.5 | ▲ |

| Zinc | -2.8 | ▼ |

| Nickel | -20.4 | ▼ |

Metals prices continue to be mixed and no major price movements are expected until the China market returns. Analysis by the World Bank suggests that there will be generally lower metal prices continuing throughout 2014.

Exchange rates | Oct 2012 average | Oct 2013 average | % change |

|---|---|---|---|

| Euro into £ | 1.2310 | 1.1947 | -2.9 |

| $ into £ | 1.6144 | 1.6375 | +1.4 |

Sterling has appreciated 8.1% in the past 12 months. The euro rose 6% and the dollar strengthened 3.7% amid speculation an improving economy will prompt the Bank of England to raise interest rates sooner than current predictions.

Construction materials

Materials price increases for the construction industry over the last 12 months are detailed below:

| % change Dec 2012 - Dec 2013 | Direction | |

|---|---|---|

| Housing - new work | +1.7 | ▲ |

| Non-housing - new work | +1.3 | ▲ |

| Non-housing - repair and maintenance | +1.7 | ▲ |

The All Work material price index continues its slow upward trend with monthly increases not exceeding 1% for over 18 months. December bucked this trend with inflation rising to 1.1%.

A few materials have shown above or below average price movement over the last year:

| % change Dec 2012 - Dec 2013 | ||

|---|---|---|

| Imported sawn or planed wood | +6.2 | |

| Particle board | +4.8 | |

| Plastic pipes and fittings (rigid) | +4 | |

| Crushed rock | -2.5 | |

| Imported plywood | -2.8 | |

| Fabricated structural steel | -3.7 |

The arrival of 2014 has seen the normal range of price increase announcements from many UK manufacturers and suppliers ranging from 5-15%, with the biggest increases being seen in masonry and concrete products.

Labour Construction workers’ pay is up 2.5%, on back of the new BATJIC agreement

05 / Labour market statistics

- Construction workers’ average weekly earnings total pay for 2013 Q4 increased by 2.5% year-on-year

- Construction workforce increased by 1.6% year-on-year

06 / Wage agreements

Building and Allied Trades

BATJIC agreed new wage rates which came into effect on 17 June 2013 and run to 15 June 2014.

The 2013/14 agreement involves a 2% increase in pay. The rise is across the board except for the hourly rate for the Adult General Operative, which increases by 3% from £7.96 to £8.20 per hour. There are also improvements in the death benefit scheme, which increases to £25,000, and statutory sick pay rises to £119 per week.

Construction Industry Joint Council

CIJC rates will increase from 30 June 2014 when the hourly rate for a General Operative will be £8.27 per hour (£322.53 per 49-hour week).

Travel and fare allowances will also increase from June 2014.

Joint Industry Board

JIB rates increased by 2% on 6 January 2014.

Wage agreement summary

The following table summarises the wage agreements currently in force for the principal wage fixing bodies within the construction industry.

| Operatives | Agreement body | Current basic hourly rate | Effective since | Details in | Date of next review |

|---|---|---|---|---|---|

| Buildings and civil engineering operatives | Construction Industry Joint Council | Craft rate: £11.00 / hour | 30 June 2014 | Spon’s Price Book 2015 | Agreement has been reached up to June 2016 |

| Building and Allied Trades Joint Industrial Council (BATJIC) | S/NVQ3 advanced craft: £10.94 / hour | 17 Jun 2013 | Spon’s Price Book 2014 | Agreement until 15 Jun 2014 | |

| Plumbers | The Joint Industry Board for Plumbing Mechanical Services in England and Wales | Advanced plumber: £13.70 / hour | 2 Jan 2014 | Spon’s Price Book 2015 | |

| Scottish and Northern Ireland Joint Industry Board for the Plumbing Industry | Advanced plumber: £13.08 / hour | 7 July 2014 | Spon’s Price Book 2015 | ||

| H&V operatives | Joint Conciliation Committee of the Heating, Ventilating and Domestic Engineering Industry | Craftsman: £11.55 / hour | 1 Apr 2013 | Apr 2014 | |

| Electricians | The Joint Industry Board for the Electrical Contracting Industry/Scottish Joint Industry Board for the Electrical Contracting Industry

Scottish Joint Industry Board for the Electrical Contracting Industry | Approved electrician: £14.86 / hour (own transport) Approved electrician: £14.86 / hour (own transport) | 6 Jan 2013

6 January 2014 | Spon’s Price Book 2015 Spon’s Price Book 2015 | 6 Jan 2014 |

No comments yet