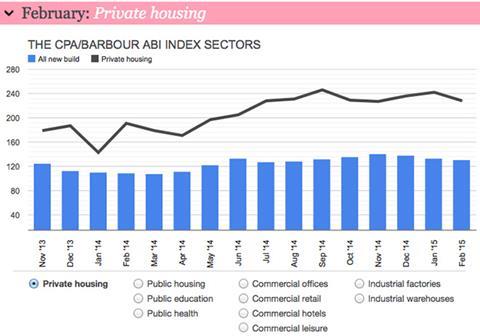

Contract awards in February higher than a year earlier, pointing towards further growth

Contract awards in February were 10% higher than a year earlier according to the latest CPA/Barbour ABI index, pointing towards further growth this year. However, they also declined for the fourth month in a row, potentially due to uncertainty over the general election. Contract awards during February declined on a monthly basis in private housing, commercial hotels and commercial leisure as investors show a degree of caution. The lag between contract awards and activity on the ground means output levels this year will be sustained by rises in contracts from 2014. Overall, we are still positive for construction in 2015 and anticipate new work rising 6.9%. Any serious impacts of a fall in orders would mainly be felt in output during 2016. However, if it is just election uncertainty, then once May is out the way we would expect private sector investment and contract awards to rise once again and a degree of “catch-up”, which means that output in 2016 should remain unaffected.

Click here for all the latest Barometer data

Private housing sector index

Promises, promises

The CPA/Barbour ABI private index in February was 228, 10% higher than a year ago but 6% lower than in January as the election impacts upon housing, one of the hot topics for politicians. The main parties have targets of 200,000 homes per year by 2020, or 300,000 in the case of the Lib Dems, but with no clear plan of how this is to be achieved given that public sector accounts for less than one-fifth of housebuilding. The most striking target is the Green Party’s 500,000 social homes by 2020. Does government even have the money for it? Even at a cost of £60,000 per home (ignoring land), that’s still £30bn. Even if they can finance it, is there capacity for it? Housebuilders are already struggling to find bricklayers. Our advice as forecasters is to ignore housing targets and look at the housebuilders; high margins and rapidly rising profits in an under-supplied market. We expect private housing starts to rise 10% this year despite a temporary slowdown due to election uncertainty. But we also anticipate growth slowing next year despite high political party targets because governments never achieve what they say they will in housing as they don’t control it.

Noble Francis is economics director at the Construction Products Association

No comments yet