Revised figures for Q1 2015 saw market pricing volatility increase, with a project’s attractiveness playing a crucial role in this current trend. Michael Hubbard of Aecom reports

01 / executive summary

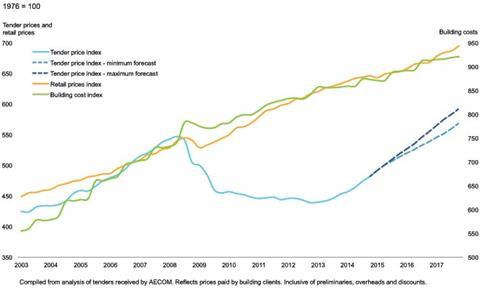

Tender price index ▲

Prices measured as an average across sectors increased to 7.9% provisionally on an annual basis in Q2 2015. Current pricing volatility stems largely from labour cost increases and cost factors linked to overall project attractiveness.

Building cost index ▲

Labour cost increases contributed almost all of the annual rate of building cost inflation. Building costs increased by 1.4% over the year at Q2 2015.

Retail prices index ▲

The annual rate of change was 1.1% in Q2 2015. Although still positive overall, this is near to the lowest annual change figure for over five years.

02 / trends and forecasts

Construction was the apparent villain of UK economic sectors recently, acting as a drag on UK economic growth figures published in Q1 2015. The fall in construction output had pulled UK GDP rates of change lower to a 0.3% quarterly change. But with data revisions in July, UK GDP fared marginally better with a 0.4% quarter-on-quarter increase. Construction output figures revised significantly upwards for Q1 2015 contributed to these improved figures, along with changes to output data already published for 2014.

The Office for National Statistics (ONS) revisions raised questions from the industry, particularly their sizes. Irrespective of the reasons for revision, and if the data is broadly reflective of underlying trends, the ONS data shows a moderation of aggregate activity levels from the hustle and bustle of last year. While this adjustment is the headline story, many areas are still experiencing heightened delivery pressures. Despite this apparent pace adjustment, conditions across the supply chain remain stretched, particularly in London, as a result of peak output recorded in Q3 and Q4 2014.

The first half of 2015 brought a tangible increase in price volatility. The speed of volatility diffusion has caused increased concern among buyers of construction work – whether main contractors or client organisations. With respect to pricing, known unknowns are back on the agenda. No one reason alone explains the volatility; nevertheless, a compounding of prices and allowances through the supply chain is amplified in some cases at the end collection stage.

Current conditions provide less clarity as to where the overlap begins between fundamental drivers of price increases and simple contractor bullishness and sentiment. But many constructors have almost full order books and are struggling themselves to obtain supply chain engagement. The peril of cover pricing has returned, notably on projects that are perceived as less attractive. A consequence of this is that higher divergence between pre-tender estimates and tender returns inevitably leads to questions about choice of procurement route, and additional work for those involved in the project to identify areas for potential cost savings.

Main contractors’ nervousness about supply chain pricing, capacity and delivery adds to design and delivery risk premiums. Their tender risk allowances have increased to guard against potential future cost inflation and other supply chain issues, such as subcontractor insolvency.

Subcontractors are seeking to optimise prices while the opportunity to secure good price levels is available. Although sometimes comparatively small on the basis of individual firms pushing up prices, the ratcheting effect across a fragmented supply chain has large aggregated consequences. All this contributes towards higher prices – and possibly greater divergence between cost plans and tender returns, certainly for projects that are poorly orientated to the marketplace.

The rate of annual change in tender price inflation is now 7.7% in Q1 2015, according to Aecom’s tender price index. This measures the movement of tender prices across all sectors in Greater London, and excludes specialist work items. This index represents an aggregation of the best available prices and on-costs in the marketplace. Provisional figures for Q2 2015 indicate an annual change of 7.9% over the previous 12-month period.

Many reasons contribute to current price variability, several of which have developed or hardened as a result of prevailing market conditions, biting capacity constraints and constructor selectivity. Not least amongst them is how a client approaches the market with its project and the project’s overall attractiveness.

Price increases are, though, all part of returning the industry to normality and healthy industry growth rates. The speed of price changes has brought higher tension. Unit rates for key trades on large package projects in central London, save for blockwork, have not surpassed peak prices recorded in the second quarter of 2008. This is despite the view that benchmarks for tendered or completed buildings have matched pre-crash pricing highs. It is predominantly other factors that contribute to elevated prices overall: design and risk allowances; main contractor preliminaries; recent substantial salary increases for staff; and regulatory changes to design standards since 2008. Additionally, subcontractor preliminaries costs have reached those seen in 2008.

Forecasts for tender price inflation are 5% to 7% from Q2 2015 to Q2 2016; and 5% to 7% from Q2 2016 to Q2 2017. Much depends on whether demand continues robustly or cools due to price increases, and on the industry’s ability or desire to increase capacity in response to this demand. But the attractiveness of a project, which is multi-layered, will heavily influence any margins either side of these forecast base ranges. The significance of this is of paramount importance in understanding prevailing market conditions.

Higher rates for overheads and profit are expected, as constructors become emboldened by ongoing trends and more inclined to raise prices to regulate workload rather than growing their business. There is little appetite to accept risk, with more of a “these are our terms, take it or leave it” approach to contract conditions and heavily qualified tenders all underlining the shift in supply-side bargaining strength. Almost all supply chain firms are seeking to strengthen their position in a market where conditions are conducive to locking in better commercial terms for the next one to two years.

Construction SMEs bore the brunt of the recession. Squeezed margins and prices followed but these positions are being recovered.

It turns out that the recession was not a wasted opportunity for constructors to appraise and review their business positioning. Many firms have taken deliberate choices to retain focus on core skills and capabilities. Some, though, have simply reacted to higher demand levels for services and restricted supply by pushing up prices. Current tightness across the supply chain will only be amplified by any additional project wins, as capacity is further removed from the marketplace.

03 / focus: trade survey

Aecom’s latest mid-year survey of trade contractors underlines the burgeoning prospects for firms in the central London market. A key highlight is the apparent rotation of trade contractors out of residential work and into the commercial sector. Residential workload provided vital support to the industry during its lean recent years, but a revival in commercial sector opportunities has brought a noticeable change in emphasis since the end of last year. Longer-standing relationships with large developer clients are certain to act as a pull factor behind this shift. With capacity constraints at elevated levels, what this will mean for the residential sector and its ability to source and secure resources in the near-to-medium term remains to be seen. Still, it offered the opportunity for joinery trade contractors, for example, to make excellent margin returns in the last 12 months.

Bidding rates vary by trade sector. Facades contractors are the most selective, whereas joinery firms bid on the highest number of opportunities presented to them. Overall, just two in three requests to tender result in a bid submission. This is a slight improvement to the same question asked of trade contractors in Q4 last year. Regularly, constraints with trade contractors’ own estimating teams result in numerous tenders being declined.

Still, an overwhelming theme of selectivity when choosing which projects to bid for raises the stakes once more for those clients actively procuring construction work. Secured turnover for 2015 is high, which only adds strength to the supply chain’s positioning for

bidding or negotiating work. The client and the scope of work are the highest ranked decision variables when trade contractors are considering whether to tender.

Main contractors concurred in December last year that client organisations were the most important factor in this decision, along with securing resources. Type of work was less important to main contractors than trade contractors, clearly because of the specialised nature of trade firms. But for the trade subcontractors their own capacity levels were strongly referenced as a key factor when deciding to tender. On the other hand, it is the supply chain presently which exerts the largest influence on price levels according to survey respondees. With the level of work available, compounded by capacity constraints, power clearly lies with the long tail of the supply chain. Main contractors may wish to remember the story of David and Goliath in these constrained times. Nonetheless, clients’ route to market engagement and contractors’ route to market delivery share the same path, with similarly aligned interests – both glancing nervously towards the supply chain.

Inflation expectations are varied, although there is agreement overall that prices will rise in coming years. Again, joinery and facade firms hold expectations that are divergent to other trade contractors. Skills shortages are cited as a primary driver of inflation. Generally, sustained under-investment in the industry’s productive capacity was accentuated by the global downturn and has not helped this current situation. Further increases in aggregate demand will only lead to price increases as existing capacity and supply struggle to meet raised output requirements. Mitigation now would undoubtedly cost less than adaptation or higher levels of investment in the future.

With this increased activity comes a higher risk of overtrading across the supply chain. The problem is particularly acute for the many SMEs that constitute the fragmented construction supply chain. Expanding activity can amplify problems with working capital, leaving little room for financial manoeuvre. And for smaller firms who do not have the benefit of better banking terms to which larger main contractors have access, cash flow is critical to survival.

Construction is still perceived poorly by banks, with its complex contractual arrangements, long payment terms and higher levels of risk. SMEs have higher fixed cost bases than larger firms. Consequently, they often suffer proportionally more pain with late payments, higher funding costs and more difficulty gaining access to lines of credit.

Resisting the temptation to overtrade – and by extension limiting the volume of work undertaken or tendered – only adds to overall price pressures being experienced in the industry. Value not volume mitigates risk of overtrading but in so doing adds to existing price pressures.

Price is what you pay, value is what you get, and in this market securing resources at higher prices seems like a small price to pay to achieve project completion.

04 / activity indicators

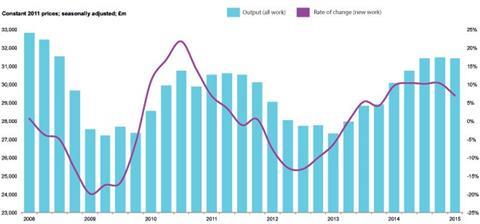

At April 2015, all new work output (in constant price terms) across the UK rose 1.6% on a year earlier.

Like most of the last 18 months, housing was the star of the show on an annual change basis and acted as the bulwark to otherwise less strong data in other sectors. Private commercial (-5.2%) and non-residential public sector (-5.0%) new work shrank on a yearly basis, with infrastructure (+9.6%) and private industrial (+2.8%) new work offsetting these falls. Total new work covering all sectors increased by +4.3% over the year. When repair and maintenance work is included, all work output (in constant price terms) increased by 1.5% in April 2015 versus the same time last year.

Single-month data points add noise in determining underlying trends in activity levels across the UK. Taking a rolling quarterly measure, new work output (constant prices) increased by 6.1% and all work by 3.7% on the same period a year earlier. Housing, infrastructure and private industrial sectors all posted strong annual change figures for new work; private commercial and non-residential public new work sectors both contracted across the UK.

Regionally, output data shows some divergence emerging. Whereas the majority of regions through 2014 recorded their best continuous volumes of new work in over three years, the same trend has not continued into the middle part of 2015. Although most regions posted higher volumes (current prices) when compared to the same period a year earlier, many quarterly movements from Q4 2014 to Q1 2015 were into negative territory.

Except for London (+35.1%) and the West Midlands (+32.7%), private commercial activity fared poorly across the UK regions when comparing Q1 2015 new work output to the same period in 2014. Private residential workloads increased in all regions except Wales and the East Midlands. Infrastructure new work posted strong annual change figures, though not in London and Yorkshire. In fact, Wales and Scotland saw 70% increases in infrastructure new work in Q1 2015 versus Q1 2014.

Despite the variable picture in the ONS national output statistics, headline activity indicators are all still positive. In fact, many are at recent highs, though some changes to established trends are beginning to emerge in activity data, with mean reversion seemingly taking place. Taken together, and combined with regional data, there is certainly a definable shift in activity levels overall. Wage rates for trades indicate some plateauing, with discernible adjustments across the regions.

Still, activity remains good and momentum already built in will see the industry continue its impressive recent form but with more manageable growth trends at play. RIBA’s Future Trends workload survey also adds credence to the belief that overall workload will maintain healthy levels, particularly where architects are early contributors to projects. The RIBA survey balance remains high despite peaking in the middle of 2014 and drifting lower through to April 2015.

Capacity – or rather lack of it – is still cited as a primary issue and concern for main and trade contractors. This is usually the catalyst for higher prices, and this has certainly transpired since peak output recorded in Q3 and Q4 2014. The ongoing squeeze for skills and associated prices will continue into the second half of 2015 given the extended duration of construction projects. Lead times for trades continue to adjust to sector changes, although synchronicity across the trade disciplines is not evident.

The Federation of Master Builders’ state of trade survey corroborates the general theme of an industry that is operating at near or full capacity; however, the number of firms reporting lower workloads also increased marginally in early 2015, with the non-residential classification indicating a slip in fortunes. But enquiries increased firmly, which supported expectations of sustained workloads in future months. Views on output prices, wages and salaries, and input costs also moved upwards or posted similarly strong readings.

Profit warnings are still being announced, which is surprising given the activity levels of the last year. But problems stem from issues engendered over the medium and long-term rather than short-term industry improvements. Namely, these are the skills crunch highlighted at the start of this return of activity, on-going commercial burdens and problem projects secured in the period after the financial crisis. While it is internal industry issuesthat have caused firms the more difficult moments in the last 12 months, it is external factors in the UK, Europe and China for example that could ultimately impact construction activity over the medium-term horizon.

No comments yet