We consider the complex, multidisciplinary nature of land regeneration and how housing need and government policy are driving increased demand

01 / Introduction

With limited undeveloped land in areas of highest need, the government has a preference for brownfield over greenfield development for the delivery of its housing commitments. Land regeneration already delivers the sites for two-thirds of new housing in the UK. With the government targeting the construction of a further 1 million new homes by 2020, demand for land is sure to increase. Bringing brownfield sites back into productive use is also a key policy tool to mitigate pressure on green belts. If current incentives are not sufficient to release enough land to build, then it is likely that arguments proposing the review of green belt policy will get louder.

Brownfield sites can be complex and expensive to repurpose for development, challenging the viability of many developments. However, this is not always the case, and regeneration specialists can make a significant contribution in delivering, co-ordinating and phasing viable development programmes. However, these specialist skills are rarely held in-house by land owners and the client’s ability to identify and assemble the appropriate expert team is an important step in unlocking a site for regeneration.

Ultimately, the regeneration of previously developed land is the task of unlocking value to create new places for people to live and work. A combination of skills in place-making, clean-up, planning and finance is necessary to ensure that conditions for a successful regeneration programme are in place.

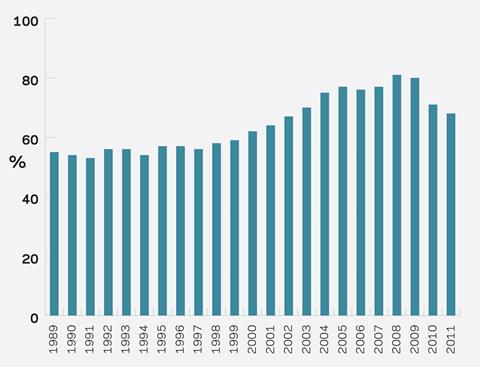

Proportion of dwellings built on previously developed land

02 / Land regeneration in the UK

The UK is a world leader in land regeneration, offering a wide range of technologies, systems and innovative ideas aimed at maximising the value of previously used land, while taking account of environmental and/or public health requirements. There is a great deal of experience in the UK of co-ordinating the many skillsets needed to underpin successful land regeneration.

The proportion of housing developed on brownfield sites has tailed off since the financial crisis due to the higher perceived cost, risk and extended development programmes. However, with the cost of remediation solutions falling due to innovation, sites that were previously unfeasible are returning into consideration. Recent policy announcements by the government provide further incentives by reducing risk associated with planning and by aligning investment in starter homes closely with development on previously used land.

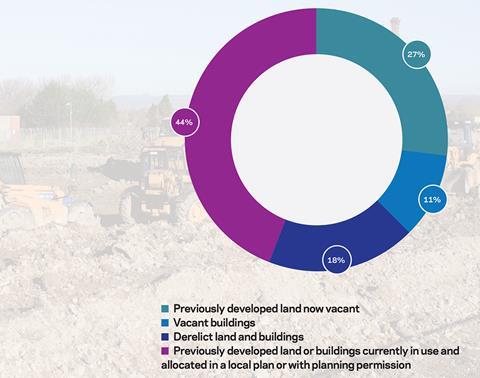

The DCLG last estimated the quantum of brownfield land in England in 2011 at 63,750ha, of which 51% was derelict or vacant. The remaining 49% was in use, but with potential for development, meaning of course that the timescale for regeneration would be extended by acquisition, decanting and remediation activities. About 10% of the stock of previously developed land is consumed each year, but rather than being a finite resource, the brownfield land stock is continually replenished.

Given forecast levels of demand, there is growing recognition that the private sector is unlikely to meet the demand for development land alone, and that other stakeholders will have an increasing role to play. The release and redevelopment of public sector assets will make a significant contribution towards housing targets. Local authorities are increasingly participating directly in development, whereas previously their main role in the regeneration process had been as a planning authority.

Delivery models that enable public sector participation include partnering with private housebuilders or developers, or direct development. One example of the partnering approach is the former Icknield Port Loop development where Urban Splash and People for Places have entered a 50% limited liability partnership with Birmingham council and the Canals and Rivers Trust to deliver 1,150 new homes. The formation of these partnership needs a lot of work at the earliest stages of development, and there is growing recognition within local authorities of the important role that specialist advice can play during the earliest stages of a development process.

As well as directly releasing publicly owned land, the government is strengthening existing incentives for brownfield development with an emphasis on housing and particularly on starter homes. Measures include:

- A brownfield land register, with 73 councils given seed funding of £10,000 to bring forward derelict and underused sites for regeneration. First announced in June 2015, this is the first survey of previously developed land taken since 2012.

- “Permission in principle” to be granted for housing-led development sites either under local development orders or for land identified in brownfield registers. Under the permission in principle system, only technical details of the development are required for full consent, which increases the level of certainty for developers and investors. The measure was passed as part of the Housing and Planning Act in May 2016.

- Land remediation relief, providing tax relief against the cost of remediation, removal of asbestos and other works, remains in place. The relief available for owners and investors is 150% and for developers is 50%, providing an added incentive to the land conversion aspects of the development process.

- Direct funding including:

– £1.2bn of the total £2.3bn funding package for the first 60,000 starter homes fund will be focused on housebuilding on brownfield sites. Announced January 2016.

– £400m central funding for Housing Zones, together with contributions from the GLA and others enabling councils to work in partnership with private developers to deliver homes on brownfield land. Originally announced in the summer of 2014, London alone has 31 housing zones which are targeted to deliver 77,000 new homes for families and first time buyers.

The brownfield register in particular aims to require local authorities to detail previously developed sites available for regeneration, with the intention that they will then include them in a locally led plan. For example, the West Midlands Combined Authority was granted £250m as part of their devolution deal to bring forward brownfield sites for development. Brownfield registers will be made mandatory under the recently passed Housing and Planning Act 2016.

Additionally, the Homes and Communities Agency (HCA) acts as enabler to facilitate housing and regeneration on brownfield land. The agency provides funding, advice and acts as a regeneration vehicle for the government. The HCA’s Land Development and Disposal Plan 2016-2017 identifies 43 new sites with capacity for over 5,000 homes. Setting out a scheduled pipeline of disposals helps housebuilders and local partners plan ahead and speeds up delivery of housing. HCA has a key role in providing funding on beneficial commercial terms.

Landowners looking to repurpose and dispose of their land are varied, including public sector bodies such as Network Rail and Transport for London. Although the market for land regeneration is spread across the UK, it is primarily focused around the bigger cities, particularly in areas of industrial legacy around the Northern Powerhouse and London. The 15 local authorities with the most brownfield land in England that are involved in the pilot include Liverpool and Manchester as well as Cherwell and Medway in the south of the country.

The recent vote to exit the EU may impact significantly on regeneration funding in some regions, and impact Council and the private sector’s ability to deliver promised land regeneration. Innovative methods of financing may be needed to fill the gap.

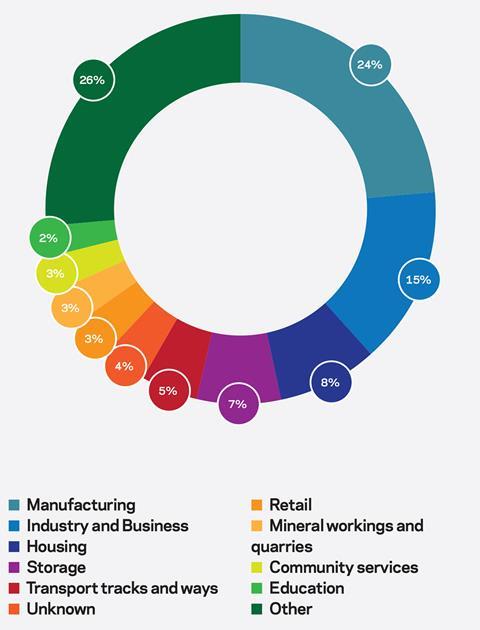

Previous uses of local authority allocated land (2012)

03 / Economics and cost

The successful regeneration of a brownfield site ultimately depends on the creation of a new “place” - lifting the value of the land by improving the quality of the local area. The ability to invest in the place-making elements is to an extent dependent on the residual value left once the costs of remediation and regeneration have been accounted for.

The variables that determine the cost and value equation include:

- Market demand for land

- Stakeholder appetite to develop

- Availability of the site and timing of the remediation programme

- Infrastructure requirements

- Location and access

- Ground and ground water conditions including extent of contamination

- Presence of structures and obstructions

- Environmental and heritage constraints (for instance, flood risk or listed buildings).

Many brownfield land sites outside of London that are as yet undeveloped have little value and in some cases, the costs of clean-up will deliver a negative land value. Without an injection of public funding these sites will remain unviable as development sites and will not be brought into productive use. Potential funding models for public sector bodies to encourage delivery of housing

include:

- Generation and separate revenue streams

- Early capitalisation of the new homes bonus/business rates

- Public sector support - eg funding provided by HCA

- Self-delivery

- Housing vehicles, joint ventures or public/private partnership.

The phasing of work and investment is an essential part of financing a land regeneration project. With high up-front costs for many activities such as remediation, demolition and so on, the timing of expenditure can be designed to generate an early income stream, generating capital to deliver the next phase. For example, a developer may choose to develop the “quick-win” phases of a development and use the income to fund later, more challenging elements - for example, heavily contaminated areas.

However, it is essential that JV partners are committed to developing all aspects of a scheme to completion. There is a history of developers walking away once the low-cost, high-return elements are completed - which illustrates that in addition to the phasing strategy, a client needs a commercial strategy to ensure the total delivery of the investment.

04 / Brownfield remediation process

Remediation and regeneration processes are highly regulated to ensure long-term safe outcomes for all stakeholders. Given the commercial implications for the site owner, brownfield sites need to be assessed by an experienced environment consultant at the outset to confirm that the desired end-state can be delivered and to understand the cost and programme implications.

The assessment involves desk top studies as well as analysis of soil, groundwater and surface water samples for hazardous compounds. Current and complete information about the land use history and the site setting for example is essential to reduce uncertainty and the risk of underestimating the extent of work required.

The findings of these studies help to ensure that appropriate, cost-effective and timely measures are taken to meet the development objectives whilst reducing identified environmental risks and liabilities. Once the constraints are identified and quantified, the costs of bringing the land back into use can be weighed against its disposal value to assess the viability of a remediation scheme and potential requirements for funding support. The elimination of planning consent risk through the introduction of “permission in principle” for residential land on the brownfield register will remove a significant aspect of risk associated with site viability.

Typical land remediation projects follow a four-stage framework:

- Stage 1: Preliminary site assessment. Extensive research to understand the history of the site and its geographical, geological and hydrological context

- Stage 2: Intrusive on-site investigation. This includes surveying, borehole drilling, sample collection and laboratory testing. A thorough risk assessment will be conducted to identify all constraints

- Stage 3: Design and construction of site works - addressing constraints through remediation works for contamination, removal of protected or invasive species, as well as the potential construction of infrastructure and utilities

- Stage 4: Verification and validation. Monitoring to assess whether all objectives have been achieved with relevant evidence duly presented.

Process innovation

With clean-up costs potentially exceeding £1m per hectare for the most complex sites, the optimisation of remediation techniques will make an important contribution to ensuring the viability of a regeneration proposal. In the past, the main technique used for remediation was soil excavation and disposal to landfill, which became prohibitively expensive due to the costs of transport, disposal and landfill tax. Soil washing techniques that reduce the volume of disposed contaminated soil have been widely adopted as well as other innovative techniques based on in-situ remediation. Collectively these innovations have permitted significant reductions in remediation costs when applied alongside innovation in financing and policy. Examples of innovative and more sustainable in-situ remediation techniques, include:

- Bioremediation, which uses natural processes to destroy or neutralise toxins and contaminants

- Phytoremediation, which uses plants to remove contaminants from the ground

- In situ chemical oxidation, injecting chemical oxidants into contaminated soil or water to destroy harmful contaminants.

The advantage of in-situ techniques is the elimination of requirements for extensive site operations. However, this needs to be balanced against the longer programme required by many in-situ processes. One area where improvements in in-situ techniques have really made a difference is in groundwater treatments, where the substitution of in-situ processes for “pump and treat” has cut clean-up durations.

In a remediation for a proposed residential use, Arcadis developed a completely novel approach for the breaking-down of CS2, the compound carbon disulphide, using in situ chemical oxidation with activated persulfate as a catalyst. On the same site, a novel soil-mixing technology was used, with a combination of vacuum conditions as well as dry ice to create an inert atmosphere during the mixing process. These innovations, among other factors, saved the client £14m.

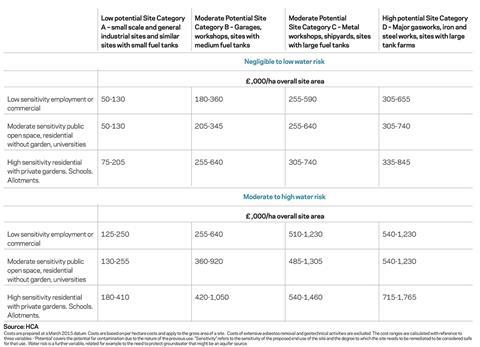

Benchmark cost range for remediation of contaminated land

Remediation costs

Estimating the cost of preparing a brownfield site for reuse can be a complex exercise, in part due to the wide variety of elements contributing to the successful re-purposing of a site. The extent of the constraints which affect the reuse of a site is determined by a combination of the condition of the site and the nature of the proposed new use - with residential development requiring the most comprehensive clean-up.

The HCA provides benchmark cost ranges for remediation of contaminated land (Table 1) and site preparation costs associated with land regeneration (Table 2).

Factors influencing the cost of overall land regeneration process may include:

- Extent of constraints related to the previous use - determined for example by the duration of uses, spread and depth of contamination and presence of redundant structures

- Extent of constraints related to the site itself - location, access, services, planning and so on

- Time available for preparing the site for redevelopment

- Size of site, determining economies of scale for remediation and infrastructure investment

- Market conditions, risk management strategy, contractor selection

Constraints are typically captured using a risk register, similar to a CDM risk register, which is then used to support informed decision-making as to prioritisation and course of action. Constraint registers typically include estimates of the costs and programme implications of a range of potential options.

Many of the risks of regeneration can be mitigated through robust due diligence, but timely action is also key to secure the lowest cost solution to addressing the site’s constraints. If regeneration experts are included early in the planning process, the solution can be informed by the constraints and the regeneration plan informed by the end design. For example, on a former pharmaceutical site, the end uses informed the packaging of the site into parcels which allowed a phased and targeted approach, with an appropriate clean-up and regeneration scope for the end uses of each land parcel.

Although there are specific costs associated with the regeneration of existing sites, it must also be highlighted that regeneration of brownfield is not necessarily more expensive or difficult than greenfield land. Differential site values will help offset some of the costs of improvement, for example, and previously used sites may benefit from existing infrastructure and utilities, reducing cost, programme and risk in comparison to a greenfield development.

Local authority allocated Brownfield land (2012) by land type

05 / Procurement

The diversity of brownfield land and regeneration challenges found in the UK has led to the growth of a specialist supply chain, including multidisciplinary consultancies, technology providers, contractors and equipment and service suppliers such as testing laboratories.

Clients undertaking regeneration and remediation work typically aim to transfer at least some of the risk associated with scope, duration and cost down into the supply chain and as a result, a lot of work is let under the umbrella of larger consultants and contractors who can underwrite that assurance.

The choice of appointment or works contract should reflect the nature and type of works to be procured. The various types of land regeneration works are generally considered to be more closely aligned with engineering contracts. Both NEC and ICC provide a suite of contracts which can be configured to reflect the complexity of the proposed works and the landowner’s particular requirements - for example, in connection with a required risk allocation. The allocation of risk between client and contractor involves a trade-off between the known up-front payment of a risk premium and the undefined residual exit-cost risk. All clients are exposed to exit-cost escalation, but the defined cost risk will be more attractive to clients that need a fixed price contract in order to secure external funding, whereas self-financing clients may choose to reduce the potential project cost by retaining a greater share of the risk themselves.

The essential elements of an effective procurement include:

- A statement of scope and works specification that supports a comprehensive comparison of bid responses, and which delivers a well-documented commercial basis for the contract

- Contractor pre-qualification and selection, ensuring key aspects of capability are included in the assessment as well as cost and programme

- Effective commercial management processes including payment, progress monitoring and change control

- Clear reporting processes so that the client is kept fully informed with respect to progress and forecasted financial outcomes.

All these are key to ensuring that the intended risk transfer is secured, and that costs and timescales are well managed, minimising potential for scope creep or claims. For example, without a well-designed specification based on detailed survey data, there is likely to be greater uncertainty surrounding the volumes of soil or groundwater to be remediated, or the extent and concentration of contamination. However, there are diminishing returns to the benefits of additional surveys, and risk can never be entirely eliminated.

06 / Croydon case study

Croydon was identified by the Greater London Authority as a centre for housing growth and has a target to build 20,200 new homes between 2011 and 2031. Croydon council has taken a proactive leadership role in delivering housing, taking control over the timing, scale, location and affordability of development.

Arcadis provided assistance to Croydon in identifying what sites were viable, the technical constraints that needed to be overcome to progress delivery and how much housing could be developed across over 70 brownfield sites. Through this process 53 smaller sites were identified, which will provide over 1,000 homes. To speed delivery but retain control over the development solution, Croydon set up an arms-length trading company with the intention of directly procuring the design and construction of housing. Through this company the council will deliver 50% affordable housing and 50% housing for the private market. Croydon clearly represents an alternative approach, which a number of councils have followed for direct development, but it is important to note that sufficient value and scale is required for this route to be justified.

07 / Conclusion

The UK’s industrial legacy means that many of the sites required to meet housing need have seen previous use and need to be regenerated. With a wealth of expertise in the regeneration of brownfield sites, and innovation in technology, financing methods and government policy, the UK market for land regeneration must rise to meet this challenge. With targets set by the government to deliver additional consents for 200,000 new homes on brownfield land by 2020, the public sector across the UK is rising to the task, and will need capability and capacity support to meet it.

We would like to thank Katy Baker, Nick Kealey, Matt Gardner, Simon Marks and Tim Preston of Arcadis for their contribution to this piece.

No comments yet