The Budget has given us a taste of this Conservative government’s economic policy and forecasts for the sector are also looking strong

Economic context

The Budget was set this month - the first major indication of the economic policies that the first majority Conservative government since 1997 will pursue. Headline measures focused on the introduction of the National Living Wage, as well as an increase in the personal tax allowance and reduction in corporation tax.

Within the Budget, the Office for Budget Responsibility (OBR) updated its economic forecasts for the UK with its estimate for growth this year now 2.4%, a slight decrease from the 2.5% forecast in the spring Budget in March. The forecast for 2016 was unchanged at 2.3% growth, but the economy is now forecast to grow by 2.4% in both 2017 and 2018, an improvement from the 2.3% forecast in the spring Budget.

Inflation forecasts were reduced for 2015 from 0.2% to 0.1%, in response to data which shows inflation falling. Given the Bank of England target is 2% it shows how far the economy is from its desired inflation rate. The OBR’s inflation target of 2.0% is predicted to be met in 2020, a year later than the spring Budget predicted.

Average earnings growth was revised down within this Budget with the OBR now forecasting 2.2% wage growth this year, when it expected the figure to be 2.3% in the spring Budget. However, average earnings growth is expected to be stronger next year with 3.6% growth now forecast, up from 3.1% in the previous forecast.

Unemployment forecasts remained similar to the summer Budget, reflecting the rapid fall in unemployment in recent months, with an estimate of 5.4% this year, compared to 5.3% in the spring Budget. Unemployment is set to fall to 5.1% in 2016 and settle at a long-term rate of 5.4% in 2019. These forecasts imply inflation will be on target and unemployment will be at its “natural” rate in 2020, indicating a healthy economy.

Policy measures announced included:

- Cutting the rate of corporation tax from 20% to 19% in 2017 and 18% in 2020

- The income tax personal allowance will be increased to £11,000 in 2016/17, and to £12,500 by the end of the parliament

- The government will introduce a national living wage for workers aged 25 and above, by introducing a premium on top of the national minimum wage

- The government will reduce social housing rents in England by 1% a year for four years, requiring housing associations and local authorities to deliver efficiency savings

- The government will lower the cap on the benefits an out of work family can receive, from £26,000 to £20,000 (outside London)

- The government has committed to the establishment of a network of national colleges to provide specialist high-level training in sectors that are critical to economic growth

- Starting from April 2017, relief on finance costs for landlords of residential property will be restricted to the basic rate of income tax.

The latest figures from the Office for National Statistics (ONS) show the construction sector in the UK shrank by 1.3% between April and May 2015. However, comparing output levels with May last year shows an increase of 1.3%. This is further evidence that, despite monthly fluctuations, long term performance of the sector remains strong. Private housing declined between April and May by 5.6% which was a big reason for the overall fall in construction output (see table, opposite). However, output was 8.9% higher than May 2014 indicating that private housing is still driving industry growth over the longer term.

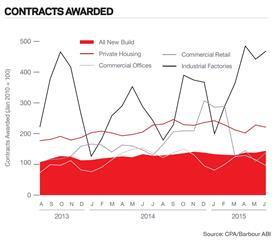

The CPA/Barbour ABI Index, which measures the level of contracts awarded using January 2010 as its base month, recorded a reading of 144 for June (see Contracts Awarded). This is an increase from the previous month and supports the view that overall activity in the industry remains strong.

The readings for private housing decreased after a large increase last month. However, the commercial office sector continues to fall with a reading of 96 compared to 115 last month.

The construction sector

According to Barbour ABI data on all contract activity, June witnessed an increase in construction activity levels, with the value of contracts awarded £6.2bn, based on a three-month rolling average. This is a 10.6% increase from May and an 18.7% increase on the value recorded in June 2014. The number of construction projects within the UK in June increased by 17.1% on May, but were 10.4% lower than June 2014.

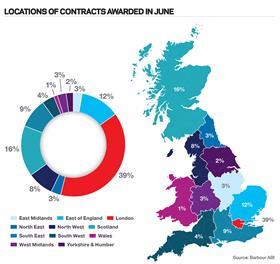

Projects by region

Most contracts awarded in June by value were in London, accounting for 39% of the UK total. This is followed by Scotland with 16% of contract value awarded and the east of England with 12% of value (see map, opposite). London’s strong performance is primarily due to the award of the £2.1bn contract at Wood Wharf, part of the Canary Wharf development - a commercially-led 10-year project, which also provides residential units, hotel and leisure uses.

Scotland’s strong performance in June is due to the contract for the Sullom Voe gas sweetening plant in the Shetland Islands, valued at £500m. In addition, despite announcements on the curtailment of onshore wind farm subsidies, the contract to construct a 288 MW wind farm in Dumfries and Galloway was another reason why Scotland had a high share of contract value in June. This is valued at £300m.

Type of projects

Commercial and retail had the highest proportion of contracts awarded by value in June, with 31% of the total. The Wood Wharf contract at Canary Wharf contributed to the sector’s strong performance. The infrastructure sector also had a strong month in June accounting for 27% of the value awarded. The Kilgallioch Forest wind farm in Dumfries and Galloway was a major contributor to infrastructure in June but there were also two improvement contracts for the A14 awarded, at a total value of £600m.

Construction performance by sector

Spotlight on commercial and retail

The value of contracts awarded in the commercial and retail sector was £1.2bn in June, based on a three-month rolling average. This is a 99.8% increase from May and a 41% increase from the June 2014 figure. In the three months to June the value of contracts were 0.1% higher than the previous three months and0.6% higher than the same period in 2014, indicating a slight increase in activity over the longer term.

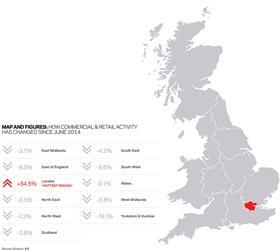

Projects by region

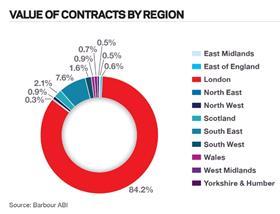

As previously mentioned, the award of the commercially-led contract at Wood Wharf, part of the Canary Wharf development, means that London was the main location for commercial construction activity in June 2015. A 10-year project valued at £2bn, it is by far one of the highest value commercial projects awarded in recent years. It means that London accounted for 84.2% of the value awarded in June, a 54.5% increase from June 2014.

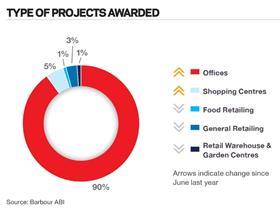

Type of projects

The Wood Wharf contract also means that offices were the dominant type of project in the sector accounting for 90% of the value of contracts awarded this month, which is 22% higher than June 2014.

Downloads

ECMR July 2015

PDF, Size 0 kb

No comments yet