September offered little cause for cheer as activity declined across all three sectors: residential, non-residential and civil engineering. Experian Economics reveals the extent of the bad news

State of play

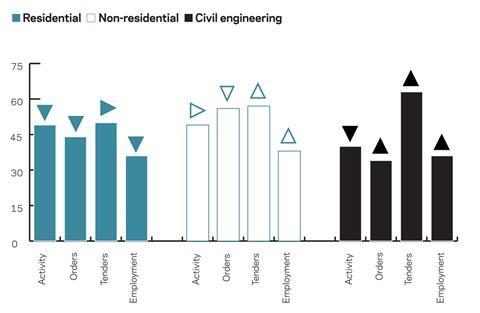

After reaching the no-change mark of 50 in August, the construction activity index fell by three points in September, to 47. Activity declined across all three sectors during the month, with the residential activity index falling back into negative territory, dropping by three points to 49. The civil engineering activity index fell by five points to 40, indicating a stronger pace of contraction, while the index for the non-residential sector remained unchanged at 49.

The orders index was in negative territory for a third successive month, unchanged at 46, but the tender enquiries index rose by three points to 53 - its highest reading for nine months. While both the civil engineering and non-residential sectors saw tenders increase during the month, tender enquiries were unchanged in the residential sector.

The outlook for employment remained bleak in September, as the employment prospects index remained below the no-change mark of 50 for a 45th successive month in September. However, the index increased marginally by one point to 37.

Twenty three percent of respondents reported no constraint on their activity in September, the lowest proportion for three months. About 56% of firms indicated that insufficient demand was a constraining factor on their activity, the highest percentage since May. Respondents indicating that finance was holding up their activity was unchanged at 17%. It is interesting to note that a small percentage of respondents continued to indicate that labour shortages are impacting their activity, despite downbeat prospects for construction employment as a whole.

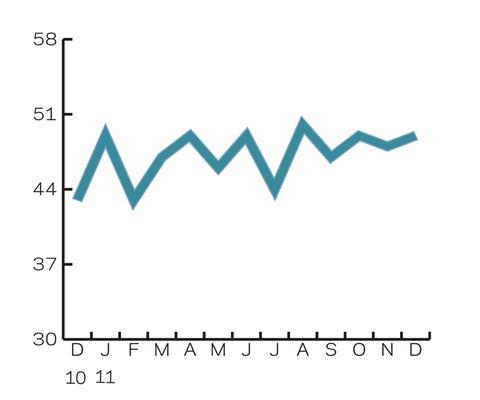

Leading construction activity indicator

CFR’s Leading Construction Activity Indicator shows that construction activity is predicted to contract at a slower rate in the coming three months. In October the index is expected to increase by 2 points to 49, before edging down to 48 in November. The index is expected to rise again to 49 in December.

The indicator uses a base level of 50: an index above that level indicates an increase in activity, below that level a decrease.

Work in hand

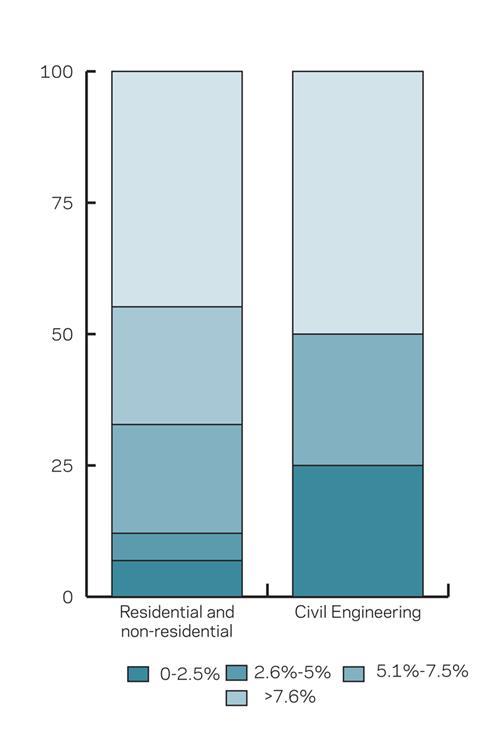

In September, about 62% of residential respondents reported less than three months work in hand, compared with 51% and 33% for the non-residential and civil engineering sectors respectively. The civil engineering sector saw the highest proportion of respondents (59%) reporting that they had enough work to keep them active for between three and six months.

A similar proportion of respondents across the sectors reported that they had more than six months of work in hand, with 9% of residential respondents, and 8% of both non-residential

and civil engineering firms indicating that their order book would keep them busy for more than six months.

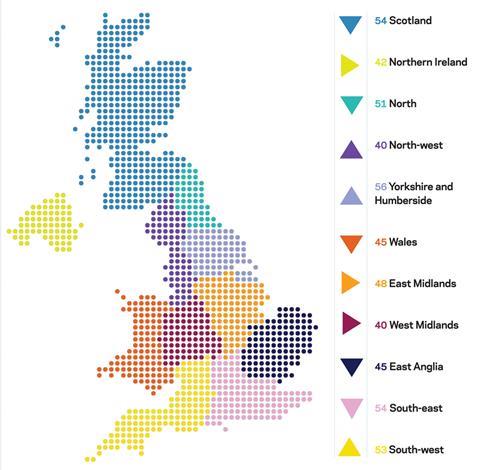

Regional perspective

Experian’s regional composite indices incorporate current activity levels, the state of order books and the number of tender enquiries received by contractors to provide a measure of the relative strength of each regional industry.

In September five of the 11 regional indices declined when compared with the previous month. Scotland and the North saw the biggest falls as their indices dropped by five points to 54 and 51 respectively. The South-east and Wales both saw a three point fall in their index to 54 and 45 respectively.

Northern Ireland, the East Midlands and the West Midlands all saw no change in their indices which remained at 42, 48 and 40 respectively.

The index for Yorkshire and Humberside edged up by one point to 56, its highest reading since June 2010.

The North-west saw the biggest increase in its index as it rose by two points to 40, although it remained in negative territory for a 42nd successive month.

The index for the UK as a whole, which includes firms working in five or more regions, portrays a bleak picture. The index fell by six points from 55 and currently stands at 49. It is the first time it has been in negative territory since November 2009.

No comments yet