With the economic outlook worsening, construction activity is expected to keep slowing until the end of 2013, with prices rising slightly

01 / EXECUTIVE SUMMARY

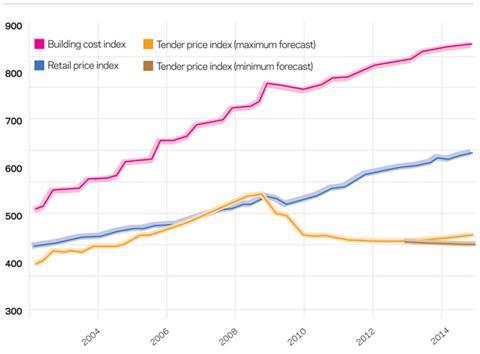

Tender price index

Tender prices continue to bump along the bottom. With falling workload and declining input cost pressures, prices may ease slightly before attempting a recovery next year.

Building cost index

Building costs rose 2.2% in the year to the second quarter of 2012, but materials price increases have come to a halt and labour cost rises are expected to be kept to a minimum.

Retail prices index

The RPI fell in May and June, mainly owing to falls in the cost of petrol and clothing; annual inflation declined to 2.8%, its lowest rate since December 2009.

02 / TRENDS AND FORECAST

Tenders received in the second quarter of 2012 reveal a mixed canvas, with some prices edging up but others coming in well below budget as contractors fight for attractive projects. Overall, prices in the second quarter have remained flat despite some further increases in materials prices. This means that prices have edged up and down for the past 18 months without moving far and remain nearly 20% below their peak in 2008.

Some contractors have been able to secure their order books for the year ahead and are now selective about the projects they bid for, reluctant to expand while the middle distance looks so uncertain. Others are eager to grab whatever opportunities come their way, including venturing into unknown territory - whether sector, region or value. With single-stage competitive tendering once again the norm (even at the expense of frameworks), success rates have fallen and may be as low as one in eight, creating wasted bid costs that need to be recouped along the line.

Figures compiled by Experian show that 1,708 construction companies went under in the first six months of this year, a rise of 3% on the same period of 2011. Business recovery specialist Begbies Traynor identified a 104% rise in construction companies in “distress” in the first quarter compared with last year. More expensive performance bonds is the resultant trend.

The longer this situation continues, the fewer companies there will be to build the next recovery when it comes. The industry will have lost a significant proportion of its workforce and supply constraints may then cause prices to rise sharply.

This does not look likely in the short term, with the next two years looking likely to witness even lower levels of construction activity. Both Experian and the Construction Products Association (CPA) have downgraded their recent summer forecasts from three months earlier. Experian now expects a slightly greater fall in activity in 2012 (5.6%), followed by a further contraction and a much weaker return to growth in 2014. The CPA had previously expected a slight decline in new-build work in 2013, but now forecasts a stronger tail-off in both 2012 and 2013 before a more significant rebound in 2014 (+3.1%).

Overall, Experian remains the more pessimistic regarding the short-term outlook. If its figures are correct, by the end of 2013 the industry will have shrunk by 14% from its output in 2007 and the new work sector will have dropped by 16%.

The UK economy in 2012 is expected to be lacklustre at best. The economy has been broadly flat for 24 months and makes this recession already six months longer than any from the 1930s to the 1990s. One of the latest forecasts, from Ernst and Young’s Item Club, expects 2012 to end up posting zero growth. It does predict growth of 1.6% in 2013 and 2.6% in 2014 however.

Keen prices are being received for cladding works. In part this reflects the competition that has entered the top end of the market with the arrival of the Chinese company Far East Global Group. The stronger pound has also improved the prices of the European cladding contractors for UK clients.

In the other direction, Crossrail has driven up the price of specialist techniques such as diaphragm walling in the South-east. Uncertainty over the new landfill tax rules also seems to have pushed up disposal rates.

M&E contractors appear to be less competitive than most trades, with prices holding up even though the stronger pound should have made imported components cheaper.

Competition may be holding construction prices steady, but building clients in England will be hit by a 15% increase in planning application fees from the autumn. Scotland, which has far lower fees than England, proposes to raise its maximum fee by 600%.

On the other hand, the weak global economy is expected to restrict commodity price rises in the short term, capping construction materials prices; and labour costs are also likely to be restrained.

There is some extra activity in the London commercial market and the need for new space in the next few years should ensure that this trend continues, but restricted finance except for strong pre-lets will hold back any dramatic increase in construction. Construction prices in London are expected to rattle along at zero for the rest of this year and rise by no more than 1% next year. Come 2014, there may be room for contractors to begin to raise prices in a range of 1.5-3.5%.

In the regions, conditions look set to get even worse. Construction prices could fall by 1-2% over the next 12 months but will hopefully stabilise after that.

03 / HOT TOPIC: WHERE’S THE MONEY

A couple of years ago, when it became apparent that public sector construction was going to be reined back, it was hoped that the private sector would fill the void. Unfortunately the private sector has shown only very weak signs of improvement and, overall, the construction industry is forecast to shrink further over the next two years.

Company profitability may be heading downwards again, but corporate bodies are estimated to be sitting on very large stacks of cash. Business investment has improved over the last year or so but, in many cases, companies are reluctant to spend capital on investment while demand is perceived as absent and the economic outlook remains so uncertain.

In the private commercial sector, new-build office construction has been noticeably absent in most UK cities for the past few years. Occupier demand remains weak, but in many locations shortages of good quality new-build space are forecast one or two years ahead. In London some increase in activity has occurred but is undertaken principally by developers who have their own strong balance sheets and are not reliant on outside debt finance.

Banks have been placed in the difficult position of being encouraged to lend to business on the one hand, while on the other being forced to bolster their balance sheets. It doesn’t help the banks’ cause when property values continue to fall, as they are estimated to have a £300bn exposure to the UK commercial property sector. Analyst IPD has reported that property values fell by 2% in the first six months of 2012, with values of offices outside the South-east falling 4.8% and regional shopping centres by 6.2%. Development outside London is not encouraged by this trend, with or without the availability of finance.

According to real estate adviser DTZ, outstanding debt secured against real estate in Europe rose by 5% last year to €2.5tn (£1.96tn). More than 90% of this debt is in the hands of banks, and many banks have embarked on a process of reducing their exposure. RBS’ real estate loan book represents 50% of its loan exposure across all sectors and it has now withdrawn from all overseas property lending. Many overseas funders, meanwhile, have completely withdrawn from the UK market.

As banks become less willing to lend to property, opportunities have arisen for alternative sources of finance. Legal & General entered into property lending for the first time in May, backing student housing developer Unite. Other insurers are expected to increase their exposure.

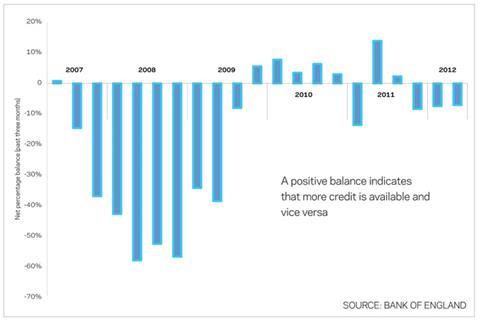

Despite government urging, lending by the high street banks to non-financial companies has fallen in every month bar one for the past year. Meanwhile, the Bank of England’s 2012 2Q Credit Conditions Survey (see graph) reveals that the amount of credit made available to the commercial real estate sector had decreased for the third consecutive quarter, considerably worse than to the corporate sector as a whole. Survey respondents, however, did not expect any further deterioration in the third quarter.

Other surveys suggest that existing lenders, mainly banks, expect future lending to decrease, but remain open to lending to high-quality prime assets.

04 / CONSTRUCTION OUTPUT AND NEW ORDERS

The latest data released by the Office for National Statistics (ONS) shows that construction output in the three months to May decreased by 7.4% compared with the same period of 2011 in constant price terms. New work fared even worse with volumes down by 9.9%. The largest drop-offs have happened in the public sector - new public housing, non-housing and infrastructure are down by 22.9%, 21.5% and 21.3% respectively.

The Markit/CIPS UK Construction PMI June survey identified the sharpest drop in construction output for two-and-a-half years. Previous surveys had painted a surprisingly resilient picture of the industry, but the latest figures identify a drop in output and new orders with civil engineering and housing activity hit the most.

Recent quarterly data has been erratic, but the total represents a 3% rise over the average quarterly value for 2011. The value is 12% lower than the average for 2010 and 37% lower than the average for 2006 and 2007.

The Glenigan Index, which measures the value of new construction starts, shows a 3% fall in Q2 of 2012 compared with Q1. Glenigan’s data confirms the drop-off in publicly funded work, but the value of private housing starts rose 40% in the quarter.

The Q2 2012 RICS UK Construction Market Survey found that activity levels reported by QSs edged lower in the second quarter, affecting most sectors of the market. Northern Ireland, Scotland and the north of England experienced the greatest decline. But expectations for workload over the next 12 months were generally positive.

Workloads for SMEs declined further in Q2 across all sectors according to the Federation of Builders State of Trade Survey Q2 2012. Enquiries showed an even stronger fall and respondents’ outlook for the coming three months deteriorated further.

There are some brighter signals. Latest ONS figures for orders for new construction showed a rise in Q1, increasing by 4.6% in value on a seasonally adjusted basis compared with Q4 last year, including substantial increases in order values for infrastructure, private commercial and private industrial work.

The RIBA Future Trends Survey of architects carried out in May found a positive outlook for the profession, with more respondents expecting workload to increase rather than decrease over the following three months, and larger practices particularly optimistic. This measure continued the positive trend that began in January. However history has shown that, over the past three years, subsequent events have failed to support architects’ initial optimism.

05 / BUILDING COST INDEX

The rate of increase in the Building Cost Index has fallen to 2.2% over the year to the second quarter of 2012, as materials cost inflation slows and labour costs remain muted or frozen.

The index rose by 0.4% in the second quarter of 2012 in response to a few spring increases in materials prices, including from some suppliers of cement, bricks and timber.

The index is forecast to rise by 2.7% over the year ahead, with materials prices expected to grow at a slower pace than of late and wage awards undershooting general inflation.

| Actual (2Q11-2Q12) | Forecast (2Q12-2Q13) | |

|---|---|---|

| Labour | +1.5% | +3.3% |

| Materials | +2.9% | +1.7% |

Labour

Building operatives won a 1.5% wage increase last September, but had hoped to return to their normal anniversary date of the end of June for a renewed offer this year. At initial meetings that started in May, the employers declined to make any pay offer at all, seeking to freeze rates again, following the three-year freeze that existed between 2008 and 2011. Subsequent negotiations have extracted an offer of 1.6% from January 2013, but to last a period of two years, a deal described by the unions as “derisory and insulting”. At the time of writing, the unions were “considering their next steps”, which, it has been suggested, could include strike action.

Even with no increase in wages, employers will be faced with an extra cost towards the end of the year as the National Insurance concession on holiday pay schemes, which has operated since the 1960s, comes to an end. From 1 November, employers will have to pay 13.8% National Insurance on employees’ holiday pay, which could result in a 3% increase in annual wage bills.

Materials

There were the usual early-year materials price rises, but by May the annual rate of increase in construction materials had declined to 2.9%, its lowest rate for more than two years. Rises in the first five months of 2012 amounted to 1.9%, compared to 6.2% last year and 5.1% in 2010.

The biggest price increases so far in 2012 have been in coated roadstone (up 10%), following the surge in oil prices and cement (up 6.6%), leading to an increase in ready-mixed concrete prices (up 4%) and bricks (up 5%). These latter materials are energy-intensive during production and manufacturers were faced with higher fuel costs at the end of last year.

Steel, which was behind many of the higher materials price increases of 2010 and 2011, is now subdued. Global prices have largely been falling since their peak in spring 2011, following the Australian floods and the subsequent shortage of coking coal. European steel prices had fallen by nearly 25% by the end of last year.

Some price recovery was achieved in the early months of 2012, but prices have been declining again in recent weeks as demand weakens with Europe looking set for more recession.

Prices are generally expected to continue their declining trend for the rest of this year. Demand is weak, but raw material prices are also benign, with iron ore, coal and scrap prices all at much lower levels than this time last year.

Other commodities such as copper and aluminium are also lower than this time last year, both down 25-30%.

Oil prices which, in the first quarter of the year, threatened to further undermine the world economy, passing $125 a barrel on fears of Iranian oil blockades, fell back in June to below $90 a barrel, the lowest level since December 2010. Since the end of June, however, prices have rallied steadily to above $105. Recent rises were attributed initially to concerns about supply following declines from Iran, the North Sea, and the US. More recently, renewed Middle East tensions and US stimulus hopes pushed the price even higher. But new European fears have sent the price back in a downward direction. The US Energy Information Administration now expects the price of Brent crude to average $106 a barrel (its current price) in 2012 but to fall to $98 a barrel in 2013.

The steady rise in the value of the pound against the euro since last autumn has benefited the construction industry, which imports 20% of materials and components, largely from the eurozone. The 14% increase in value over the last year has played its part in reducing the cost of M&E components, timber, steel, ironmongery and hard finishes such as ceramic tiles. Most commentators expect the current relationship between the pound and the euro to be maintained over the next couple of years.

No comments yet