The new year kicked off with fears of a triple-dip recession but with the markets bullish and most companies cautiously optimistic. Peter Fordham of Davis Langdon, an Aecom company, reports

01 / EXECUTIVE SUMMARY

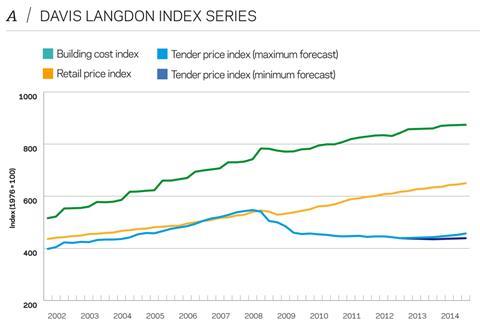

Tender price index

The second half of 2012 saw prices come under renewed pressure. 2013 will bring little respite.

Building cost index

Employers faced higher wage bills at the end of last year and will have to fund a small wage increase at the beginning of 2013.

Retail prices index

Higher utility costs caused retail prices to move back up. Higher food prices coming through will stop consumer price measures falling towards target.

02 / TRENDS AND FORECASTS

Last year ended with construction prices continuing their slide. Prices stabilised at the beginning of 2012 but in the second half of the year prices fell, partly in response to the growing holes in contractors’ forward order books and partly as input cost pressures faded. The Tender Price Index shows a fall of 1.5% in the second half of 2012.

GDP fell in the fourth quarter, leading to speculation about a triple dip recession, following an overall flat 2012. A triple dip may be avoided but few expect 2013 to be a year of plenty. The consensus view is for growth of around 1%.

Stockmarkets around the world started the year in bullish fashion, climbing in response to the initial political resolution in the US of the “fiscal cliff” crisis that further threatened the world economy. In the UK the FTSE broke through the 6,000 barrier and hit a four and a half year high. Companies may be sitting on cash piles but investment intentions remain weak while demand fails to grow.

The Bank of England has now held interest rates at 0.5% since March 2009 and some suggest that that is where they will stay until 2017. The Centre for Economics and Business Research forecast that austerity could last another 10 years. This would imply a Japanese style lost decade or more as we are already more than five years into the downturn.

There are some promising signs. The Autumn Statement recognised the need to restore capital spending and announced an extra £5bn of investment for roads, rail and education. The latest infrastructure investment pipeline sets out some 550 projects and programmes, worth over £330bn to 2015 and beyond. The problem is the government expects 85% of the pipeline will be privately or partially privately funded.

There are early signs credit may be easing. The Bank of England’s Credit Conditions Survey showed that credit availability to the corporate sector increased in Q4, including to the commercial real estate sector, with lenders expecting a further increase in availability in 2013 Q1. However, commercial property prices exert a negative influence on credit availability and new regulatory requirements may further reduce appetite for commercial real estate lending in 2013.

More encouraging news is that Wells Fargo, the fourth largest US bank, is reportedly intending to widen its lending ambitions to UK property companies in 2013 having resumed UK commercial property lending last spring. It is to be hoped that this may encourage others to follow suit.

In the meantime, some contractors with strong balance sheets continue to try to ease the wheels of some developments by offering to help with funding. This also helps them to get in on schemes at an early stage, a far more agreeable position than competitive tendering later on.

The short-term outlook for construction is bleak given the collapse in new orders over the last nine months. Both Experian and the Construction Products Association (CPA) have once again lowered their forecasts of construction output in both 2013 and 2014. Both anticipate a return to growth in 2014 but not before further contraction this year. The CPA’s new build output forecast for 2013 has been trimmed by more than 4% (or £3bn at current prices) since their autumn prediction.

Experian believes the total new build output in 2013 will be even lower, now predicting a further 4.8% contraction this year with 2014 registering growth at just +0.6% and private commercial work not bottoming out until 2015. The recently released ConstructionSkills annual report does not anticipate a return to the 2007 levels of construction activity until 2022.

These figures suggest further pain and discomfort for contractors in 2013. Further insolvencies seem inevitable as contractors squabble over the available workload. A common observation is of contractors turning down tendering opportunities because estimating departments are so lean that management has to be discerning over which jobs to bid for. It is also apparent that some contractors are no longer chasing turnover at loss-making price levels but prefer to slim down operations and take on only those projects from which they consider they have a reasonable chance of securing a profit.

Nevertheless, competition will remain intense and a lid will be kept on any underlying cost increases. A small wage increase at the beginning of this year for directly employed operatives in most trades will not help the cause of those contractors operating in a traditional way against others who rely mostly on agency or self-employed labour. Labour costs may also come under further downward pressure next year when Romanian and Bulgarian workers gain free access to the UK market.

Material cost increases are likely to remain subdued in 2013. There may be a rise in steel prices at the start of the year, but this will only balance out the decline in prices over the last six months. With demand low or falling, higher steel prices are unlikely to be maintained. The pound has been falling against the euro of late and many now predict a period of decline as Europe seems more stable and the UK comes under increased scrutiny from credit agencies. This may eventually lead to higher prices for imported construction materials and components, but this is one to watch.

London is the region with most construction activity now and looking forward. Even here prices are not expected to rise significantly or even at all over the coming year, a forecast of -1% to +1% is most likely. Outside of London, competition pressure will probably push prices even lower and -2% to 0 is the most likely outcome. During the following year, to 4Q14, there remains some hope of increased activity, particularly in London and the South East, and a small rise in prices of between 1 and 3% may be expected. Even in the regions, there may be room for some price recovery by 2014 but nowhere is this likely to exceed 2% at most.

03 / PREDICTIONS FOR 2013

Will 2013 be the start of a bright new future where the long recession of the late 2000s begins to fade into memory or will it be more of the same? Will the arrival of a new governor of the Bank of England later in the year encourage a change in policy? Already, he seems to be more focused on economic growth rather than the narrow requirement to chase an inflation target. But growth is stymied by the lack of demand. The UK economy is dependent on consumer spending which has been cut by policies that have resulted in high inflation coupled with low wage growth and poor returns on savings. However, the UK economy is also dependent on what happens elsewhere in the world and Europe in particular.

Economic prospects for Europe in 2013 remain subdued, with the IMF forecasting a further small contraction (-0.2%) for the eurozone, before achieving a

small 1% increase in 2014, suggesting that businesses in Europe will continue to face a tough operating environment. The risks to the European construction outlook are still on the downside given government austerity programmes and subdued investor and consumer confidence.

This year has started with many of the issues from 2012 unresolved. Throughout last year, the focus was very much on the eurozone economy and the problems in Greece. While the eurozone is looking slightly more stable for now, it will remain a key risk throughout 2013. Spain could take over centre-stage from Greece, as what happens in the eurozone’s fourth-largest economy poses a bigger threat. Other key issues are foreseen as follows:

- Global economy should stabilise in 2013

Most forecasters expect 2013 global economic growth at a steady rate similar to 2012, with the possibility of an acceleration of growth in the latter part of the year. A weak eurozone and slow Japan are predicted to be offset by a US economy that is gradually picking up steam if uncertainty about the fiscal cliff and debt reduction is resolved.

- Emerging market growth to gain momentum

Chinese growth is expected to regain momentum in 2013 and should surpass the 8% mark. With the leadership transition complete, there are expectations of a further package to stimulate domestic demand, while stronger growth in the US and other emerging markets should support exports. Fairly strong domestic demand and a gradual pick up in global growth should support other emerging markets in 2013.

- More commodity price fluctuation

Uncertainty around the performance of major economies and continued instability in the Middle East are set to keep commodity prices volatile in 2013. Most forecasters predict that commodity prices will come under mild downward pressure in the first half of the year due to muted demand, though stronger than expected growth in China and the rest of Asia could push prices in the opposite direction as the year progresses.

- Austerity measures and funding challenges will continue to limit infrastructure investments in Europe

The trend of public sector austerity of many European governments is set to continue in 2013, which means less investment in infrastructure. At the same time private sector activity is limited by low confidence and a lack of project finance. Further ahead, the need to upgrade or extend vital infrastructure, such as ageing or insufficient power generation, or transport links is expected to drive renewed growth in the construction sector.

European Union funding for infrastructure projects will continue to support these efforts in particular regions. Further developments in the eurozone sovereign debt crisis will be of critical importance for the European construction sector.

04 / ACTIVITY INDICATORS

Construction output

Figures from the Office for National Statistics (ONS) show that construction output in October and November last year picked up following the disastrous summer figures, both months registering the highest volume of output since March. The volume of new work was still 9% lower than the same period the year before. The total for the year to November was 11% lower than the corresponding period the year before. The fall in activity was led by public non-housing work (-21%), public housing (-19%) and infrastructure (-13%). None of the private sectors was able to register any increase in activity.

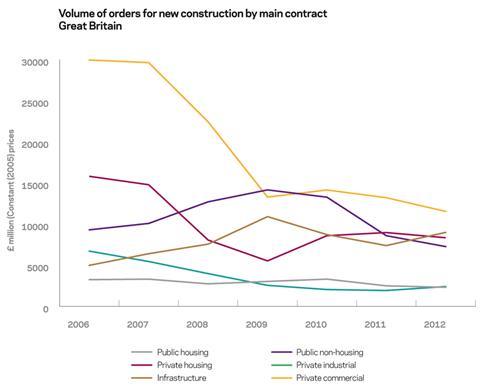

Orders for new construction

The disastrous level of new orders secured by contractors in the second quarter last year, the lowest quarterly figure since 1980, was bettered in the third quarter but still remained at the level last seen 32 years ago. Taken together, the value of orders in these two quarters totalled £21.6bn, a 45% drop on the value of work put to the industry in the middle two quarters of 2006. The volume of orders in both the private industrial and private commercial sectors was just a third of those proffered to the industry six years before. The one bright spot is infrastructure, where the volume of new orders was up by two-thirds compared with six years ago and remains the brightest hope for the industry in the short to medium term. The strongest area is railway work, for which new orders in this six month period were worth £1.6bn, compared with just £370m that was being spent on this part of our infrastructure in 2006.

RICS UK Construction Market Survey

The survey found surveyors’ workloads edged upwards in the final three months of 2012. Workloads increased markedly in London, the South-east and the North but remain in decline in Scotland and Northern Ireland. A net balance of 15% are optimistic that workloads will grow in 2013.

Markit/CIPS UK Construction PMI

Markit’s January PMI report showed the construction purchasers’ managers’ index hit a six month low in December, driven by a reduction in housing activity. Drops in the volume of incoming work were reported for the 7th consecutive month in December, supporting the new orders statistics from the ONS.

05 / BUILDING COST INDEX

Provisional figures for Q4 2012 show the Building Cost Index rose 1.6% compared with Q4 2011. This has risen from 0.7% the previous quarter. The rise was largely due to the government’s withdrawal of the National Insurance (NI) concession on construction holiday with pay schemes from 1 November, forcing employers to pay NI contributions for 52 weeks a year rather than 46 weeks. Over the year to Q4 2013, the index is forecast to rise 2% but falling to 1.5% the following quarter as the extra NI contribution from November falls out of the year-on-year calculation.

Labour

Building operatives secured a 2% rise in basic wage rates applicable from 7 January 2013. Many other operatives have also been successful in negotiating small wage increases from the beginning of this year including electricians whose pay rates will rise by 1.5% and steelworkers who will see their pay rise by 2% from the same date.

The latest deal to be concluded is for heating and ventilating operatives who will see an increase in wage rates and allowances of 1.5% from 1 April, their first increase in two and a half years. They will also benefit from a staged increase in employers’ pension contribution from 1% of basic pay to 4% by October 2014.

Materials

Construction materials prices were muted since the start of last year and show a 1% increase over the year to November 2012 according to the Department for Business, Innovation & Skills (BIS).

This year has begun with a flurry of price increase announcements from materials manufacturers, including 6% on cement, 3-6% on bricks, around 6% on blocks, precast concrete products 5-8%, roof tiles 3.5%, timber windows 3% and 4-5% on plasterboard. It remains to be seen how much of these price increases finds it’s way to the end user.

Steel prices, for so many recent years the underlying cause of construction materials price inflation, drifted down throughout most of 2012. BIS figures show that the price of fabricated structural steel was 3.4% lower in November than a year before and reinforcement prices were down 8.2% over the same period.

The beginning of 2013 may see some slight upward movement in prices. Tata Steel introduced a £30 per tonne increase in prices in early December which was echoed by other steel manufacturers around Europe. These prices were supported to some extent by price increases in raw materials such as scrap and iron ore.

Iron ore prices have risen back to $155 a tonne from below $90 last September, an increase approaching 80%, as Chinese steel makers have increased demand.

Scrap prices increased sharply in December and will likely impact reinforcement prices in particular.

Iron ore prices are expected to decline again shortly once restocking in China has been completed. Average prices in 2013 are expected to be no higher than last year’s average price. Longer term, iron ore prices are expected to decline as capacity increases through mine expansions and new projects in Australia, Brazil and West Africa.

No comments yet