Fears over the eurozone crisis may be subsiding, but construction is still in for a miserable year, with £5.4bn less work than 2011

01 / EXECUTIVE SUMMARY

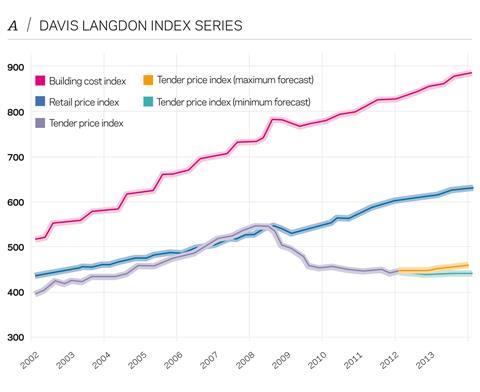

Tender price index

Tender prices edged up in the first quarter but it is a trend that is unlikely to continue. Falling workload is likely to see prices slip back as the year progresses.

Building cost index

Building costs rose 3.2% in the year to the first quarter of 2012. Employment costs are expected to rise this year, resulting in a 3.5% increase in the index over the next 12 months.

Retail prices index

Retail price inflation fell back to 3.7% in February. Further reductions are anticipated as consumer price inflation falls back towards the government target.

02 / TRENDS AND FORECAST

Construction prices at the end of last year took a greater fall than at first thought. Analysis of further tender returns shows that prices dipped by 1% in the last quarter, leaving prices 1% lower than a year before. The drop in prices mirrored the trough in sentiment that pervaded all walks of life as the eurozone crisis created grave uncertainty.

Prices in the first quarter of 2012 have seen a small uptick as the nervousness regarding events in Europe has eased and contractors have been faced with a barrage of materials price increases that they have found impossible to absorb. This is not expected to be the start of any sustained upturn in price movement, rather a further indication of the “bumping along the bottom” that has been described for much of the last year.

Surveys paint a mixed picture of conditions facing the industry, with some indicating a mood of rising confidence and increased orders. But Office for National Statistics figures for new orders at the end of last year were very depressing, with the total volume for 2011 16% down on 2010 and falling. Other activity surveys supported this trend.

Experian’s forecast is not quite as bleak as that made three months ago. Nevertheless 2012 is still expected to be a tough year for all in the industry, with total output expected to fall by 4.4%, and new work down by 6.9%. At last year’s prices, that means £5.4bn less work to fight over. Private housing will be the only sector to show any increase over 2011.

If Experian’s forecasts are correct, however, 2013 will begin to bring some respite as private housing activity builds on growth this year and private commercial work begins to recover. But it will be 2014 before any significant improvement begins to show.

Most commentators have marginally upgraded their outlook for the UK economy. The National Institute of Economic and Social Research estimates that GDP grew by 0.1% in the three months to March, just avoiding a technical recession of two consecutive quarters of decline. Its estimate assumes that construction output has been flat for the last five months.

However, manufacturing was looking up: output progressed steadily through 2011 and was nearly 6% higher than in 2010. The latest figure for February 2012 shows a fall of 1%, but it is hoped that this is a blip, because surveys paint a much brighter picture.

With consumers retrenched, the retail sector is going through a torrid time. The number of retailers entering administration in England and Wales in the first quarter was up 15% on a year earlier, according to Deloitte. Retail sales figures have weakened again, further administrations are expected and rents are expected to fall further in 2012. Shopping centre space completed in 2012 will be the lowest since the sixties.

Hopes continue for the office development pipeline, particularly in London. The momentum that began last year was halted by the eurozone crisis, but there remain plenty of enquiries, and schemes are progressing through to planning. Rents are stable but the need for pre-lets remains paramount. Regional centres are still quiet but work in Manchester to promote infrastructure development may bear fruit in the commercial sector before too long.

The construction industry looks set to suffer further difficulties before any improvement is seen. The public sector cuts will begin to bite harder now, and business investment is expected to be weak this year with the Office for Budget Responsibility slashing its forecast from 7.7% in the autumn to 0.7%. Credit conditions are expected to tighten further over the next few months.

Tender prices may have edged up in the first quarter but falling workload is expected to exert downward pressure as the year progresses. Preliminary costs have bottomed out, typically at 9-13% on large projects, as contractors are unable to trim further and still maintain an acceptable service level.

In London, prices by the end of the year are expected to be close to where they started. It is possible that the gap between London and elsewhere will widen further - prices outside the capital could fall by up to 3%.

Insolvencies may not have been as severe as expected up to now. But with the recession stretching on into the next year to 18 months, there is a very real fear that some larger contractors could hit the wall.

It is hoped that 2013 will be a year of stabilisation. This should be sufficient to halt the spiral of falling prices but is unlikely to herald anything other than cost recovery. The forecast for the year to the first quarter 2014 is for construction price inflation in London of 0 to 2% but still -1% to +1% in the regions.

03 / HOT TOPIC: THE BUDGET, ONE MONTH ON

Last month’s Budget produced little for the construction industry that had not already been trailed. However commentators were generally positive that it set the right mood in terms of encouraging business, if not pensioners. The government’s focus remained squarely on presenting the UK as a safe haven for investment when compared to our competitor countries, especially elsewhere in Europe.

There were encouraging signs in the various policies for stimulating business, including the reduced corporation tax and investment in new industries. The reduction in corporation tax from 26% to 24% in April and then to 23% and 22% in 2013 will give the UK the lowest main corporation tax rate in the G7.

However the chancellor’s attempt to lift consumer spending power by raising the personal allowance (from April 2013) may have backfired, as a report from the Institute for Fiscal Studies reveals that households will lose £4.1bn in 2012-13 (£160 per household) as a result of tax and benefit reforms, rising to £9.8bn (£370 per household) in 2013-14. Business investment is vital as are measures to improve lending, but the major economic concern remains a lack of demand.

Infrastructure

The Budget served as a progress report on the National Infrastructure Plan rather than introducing new landmark investments. A new pension Infrastructure Platform owned and run by UK pension funds has been established and it was announced that it would make the first wave of its initial £2bn investment by early 2013.

The 2011 National Infrastructure Plan announced that the government had identified 40 priority infrastructure projects and programmes and the government set out progress against each of them. This included “support” to Network Rail to invest a further £130m in the Northern Hub rail scheme but still subject to “value for money”.

However it remains to be determined how the National Infrastructure Plan will be delivered in practice, especially at a time when investors have many alternative markets across the world. This places ever greater importance on the PPP reforms still to unfold over the coming months.

Housing

In March the Get Britain Building fund was launched, providing £420m to support construction firms in need of development finance; the fund was quickly over-subscribed and a shortlist

of sites was identified which were planned to deliver 12,000 new homes. The Budget increased the fund by £150m, enabling the delivery of a further 3,000 homes.

The government also claims to be accelerating the release of public sector land and has stated its ambition to dispose of land with the capacity to build over 100,000 homes by April 2014.

Regions

The government has agreed proposals with the Greater Manchester Combined Authority to pilot an Earn Back Model that “is set to unlock £1.2bn of infrastructure investment across the city region”.

Manchester will be able to earn back up to £30m a year of the tax it generates by investing £1.2bn in infrastructure. This follows Liverpool’s earlier deal to take on powers over economic and housing strategy and Newcastle is expected to follow suit shortly.

These deals will include an element of tax increment financing, which enables local authorities to borrow against future growth in business rates.

04 / CONSTRUCTION OUTPUT AND NEW ORDERS

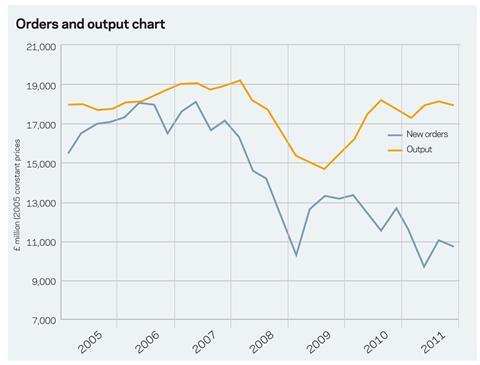

Mixed messages continue to emanate from the various industry sources related to activity and orders.

The Office for National Statistics’ latest figures show that 2011 was not a bad year for construction, registering 2.7% growth in the value of new work at constant prices, following 15.1% growth in 2010 over the low point of 2009. Most of the growth was found in the infrastructure sector where the value of output rose by almost £4.5bn over the two years.

The final quarter’s figures show a small downturn that was maintained into January and may herald the fall in output in 2012 anticipated by most analysts.

ONS figures show that orders in 2011 were very weak, down 14% on 2010 and 38% lower than in 2007 (at constant prices). Unsurprisingly, the biggest loser was the public non-housing sector, in which the value of new orders dropped 35%, depriving the industry of £4.3bn of work.

Meanwhile, Experian’s leading activity indicator index remained in decline in February. Construction activity fell further (making it 16 continuous months of decline), orders fell, but tender enquiries rose.

Finally, Markit’s March survey of construction purchasing managers painted a very strong picture for the industry, showing a pattern of continuous growth for the last 15 months. The latest figures registered the sharpest expansion of output in 21 months, while new orders expanded at their fastest rate in four-and-a-half years.

05 / BUILDING COST INDEX

The Building Cost Index rose by 0.7% in the first quarter of 2012 as materials manufacturers introduced price increases. The yearly rate of increase however declined to 3.2%. This may rise slightly to about 3.5% over the next year as labour costs become more important.

| Actual | Forecast | |

|---|---|---|

| 1Q11-1Q12 | 1Q12-1Q13 | |

| Labour | +1.8% | +3.4% |

| Materials | +5.4% | +4.2% |

Labour

Building and civil engineering operatives secured a 1.5% wage increase from 5 September last year, the first rise for three years. The traditional anniversary date has been the end of June. Discussions regarding changes to rates and allowances are due to begin next month. Electricians, heating and ventilating operatives and steel erectors are all in the midst of a

wage freeze.

The withdrawal of the National Insurance concession on approved holiday pay schemes such as those in the construction industry from November this year is an additional cost on the industry and the extra bank holiday for the Queen’s Jubilee in June is a further cost for directly employed staff.

Materials

In the first two months of 2012, materials prices rose by 0.9%, just below the 1.1% recorded at the beginning of 2011. However, the price increases this time around are more widespread as those manufacturers who held off raising prices last year have felt unable to hold prices for a second year running. Aggregates, cement and concrete prices have all risen, typically by around 4%. Bricks have risen sharply as manufacturers attempt to recoup higher energy costs, in some case up to 12%. Oil price rises have led to an 8% increase in coated roadstone. Paint prices have risen 9% over the last year following the oil price rise in 2011.

For once, steel prices do not feature in the top 10 materials price rises. In fact, prices declined slowly since last May and are virtually flat. Tata Steel introduced a 6% increase to their sections price list in February but it remains to be seen if any of it passes through the supply chain. Global steel prices have made a tentative recovery of around 3% since their low point in December but are finding it difficult to maintain traction.

In Europe, structural steel sections have shown a fall of 5% over the last year while reinforcement prices have risen fractionally. No further increases are expected this year as construction demand continues to wane and raw material costs are expected to decline.

The most serious danger to escalating materials prices may be oil and energy prices. Energy intensive manufacturing processes such as cement and brick-making have already forced suppliers to raise prices this year. Since oil prices dropped below $34 a barrel at the end of 2008, prices have been climbing steadily, notably including a near 60% increase between the autumn of 2010 and the spring of 2011 before the Eurozone crisis dampened confidence. But recent geopolitical events, namely tensions with Iran, have forced prices back above that level. Spot prices reached £128 a barrel in early March, passing the level reached in May last year but still well short of the peak just below $144 of July 2008.

But, more importantly, the Sterling price of oil is now at a record high level as the value of the pound against the dollar also crashed in the second half of 2008, losing nearly 30% in value in eight months. In Sterling terms, the price of oil passed that 2008 peak price at the beginning of February. By the middle of March, the price was 12% higher than the July 2008 peak. Prices have come down a little since then as Middle East tensions have eased but at £77 a barrel remain 6% higher than that 2008 landmark.

Gas prices are also linked to oil prices. Gas prices have risen 68% since April 2010 but are still below the peaks reached in January 2009 and December 2005. Nevertheless steadily increasing fuel prices make it difficult for manufacturers to hold prices and still remain in business.

Further increases in oil prices are impossible to predict and may well be dependent on political stability in the Middle East. The gap between spot and 12-month futures prices has increased recently to $8 a barrel, indicating nervousness about future supply. The US Energy Information Administration has increased its forecast average 2012 price by $10 a barrel, reflecting the recent price increases but expects 2013 prices to come back by $5.

No comments yet