There is plenty of room for greater hope, but there remains plenty of reasons to temper optimism with caution

Construction industry forecasters have been busily upgrading their forecasts in the light of a turnaround in industry fortunes since Spring.

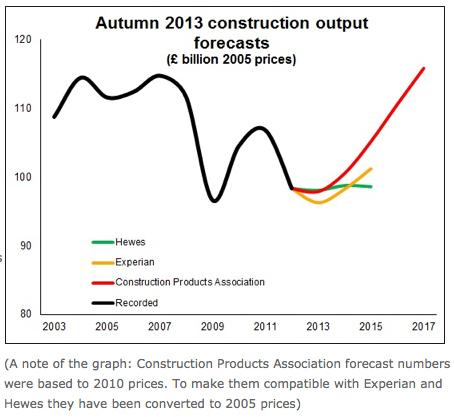

Despite all raising their expectations for the future path of construction, at first glance the forecasts from Construction Products Association, Experian and Hewes appear to be telling very different stories. That certainly seems to be the take-away message from the graph.

In some ways they are telling different tales, but in reality there’s more similarity than meets the eye.

One important point to note is that the Experian forecast was cast before recent revisions to the official data. The chances are that it would have been more bullish had it been produced a few days later. That is one of the problems of forecasting against data that is regularly and sometimes quite heavily revised.

But importantly, all three forecasts see, quite predictably, stronger growth in the private housing sector in the years to 2015. But they also see a smaller fall in the public sector spend.

The net effect of this is that the turning point where the industry starts to grow again has been in effect brought forward. We are enjoying the turn now rather than later in the year or early next year as had been expected in previous forecasts.

The initial source of the improvement in the housing sector seems to trace back to Funding for Lending introduced last year, which provided funds for mortgage lending. More recently this has been bolstered by the Help-to-Buy scheme, which provided a mechanism for delivering that extra money into an expanded market that includes those with more limited access to deposits.

The reason for a less severe crash in public sector construction is less obvious. There are areas where things may be performing better than expected, such as spending by universities. But in general it does rather fit with the view that capital spending has been increasingly subject to a lighter form of austerity than might have been expected earlier, as the government has tweaked the tiller in the face of heavy lobbying.

Looking to what might be regarded as the market driven improvements, rather than government sponsored, these are a bit patchier. Yes there is a degree of confidence that the economy is finally on the mend and this should translate into improved demand for construction.

Certainly the Construction Products Association sees a brighter outlook for the commercial sector, especially offices.

And it sees this supporting strong growth across the industry through to 2017. Hewes and Experian do not present such long-range forecasts. The implication in the Construction Products Association forecast is that output will return to its previous peak level in 2017.

This implication needs to be taken with some caution, which is recognised by economics director Noble Francis. The official data is in reality a splice of two different surveys and the parts that made up the series before 2010 are not fully replicated in the new series.

That aside, what underlies the bullishness in the forecast is the belief that firms are now in a stronger position to invest and that this investment will come from a low base, so one would expect a degree of catch-up.

Furthermore helped in part by the support to the housing sector, the view is that consumer spending will strengthen.

All of this comes against a background of reduced anxiety over the economy generally. Fears over the Eurozone have been less prevalent of late. This will have helped confidence, which is a key factor in turning investor intentions into actual investments.

For the first time in a long while the Eurozone is not noted as a potential downside risk within the Experian forecast. This doesn’t mean it has disappeared, but it is less worrisome.

It is the forecasters approach to risk and the general confidence in the underlying economic prospects that most separates the views of the forecasters.

The Construction Products Association and Experian tend to take a positive view, suspecting that the balance of risks favour relatively strong growth. Hewes tends to forecast on the downside relative to the other two forecasts. While Hewes is hopeful of an economic recovery strong enough to bolster growth in the construction sector, the view expressed in the forecast remains cautious.

It is certainly true that there is a huge question mark over what happens to the private housing sector when and if Help to Buy runs down. Furthermore the scheme may be reined in if house prices race.

Meanwhile, interest rates remain at their historical low point. They will have to rise at some point. And there is a General Election closing on the horizon, so how much of what we are enjoying now is a pre-election surge?

And the threat of further global economic tremors has not disappeared.

So there are plenty of potential downsides. However, with the balance sheets of firms much improved, with firms seemingly more confident to invest and consumers more willing to spend there are upsides too. Generally speaking the signs are that the risks are more evenly balanced.

This explains some of the optimism in the Construction Products Association and Experian forecasts. However, because significant uncertainty and big risks do remain, it would seem that Hewes is eager to see more proof before committing to a view that strong growth is on the cards.

Perhaps the message to take is that there is plenty of room for greater hope, but there remains plenty of reasons to temper optimism with caution.

Brian Green is an independent analyst, commentator and consultant working in construction, housing and property

No comments yet