There was no change in the monthly activity index for September, but civil engineering orders have dropped alarmingly, according to the latest figures from Experian Economics

01 / THE STATE OF PLAY

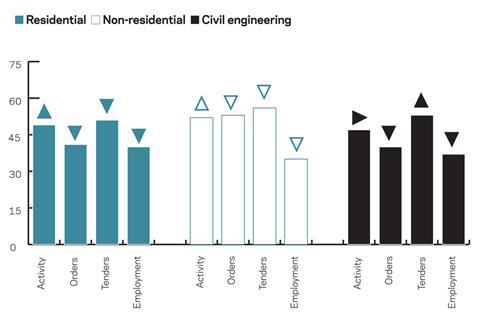

Experian’s construction activity index edged upwards by two points to the no-change mark of 50 in September, a level not seen since June last year. The non-residential activity index was the only one in positive territory, increasing by two points to 52. Meanwhile, the residential activity index also went up by two points to 49, although it has still not exceeded the 50 mark since the beginning of this year. The civil engineering index remained at 47 for the second month.

The orders index fell by five points to 44, indicating that orders were still below normal for the time of the year. During September, the orders indices fell across all sectors, with the most marked decline in the civil engineering sector, which dropped 16 points to 40, taking it back into negative territory. The non-residential orders index went down by five points to 53, however remained above the no-change mark of 50. The residential orders index edged down by three points to 41.

The percentage of respondents reporting no constraints on activity increased marginally to 23% - the highest reading since the same time last year. But insufficient demand as a factor restricting activity saw a small rise to 53%. The proportion of respondents reporting finance as a limitation on activity levels remained unchanged at 17%.

The employment index has been in negative territory since January 2008. The upward movement in the employment index last month proved to be short-lived as September saw a fall of six points to 37. Yet again, firms are indicating that they expect employment levels to decrease over the next three months.

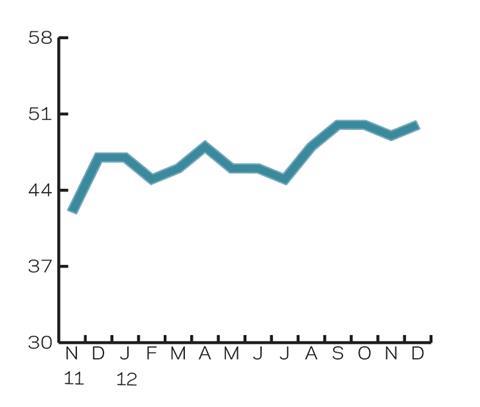

02 / LEADING CONSTRUCTION ACTIVITY INDICATOR

CFR’s Leading Construction Activity Indicator is predicted to remain unchanged at 50 in October before seeing a marginal decrease of one point to 49 in November. The index is expected to edge back up to the no-change mark of 50 in December.

The indicator uses a base level of 50: above that level indicates an increase in activity, below that level a decrease.

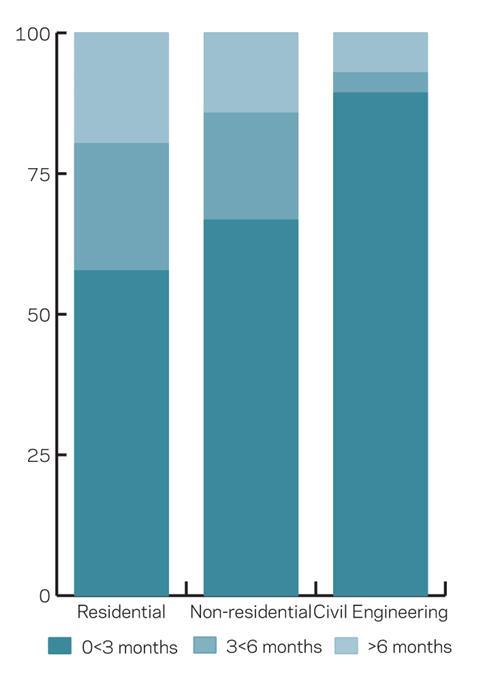

03 / WORK IN HAND

In September 2012, around 58% of residential respondents reported less than three months’ work in hand, while it was higher for non-residential and civil engineering firms at 67% and 89% respectively. A look back through the records shows that this is the highest proportion for civil engineering firms since December 2009, when a figure of 100% was reported.

Firms in the residential sector reported the highest level of work still being readily available beyond six months, at 20%, compared with 14% and 7% for non-residential and civil engineering firms respectively. While more than half of respondents (58%) in the civil engineering sector reported between three and six months of work in hand in September 2011, this had fallen to just 4% in September this year.

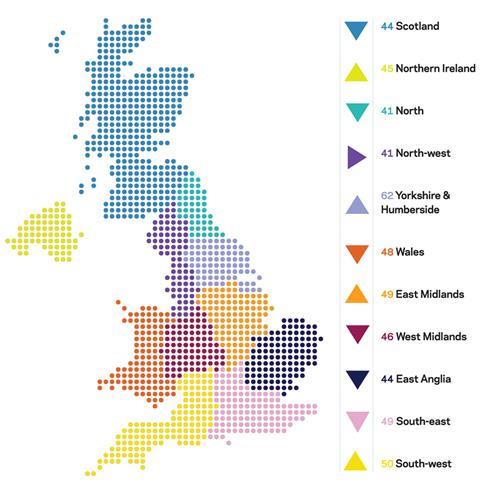

04 / REGIONAL PERSPECTIVE

Experian’s regional composite indices incorporate current activity levels, the state of order books and the number of tender enquiries received by contractors to provide a measure of the relative strength of each regional industry.

In September only four of the UK’s 11 regional indices saw a rise. Yorkshire & Humberside saw the largest increase, by nine points to 62 - the highest reading since June 2010.

The South-west index improved by three points to the no-change mark of 50 while both the East Midlands (49) and Northern Ireland (45) saw their indices edge up by one point.

The North saw the most marked decline in its index, dropping by 13 points to 41 - taking it into negative territory for the first time since August 2010. East Anglia’s index went down by four points to 44. The South-east, West Midlands and Scotland all fell by three points, to 49, 46 and 44 respectively.

The North-west’s index remained unchanged at 41. It has not seen positive territory since January 2008.

As a whole, the picture for the UK index, which includes firms working in five or more regions, is somewhat brighter, as it has moved up eight points to 52, taking it above the no-change mark of 50 for the first time in six months.

No comments yet