Adam Mactavish of Sweett Group looks at why the cost of residential photovoltaic systems has fallen, assesses their cost effectiveness and considers the potential for future cost reductions

01 / Drivers for Cost reductions in the last decade

Over the past decade the cost of residential photovoltaic (PV) systems has declined from over £10,000 per kWp to current costs of £2,000 per kWp and below.

Several elements contribute to the cost of a PV system. Most significant are the PV modules (the panel area), with other costs comprising inverters (to convert the electricity generated into a useable form), fixings, wiring, installation (including scaffolding and any modifications to existing roof systems), overheads and contractor profit.

In the build up of a system the proportion each category contributes to the overall cost varies with the size of the installation and whether the building is new build or retrofit. As a general rule of thumb, however, about 60-70% of the system cost is for technology with the remainder going on installation, overheads and profit.

Costs have reduced in all these categories as a result of:

- Lower material costs, owing to the development of more efficient techniques for producing silicon wafers

- Increased efficiencies in PV modules, resulting in greater outputs per m2 of panel

- Significant growth in the scale of global manufacturing and distribution

- Significant growth in the UK market, producing greater economies in purchasing and a larger base of qualified installers

- Increased price competition among suppliers and installers

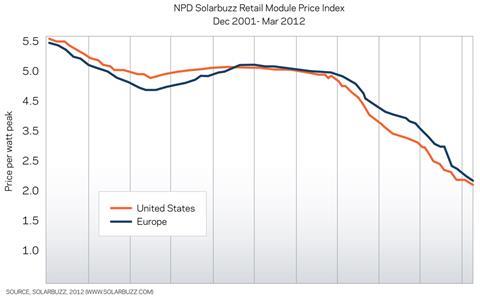

Perhaps the most marked cost reduction is that in module prices. Research by solar market analyst Solarbuzz shows that between 2001 and 2012 prices fell by nearly 60% (see Figure 1).

Solarbuzz also notes that while average European prices in March 2012 were around €2.30/Wp, over 30% of those surveyed were able to supply panels at less than €1.50/Wp and some suppliers were charging less than €0.80/Wp.

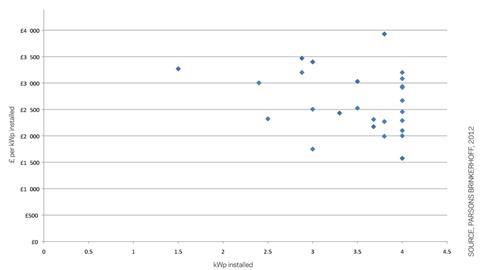

While the last decade has seen system costs fall, changes to the financial incentives for PV throughout Europe in the last 24 months have created significant upheaval in the market and European panel producers are increasingly concerned that Chinese manufacturers are trying to buy market share by selling product at or below cost. Some recent price changes in the UK may be affected by surplus capacity following changes to the UK feed-in tariff regime. For example, research by Parsons Brinckerhoff for DECC has shown average reductions in cost of around 20% between January and April 2012 for systems below 4 kWp, (although they note that costs for larger arrays have increased slightly).

02 / rates of return on capital costs

Despite the radically increased size of the UK PV market there is still a wide variation in costs across the market. Figure 2 (shown overleaf) shows the costs per kWp reported for 28 different installations of below 4 kWp, with costs ranging from £1,500 to over £4,000 per kWp. Some of this variation might be explained by project specific factors, but it is also clear that effective purchasing offers an important opportunity to save costs.

Beyond capital cost, the other factor impacting the return from PV investment is the level of incentive (provided via feed-in and export tariffs) for each unit of energy generated.

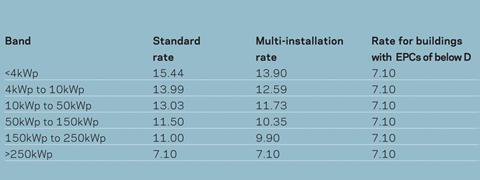

This area has developed markedly in 2012 with a new tariff structure introduced in April. Installations will now be eligible for the inflation indexed tariff for 20 years, starting at one of three levels - the standard level, a reduced level for claimants with over 25 separate installations and a further reduced level for installations on properties that do not have an Energy Performance Certificate rating of at least D.

From next month the tariff level will reduce each quarter by a default of 3.5%. The tariff degression may be increased up to a maximum of 28% or postponed (for up to two quarters) depending on the levels of PV deployment within each tariff band. The tariffs to be introduced in November are shown in table 1.

Analysis of the returns available from PV installation shows that good returns are still possible provided costs are towards the lower end of the range.

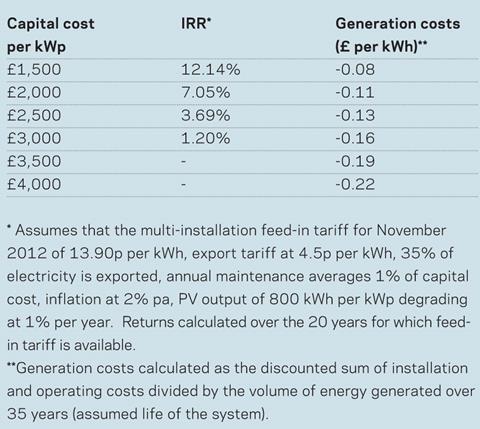

Table 2 shows the return on investment (internal rate of return or IRR) per kWp for multiple installations of below 4 kWp.

Because capital costs and tariff levels are much lower than they were when the feed-in tariff was introduced, a difference in capital cost of a few hundred pounds per kWp can make the difference between returns of less than 5% or more than 10%. Within the cost range identified

in Figure 2 the range in IRRs achieved is between 0% and 12.5%. Similarly the cost of generation over the life of the technology can range from a highly competitive 8p to a less attractive 22p per kWh.

03 / projected future capital costs

Despite the substantial fall in the cost of PV systems during the last decade, most projections suggest further significant reductions by 2020. These will be driven by the further expansion in global demand as the PV market expands, particularly in areas where it is able to provide electricity at a cost lower than conventional alternatives.

Research by McKinsey suggests that by 2020 up to a terawatt (1000 GW) of electricity could be generated by PV at a lower cost than conventional sources (in practice they expect only about half of this to be installed because of finance and regulatory barriers).

A terawatt amounts to around 6% of average global power demand, although a much smaller fraction of peak demands. Given that current global capacity is in the order of 50-60 GW, growth of 10 times or more is projected.

The continued investment in all aspects of the PV market will result in further reductions in cost through to 2020 where whole system costs are projected to be well below £1 per Wm2p. At this price PV will be a cost competitive technology in much of Europe with generation costs of 5p per kWh or below.

04 / conclusion

As UK and global PV markets continue to mature, this technology will become increasingly competitive as a low carbon energy source. Even as financial incentives are cut, opportunities for good returns remain for those able to find low cost suppliers and installers.

1 Readers' comment