Construction analysts spent most of the week marvelling at the speed with which Morgan Sindall had slapped £28m on the table for the social housing arm of Connaught

The money was in the account of administrator KPMG within 24 hours of talks opening with interested parties. According to one source close to the sale, it wasn’t the amount offered that put Morgan Sindall in pole position but the speed with which it struck.

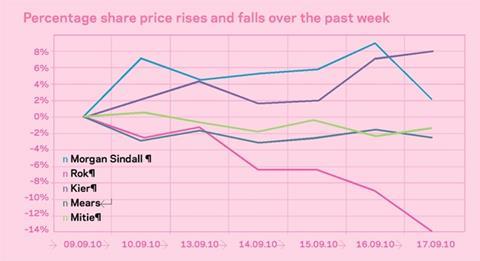

Its share price climbed 12% from 625p to 700p after the deal, where it has remained since. But some questioned whether the benefits outweigh the risk. This was perhaps a pertinent question in the week that Eric Daniels, Lloyds Banking Group’s chief executive, announced his exit after being criticised for buying HBOS in haste.

Morgan Sindall didn’t have the government breathing down its neck, but the company bought Connaught’s work-in-progress and debt rather than the contracts themselves. This leaves it at the mercy of about 100 local authorities and housing associations as to whether they transfer the deals - and as the story above makes clear, this is by no means certain.

One social housing boss contacted by KPMG didn’t bother making the journey up to the administrator’s Leeds office for more details. He decided not to, he said, when he realised he would have to fork out any money at all.

Another put it more colourfully. “It would have been a better punt for Morgan Sindall to buy £28m worth of Lucky Dips. It now has 100 clients that need making love to quickly but do they have the business development gigolos on tap?” It’s enough to make you shudder.

Morgan Sindall believes it got a good deal, and a source close to KPMG said it was the kind of transaction it was past master at, and didn’t go in with its eyes shut.

The next few months will tell whether the losing bidders should breathe a sigh of relief or turn green with envy.

No comments yet