Investment in regeneration, a young population and fast-growing employment opportunities have boosted Birmingham’s construction market and left the city well prepared for any economic turbulence to come. Ciara Walker, Matt Viall and James Bradley of Core Five examine the current market

01 / Introduction

As Birmingham continues to enjoy the demographic dividend of a young population driving demand across construction sectors, its strong market fundamentals will deliver a better market performance than many other regions in terms of growth, most notably London. While the area is, like the rest of the UK, exposed to a no-deal Brexit, the city is well placed to fend off the worst of the anticipated slowdown in activity. Consequently, we expect 0.75% tender price inflation for mainstream contractors in 2019 – a tighter market than London’s flat performance. Major projects contractors, with more market power to drive margins, will continue to operate in a relatively busy market, and be able to push prices up by 2%.

02 / Economic context

Birmingham has recently seen a significant revival in fortunes, with new districts springing up across the city in areas of prior industrial dereliction, as part of a regeneration programme that is continuing to change the face of the city. This programme involved expanding the central metropolitan area of Birmingham, pursuing enterprise zone status for tax incentives, and breaking down concrete barriers that physically blocked various parts of the city from integrating into a whole. Developments such as Paradise have been key to changing the face of the city, and Smithfield, the Martineau Galleries and others will continue this trend. Where previously factories stood (often abandoned), a myriad of start-ups have taken root, driving a new dynamism at the fringes of the city centre and reconnecting parts of the city to economic activity and urban life.

This multibillion-pound regeneration has driven Birmingham and the West Midlands to be one of the brighter spots in the slowing UK economy over the past three years. The area is growing faster than any other city region outside London, with output up by 35% over the past five years, and gross value added – a measure of economic output – up 3.5% on the year in Q2. Inward investment has ballooned, almost doubling between 2000 and 2017 to £25bn. This has been driven by foreign direct investment as well as government investing significantly into the region, with money for local tram and metro lines, alongside plans for a high-speed connection to London with HS2. The year 2017/18 was a record one for foreign direct investment, up 10.6% in terms of projects, and 30% in terms of jobs created compared with 2016/17.

The city is experiencing a demographic dividend – economic growth brought on by a change in population age structure – explored in more detail later in this report. A very young population, with 38% under 25 compared with a national average of 30%, is driving city-centre living, the jobs market and economic activity. Regenerated industrial areas of the city have cheap rents and the growing sense of a “start-up community”, creating ideal conditions to capitalise on the demographic dividend. This has resulted in a booming start-up market, with Birmingham second only to London in recent surveys of new business creation. Other industries are also taking note of the favourable market conditions for employers in the city, with large-scale investment from the financial sector over recent years. While employment rates remain low compared with national averages, unemployment is falling, down to 7.7% in most recent figures, and investment into upskilling the workforce to combat poor employment performance continues. Job growth is expected to persist over the next five years, averaging 1.1% a year, well above the national average of 0.5%.

Looking forward, the property markets in Birmingham and the West Midlands are expected to hold up better in the face of Brexit than for the UK as a whole, with a GVA growth forecast of 2.9% a year, based on the strong demand fundamentals in the city, such as demographic dividends, strong job growth and the opportunity to be the UK’s logistics and distribution centre. HS2’s anticipated arrival, preparation for the Commonwealth Games in 2022 and selection as the first large-scale test-bed of 5G networks will contribute to boosting demand in the next few years.

However, given the region’s long-held traditions of manufacturing and trade, and subsequent dependence on exports, a no-deal Brexit is a threat to current strong levels of activity, though with strong fundamentals Birmingham is better placed than most regions to shrug off the threat.

03 / Construction and property market

Public and private investment, combined with a growing economy, has opened up new opportunities for development across the city centre and beyond. With much of this investment going towards local and national infrastructure, newly connected areas of the city are becoming attractive to investment for the first time in decades, particularly through expansion of the metro network.

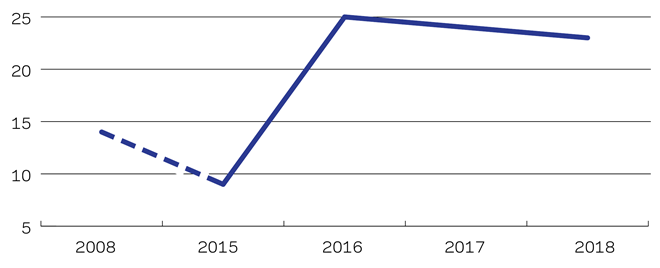

The combination of improved access to development opportunities and high levels of infrastructure construction in the city has led to a hot construction market, with activity in Q1 of 2019 at its highest level since 2008. The Deloitte crane survey measured 23 new scheme starts in 2018, one fewer than 2017 but still well above long-term averages for the city (see figure 1).

Residential

The housing market in Birmingham has held up well compared with other regions of the UK, particularly London and the South-east, with prices still rising despite a slowdown in transactions. The city saw 4.3% house price growth in the year to May 2019, as strong demand trumped uncertainty in pushing up prices.

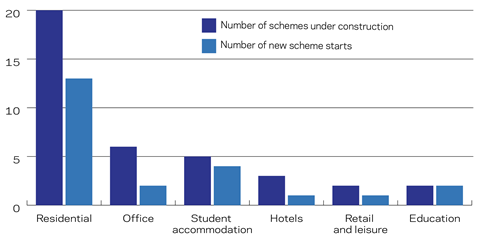

Birmingham’s population has grown by 12% over the past decade and is set to continue growing at a similar pace. An additional 3,145 households are expected each year over the next decade, and the West Midlands has received £350m of funding to meet this demand, to be used to fund a pipeline of 215,000 new homes to 2031. In 2018 the most residential units were completed since 2008, and the 5,065 units currently under construction (see figure 2) is the highest figure in the history of the Deloitte Birmingham crane survey. House price growth is supporting viability in complex regeneration schemes, and the shape of the market is increasingly shifting towards new entrants, such as build-to-rent operators and housing associations.

Despite the blow to profits from changes to mortgage tax relief, some 30% of the pipeline will be entering straight into the rental sector as build-to-rent or multihousing schemes. Previously the majority of supply in the UK build-to-rent sector was based in London and Manchester, but with 16% rental price growth in 2014-18 and strong ongoing demand for housing, Birmingham has the key market fundamentals to attract investment into this sector.

Offices

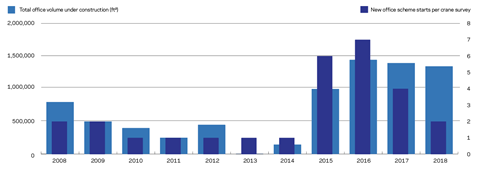

Although new office starts are set to be at their lowest point in 2019 since 2014, they are still working through a significant pipeline, with 2019 set to be a record-breaking year for completions. The office market was strong in Q2 with take-up significantly higher than in Q1 and outstripping t he levels recorded in each quarter of 2018. A continuation of H1 levels of activity through the second half of the year would see take-up matching 2017’s record breaking 1 million ft2. The relocation of major employers to the city has driven these high levels of take-up, as well as the budding tech and start-up sectors. However, the demand profile is shifting, with the changing role of the workspace influencing requirements: more innovative and collaborative spaces are demanded, with many new developments implicitly positioning themselves as innovation labs, or business accelerators/ incubators. Serviced and shared offices are therefore garnering increasing interest within the market, accounting for 23% of take‑up, and experiencing unprecedented growth across the past year. Speculative development also increased in 2018, as strong demand fundamentals drove increased confidence in scheme viability.

Supply is not keeping up with demand, however: available stock is forecast to erode further over the second half of this year, bringing the city to a historic low for availability, at a point when demand from all sectors and inward investment has never been higher. While 2019 is set to deliver a number of large schemes, continued low availability will still have a direct upward effect on rents, which in turn will support further investment and therefore supply growth. Although Brexit is holding back some relocations and investments into the city centre, the strong demand conditions are set to sustain a healthy pipeline for several years to come.

Industrial and logistics

There is a huge opportunity in the industrial and logistics market to fulfil the urgent need for improved supply chains created by online shopping. Demand for new warehousing space is being driven by store-based retailers adapting to this changing environment, as well as by Brexit stockpiling and demand for more efficient supply chains. Unprecedented levels of population growth are contributing further to online retail demand in the local area.

Sitting at the centre of the UK’s rail and road network, with 90% of the UK accessible within four hours, and with existing expertise in logistics and distribution, Birmingham and the West Midlands are ideally placed to take advantage of this opportunity. This sector continues to outperform other markets, and despite increasing levels of speculative development, supply is not keeping pace with demand. As a result, growth in rental levels and capital values is anticipated for the coming years.

Advanced manufacturing and technology industrial space also represents an opportunity for the region over the longer term. Birmingham has been selected to be the testbed for incoming 5G connectivity technology, which will further boost conditions for tech start-ups in the city.

Student accommodation

After a recent dip in student numbers, this demographic is now expected to increase by 5% up to 2022. Universities have been investing in additional education space to meet demand, and have aggressive short- to mid-term expansion plans, driving student numbers up further. Thanks to this large and growing student population, Birmingham is seeing increasing levels of activity in the student accommodation market, with a total of 2,667 bed spaces under construction. In 2018 a total of 1,262 new bed spaces were delivered, a significant increase on the 2008-18 annual average of 657. With growing demands on the quality of the accommodation and a desire from students for city-centre living, this presents further development opportunities.

04 / Costs and tender prices

Costs

High levels of activity in the West Midlands area have pushed construction costs up significantly over the past decade. Costs increased by 13% between 2016 and 2018, and by 34% over the past 10 years. A large part of this is coming from growth in wage levels as the local population is increasingly pulled into employment, but materials inflation has also contributed as a hotter market puts demand pressure on materials supply.

Materials inflation is likely to rise to 4%-5% in the latter half of this year as recent exchange rate depreciations feed through to import costs. Should we have a no-deal Brexit this will be exacerbated, with significant exchange and tariff linked material inflation to be taken into account.

Wage levels are rising faster than in any other UK region. While this is positive news for the city, it does mean construction will face rising labour costs. Added to this is the existing nationwide shortage in both skilled and unskilled labour, which will exacerbate any mismatch between on-site demand and the supply of labour.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2019-23 | |

|---|---|---|---|---|---|---|

| House price growth | ||||||

| Birmingham | 2.5% | 2.5% | 3% | 3.5% | 3.5% | 15.9% |

| UK average | 0.5% | 1% | 3% | 3.5% | 3% | 11.4% |

| London | 0.5% | 2% | 4% | 4% | 3.5% | 14.8% |

| Rental growth | ||||||

| Birmingham | 3% | 3% | 3% | 3.5% | 3% | 16.5% |

Tender prices

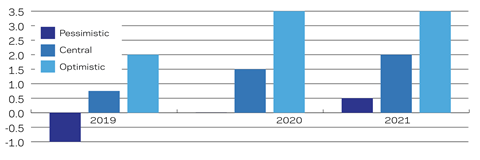

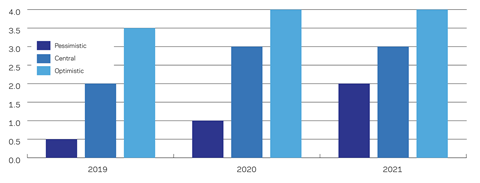

Our tender price forecasts (figure 4) are predicated on Brexit outcomes, and as such are presented as three separate tender price scenarios. Our central scenario expects a further extension to Article 50 to avoid a no-deal exit, and a continuation of the current uncertainty. This will result in continued slowing activity, as well as further exchange rate-linked inflation should the currency suffer more depreciation. In this scenario we forecast mainstream tender price inflation at 0.75% for this year.

Our lower scenario envisages a no-deal Brexit, with the well-documented consequences involved: a dramatic slowdown in activity, spiking materials inflation due to exchange rate and tariff effects, exacerbated labour shortages and project delays due to difficulties at the ports. In this scenario, Birmingham will suffer about as much as London, and we are forecasting the same hit to tender prices of -1%. Heavily reliant on exports, Birmingham’s economy will suffer disproportionately from Brexit, which in determining tender prices will not quite make up for its stronger market fundamentals being greater than those of London.

In our optimistic scenario we envisage no Brexit, or that a good deal is made leading to a soft Brexit. In this event we expect a “deal dividend” of projects returning to the market as certainty returns, which will drive tender prices significantly higher than our central scenario as capacity tightens, at 2% for mainstream contractors for 2019. With less risk of materials inflation and labour shortages, we expect mainstream contractors to increase margins as activity ramps up.

Similarly to London, there is a sub-market in Birmingham for major projects, where fewer contractors have the capabilities to deliver the £60m+, complex projects that are increasingly being developed in the city. Major projects contractors therefore face better tendering conditions due to their relative scarcity, and we are forecasting similar levels of tender price inflation to London’s major projects market, at 2% for 2019 and 3% subsequently in the central scenario (figure 5). Our forecast for the lower scenario is also in line with London’s major projects market, facing similar conditions. Only in our higher scenario are we likely to see diversion between London and Birmingham’s major projects tender price inflation, as projects return swiftly to market in London, dragging in capacity from the regions, and driving tender price inflation higher in Birmingham even than London, at 3.5% for 2019.

05 / Opportunities and risks

Leveraging a demographic dividend

The city retains around half (49%) of its significant supply of graduates, providing young, dynamic employees to a fast-growing jobs market. Additionally, the city is capturing the bulk of the youth exodus from London, offering cheaper rents and a better quality of life to those struggling with London’s poor affordability. As a result, the population has gone up by 16% since 2000, maintaining Birmingham’s position as the UK’s most populous city outside London. In 2018 more people migrated from London to West Midlands than vice versa, a symbolic reversal of London’s decades long draw for the youth of the country.

Birmingham’s strong market fundamentals are in large part driven by this demographic dividend. With 39% under 25, the youth of the population is fuelling demand for development – they need rental housing, then homes for purchase later down the line. They make use of urban facilities more than do older generations, driving demand for leisure, restaurants, retail and community facilities.

Most importantly, a young, educated population is a draw for business: major multinationals and start-ups alike have flocked to Birmingham to take advantage of this beneficial labour market, driving demand for office space. With the population set to increase at more than 1% annually over the next decade, favourable demographics are likely to continue to underpin the strong fundamentals of the Birmingham construction market.

Brexit – a risk, but with a silver lining of opportunity

A no-deal Brexit represents a significant risk to Birmingham and the West Midlands in terms of economic growth and opportunity. With a full 25% of regional GDP dependent on goods exports, any damage to exporting capabilities will be a blow to the region. In addition, EU structural funds contribute to creating jobs and supporting the local economy, with £86m provided over the past five years. The absence of this funding will not be critical but will be an added drag at a time of economic turbulence, unless of course it is replaced by new government funding.

However, the West Midlands is one of the few areas of the UK that could see some benefit from Brexit, in the form of increased logistics, warehousing and distribution demand at a time when supply chains will have to become more complicated due to Brexit and so more reliant on these middle stages. At the time of writing an extension to the Brexit deadline looks likely, and as such stockpiling has not been undertaken to the same extent as earlier in the year, but any future deadline could see it ramp up again.

In addition, London-based businesses looking to reduce their cost base could find the fundamentals of Birmingham attractive in the event of a no-deal Brexit, reducing London’s draw to business and attracting more company headquarters to Birmingham.

Development dependent on HS2 – what happens when it is delayed?

It has now been confirmed that HS2 will cost £22bn more than expected and will not be completed until 2040, seven years after it was planned to be. With much of recent development in Birmingham predicated on the arrival of HS2, talk of delay is sowing some uncertainty in the market. Even if the project is not cancelled, a significant delay could provide some challenges to viability, and potentially see some projects delayed to meet the new timeline.

The huge importance of inward investment into the region cannot be ignored, and with HS2 a trigger for much of the recent investment into the city, there are some concerns that the flow of money will slow. However, after years of under-investment, development in Birmingham will not be derailed by any delay or cancellation of HS2: the demand fundamentals across the residential, offices, logistics and higher education markets will ensure that investment stays on track.

No comments yet