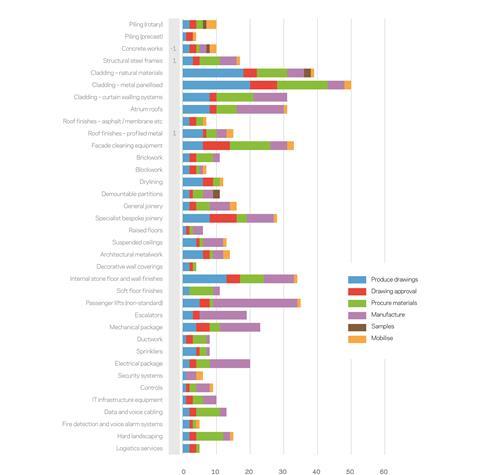

Companies report being busier, and the lead times of several packages have changed but most have remained level, while little alteration is expected in the next six months

01 / Going up

▲ Structural steel frames

▲ Roof finishes – profiled metal

02 / Staying level

▶ Piling (rotary)

▶ Piling (precast)

▶ Cladding – natural materials

▶ Cladding – metal panellised

▶ Cladding – curtain walling systems

▶ Atrium roofs

▶ Roof finishes – asphalt/membrane

▶ Facade cleaning equipment

▶ Brickwork

▶ Blockwork

▶ Metal doors

▶ Dry lining

▶ Demountable partitions

▶ General joinery

▶ Specialist bespoke joinery

▶ Raised floors

▶ Suspended ceilings

▶ Architectural metalwork

▶ Decorative wall coverings

▶ Internal stone floor and wall finishes

▶ Soft floor finishes

▶ Passenger lifts (non-standard)

▶ Escalators

▶ Electrical package

▶ Mechanical package

▶ Ductwork

▶ Sprinklers

▶ Security systems

▶ Controls

▶ IT Infrastructure equipment

▶ Data and voice cabling

▶ Fire detection and voice alarm systems

▶ Hard landscaping

▶ Logistics services

03 / Going down

▼Concrete works

04 / Lead times summary

Rotary piling ▶ companies are reporting no change in the 10-week lead times. Demand in the next six months is set to be quieter, but change is not anticipated.

Precast piling ▶ lead times remain at four weeks. Workload over the next six months is set to be quieter and lead times are anticipated to reduce.

Concrete works ▼ lead times have reduced by one week to 10 weeks. Contractors do not anticipate any further change over the next six months.

Structural steel frames ▲ lead times have increased by one week to 17 weeks. Enquiries are on the increase, but contractors do not anticipate any change to lead times in the next six months.

Cladding – natural material ▶ lead times remain at 39 weeks, with no change in more than a year and none anticipated in the next six months.

Cladding – metal panellised system ▶ lead times remain at 50 weeks. Some contractors anticipate increases in the next six months due to higher workload.

Cladding – curtain walling system ▶ lead times are at 50 weeks – this data has been restated due to reflect better information available.

Atrium roof ▶ lead times remain at 31 weeks.

Roof finishes – asphalt / membrane ▶ lead times remain at seven weeks. Contractors do not anticipate lead times increasing in the next six months.

Roof finish – profiled metal ▲ lead times are up by one week to 14 weeks. Workload and enquiries have stabilised, so no increase is anticipated.

Facade cleaning equipment ▶ lead times remain at 33 weeks. Contractors are busier and enquiries up, but change is not expected in the next six months.

Brickwork ▶ lead times remain at 11 weeks. No change in lead times anticipated in the next six months.

Blockwork ▶ lead times remain at seven weeks. Firms do not expect an increase in the next six months.

Dry lining ▶ lead times remain at 12 weeks. No increase in lead times anticipated in the next six months.

Demountable partitions ▶ lead times remain at 11 weeks. No change anticipated over the next six months.

General joinery ▶ lead times remain at 16 weeks. No further increases anticipated in the next six months.

Specialist joinery ▶ there has been no change this quarter, with lead times remaining at 28 weeks.

Raised floors ▶ lead times remain at six weeks. No change despite increased workload and enquiries.

Suspended ceiling ▶ lead times remain at 13 weeks with no change reported.

Architectural metalwork ▶ lead times remain at 14 weeks – no further increases anticipated.

Decorative wall coverings ▶ lead times remain at four weeks. No change anticipated in the next six months.

Internal stone floor and wall finish ▶ lead times remain at 34 weeks. No increases anticipated in the next six months.

Soft floor finishes ▶ lead times remain at 11 weeks. Increases anticipated in the next six months as contractors continue to be busier.

Passenger lifts – non-standard ▶ lead times remain at 35 weeks. Companies are currently busier but do not anticipate any changes for next six months.

Escalators ▶ lead times remain at 19 weeks with no change predicted for the next six months.

Electrical package ▶ lead times remain at 20 weeks and while contractors are busier they do not forecast any increase in the next six months.

Mechanical package ▶ lead times remain at 23 weeks. Enquiry levels are increasing but contractors do not anticipate change in the next six months.

Ductwork ▶ lead times remain at eight weeks with no change forecast for the next six months.

Sprinklers ▶ lead times remain at eight weeks with no increase forecast for the next six months.

Security systems ▶ lead times remain at six weeks with no changes expected for the next six months.

Controls ▶ lead times remain at nine weeks. No change is anticipated in the next six months.

IT Infrastructure equipment ▶ lead times remain at 10 weeks.

Data and voice cabling ▶ lead times remain at 13 weeks.

Fire detection and voice alarm systems ▶ lead times remain at five weeks. Contractors report lower levels of work and enquiries with possible reductions ahead.

Hard landscaping ▶ lead times remain at 15 weeks. Contractors report being busier and increased enquiry levels but no increase is predicted in the next six months.

Logistics services ▶ lead time remains at five weeks. There is no change forecast in the next six months.

There are only three changes in lead times, with two of these within the structural frame – a slight decrease in concrete lead times and a small increase in the steel frame. The only other movement is a rise in profiled metal roof lead times. Many companies report being busier but anticipate little or no change to their lead times in the next six months.

Data capture and analysis by Mace Business School

No comments yet