With some materials prices going through the roof, inflation has become the hot topic for 2021. Simon Rawlinson of Arcadis examines what is causing the problem, why some categories are more affected, and what options clients have to mitigate inflation, including timing and risk transfer

01 / Introduction

When ex-Bank of England economist Andy Haldane forecast in summer 2020 a V-shaped recovery, few commentators predicted how difficult it would be to restart an integrated, just-in-time, global economy. Twelve months on, the challenges become clearer day by day. Not only has McDonalds run out of milkshakes, but the shortage of microprocessors is so acute that UK car manufacturing in July fell by 38% to the smallest volume in 65 years.

Construction clients and contractors are used to operating in an inflationary environment. Over the past 20 years, prices have risen by at least twice the Bank of England’s 2% target rate for 50% of the time. Most of this inflation has been driven by rising demand. Inflation caused by materials inputs is not so common, and the current situation is almost unprecedented. You need to go back to the bad old days of the 1970s to find records of similar, sustained industry-wide materials price increases.

The big problem with disruption to materials markets is the knock-on effects. Increased costs always affect viability, but if contractors are not able to fix their materials prices as part of a bid, then the value of the risk allowance will be much higher too. Shortages, allocations and delivery problems threaten delays as well as price increases. What’s more, even the constant talk about rising costs, shortages and bottlenecks is inflationary – increasing fears and expectations that prices will continue to rise.

Many commentators think the current bout of inflation is a blip related to the reopening of the world economy. The Bank of England is still “seeing through” rising prices, even when CPI is forecast to reach 4% this autumn. However, construction inflation has been going on for a while now and could prove more stubborn than expected. What clients and contractors need now are ways of dealing with the inflationary risk that are practical and fair. This will enable clients who really do need to build to proceed with greater confidence towards a more certain outcome.

02 / Causes of materials cost inflation

Materials shortages and inflation are being triggered by multiple causes that are difficult to unpick. For example, how long will disruption to container shipping last and what is the actual effect of a tenfold increase in freight rates on prices? However, the main causes are:

- Demand The effect here is from a combination of a simultaneous global increase in demand for products such as steel and timber and a change in patterns of domestic consumption. The big price rises for timber in the UK can be attributed to a post-covid leap in the construction of traditional homes as well as the DIY boom. Patterns of demand remain unpredictable, although the addition of a big infrastructure programme to the mix is likely to add to inflationary pressures.

- Supply disruption Supply is always going to be tight in a rising market. Unfortunately, key materials are suffering from production difficulties, covid-19 disruption and even political upheaval. Some raw materials producers have faced huge problems, with Rio Tinto recently reporting that its second quarter 2021 iron ore output was 12% to 13% below 2020 levels.

- Accidents and weather events The Suez Canal blockage is the best example of a major accident affecting supply chains, but there have been others with potentially even greater impact on the sector. Plastics polymer production was disrupted by winter storms in Texas, and there will be more disruption following Hurricane Ida. Low inventories and lack of shipping capacity mean availability of plastics will remain tight for much of the year.

- Raw materials Raw material costs have also been a big factor in the inflationary trend. Energy costs, which fell sharply in 2020, have been bouncing back, and a 70% rise in wholesale gas prices has contributed to upcoming price rises for bricks.

- Bottlenecks Low inventory, delays on ships and in ports, shortages of packaging and a crisis in logistics are all contributing to problems getting materials to where they are needed. Paying a premium cost to ensure on‑time delivery is increasingly common.

This is a very complex picture, to which can be added a steady growth in new workload and some signs of pressure in the labour market.

03 / Why are some materials categories more affected than others?

Not all materials are affected by inflationary price rises. Steel and timber have been most affected, and interior products such as suspended ceilings and raised floors have also seen significant price rises. By contrast, other categories, including readymix concrete, have so far seen very little inflation.

Some sectors are more exposed than others. While no sector is immune to these inflationary pressures, it is some of the busiest parts of the construction market – including new‑build housing, distribution and heavy infrastructure – that are most the exposed to materials cost inflation.

Volume housebuilding has faced shortages of sawn timber, roofing tiles and plastic pipe, although the big housebuilders have the ability to stockpile and have benefited from rising sale prices. Utilities businesses are also highly exposed to price movements in copper cable and polyethylene pipe. Complex projects such as data centres should be proportionally less exposed due to the higher value-added content in their complex mechanical and electrical systems.

The following factors are those that determine why the inflation exposure of a project will vary.

Raw material content

Most of the inflation is being driven by raw materials prices. For example, there is a very close relationship between the cost of iron ore and the price hikes announced by UK steel manufacturers. Raw materials account for a large share of the cost of some construction work, such as in-situ concrete, ductwork or high-voltage cable, but for a much smaller proportion of the cost of complex components such as curtain wall or mechanical and electrical plant.

Local versus global content

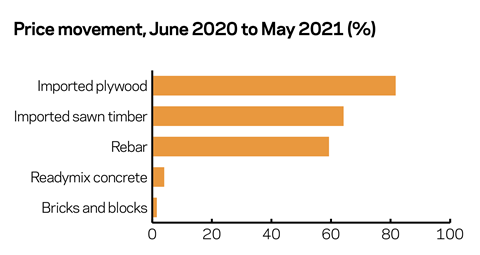

The inflationary trend is global, but it mostly affects globally sourced products. About 75% of construction materials used in the UK are sourced domestically, and the costs of many of these are relatively stable. This is illustrated by latest data from the UK business department, comparing annual price rises for imported and UK-sourced products. This difference can be seen in a comparison of price movements for common construction materials (see chart). The crucial difference is that the raw materials for bricks and concrete are sourced from the UK domestic market.

Typically, construction projects will feature a blend of materials exposed to varying levels of inflation, and the key to understanding the impact is the relative share of spend on different materials.

Project complexity

In the same way that complex components are less exposed to raw material cost inflation, the overall cost of complex projects should also be less affected by materials inflation. Organisationally complex projects with an extensive supply chain will have a higher proportion of on-costs including management and preliminaries. These can often add up to 40% or 50% of project cost. At the moment, there is less inflationary pressure on these cost categories. The same principle applies to complex components with a high proportion of value-added. Relatively simple projects such as distribution sheds will be more exposed to inflation, partly because the on-cost share is lower, but also because there is less value-added in many of the components used.

Programme constraint

Extended lead-in periods and product allocation arrangements may be contributing to extra inflation exposure. Products like steel cladding for distribution sheds are mostly on a on a 12-month lead-in period. For projects with faster programmes, contractors have to go onto the secondary market for materials that are available at short notice. These materials are priced at a significant premium. The data on these additional costs is inevitably difficult to obtain, but this is an important trend that is likely to persist into 2022.

Carbon

Carbon prices under the Emissions Trading Scheme (ETS) for energy-intensive industries have more than doubled in the past year. For some products, such as structural steel and rebar, the additional cost is now around £100 a tonne. The UK was previously a member of the EU’s ETS but introduced its own system in May 2021 as part of Brexit. Some contractors have suggested that the UK ETS is a completely new cost. However, in practice UK products included the costs of the EU scheme. The UK ETS is a smaller market and carbon credits will be removed in line with the UK’s 2050 net zero commitment. As a result, the only way for the price of UK carbon is upward.

04 / Other sources of inflation

Materials account for no more than 30% to 40% of the cost of a project, so clearly there is the potential for other factors to come into play. What is the current state of play here?

Brexit

So far this has had relatively little impact on prices. Full customs checks will be introduced in October 2021, possibly pushing administration costs up a little. Further ahead, the implementation of the UKCA mark from January 2022 might reduce the range of products available in UK markets, but this should not affect production quantities. So with the exception of tariffs related to rules of origin, Brexit impacts on price are likely to be limited.

Labour

There are many mixed signals in connection with the labour market. Many people are still on furlough, and a large number of self-employed operatives have not yet returned to the sector. Average day rates for self-employed operatives are well up on levels from summer 2020 but in practice are no higher than they were in 2018. With the possibility of a tight labour market, particularly if EU workers do not return, inflation is a real risk. However, labour costs are unlikely to drive inflation until the full effects of furlough are out of the system – probably by mid-2022.

Plant

Costs are likely to vary significantly, with plant aimed at the civils and industrial sectors doing much better than that supporting commercial and high-density residential, such as hoists and tower cranes. One major element to watch out for in 2022 will be the 48p per litre increase in fuel duty on construction plant, following the removal of red diesel concessions.

Margins and risk allowances

Like all businesses, main contractors and their supply chains are all aiming to increase their margins. Markets have been quite competitive over the past two to three years as a result of Brexit and covid-19. Should the market recovery be sustained well into 2022, it is likely that competitive pressure will fall – giving contractors more opportunity to increase their prices ahead of input costs.

These findings point to the likelihood of new sources of price pressure once the current problems with materials subside.

05 / Procurement options to mitigate inflation

With procurement, the key consideration is achieving a balance between competition and the attraction of the project. As the market continues to recover, there is growing evidence that contractors are withdrawing from bids where the balance between competitive pressure in the bid and the extent of risk transfer favours the client too much.

There is no ideal procurement route for the current market conditions.

Clients that go down the single-stage route will increasingly risk securing only a low level of interest in their project, and, as a result, lower levels of competition. However, other routes provide contractors with much more opportunity to fully price for the inflation risk, and this should be reflected in inflation allowances.

Clients and their teams need to pick the option best aligned to their market and commercial position.

The advantages and disadvantages of the various options include:

- Single-stage tender competitions are increasingly less acceptable to bidders, particularly on larger schemes. This is a fast turnaround in sentiment, as single-stage bids were common earlier in 2021. Given current market appetite, clients should engage with the supply chain to confirm levels of interest before proceeding with a single-stage competition.

- Two-stage tender competitions are likely to become the default option while the exposure associated with price inflation is high. Such tenders are risky in volatile markets because of the possibility of unexpected price hikes during the second stage, but risk transfer mechanisms may reduce the pressure to make these adjustments.

- Reverse two-stage tender competitions, where the client directly procures specialist packages as well as the main contract, are a useful option in the current market – providing greater transparency over pricing and early access to the supply chain for items with long lead times. However, if a client cannot contract directly with a specialist, it may not be possible to secure cost certainty prior to the end of the second stage.

- Construction management (CM) provides no cost certainty until all packages are procured. In the current market, CM is risky, but will enable clients to optimise the timing of their procurement. Challenges for clients going down the CM route include risks around programme and lead times as well as the need to attract trade contractors to a one-off opportunity. As always, CM is only suitable for clients that have previous experience and access to appropriate resources.

- Negotiation in the current market is likely to result in full pass-through of inflation costs at the outset of a project. The limited advantage of negotiation in these market conditions is that a fast negotiation may get the supply chain into contract quicker – fixing future inflation risk. Negotiation may also facilitate a more favourable risk transfer than might be achieved in a competitive bid.

Timing mitigations on pricing

With any lump-sum procurement, some flexibility can be built into the pricing using provisional sums, prime cost allowances or early procurement.

- Provisional sums These can be used to delay the procurement of later packages on a project, such as fit-out. In the current market, this may mean that some of the inflationary fever and risk-averse pricing being seen might be avoided later. However, prices are likely to continue to rise. If provisional sums are used, material availability issues will also be a risk to the programme. Allowances for provisional sums should include for costs of preliminaries, overheads and profit.

- Prime cost allowances These can be used to include costs against measured items where it is not desirable to fix the price at tender. Prime costs are currently being used to include negotiable rates for items such as bar reinforcement. Given the risk, it is important that the time to the price fix is long enough to make the risk worthwhile – say, 12 months. The basis of the prime cost should also be clearly understood – for example, whether it is inclusive of all subcontract on‑costs and margin, transport costs, wastage and so on – so there is no risk of misunderstanding later.

- Early procurement of bulk materials or production slots Clients can secure early orders for bulk materials with manufacturers either directly or through the supply chain. Typical applications of early procurement are the purchase of bulk steel for fabrication or aluminium billet for curtain walling. The advantages of early procurement are price and programme certainty. The disadvantage is the client’s financial and physical commitment to the purchase. There will always be the risk that clients will cancel projects after having procured their materials. The less processed the materials are, the lower the risk will be. The problem with delaying the procurement of sections of the project is of course that the total cost is not fixed and that the client takes all of the risk of cost overrun above contract allowances. However, as a contractor would have to include a risk allowance in its bid, a similar sum can be added to the prime cost and provisional sums to provide protection. This risk allowance is controlled by the client rather than by the contractor.

06 / Risk transfer options

Another option for securing a competitive initial price from the market in order to mitigate inflationary risks is to vary the terms of the risk transfer in the contract.

Clients often vary terms such as payment periods to make their projects more attractive to contractors. The changes required in the current market are more significant, such as increasing the scope for extensions of time with or without cost.

Based on longstanding practice, most contracts have all provisions for risk transfer associated with inflation and labour and material availability deleted. This risk transfer is passed down the supply chain through similarly worded subcontracts. It is well known that these amended provisions caused significant problems during the covid-19 pandemic, requiring the supply chain to absorb much of the cost associated with pandemic disruption.

There are two main ways of allowing for risk transfer aligned to current market issues:

Materials availability

Clients that have some flexibility on completion dates might consider including materials availability as a permitted trigger for a compensation event or extension of time. Awarded on a time-only basis, this step will eliminate one source of contractor risk (cost of liquidated and ascertained damages) without exposing the client to full inflation risk.

Fluctuating prices

Fluctuating price contracts include the provision for a monthly calculation of inflation based on published indices. Fluctuating price contract clauses are available for JCT and NEC contracts, although they have not been widely used since the early 1990s. There are some practical considerations for the application of fluctuations on live projects, including the inclusion of product categories in the pricing documentation and the mechanics of the valuation.

It is worth noting that fluctuations apply to variations as well as to the original measured work so will add further complexity to project administration.

A generous risk transfer is only worth implementing if it secures a lower bid price. Therefore if clients are considering a relaxation in the balance of risk transfer, it is important to discuss the likely benefit with bidding contractors. If bidders are not planning to offer a discount in their bids, then there is no benefit in accepting the increased risk.

07 / Conclusion

Construction is often subject to above-average inflation, but the current market conditions are unusual. Price rises have to be absorbed by one or many parties in the construction supply chain. At the moment it is increasingly likely that more of this risk will be passed to clients.

In such a market it makes sense for clients to take steps to pay for inflation only when it occurs, which is why risk transfer mechanisms and methods of delaying procurement are worth considering. Furthermore, steps that give clients greater transparency around the availability and timing of materials procurement and delivery will reduce risks around delays to progress on site.

An uncertain business environment makes all aspects of project administration more complex and highlights the need for accurate and complete site records. Resolving claims might be even more complex than normal, given that the timing of instructions or mistakes in ordering or scheduling might have a bigger knock-on effect related to costs or programme.

Ultimately, all of the measures aimed at mitigation rely on aspects of collaboration, including transparency, risk-sharing and problem-solving. However, collaboration is often in short supply when prices are rising. Channelling some of the spirit of the covid-19 response across the supply chain will be a good step towards better managing the current market.

No comments yet