Building, electrical and mechanical costs are rising at varying rates along with materials costs as sterling continues to fluctuate but wages have fallen slightly year-on-year

01 / Key changes

Percentage change year-on-year (Q1 2016 to Q1 2017)

| % | Direction | |

|---|---|---|

| Building cost index | +4.1 | ▲ |

| Mechanical cost index | +4.6 | ▲ |

| Electrical cost index | +2.5 | ▲ |

| Consumer prices index | +2.3 | ▲ |

(Q1 2017 figures are provisional)

Building cost index

A composite measure of building costs increased over the last 12 months by 4.1% at Q1 2017. Materials cost inflation increased notably, resulting from a combination of sterling depreciation. Labour costs increased steadily.

Mechanical cost index

The rate of annual change increased to 4.6% at Q1 2017. Notable materials price changes have contributed more to the overall increase this quarter, helping to propel the overall level of change to its highest rate in eight years.

Electrical cost index

The electrical cost index increased by 2.5% over the year. This is a marginal decrease in the yearly rate from last time at 3.1%, but remains higher than prevailing trends in the last five years.

Consumer prices index

Consumer price inflation continued to pick up pace. Growing domestic inflationary pressures resulted from a significant fall in the value of sterling.

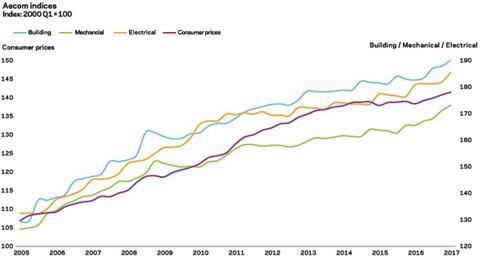

The following chart shows Aecom’s index series since 2005, reflecting cost movements in different sectors of the construction industry and consumer prices.

02 / Price adjustment formulae for construction contracts

Price adjustment formulae indices, compiled by the Building Cost Information Service (previously by the Department for Business, Innovation and Skills), are designed to calculate increased costs on fluctuating or variation of price contracts. They provide guidance on cost changes in various trades and industry sectors – ie those including labour, plant and materials – and on the differential movement of work sections in Spon’s price books.

The 60 building work categories recorded an average increase of 5.6% on a yearly basis. Higher increases were recorded in the following categories:

Price adjustment formulae

| April 2016 – April 2017 | % change |

|---|---|

| Cladding and covering: copper | 20.7 |

| Pipes and accessories: copper | 19.5 |

| Cladding and covering: lead | 19.0 |

| Cladding and covering: zinc | 15.9 |

| Concrete: reinforcement | 15.6 |

| Windows and doors: steel | 15.5 |

| Piling: steel | 11.3 |

The lowest yearly increases were in these groups:

Price adjustment formulae

| April 2016 – April 2017 | % change |

|---|---|

| Pipes and accessories: plastics | 1.5 |

| Ironmongery | 1.4 |

| Pipes and accessories: clay and concrete | 1.3 |

| Finishes: flexible tiles and sheet coverings | 1.3 |

| Insulation | 0.5 |

| Finishes: rigid tiles and terrazzo work | 0 |

| Concrete: in-situ | 0 |

Materials

03 / Summary

- Consumer price inflation increased by 2.7% in April 2017 compared with the same month a year earlier ▲

- Manufacturing input prices increased 16.6% in the year to April ▲

- Factory gate prices (output prices) rose 3.6% in the year to April 2017 ▲

- Commodity prices in Q1 2017 reversed some rises recorded last year ▲

- Construction materials prices continued to increase on an annual basis in Q1 2017 ▲

04 / Key indicators

Construction industry

The All Work material price index increased by 5.9% in the year to March 2017. Housing-related materials increased by almost 6% in the same period. Non-housing materials prices also increased, by 5.6% annually. All M&E categories posted significant yearly increases.

| Construction materials | % change | March 2016 – March 2017 |

|---|---|---|

| New housing | 5.9 | ▲ |

| Non-housing new work | 5.6 | ▲ |

| Repair and maintenance | 7.1 | ▲ |

| Mechanical services materials | % change | April 2016 – April 2017 |

|---|---|---|

| Housing only | 9.7 | ▲ |

| Non-housing | 7.0 | ▲ |

| Electrical services materials | 5.3 | ▲ |

*provisional

| Materials showing largest cost movement | % change, March 2016 – March 2017 |

|---|---|

| Concrete reinforcing bars (steel) | +24.7 |

| Fabricated structural steel | +17.8 |

| Imported sawn or planed wood | +14.9 |

| Electric water heaters | +9.2 |

| Imported plywood | +8.0 |

| Doors and windows: metal | +4.9 |

| Clay products: bricks | -0.5 |

| Metal sanitaryware | -0.7 |

| Paint (aqueous) | -1.7 |

| Ready-mixed concrete | -2.3 |

| Other builders’ ironmongery | -2.5 |

| Lighting equipment for roads | -4.5 |

Data sources: ONS and BIS

UK economy

| Consumer prices | % change | April 2016 – April 2017 |

|---|---|---|

| Consumer Prices Index (CPI) | 2.7 | ▲ |

Consumer price inflation rose over the year by 2.7% in April. Inflation reached its highest rate since September 2013. Consumer price inflation is now higher than overall earnings growth, leading to falling real wage levels. This is expected to lead to a squeeze on consumer spending in 2017. Increased costs of raw materials are now being passed through the supply chain, which will result in higher consumer prices this year.

| Industry input costs | % change | April 2016 – April 2017 |

|---|---|---|

| Materials and fuels purchased by manufacturing industry | 16.6 | ▲ |

| Materials and fuels purchased by manufacturing industry excluding food, beverages, tobacco and petroleum industries | 10.5 | ▲ |

Input costs increased by 16.6% on a yearly basis up to April 2017. Despite this high rate of yearly change, the pace of change slowed in Q1 2017 after rising quickly though the second half of 2016. Recent strengthening of sterling explains for the most part the slower rate of input cost increases. Metals and oil were the input cost components that saw the highest increases over the year.

| Industry output costs | % change | April 2016 – April 2017 |

|---|---|---|

| Output prices of manufactured products | 3.6 | ▲ |

| Output prices of manufactured products excluding food, beverages, tobacco and petroleum | 2.8 | ▲ |

Source: ONS

Factory gate prices increased 3.6% on a yearly basis in April. Although input cost changes stalled in recent months, output prices have continued to rise. This marks more than 12 months of positive monthly changes to output prices.

A combination of higher input costs, continuing sound but weaker economic activity, a stronger export environment and increased confidence among manufacturers to pass on higher prices to consumers have all contributed to this sustained trend.

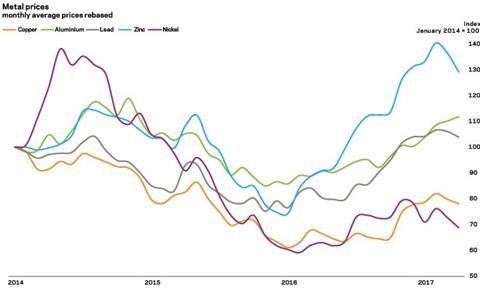

Metal prices

| % change | April 2016 – April 2017 | |

|---|---|---|

| Aluminium | 23.4 | ▲ |

| Copper | 17.5 | ▲ |

| Lead | 29.1 | ▲ |

| Zinc | 42.2 | ▲ |

| Nickel | 9.2 | ▲ |

Source: LME

After a year of rising commodity prices through 2016, some of the gains were reversed in the first quarter of 2017. A reappraisal of global economic growth expectations – or at least the speed of growth – and their link to commodities demand, seasonal effects and a slip in Asian growth prospects all sought to loosen the strength of the price growth trends.

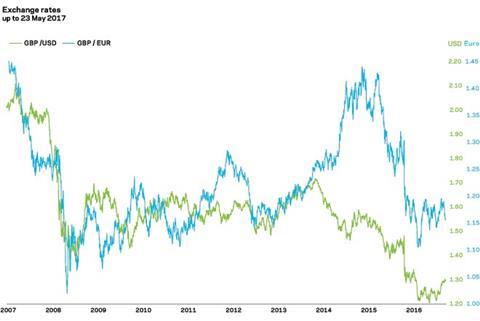

Exchange rates

| April 2016 average | April 2017 average | % change | |

|---|---|---|---|

| GBP / EUR | 1.2622 | 1.1798 | -6.5 |

| GBP / USD | 1.4312 | 1.2946 | -9.5 |

Sterling regained some ground against its major currency pairs during the first quarter of 2017. However, the recent general election outcome once again introduced more volatility into sterling currency markets. Political uncertainty in the UK was the over-arching reason for the currency movement this time, principally against the US dollar. Sterling is likely to fluctuate as the political narrative ebbs and flows at home and during the period of Brexit negotiations.

Labour

05 / Labour market statistics

- Average weekly earnings (total pay including bonuses) in construction fell to £609 in March 2017, from £621 a month earlier. Annually, total earnings increased just 0.5% in March on a single-month basis, and 1.6% annually on a three-month average basis. Regular pay (excluding bonuses and arrears) fell to £584 per week in March, with annual rates of 0.3% on a single-month basis and 1.7% using a three-month average.

- Construction industry regular and total pay rates of change are now lower than equivalent changes to average earnings for the whole economy classification.

- Real average weekly earnings for the whole economy fell by 0.5% (regular pay) in March 2017 compared with March 2016.

06 / Wage agreements

Construction Industry Joint Council

Following negotiations between the parties to CIJC, the council has agreed a two-year agreement on pay and other conditions. This is the second phase of a two-year agreement reached in June 2016. Hourly pay rates will increase by 2.75% in June 2017. Industry sick pay and subsistence allowance will also increase in line with the basic pay rate increases. Workers will receive an extra day’s holiday from 1 January 2017, which is worth an additional 0.4%. For more details on apprentice rates, daily fare and travelling allowance and other rates refer to CIJC document IR.2016.19.

Joint Council Committee of the Heating, Ventilating and Domestic Engineering Industry

A two-phase agreement has been agreed between BESA and Unite trade unions. Phase 1: 2% and 2.50% increases in hourly wage rate effective from 3 October 2016 and 2 October 2017 respectively. Phase 2: Covering period 2018/2019 and 2019/2020 involving increases in index and other benefits agreed in July 2016. Introduction of calculating daily fare and travel allowances has been changed from kilometres to miles. Workers’ annual holiday to increase from 23 to 24 days effective from February 2020. For more information on the agreement, refer to JCC letter 117 of BESA.

The Joint Industry Board for the Electrical Contracting Industry

The electrical contracting industry has agreed on a four-year wage deal, effective from January 2017. Hourly wage increases of 2% in 2017, 2.5% in 2018, 2.75% in 2019 and 3% in 2020. A new mileage allowance and rate to replace travel allowance and travel time has been introduced. Annual holidays are to increase to 23 days in 2019 and 24 days in 2020. For more information on the agreement, refer to the electricals’ and Unite wage agreement document – July 2016.

Building and Allied Trades Joint Industry Council

As the second part of a two-year agreement reached in 2016, this year will see a further 2.5% pay rise in all wage rates. Changes to employer pension contributions mean the minimum employer contribution prior to 5 April 2017 under pension auto-enrolment rules is 1% of pensionable pay between £5,824 and £42,385. From 6 April 2017 until 5 April 2019, this minimum employer contribution rises to 2%. From 6 April 2019 onwards it rises to 3%.

The Joint Industry Board for Plumbing, Mechanical Engineering Services in England and Wales

This is the second phase of the agreement completed in 2015. Rates for workers in JIB-PMES increased by 2% effective from 2 January 2017.

The BATJIC rates of wages effective from 26th June 2017 are:

| Standard rates of pay for 39 hours per week | Per week | Per hour |

|---|---|---|

| S/NVQ3: Advanced | £471.12 | £12.08 |

| S/NVQ2: Intermediate | £405.60 | £10.40 |

| Adult general operative | £359.97 | £9.23 |

| For entrants aged 19 years and over | ||

| ■ Third 12 months with NVQ2 | £383.37 | £9.83 |

| ■ Third 12 months without NVQ | £333.84 | £8.56 |

| Apprentices under 19 years of age | ||

| ■ 18 years of age with NVQ2 | £315.51 | £8.09 |

| ■ 18 years of age without NVQ2 | £333.84 | £8.56 |

WAGE AGREEMENT SUMMARY

The following table summarises the wage agreements currently in force for the principal wage fixing bodies within the construction industry

| Operatives | Agreement body | Current basic hourly rate | Effective since | Details in | Date of next review |

|---|---|---|---|---|---|

| Builders and civil engineering operatives | Construction Industry Joint Council | Craft rate: £11.93/hour | 26 June 2017 | Spon’s Architects’ and Builders’ Price Book 2018 | June 2018 |

| Building and Allied Trades Joint Industrial Council (BATJIC) | S/NVQ3 advanced Craft: £12.08/hour | 26 June 2017 | Spon’s Architects’ and Builders’ Price Book 2018 | June 2018 | |

| Plumbers | The Joint Industry Board for Plumbing Mechanical Engineering Services in England and Wales | Advanced plumber: £14.70/hour | 2 January 2017 | Spon’s Architects’ and Builders’ Price Book 2017 | January 2018 |

| Scottish and Northern Ireland Joint Industry Board for the Plumbing Industry | Advanced plumber: £13.68/hour | 4 July 2016 | Spon’s Architects’ and Builders’ Price Book 2017 | July 2017 | |

| H&V operatives | Joint Conciliation Committee of the Heating, Ventilating and Domestic Engineering Industry | Craftsman: £12.46/hour | 2 October 2016 | Joint Conciliation Committee of the Heating, Ventilating and Domestic Engineering Industry | A two-year agreement. Next review end of 2017 for October 2018 and 2019 |

| Electricians (national) | The Joint Industry Board for the Electrical Contracting Industry | Approved electrician: £15.92/hour (own transport) | 2 January 2017 | JIB for the Electrical Contracting Industry | A four-year agreement 2021 |

| Scottish Joint Industry Board for the Electrical Contracting Industry | Approved electrician: £15.92/hour (own transport) | 2 January 2017 | SJIB for the Electrical Contracting Industry | A four-year agreement 2021 |

Guide to data

Aecom’s cost indices track movements in the input costs of construction work in various sectors, incorporating national wage agreements and changes in materials prices as measured by government index series.

They are intended to provide an underlying indication of price changes and differential movements in the various work sectors but do not reflect changes in market conditions affecting profit and overheads provisions, site wage rates, bonuses or materials’ price discounts/premiums. Market conditions and commentary are outlined in Aecom’s quarterly Market Forecast (last published May 2017).

No comments yet