You don’t have to be Charles Darwin to know that survival is about adapting to your circumstances better than your rivals. Roxane McMeeken looks at how firms have changed their strategies since our last consultants survey, when the market was booming

Last year, Building’s annual snapshot of the industry’s consultants was all about the “staggering success” of the sector. Times were good – consultants were employing more staff than the previous year and fees income had risen a massive 24%.

This year, the mood is considerably more sober as the future of these one time high-rollers looks decidedly uncertain. It’s come as a bit of a shock. As Keith Clarke, chief executive of Atkins (which is once again Britain’s biggest consultant), says: “We had no idea the sub-prime crisis would take us to the brink of capitalism’s survival.”

Not everything is black and bleak – fees have gone up and acquisitions are still fairly frequent – but the slowdown in the domestic private sector is a bitter blow. Now, hopes are pinned on the public sector and overseas markets. Will this be enough to stop firms falling on hard times? And who has the right strategy to survive?

Sobering picture

In 2007, consultants were enjoying a massive boom. Building’s survey showed that, in the previous 12 months, the top 250 consultants had increased their employee headcount by 18% and their income was up by a very healthy one quarter.

This year, consultants have continued to expand, but at a slower pace. The top 250 have grown their collective UK staff by 14% compared with last year, which means they employ a total of 128,000 people. Fee income also grew, by 18% to a total of £8.7bn for the 235 firms that disclosed their earnings. Another positive sign is that the number of chartered staff has grown by 8% to 53,100.

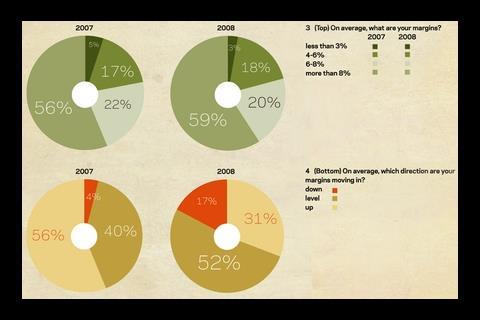

On the downside, there was an increase in the number of firms reporting falling margins this year, 17% compared with just 4% in 2007. Considering that participants responded to this survey before September’s economic meltdown, the situation must be even bleaker by now.

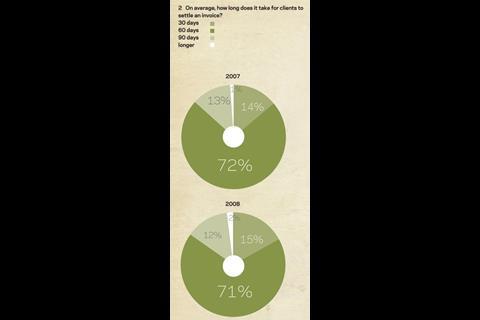

Our research also found that fees are taking longer to come through. Atkins’ Clarke says: “It’s true it’s taking longer to get paid. There is less cash in the system, so everyone is looking to collect payment as soon as possible and hold on to money as long as possible.”

Meanwhile, a hefty 22% of firms admitted laying off staff over the past year. For example, last month there were 13 redundancies at Davis Langdon’s London office. Again, conditions are likely to have worsened since the survey was taken.

Mergers and acquisitions

Considering the lack of credit around, it is perhaps surprising that the frenzied merger and acquisition activity we recorded last year among consultants – there were at least 50 deals – has actually intensified. In the past 12 months there have been over 60 acquisitions (see page 79). The most acquisitive consultant was Cyril Sweett (ranked 15th in the surveyor’s table). The QS was listed on the alternative investment market (AIM) last year and used the money it raised to buy four firms in April: Nisbet, BurnsBridge, Jones Sweett International and Roger Richards Partnership.

Less well-known firms have also been snapping up businesses. Environmental and engineering consultant Grontmij, for example, (ranked 16th among the engineers), bought three: Whitelaw Turkington; Trett Consulting and Roger Preston & Partners.

One analyst believes that the spate of mergers and acquisitions is being fuelled partly by the tougher economic conditions, which are driving a need to diversify in terms of both geography and sector. “Firms such as Hyder are buying companies in Australia and the Middle East, where construction is still booming. Other people are looking for sectoral diversification, like Cyril Sweett, which bought Nisbet for its public sector expertise.”

The analyst adds: “This activity is also being fuelled by a megalomanic streak in the sector and the simple fact that acquisitions are fashionable.”

Toil and trouble

Megalomania aside, exactly how much trouble are consultants in? First off, the lack of private sector work is certainly a serious problem. Consultants owe the good times of recent years largely to the UK private sector. From 2000 to 2007, public sector construction output doubled (as measured by the business and enterprise department), amounting to a spend of £8.6bn. Private sector output over the same period, by contrast, only went up 80%, yet the rise in spending was £23bn – approaching three times the rise seen in the public sector.

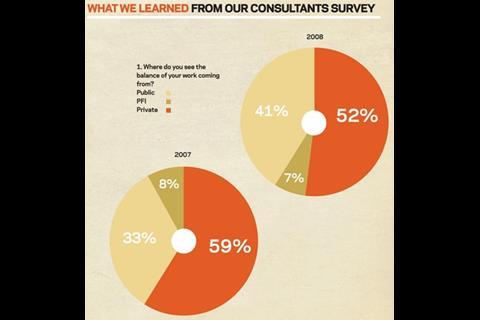

This year’s survey highlights just how much consultants have been relying on the private sector. Of the firms that reported fee incomes by market, 60% said over half their income is from commercial, industrial and housing work. Only 20% said half or more of their income is from infrastructure and public non-housing work.

Martin Hewes, the economist who compiles Building’s Top 250, says: “Growth in public sector work has been important but nowhere near as important as in the private sector. This fact will weigh on the industry over the next few years.”

On the plus side, public sector work is forecast to rise by 28% (or £4.7bn) over 2008-2010. But although this is a decent rise, it is nowhere near enough to offset what will happen in the commercial sector. The business and enterprise department expects a slump in private sector output of almost 19% (£9.8bn) between now and 2012. Overall, total new work in the UK is set to decline 7.5% (or £5bn) between now and 2010.

So what will happen to public and private sector workloads in future? Francesca Raleigh, director and analyst at Numis Securities, says: “Will there be enough public sector work to keep consultants going? That’s the unknown. We don’t know for sure what will happen to government spending over the next few years, especially if there is a change of government.” She adds that routine public work, such as road maintenance, looks the safest bet, while flagship projects such as Crossrail and Building Schools for the Future look less certain. In these austere times, could it be argued that building new schools to replace existing ones is a luxury we can’t afford?

The unknown

With the outlook for the UK market looking so grim, it’s little wonder that many consultants are building up international business. The survey found that nearly 70% of firms have an overseas presence and of these, 89% are planning to boost the amount of income they get from abroad. Meanwhile, 31% of consultants with no overseas income plan to get one.

But international business may not turn out to be the panacea that these companies are hoping for. The survey found that overseas revenue accounts for only 15% of total incomes, which casts doubt on their ability to make up for the downturn at home. Our unnamed analyst adds: “There is a lot of talk about the Middle East; many people think it’s going to bail them out. But pinning everything on that means there’s no room for error. If the Middle East doesn’t work for any reason, all bets are off.”

A further sign that consultants may be a little overconfident is our survey’s finding that 70% plan to take on staff in the next six months. Again, they may have changed their plans after the events of mid-September. But even before the collapse of Lehman Brothers, Hewes says the economic background was forbidding enough to make “plans to hire staff look optimistic”.

This hopeful attitude could be down to the fact that the average age of professional staff, according to our survey, was 38 this year, which means they would have been 18 at the start of the last recession. Hewes says: “A large number of professional staff have never experienced a slowdown, let alone a downturn, at least in a professional capacity.”

As one consultant surveyed puts it: “‘We’ve spent the past 10 years struggling to manage growth, and after much effort, we are well versed in coping with mountains of work and seemingly impossible deadlines. But as far as managing a downturn in business goes – it’s a journey into the unknown”.

5 Survival strategies: firms that stood out in our survey reveal their tactics

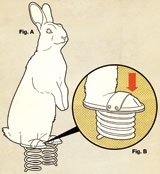

1) Strategy one: the rabbit

Burrow your way into the public sector, increase your population as fast as you can to handle the workload and fit your hind paws with springs to jump through hoops and win education and healthcare work

Taylor Young

Survival strategy: Safety in numbers

USP: Fastest grower of 2008

Amazingly, architect Taylor Young has increased its UK staff by 71% in the past 12 months, and not through acquisitions but by recruitment. The Manchester firm tops our table of for increasing staff numbers, with 199 people compared with 116 last year.

Stephen Gleave, managing director, says Taylor Young needs the recruits to handle its expanding public sector workload. The firm has just opened its fourth office, in Leeds, and is planning to hire even more people by December. “Health and education are our strongest suit at the moment,” says Gleave.

The firm’s expected turnover for 2008 is £10.4m, up from £7.3m in 2007. Some £3.5m of this year’s turnover is in the education sector, and health accounts for £2.5m.

Taylor Young will also turn over about £1m worth of housing work this year, but Gleave admits this income string has “gone pear-shaped” lately.

“We’re not complacent – people are talking about no upturn until 2010 and in commercial and housing I’m sure that’s true. But the public sector still has the resources to keep spending. Of course, that could change, but we’re not too pessimistic.”

Gleave believes that having existing business in the public sector is crucial. “People who have been more commercially successful than us in recent years through working in the private sector are now going to struggle because they don’t have their business in the right shape to win public sector work. Public clients want you to jump through many hoops these days, including rigorous interviews, so you need to know how it works.”

Taylor Young’s key contracts include places on English Partnerships’ five-year masterplanning framework and a Northwest Regional Development Agency framework. Its most recent contract win is a £100m scheme to create new buildings for Hull Further Education College.

2) Strategy two: the meerkat

Form a tightly organised group so you can spot opportunities, then join forces to take them on. Co-ordination, aggression and a large fighting fund are all required

Baqus

Survival strategy: Co-operation

USP: Britain’s only listed small QS

A new entry at 97, Baqus has made an instant impression in our league of the top 250 consultants, with 131 staff. The firm has a fairly unique strategy which is enabling it to win contracts hitherto off limits. Formed last year through a merger of three firms (Boxall Sayer, Denley King and Fletcher McNeill), Baqus floated on alternative investment market in December last year. This raised a £1.7m warchest, with which the firm plans to acquire two consultancies a year and build a business capable of winning bigger contracts than the individual firms that make up the company would be able to win on their own.

Yvonne Wood, director of business development, says: “Our aim is to be a key consolidator in the QS market, which we see as being led by four big players.” Baqus seems to be on target regarding its acquisitions, having bought Oxford-based Sworn King and Partners this year; it has also signed a share options deal with Brian Hannaby & Associates with a view to buying the Liverpool-based QS later this year.

Wood says: “As combined firms we have a better regional spread, a bigger turnover and more staff, all of which makes us more attractive to clients.” She says, for example, that Fletcher McNeill was working on a hotel within a major sporting ground. Now Baqus has also been given a part of the overall project. “We probably wouldn’t have got it without the resources we have now.”

Wood adds that being a bigger entity also means that Baqus scores more points in public sector selection processes. T has the extra trump card of an order book skewed towards public clients. Its workload is split 60% public and 40% private sector. Wood says: “Many of our projects are long term, such as health campuses and further education colleges. We’ll be looking to get on to all types of frameworks.”

3) Strategy three: the eagle

Large wings are necessary for intercontinental migration. Powerful talons are essential for seizing smaller companies and carrying staff to foreign climes

Scott Wilson

Survival strategy: Expand your territory

USP: Steady and speedy growth

We wrote about engineer Scott Wilson in last year’s Top 250 survey because it had made more acquisitions than any other firm surveyed. This year it has continued in the same vein, with three acquisitions: Terence Lee Partnership, Strategic Leisure and Benaim. Although it has slipped from fifth place to a still-respectable 14th, it has more than 6,000 staff. Crucially, of these, 2,500 are based overseas.

International business is critical to surviving the UK downturn, says Hugh Blackwood, its chief executive. “About 5% of our turnover was UK residential. This has largely disappeared. Our first tactic is to ask UK staff if they want to work abroad – we’re redeploying them overseas in the small hundreds.”

Scott Wilson is focusing on the Middle East, China and Hong Kong, south-east Asia and eastern Europe. This is reflected in the growth of the firm’s staff in these areas. In China and Hong Kong, Scott Wilson has 928 staff in eight offices, up from 796 last year. In the Middle East, staff are up to 176, from 91. In south-east Asia, they are up to 110 from 93 and in eastern Europe the company has 283 people, up from 209.

Extra manpower is needed in part for “a strategic plan to expand in Australia”, where Scott Wilson currently turns over £1m. Blackwood sees potential in Australia’s ports and railways, which are growing to serve the mining industry. “A lot of the work we are already doing is based on supporting the mining industry, including a railway we are building for Rio Tinto in Western Australia that allows it to transport coal to Asia.”

But the UK market, where the firm still has over 3,500 staff, remains a substantial part of its business and this seems to be a worry for Blackwood. “We still have a strong order book of public sector work in rail, airports, ports, defence, health, education, nuclear and waste management. But our fear is that the credit crunch starts to affect public spending. We hope that the government will keep spending, but nothing is guaranteed.”

As for the acquisitions, Blackwood says these were funded through profits and overdraft facilities and the firm has the ability to keep buying. “We expect to a see a fall in the prices of companies we would like to buy and we’re ready to make further acquisitions.”

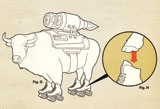

4) Strategy four: the bison

The sheer bulk of this animal means it can withstand prolonged shortages of fodder and persuade clients to pay simply by walking towards them. Its leisurely gait is compensated for by massive jet engines

Atkins

Survival strategy: Be bigger, stronger, faster

USP: The biggest fee earner (and the biggest consultant)

Keith Clarke, Atkins chief executive, wants to set the record straight. Yes, Atkins did cut 51 jobs this summer, as Building reported. But he says these cuts (which were UK design jobs, mainly in Scotland) were planned before the credit crunch. And in September Atkins hired about 45 people in other areas of the business and it’s still hiring. “We have 18,000 staff all over the world, of course there are going to be staff coming and going,” says Clarke.

The business is strong, he insists. Analyst Merrill Lynch backed this up in a report in September that upgraded Atkins to “buy” and said the firm’s “defensive qualities” had been underestimated. But like Scott Wilson, Atkins is changing its business model by concentrating less on the UK market. “We are still growing overall. But a characteristic of the market is that you have to deploy resources where there is a client need and that’s why we are moving people to the Middle East.” Atkins has 3,000 staff in the region. Clarke says: “We don’t have an aim to be x number of people by x date but we are certainly growing.”

Another problem that has resulted from the UK economic situation, Clarke admits, is that clients are taking longer to pay fees. “It’s not ideal but it is manageable,” he says. “It’s not a threat to our business but it helps if you have a good relationship with your client.” And it is worth chasing the client for your fee. “Engineers tend to be a bit too nice and just focused on the interesting work they are doing, but if you’ve done a good job you have the right to ask to be paid.”

5) Strategy five: the squirrel

Simply collect as many resources as you can and wait for a downturn so that you can buy more profligate rivals for peanuts. Or hazelnuts

Grontmij

Survival strategy: Hoard resources

USP: Has no need to borrow to find acquisitions

You might not have heard of Grontmij but in our rankings it’s the 16th biggest engineer and 28th biggest consultant overall, with 437 UK chartered staff.

Grontmij, environmental and engineering consultant, acquired the Carl Bro Group in August 2006. Since then, it has continued to grow both organically and through acquisition – it has bought three firms in the past 12 months.

Where did the company get the money for acquisitions in the current credit-strapped market? Dennis Markey, director of built and natural environment, says the firm is in the luxurious position of being 100% debt free, with enough reserves to fund acquisitions. Even better, he believes others will not be buying as much now, “which means this is a good time to buy because we are going to get the best prices.” The firm is planning two more deals with smaller companies or one deal with a larger entity in the next three to six months.

Markey believes Grontmij’s lack of debt will make it attractive to any seller. “If your business gets bought by a company that has got into lots of debt to pay for the deal, then you’ll worry that the buyer will have to squeeze you to pay it off.”

The acquisitions are all about winning new clients. “We have bought complementary businesses in the hope of offering new services to existing clients and also attracting new clients,” says Markey.

In the past 12 months the firm has bought three companies that added new services to the existing firm: Roger Preston & Partners, a £12m-turnover civil engineering consultancy in Maidenhead; Whitelaw Turkington, a £4m landscaping business in London and Leeds; and Trett Consulting, a £17m London-based dispute resolution firm.

The idea is to offer a “one-stop shop”. Markey says: “Clients don’t want to deal with umpteen consultancies for all their different needs. The ideal solution for them is to use one firm for everything.”

Next, he plans to buy in expertise in sustainable energy and carbon management.

Top 250

Martin Hewes counts down this year’s top 250. See the attached files below for tables…

Downloads

Top 250 tables

Other, Size 0 kbTop 100 fee earners

Other, Size 0 kbTop 100 surveyors

Other, Size 0 kbTop 100 engineers

Other, Size 0 kbTop 100 architects

Other, Size 0 kbTop 50 project managers

Other, Size 0 kbTop 100 fastest growing companies in the UK

Other, Size 0 kbTop 100 financial performers

Other, Size 0 kbNotes and methodology

Other, Size 0 kb

2 Readers' comments