Rising price levels still reflect an industry in relatively rude health, despite ongoing capacity issues and question marks over the global economy

01/ Executive summary

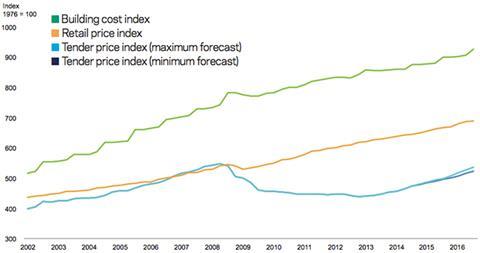

Tender price index ▲

Prices measured as an average across sectors increased to 6.1% on an annual basis in Q3 2014. The annual forecast from Q3 2014 to Q3 2015 has increased to 4.7%.

Building cost index ▲

Existing demand for labour propelled the annual rates of cost inflation. Materials demand was mostly steady overall.

Retail prices index ▲

The annual rate of change fell to 2.4% in Q3 2014. A trend of falling retail prices has become firmly established through 2014.

02 / Trends and forecasts

Momentum in the industry’s workload resulted in a 1.9% quarterly tender price inflation increase in the third quarter of 2014, when measured by Aecom’s index. The annual rate of change in tender prices to the year Q3 2014 is currently 6.1%. Regionally, price levels are moving up but still lagging behind the growth rates in the South-east.

Is industry output creating this pricing momentum, or do expectations of future workload bear more influence on market price levels? The proliferation of fixed-price contracts requires that an assessment is made of future costs and prices. But prevailing trends also determine current price levels. Though momentum can sometimes lead to loss of control, the pace of industry activity has not over-tipped the point where overall inflationary trends are unexpected and unpredictable. Certainly, some trades are experiencing higher than average yearly rates of inflation (reinforced concrete at 8%; structural steelwork at 6%; plastering at 10%). Bricklaying continues to experience much higher inflationary pressures.

For the meantime, while a window to secure higher prices is open, the supply chain is seizing the opportunity. Continuing resource constraints within management teams are influencing decisions to proceed with a tender and price offer. This selective procurement is a recurring theme that Aecom picked up in surveys last year.

Any successful strategy is as much about avoiding bad projects as it is about choosing good projects. Industry news lately has reported a range of stories about contractors still working through problem projects. Financial statements have already borne the effects of these projects, with plausibly some problems still to emerge. Similarly, profit warnings among constructors have become common.

A form of differentiated pricing across sectors - or even projects within the same sector - is evident. Attractive projects for good clients still yield sensible pricing. But contractors and subcontractors are able to pick and choose projects, such is the present level of enquiries. Equally, there is a need to understand customer price sensitivity and corresponding elasticity. Excessively high or above market price levels are not commonplace.

A smaller pool of market resource accentuates any relationship aspects of trading.

Main contractors therefore continue to manage a delicate balance between securing their own higher output prices and managing growing price demands from the supply chain.

A / Aecom index series (Previously Davis Langdon)

Median forecasts for tender price inflation across sectors in Greater London are 3.5-5.5% to Q3 2015; and 3.5 to 7.5% the following year to Q3 2016. Expectations among constructors of securing higher future output prices are still firmly positive. At the same time, solid views exist that input costs are set to rise in coming quarters. Workload and output continues to be generally supportive of further rises in tender price inflation. This is despite more general slowing - or deflationary - producer price and cost trends evident in other parts of the UK economy and its trading partners. Transient price spikes are still likely though in the next two quarters as localised supply and demand factors converge at specific times.

Assumptions underpinning these forecasts relate to present industry momentum being maintained and some resource constraints continuing to provide operational problems. Additionally, softening commodity prices are expected to offset other inputs that are rising because of supply and demand imbalances. Broader considerations extend to ongoing issues in the eurozone, China and elsewhere, and are assumed not to materially increase in magnitude and scale. Pre and post-election uncertainty in the UK will also introduce additional complexities to pre-contract decision-making and affect construction demand in 2015.

Will current UK construction activity enable it to decouple from broader issues relating to the world economy? One argument says current momentum will create a steady industry environment over the next 12 months. Good volumes of work already under way will need completing. The flip-side is that some activity is still in its pre-construction phase and not yet committed to site.

Following a raft of revised growth forecasts and weaker data, the International Monetary Fund (IMF) recently sounded a note of caution that a recovery in the global economy was still at risk from geopolitical uncertainties, possible changes in central bank base rates and slower growth in emerging economies. It said growth in the first half of 2014 proved weaker than it had initially envisaged. The IMF’s revisions supplement other changes to outlooks from Moody’s, Organisation for Economic Cooperation and Development and, most recently, the World Bank for 2014 and 2015, covering most of the world’s major economies.

Enhanced sentiment over the last 12 months has led to corresponding improvements in the outlook for businesses, and to some degree consequent capital expenditure. However, surveys lean towards expectations and not always eventual activity. With persistent economic uncertainties and market fluctuations, shorter, more symmetric cycles of economic activity may well prevail over the longer, asymmetric cycles that have happened historically.

Construction’s recovery so far has been predominantly driven by cyclical factors at local and national levels. Complementary moves to longer-term planning and approaches that address infrastructure quality and capacity for example, will yield more durable benefits.

03 / Focus: supermarkets

Supermarkets remain in the news.

As the fallout over Tesco’s overstated profit guidance continues with the announcement that chairman Sir Richard Broadbent is to step down, the retailer also decided to mothball two recently built stores. This compounded figures from Kantar Worldpanel for the 12 weeks up to mid-October which show that Tesco’s sales market share dropped by 3.6%. Sainsbury’s and Morrisons saw their share of market sales fall too. Only Asda bucked the trend, gaining 1%. In contrast the discount retailers’ market advancement continued. While still a modest 8.3%, Aldi and Lidl’s joint sales market share rose such that over half the country’s spending population shopped in a discount retailer at least once in the last quarter. Meanwhile, Amazon has recently announced its intention to supply online groceries. At the higher end of the market, Waitrose set a record for market share, arguably down to its policy of concentrated brand and quality distinction.

In this context of continuing erosion of middle market share, Kantar Worldpanel reports a year-on-year grocery price deflation of 0.2%, providing the big supermarkets with a conundrum. If they can’t put their prices up, and are losing share to the higher and lower ends of the market, then taking a share from comparable rivals takes on increased emphasis.

Middle market retailers have attempted to realign their strategies with changing shopper behaviour. Not only is there a growing trend for shoppers to shun the big supermarkets for shopping online and delivery to their door, but the approach of “little and often” shopping has continued to grow.

This scenario has led retailers to reduce large store construction, and put further emphasis on convenience stores. The rise of this format of shop is not new. Sainsbury’s and Tesco have an established estate of smaller stores, and Morrisons is expanding into the convenience market. However, retailers are now altering their convenience offer and layout on an individual basis to better meet customers’ needs and adapt to demands of particular local trends, as the line between discount and convenience blurs. In the larger supermarkets, retailers have expanded the offering in their main stores. Sales area has been converted into cafes, restaurants, banks, opticians, fashion outlets, phone shops and electric car charging points.

So how does this affect retail construction? Whereas the big four supermarkets have 73% of grocery sales, albeit with diminishing profitability, supermarkets with multiple convenience stores account for less than 20% of convenience market share. Small stores will represent 25% of all grocery sales by 2019 according to IGD - a 30% increase, so even though the convenience shop has lower margins than the out-of-town store, there is still scope for further conversion of high street space to a convenience format. Budget retailers are building too. Aldi recently announced its intention to open over 50 new stores to accelerate its increasing market share. The middle market has refocused on brand modernisation of its traditional core products, and internal fit out projects to facilitate the change in form of supermarket sales floor area.

The rise of online shopping continues to require construction to facilitate the retailers’ collation, distribution and delivery services. Whether this is done through “dark stores” - designated centres for online order processing - or expansion of existing distribution infrastructure and conversion of stores’ back-of-house provision varies between retailers. Furthermore, the “click and collect” approach needs associated construction, not least for new retailers entering the market.

In this environment, lower value projects have become the norm as supermarket retailers seek to maintain brand strength, respond to falling sales, grow their convenience store estate, and update their main store shopping environment. This in turn may provide opportunity for smaller contractors to provide specialist shop-fitting services. Nevertheless, scope exists for the involvement of larger contractors to adopt national roll-out programmes of work, offering consistency of workload and approach.

Framework contracts have been a mainstay of retail procurement. Their use is perhaps even more applicable to a roll-out of smaller projects across a retail estate, and may be of particular use to appease shareholders’ wishes to prioritise capital expenditure projects to support newly revised business objectives, and address areas with particularly poor sales.

Delivery of smaller refresh works may be carried out in phased night shifts to allow trade continuity, although this poses potential risks concerning the logistics of remerchandising, managing party wall issues, adhering to tenancy agreements, and so on. Integrated service delivery to manage cost, procurement, programme and commonality of approach could provide the strongest capability for these composite delivery issues as well as offering overall roll out programme management - useful for retailers who may have reduced their in-house construction team.

The demands on grocery retailers are evolving rapidly. Whether this represents a reversible trend or a paradigm shift in retail provision remains to be seen, but retail construction needs not just to adapt but to innovate in its solutions to client needs for expediency, originality and value in their projects. As value becomes a higher priority to shoppers, similarly retailers will require greater value for their capital expenditure and the pressure is on the retail construction sector to provide both lean and inventive solutions which can increase sales with a continuing eye on costs.

04 / Activity indicators

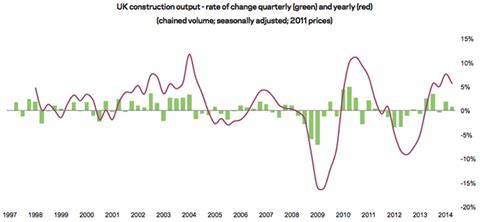

Latest output data published by the Office for National Statistics (ONS) in October caused some surprise, principally because of the magnitude of the monthly fall. The ONS commented that these figures were the first time since the beginning of 2013 that quarterly rates of change had fallen when compared with the preceding quarter of the same year.

Yearly growth for all work (new work and repair and maintenance) to August was recorded at -0.3%, the first decline on a yearly basis since May 2013. But a quarterly comparison (June to August) with the same quarter last year shows that the industry grew by 3% overall. Although this is down from 5% (see Chart B, below) at the time of the last Market Forecast, evidence remains that momentum is still with activity. Both the Construction Products Association and Experian are broadly maintaining their projections for future workload.

B / UK Construction output - rate of change

Yearly growth rates for new work were highest for the housing and private industrial sectors. Monthly changes to new work output saw private housing as the third highest faller, after the commercial and infrastructure sectors. This slip for private housing workload may reflect early signs of this sector’s extended rally now levelling out. Should these output changes signal some adjustment in residential activity then it is entirely feasible that the two primary constraints to building - labour and certain materials - could well ease in the next 12 months.

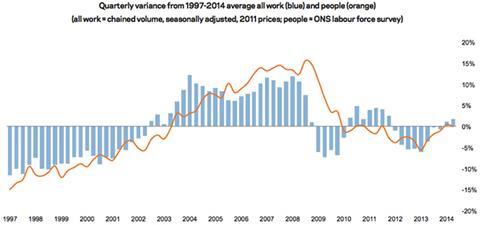

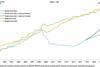

The housing sector’s influence continues to play a fundamental role in supporting a comparatively vibrant industry. Without it the national output figures for all new work would take on a different complexion. Nevertheless, if the latest quarter’s output data is measured against a long-run average (1997-2014) then all work and all new work is actually above trend (see Chart C, below). The chart also shows that, comparatively, this recovery is smaller than recent examples where output is above the long-term average.

C / UK construction output and labour force

05 / Building cost index

Aecom’s building cost index increased by 2.2% on a yearly basis to Q3 2014. Labour costs are the principal component to have propelled the index’s yearly growth rate. Lower materials price inflation, excluding bricks and blocks, is not providing similar levels of buying concern. The Bloomberg Commodity Index fell to its lowest levels since 2009 in October, with global commodity prices being knocked by a combination of reduced demand, a strengthening US dollar and a range of supply issues. Falling commodity prices often result from broader concerns about the strength of the global economy.

How things have changed for the price of oil in such a short space of time. At the time of our last Market Forecast, the average price level was $104/barrel; now it is nearer $80. Inevitably a host of explanations are offered for this change: global economic growth rates, and new exploration techniques in the US to name but two. As supply is increasing, demand is also falling. Key producers are reducing future prices in a bid to maintain market share. Nonetheless, current oil price futures are at higher levels than present. This may suggest that any current weakness in prices is temporary.

For steel-intensive industries like construction, the price of iron ore offers some indication of the likely trend in general steel prices. Weaker Chinese demand for iron ore resulted in a continuation of falling prices that began earlier in 2014, now down by almost 40%. Perhaps counter-intuitively, iron ore producers are planning to increase output despite a lower price environment. This strategy is not expected to reverse price falls.

Metals prices added further complexity to recent market movements. Industrial metals, led by aluminium (down 10 % in September) and nickel (down 25 % since May), have declined on the back of weaker Chinese economic data. Forecasts for nickel prices are though slightly more bullish.

Average wage rates, across a number of trades, are up between 5 and 10% on a yearly basis. Wage levels still vary by month in the UK regions, which reflects the mixed nature of activity across the country. Some areas are seeing higher than trend inflation rates, probably where average wages have lagged behind the regions where activity started to recover sooner.

Higher increases are typically linked to trades required by residential construction. Most notably, these include bricklaying (12-25% year on year), joiners, dry lining and plastering. Capacity issues raise the likelihood of transient price spikes, and skilled trades necessary for high-end joinery and finishes are experiencing particular demand pressures. General labour though is not suffering the same current pressures, with some overseas labour still filling any supply-side gaps.

No comments yet