The brief rise in tender prices is over but so, it seems, are the sharp falls that characterised last year.

01 / Executive summary

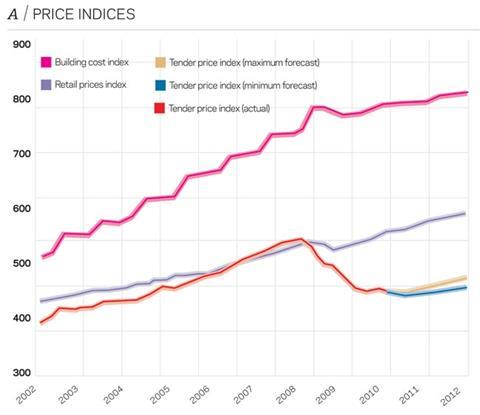

Tender price index

Tender prices eased down a fraction in the second quarter and are expected to continue on a similar track for the rest of the year.

Building cost index

Labour costs remain static but the building cost index has moved up sharply as materials prices accelerate.

Retail prices index

Consumer price inflation remains stubbornly high with the retail prices index recording a rise of 5% over the year to June. The rate of inflation is expected to decline as the year progresses.

02 / Trends and forecast

As predicted in the last Market Forecast (30 April 2010), the small rise in tender prices recorded in the first quarter of 2010 eased off in the second quarter - the tender price index registering a provisional fall of 0.5%. This leaves prices in Greater London 17% below their peak in the second quarter of 2008. Most regions have experienced similar falls in prices, though in some instances clients have been able to achieve even greater savings by selecting contractors whose order books were particularly thin. In such circumstances, it is even more important to ensure that the price offered is viable, that the management offered is adequate and that contingency sums are in place, either above or below the line, to cover legitimate claims that may well arise as the project progresses.

Although a small price reduction has been recorded in the second quarter, the substantial price falls that characterised 2009 appear to be over. The effective stabilisation of prices in the first six months of 2010 coincided with various surveys in construction and the wider economy that moved from negative to positive for the first time. The country officially exited recession in the fourth quarter last year and there have since been three quarters of slight, but nevertheless positive growth.

Some projects will have experienced price inflation rather than deflation this year. Steel prices have leapt (see building cost index overleaf) in 2010 and schemes with above-average proportions of structural steelwork or reinforcement will have suffered an overall price increase. Erected steelwork rates, which were as low as £1,000 per tonne last summer, are now at least £1,200. Reinforcement rates that were typically £900 per tonne at the end of last year are now above £1,000. Material costs may now be mellowing so we could see these rates ease back again.

The effect of higher steel prices is also being seen in some M&E components, including lifts. The above-trend increases for steelwork are, to some extent, just a rebalancing of costs that fell 40% during the depths of the recession.

Other areas that are seemingly bucking the trend of stable or falling prices include overheads and profit allowances. These seem to have moved upwards a little from rock bottom levels, perhaps indicating that contractors are retaining a reasonable percentage here at the expense of price cutting elsewhere as a hedge to maximise the valuation of variations and claims. A similar explanation may be behind an increase in contractors’ tendered overheads and profit allowances on dayworks sums.

Instances are returning of contractors declining to tender and certainly requesting extensions to tender periods but this is more likely to be a reflection of reduced resource levels in contractors’ and subcontractors’ estimating departments than an over-abundance of work opportunities.

In some areas of the country, bricklaying, carpentry, plastering and decorating subcontractors are becoming more selective in their choice of work as the residential sector has picked up, leading to a hardening of prices.

The optimism that was present in the first quarter is now waning. The announcement of cuts such as the Building Schools for the Future programme are beginning to create an atmosphere of doom and gloom. For some contractors these cuts will create holes in forward order books that had looked secure. This may mean them returning to the tender market with sharper pencils.

It is now clear that the public sector is going to suffer severe cutbacks with the effect beginning straight away. The private sector is beginning to look up - housing starts improved quite markedly last autumn but there is a fear that housebuilders may start to retrench again. The rise in house prices has come to an end and with unemployment likely to rise as jobs are cut, housebuilders will be wary once again of bringing too many units to market with not enough buyers.

There are signs of life in the offices market, though these may be largely restricted to London. Prime rents in the City show double-digit growth over the last year. Developers with finance have already started construction to feed a market that is anticipated to be in short supply by 2013. Others are buying sites and working up planning applications, or gearing up for preparatory works ready to begin construction once a pre-let has been achieved. However, outside London, the market remains quiet. Rental levels in most regions are flat at best and still falling in some places such as Yorkshire and Humberside. The retail market is behind the offices curve with rents still falling in a number of regions, including the North-east, Yorkshire, the South-west and Wales.

Although commercial activity is beginning, there is real concern that the public sector work on which the industry has thrived in recent years will disappear before the private sector can fill the void. Even in London it is likely to be another 12 months before any significant numbers of projects reach the construction stage. Elsewhere many regions have been much more dependent on public sector work than London and a significant North-South divide could re-emerge.

As such, it is anticipated that construction prices could continue to drift for the rest of this year. In Greater London it seems likely that average prices could slip back by 1% before showing signs of a recovery at the beginning of next year. In the second quarter of 2011, prices are anticipated to be about the same as now. A small recovery in prices is expected the following year as the commercial market begins to provide a reasonable volume of work for contractors and a rise of 2.5% to 4% is built into the index. Outside London, the recovery is likely to be slower and prices are likely to slip further over the next 12 months as contractors fight for a dwindling workload.

a / Price indices

03 / HOT TOPIC: The cuts

The Office for National Statistics’ revamped construction output data suggests that the public sector plays a smaller part in total industry workload than previously thought. The latest data shows that public sector output in 2009 was worth just under £35bn or 32% of the overall total. Previous data had estimated it at almost £40bn, or 37%. For new work, the total value of the public sector has been marked down from almost £21bn to £19bn, accounting for just 29% of all new build work, rather than the 38% the previous statistics had indicated.

The revised statistics still reveal a huge change in the balance of workload over the last decade.

In 1999 the public sector accounted for just 17% of the new build market, or 26% of the total market including repair and maintenance, compared with 29% and 32% last year. This increase was, of course, partly the result of the collapse of private sector construction in 2009 but mainly due to a progressive rise in public sector work over the period. In constant price terms, new-build public sector construction increased by 78% over the past decade.

In spite of the downward revisions, the public sector still accounts for almost a third of construction spending. But how much of that construction work is at risk?

Public sector construction increased sharply in 2008 and 2009 partly because the government brought forward investment spending previously planned for 2010-11 in response to the economic crisis. But their plans were then to sharply reduce investment from 2010-11 so that by 2013-14 public sector net investment would be worth just 1.25% of national income, down from 2.6% in 2008-09 and 3.1% in 2009-10.

One of the first acts of the new government was to save £6.2bn this financial year, including £1.7bn from delaying and stopping contracts and projects. The savings include:

- Communities department £780m

- Department for Transport (DfT) £683m

- Department for Education £670m

- Ministry of Justice £325m

The previous administration had laid out plans for large cuts to reduce the budget deficit. The June Budget extended those plans to reduce public expenditure by £83bn a year by 2014-15. Capital expenditure will fall from £69bn in 2009-10 to £43bn by 2013-14 with the sharpest drop in the first two years.

We will have to wait until the Comprehensive Spending Review in October to find out which departments will have to bear the brunt of further spending cuts, but the chart above shows how capital spending for some of the main departments has increased in recent years, as well as the effect in 2010-11 of the Budget and the £6.2bn savings package.

Education

Only in March the government announced a decision to bring forward a further £420m tranche of money to enable another six local authorities to begin work on their rebuilding and refurbishment programmes. Inevitably these were all included in the list, released in early July, of the schools that would no longer be able to go ahead with their plans - at least they had not had too much time to chalk up vast sums of wasted money.

It is estimated that more than £2bn of Building Schools for the Future (BSF) contracts were lined up to hit the market this spring but many will not now go ahead at all. On 5 July Michael Gove, the education secretary, announced that all BSF schemes yet to reach financial close would not go ahead, effectively scrapping £7.5bn of schemes. Some 123 academies yet to reach financial close are being reviewed on a case-by-case basis. There are 706 BSF schemes that will be allowed to go ahead under new arrangements. It is probable that these schemes may still be watered down and some will end up as refurbishments.

Housing

In June, the National Housing Federation warned that the number of affordable homes built in England this year could fall by 65% as a result of budget cuts, the funding black hole for already earmarked developments, the end of regional housing targets and the scrapping of minimum density targets. The Homes and Communities Agency has since been granted a proportion of the black hole and hopes to restart some of the stalled schemes. In essence the HCA’s capital budget for 2010/11 is down by about 10%. As a result of the hiatus, 40% fewer social housing schemes started on site in the second quarter than last year.

Repair and maintenance

Nearly half of public sector construction spending is on repair and maintenance work, split fairly evenly between housing and non-housing work. The Decent Homes programme was supposed to be completed by the end of 2010, but some 25% of the original target will still be below standard. With heavy cuts due to fall on the communities department, further funding may be much reduced.

In the non-residential sector, R&M work may be easy to cut back on, as happened during the nineties when spending dropped by 35% following the last recession. Road, rail and buildings maintenance look set to be curtailed although a swing from new build to “mend and make do” may partially offset the otherwise inevitable reductions.

Transport

Many expect transport to be the hardest-hit sector when the capital spending cuts are allocated in October. There have already been casualties of the early £6bn of cuts, with the DfT’s budget for this year scaled back by 4%, spread across local authority grants, Network Rail and road scheme deferrals. The department has postponed decisions on all local transport schemes, is reviewing all schemes that have not yet begun construction and has postponed or cancelled all public enquiries on schemes requiring DfT funding.

b / Departmental capital spending limits

04 / Activity indicators

In 2008, responsibility for compiling construction output and contractors’ new orders statistics transferred from the business department to the Office for National Statistics. The ONS has undertaken a thorough review and overhaul of the methodology of compiling the statistics and released a complete new data set for both output and new orders on 16 July.

The new work output figures show that workloads bottomed out in the third quarter last year, having declined by 19% from a peak of £20.93bn in the first quarter of 2008. An upward trend has been maintained since then with 5% growth to the first quarter of 2010 and rising further through to May. Growth has come from the infrastructure and public housing and non-housing sectors as the previous government fulfilled its promise of bringing forward construction projects as part of its economic stimulus.

The figures also suggest that the decline in private commercial activity, which dropped by a third, may have halted at the end of last year. Figures for the first five months of 2010 suggest that private commercial work is back up by 7.5% from the low point of the fourth quarter of 2009. With the forthcoming drop in public sector work it has to be hoped that this increase in private commercial activity will be maintained.

Examination of the value of construction new orders by contractors also paints a promising picture. The data confirms the dramatic collapse in orders that occurred between 2Q07 and the first quarter of 2009 when the value in constant prices dropped by 43%.

The figures suggest that there has been quite a dramatic recovery since that low point with a 29% increase in the value of new orders over the year to the first quater of 2010. However, the quarterly total (£14.7bn) is still the lowest figure in constant price terms since 1995 (notwithstanding the latest recession).

Contractors working in the public sector have been the biggest benificiaries of the increase in orders, but the private housing sector has also witnessed a steady increase since the beginning of last year.

c / Construction output and new orders

05 / Building cost index

The building cost index has regained its upward momentum, registering an increase of 2.5% over the second quarter of 2009, though still undershooting inflation in the general economy, which rose by 3.4% according to the consumer prices index, or 5.1% following the retail prices index. The BCI is characterised by opposite trends in its labour and materials inputs.

Labour

Last summer, directly employed building and civil engineering operatives found that their pay rates had been frozen at levels set in June 2008. The normal anniversary date (the end of June) for wage revisions has again been and gone and the 2008/09 rates will continue to apply “until further notice”, though fare allowances have been allowed to rise. It is understood that the parties have agreed to meet again in the autumn but, with the construction industry suffering further falls in demand, it is unlikely that the union side will be successful in securing any wage increase this year.

However, some hope may be held out given that smaller builders have agreed to a 2% wage increase for workers under the BATJIC agreement from 13 September and heating and ventilating operatives will receive a similar wage rise from 4 October. Plumbers, whose wage rates have been frozen since January 2009, negotiated an agreement that will come into effect on 3 January next year tied to the retail prices index at June this year, meaning that their wage rates and allowances will rise by a healthy 5%.

Materials

By contrast, construction materials prices have been accelerating fast. Figures from the Office for National Statistics show that construction materials prices rose 4.5% in the five months to May. Since bottoming out in July last year, construction materials prices have risen by 8%.

The big numbers relate to timber and steel.

ONS figures suggest that the prices of imported softwood and plywood have risen by 36% over the last year with some contractors complaining that plywood is all but impossible to buy at all. Demand from Asia and North Africa seems to have been the major cause of the price hikes but the increasing biomass market has had an influence on all timber-based products. Log shortages are reported in all the main supplier markets to the UK, with rising prices forecast for the remainder of this year.

Steel prices started to rise in earnest from the beginning of 2010. ONS figures show that fabricated structural steel prices rose 16% to May, although most of that was in April and May

as the price rises announced by Corus (and others) from March onwards began to bite. Reinforcement prices have risen 30% since the start of the year. Steel prices have risen in response to the sharp increase in raw material costs faced by steel manufacturers as detailed in the last Market Forecast. It has been possible to pass on many of those price rises to the end user in spite of subdued demand.

Steel prices have now begun to soften as inventories have been replenished and demand has waned again. Raw steel prices in Europe rose more than 50% from their low point in May 2009 to the high in May 2010, mostly in the first few months of this year, but have since drifted down by 5%. European rebar prices rose by more than 70% between November last year and May 2010, but have fallen nearly 10% and are expected to continue to fall through to the end of the year.

Pressure has eased on steel manufacturers as raw material cost pressures dissipate. Scrap costs are down 20% from their high in April, though prices remain 65% higher than a year ago. Iron ore prices - which caused so much uproar at the beginning of the year when steeply rising spot prices caused miners to refuse to commit to annual price contracts and insist instead on quarterly contracts tied to the spot market - rose a lot further in March and April, causing miners to seek a further price increase for the July to September price period.

However, prices peaked in April and have since tumbled back to the level at which they were agreed for April to June, making it difficult for miners to secure any further increases.

No comments yet