Only non-residential bucks the downward trend for the construction activity index, while employment and tender price indices also see dramatic dips

01/ State of play

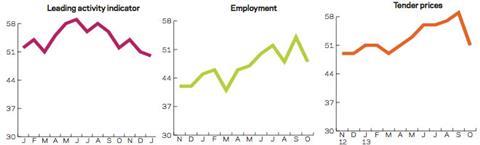

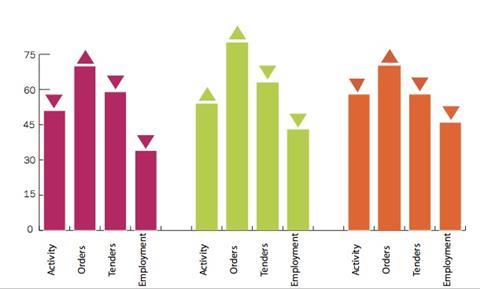

The construction activity index stood at 52 points in October, down four points on the previous month, representing the third straight monthly decline. Activity fell sharply in both the residential (51) and civil engineering (58) sectors: the former saw a seven-point decline, while the latter saw a steep, 15-point fall. Non-residential activity was the only sector to see its index rise, with a two point month-on-month increase to 54.

Last month the orders index climbed 13 points to reach 69, the highest figure since December 2007 and the index is also up 20 points on an annual basis.

The percentage of respondents indicating that they were experiencing no constraints on activity decreased to 24% in October. In line with this, the proportion indicating that bad weather and labour shortages were hampering activity both increased to 7%.

Meanwhile the percentage of respondents indicating that material or equipment shortages were hampering activity levels remains unchanged from last month’s figure at 3%, representing the highest figure on our records. The share of respondents indicating that insufficient demand was restricting activity decreased to 39%, the lowest proportion for three years.

Following last month’s four-year high of 54, the employment prospects index dropped back down to 48. This indicates that businesses expect employment to fall over the coming three months.

Following a peak of 59 in September, the tender prices index dropped eight points to reach 51 last month.

02/ Leading construction activity indicator

CFR’s Leading Construction Activity Indicator fell by four points last month to reach 52, the lowest recorded level since March this year. It is expected to remain relatively stable before dropping to the no-change mark of 50 in January.

The indicator uses a base level of 50: an index above that level indicates an increase in activity, below that level a decrease.

03/ Labour costs

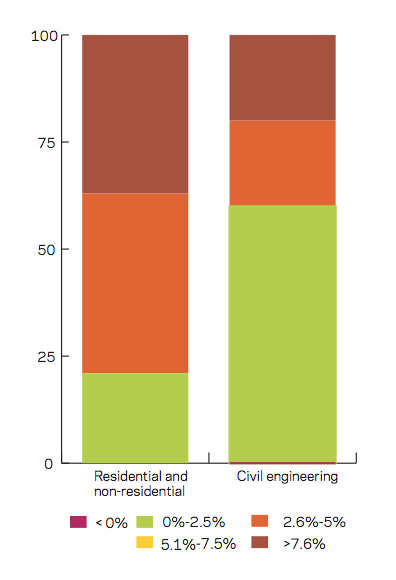

For the fourth consecutive quarter, the percentage of building firms reporting falling labour costs declined and last month not a single firm reported falling labour costs. Approximately 21% of respondents indicated that they had experienced annual labour cost inflation of less than 2.5%, down 3% from three months ago. The percentage of respondents indicating that their labour costs had risen by between 2.6% and 5% rose to 42%, while the percentage of respondents indicating that their wage bill had risen by between 5.1% and 7.5% decreased to zero. The share of firms reporting labour cost inflation over 7.6% doubled to 37%.

04/ Regional perspectives

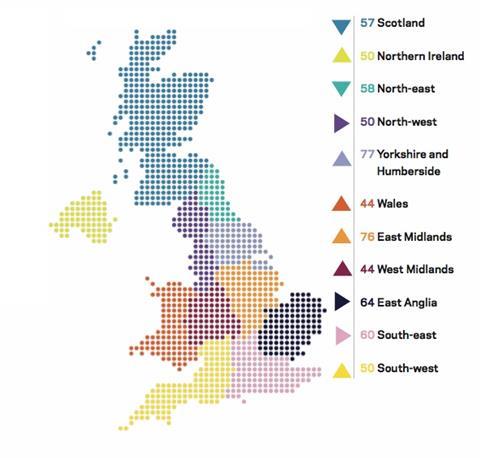

Experian’s regional composite indices incorporate current activity levels, the state of order books and the number of tender enquiries received by contractors to provide a measure of the relative strength of each regional industry.

In October, six out of the 11 regions and devolved nations saw their indices rise. Yorkshire and Humberside saw the largest increase with a 17-point increase to 77, the highest index on record for the region. The South-west also rose significantly, climbing seven points to 50. The East Midlands and Wales both saw their indices rise by six points to 76 and 44 respectively. Northern Ireland’s index rose two points to take it to the no-change mark of 50, which is the highest index on record for the region. Despite the West Midlands’ index improving by three points, it remained in negative territory at 44.

For the third successive month, the North-west saw its index remain at the no-change mark of 50. While East Anglia and the South-east also saw their indices unchanged from last month at 64 and 60 respectively, a decline was seen in Scotland as its index dropped five points to 57.

This an extract from the monthly Focus survey of construction activity undertaken by Experian Economics on behalf of the European commission as part of its suite of harmonised EU business surveys.

The full survey results and further information on Experian Economics’ forecasts and services can be obtained by calling 0207-746 8217 or logging on to www.experian.co.uk/economics

The survey is conducted monthly among 800 firms throughout the UK and the analysis is broken down by size of firm, sector of the industry and region. The results are weighted to reflect the size of respondents. As well as the results published in this extract, all of the monthly topics are available by sector, region and size of firm. In addition, quarterly questions seek information on materials costs, labour costs and work-in-hand.

No comments yet