As Barbour ABI launches its latest monthly Economic & Construction Market Reviews, Michael Dall presents highlights, including sector and regional statistics with a focus on the residential sector

Economic context

Preliminary figures from the Office for National Statistics (ONS) show UK GDP growth in the final quarter of 2013 was 0.7%, equating to yearly growth of 1.9%. This compares with 0.3% growth in 2012 and demonstrates the stark improvement in UK economic performance over the last year.

The latest forecasts from the Bank of England now predict the economy will grow by 3.4% this year, well ahead of its previous forecast of 2.8%.

This includes assumptions that business investment and house building will significantly increase in 2014. Should this turn out to be the case, the longer-term outlook for UK economic performance will be substantially improved.

Other news this month which supports the improving economic environment includes:

- Markit’s index of household finances rose to 41.5 in January - the joint-highest level in five years;

- Retail sales in the UK rose by 5.3% in December 2013 compared with the previous year;

- A survey by recruitment firm Astbury Marsden showed a 34% increase in City vacancies in the past year.

With the latest forecasts from the Bank of England and the continuing positive macroeconomic news the UK economy seems well placed to have a strong year. If the challenges of underemployment and low business investment are addressed, as the Bank suggests they will be, then the long-term outlook will be much more encouraging. However, there is sparse evidence that this is happening at the moment so it will be closely monitored this year to determine the sustainability of the UK economic recovery. It is Barbour ABI’s view that the near-term outlook for the UK economy has improved but the challenges of addressing the output gap, the trade deficit and encouraging greater business investment will be vital in ensuring sustainable economic growth in 2014 and beyond.

The construction sector’s performance

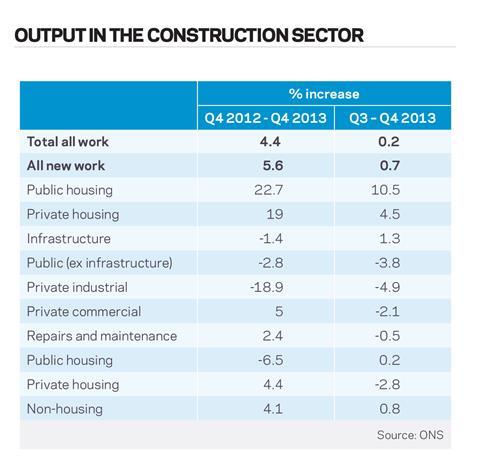

The latest figures from the ONS show that the construction sector in the UK grew by 0.2% between Q3 and Q4 2013. This consisted of a strong October, a weaker November and growth returning in December.

Comparing Q4 output levels with the same period in 2012 showed an increase of 4.4%. Overall, in 2013 the construction sector grew by 1.3% but still remains 12.2% below its peak in 2007.

It is clear that it is the housing and commercial sectors that are driving growth within the industry. New private housing increased by 10.5% from the previous quarter and 22.7% from the corresponding quarter in 2012. At the same time new public housing increased by 10.5% between Q3 and Q4 2013 and 19% from Q4 2012. Output in the private commercial sector was also strong this quarter, increasing by 5% in Q4 2013 from Q4 2012.

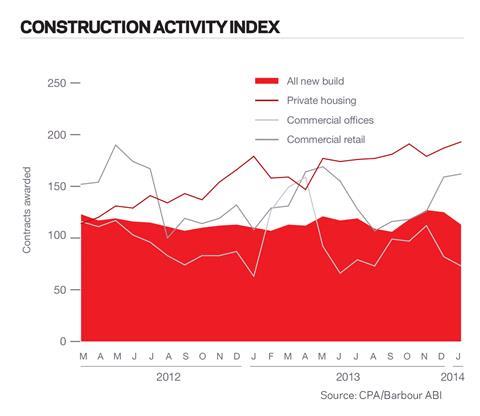

The CPA/Barbour ABI Index, which measures the level of contracts awarded using January 2010 as its base month, recorded a reading of 109 for January. While lower than the months of November and December it is still above its January 2013 levels, supporting the view that activity in the industry remains strong.

As well as private housing, the reading for commercial retail continued to rise in December 2013 while commercial offices fell again from 82 in December to 73 in January after a number of months of growth.

According to Barbour ABI data on all contract activity, January witnessed a slight fall in construction levels with the value of new contracts awarded £5.6bn, based on a three-month rolling average. This is a decrease of 3.5% from December but a 36.5% increase on the value recorded in January 2013, an indication of a significant upturn in construction activity in the UK in the past year. The number of construction projects within the UK in January was up 59.3% on December, and 19.6% on January 2013.

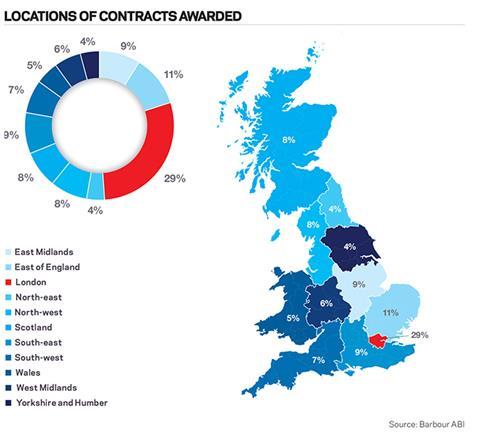

The majority of the contracts awarded in January by value were in London, which accounted for 29% of the UK total. The award to Balfour Beatty of the contract to redevelop the Olympic stadium this month is one of the main reasons for this as well as a number of high value residential projects.

The east of England was the next most prominent region with the Boreham Interchange redevelopment to include a railway station, offices and shops key to the large values recorded this month.

The East Midlands and the South-east had the next highest amounts of construction activity with the Victoria Centre project in Nottingham the reason for the former’s high project values this month.

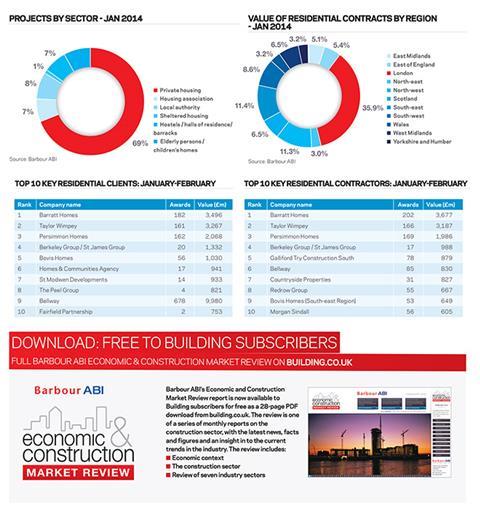

Spotlight on the residential sector

Activity in the residential sector remained strong in January with a total value of contract awards of £1.9bn, based on a three-month rolling average. This is an increase of 2% compared with December and is 87.7% higher than January 2013, indicating the sharp upturn in activity experienced in the sector over the last 12 months.

Importantly, while the number of units associated with residential contracts awarded fell 5.8% between December and January 2014, based on a three-month rolling average, they were 49.6% higher than January 2013, confirming the scale of the upturn in the market in 2013.

A series of positive news stories demonstrates the continued improvement in the sectors performance with Bovis Homes providing a strong trading update this month. This included a 26% increase in private home completions in 2013 and a 14% increase in the Group’s average sales price.

Taylor Wimpey reported similar positive news with total completions increasing by 7% in 2013 and forward sales increasing by 27%. In addition, forward sales at Persimmon and Barratt also increased by 41% and 71% respectively last year.

The RICS Residential Market Survey echoed this sentiment by revealing that the average number of homes sold per chartered surveyor reached its highest point since March 2008. The low rate of house building in the UK compared to demand continues to be debated and this month the Labour Party outlined proposals this month to build at least 200,000 homes a year by 2020.

This will remain a key issue over the coming months and is likely to be high on all the political parties’ agendas as we head into the next election.

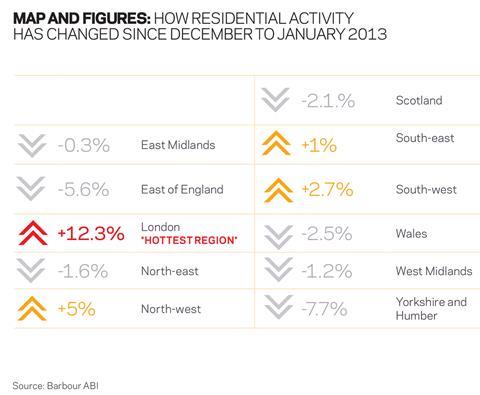

As expected it is London that is the main location of activity in this sector, accounting for 35.9% of the value of contracts awarded this month, an increase of 12.3% from the same month last year.

The South-east was the other major location of residential development by value in January accounting for 11.4% of contracts awarded, a 1% increase from the corresponding month last year.

The North-west was also prominent with 11.3% of the contracts awarded by value, a 5% increase from January 2013.

No comments yet