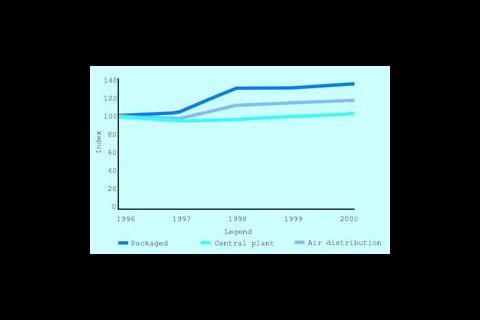

The air conditioning market has been growing steadily from 1995 and in spite of a 1% downturn in 1997, growth continued in subsequent years. In 1998 a 15% nominal increase took sales of air conditioning equipment up to £563.2 million. And further grow of 2% in 1999 and 3% in 2000 took the market to around £592 million.

Robert Morgan, manager of UK sales and marketing for air conditioning specialist Daikin takes an optimistic view: "We believe the next five years will see positive growth, with various cyclical downturns and upturns along the way. We're currently in a downturn compared to the growth of last year, but this will pick up again."

Alan Tyson, commercial director of Carrier, says: "The market looks healthy, but indications at the moment are that thing have flattened out. New enquiries have dropped since February and March of this year. But it's not a substantial drop, and I think this is just a dip."

The demand for air conditioning units is intrinsically linked to the level of construction activity, including refurbishment within the key commercial and industrial sectors. Other market factors can come in to play. For example, Tyson says that high growth for the last couple of years for Carrier has been partly due to work on replacing R11R and R12R refrigerants.

An estimated 60% of air conditioning equipment sales is linked to the offices, retail outlet and industrial plant sectors. And around 80% of packaged air conditioning equipment is used in offices and shops. So the commercial and industrial construction markets are major factors in the demand for air conditioning units.

The vast majority of equipment is installed at the time of new construction. Nonetheless, it is still believed that only 4% of retail outlets and restaurants, and 7% of offices have air conditioning systems, yet this includes most larger buildings.

However, the refurbishment market also plays a key role in the demand for air conditioning, and will continue to do so.

Some of the main users of air conditioning equipment are hotels, hospitals and shopping centres. The hotel market is fragmented and was adversely affected by the last recession. However, major investment has taken place with much refurbishment in the wake of major ownership changes. Alan Tyson comments: "The hotel sector seems to be taking air conditioning right down to the economy end of the market, which is something quite new."

Hospital construction has seen some delays in PFI projects, but the government has announced its intention to increase its spending within this sector.

Retail has proved a fairly buoyant market for packaged air conditioning units. The number of shopping centres being built has reduced, but against this the use of air conditioning by most retail sectors has proved to be one of the more resistant sectors in the market in recent years. This is especially true of grocery chains and supermarkets. Here any recession has not been strongly felt and construction activity has continued, creating a base level of demand.

Within the sector, different types of air conditioning equipment are subject to fluctuations in their markets. For example, demand for close control air conditioning is seen to be in gradual decline compared with the overall air con market. The primary reason for this is that use of close control air conditioning for offices containing mainframe computers has dropped off with the rise of the personal computer.

At the same time, developments in other types of air conditioning units have allowed closer control and monitoring of temperatures. But the telecommunications sector is still a significant user of this type of air conditioning and may represent a development are for this market in the future. In 1999 the close control market was worth around £30.7 million and value growth of 1% is predicted for 2000.

The IT sector is also still a big user of air conditioning of this type. Air conditioning manufacturers have ridden the wave of growth in the internet sector. Like everyone else, they're feeling the pinch now. Tyson says: "The IT market has taken a big drop. Internet hotels and server centres were a boom area towards the end of 1999 and into 2000. This seems to have fallen on its face. However, opinion is that this is a time of consolidation, and the market will pick up again in 2002."

By contrast, split system air conditioning has grown on the back of increased refurbishment work. Morgan comments: "Clients tend to think more about refurbishing offices during an economic slowdown. They also tend to have to put more people and equipment into the same space, and so air conditioning becomes more important."

Split systems are attractive to clients on new developments looking for low capital costs. Also, split systems have penetrated smaller retail outlets and offices. This has been a relatively new market for air conditioning and its growth has been fuelled by increasing extremes of temperature in the UK. In 2000, growth of 4% took the split systems market to £226.8 million. Split systems have accounted for around 79% of the packaged air conditioning market for the past five years.

The air conditioning sector is characterised by technological developments. Tyson predicts continued advances in refrigerants. "On the split system side, I think there will be a move to using R410a, which will ultimately replace R407c. The new refrigerant is more energy efficient, and means that equipment can be manufactured to smaller specifications."

The R410a does have disadvantages, though. It works at higher pressures, and so installers will have to pick up new skills. "This is going to be a big issue," says Tyson.

Morgan predicts a move towards inverter-driven products. "Energy efficiency is increasingly important in our products. Inverter driven will move down the product chain to the very small stuff. For example, in Japan, about 90% of smaller chillers are inverter driven. At present in the UK that figure is around 10%. But that will increase in the next five years."

Tyson agrees, adding: "There are a lot of drivers towards energy efficiency. But ultimately you can talk to clients about this, but they have to decide to spend the extra money. I think the only way to encourage this is with legislation."

Source

Building Sustainable Design

Postscript

Market Watch is based on information supplied by Market & Business Development. For more information on MBD reports see the website www.mbdltd.co.uk, or call 0161 247 8600.