Costing Steelwork is a series from BCSA, Steel for Life and Aecom that provides guidance on costing structural steelwork. This quarter provides a market update by Dr Michael Sansom based on recent CPA forecasts, and data on prices and costs from Pablo Cristi Worm, associate construction economist at Aecom

Click here to read the full costing report

Total UK construction output is forecast to grow by 1.9% in 2025 and 3.7% in 2026. The summer forecast is largely unchanged from the start of the year but the risks and uncertainties have increased significantly.

Construction activity was subdued in January and February, followed by a considerable rise in March and April, easing slightly in May, followed by an uptick in June and early July. Despite this, the S&P Construction Purchasing Managers’ Index (PMI) dropped to 44.3 in July, marking the steepest downturn since May 2020.

UK economic growth was positive in 2025 Q1, but with the impacts of increases in business wage costs since April and likely tax rises in the autumn Budget, medium-term growth prospects are likely to be more subdued than in recent forecasts. More positively, the government’s supply-side reforms and current focus on capital expenditure may benefit the economy in the long term, although in the short term, business investment remains weak.

In addition, continued US tariff disruptions and the escalation in the Middle East conflict raise risk and uncertainty levels which, in turn, impact UK growth prospects.

From a government policy perspective, its spring statement in March and spending review in June point to medium- to long-term growth in affordable housing, rail and energy infrastructure, as well as military housing, education and some areas of energy efficiency retrofit.

Capital budgets for government departments are expected to grow substantially over the forecast period, but it will take time for this to translate into higher output. The spending review 2025 confirmed long-term funding for the main investment programmes in health and education, along with new prisons.

UK construction challenges, identified earlier in the year, largely remain. Delays of six to nine months caused by the Building Safety Regulator continue at gateway 2 for high-rise residential buildings. Barbour ABI suggest new project starts in this sector, in the six months to 2025 Q1, were 58% lower than the average in 2021.

UK construction employment continues to fall in 2025; down 13% on 2019 and 20% on 2008. Loss of skilled workers is largely in the 50 to 64 years age bracket. In addition, this has been exacerbated by younger EU construction workers leaving since Brexit.

In March, the chancellor announced £625m to train up to 60,000 more skilled construction workers, but there is a lack of qualified teachers and assessors for these potential new entrants. Furthermore, construction apprenticeships still have high drop-out rates, 50% for men and over 70% for women.

There were 4,032 contractor insolvencies in the year to April 2025, down 8.7% from the previous year. Despite this, the ISG administration fallout, Building Safety Regulator delays and wage cost increases are likely to increase costs and impact the cash flow and viability of subcontractors.

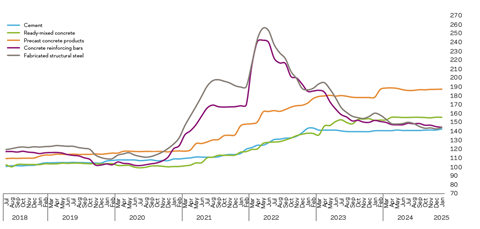

Figure 1: Material price trends

Price indices of construction materials 2015=100. Source: DBEIS

The infrastructure sector was worth £29.7bn in 2024, and activity remains strong on major projects and frameworks such as Hinkley Point C and HS2. The June spending review confirmed funding for HS2, and beyond the forecasts for Sizewell C, along with large announcements of capital expenditure more generally.

Energy generation and, especially, National Grid distribution work continue to grow and are likely to progress throughout the forecast period, in line with previous predictions. Overall, infrastructure output is expected to rise by 1.9% in 2025 and 4.4% in 2026.

Industrial output was worth £7.4bn in 2024. Sector activity peaked during the pandemic, with spikes in large warehouse construction to meet online shopping demand and strong factory construction. Since then it has dropped, but it has been picking up since autumn 2024 due to an array of small and medium-sized projects. Furthermore, industrial output will be boosted during the forecast period by projects in defence, renewable energy and giga-factories. Industrial output is expected to rise by 0.9% in 2025 and 2.6% in 2026.

Commercial sector output was worth £25bn in 2024. Activity on smaller, high-end, high-value refurbishment and fit-out projects remained very strong at the start of 2025. However, investors have become more price-conscious over the last 12-18 months, given the rise in construction costs. Construction and financing costs remain a major issue for large, new-build commercial developments in the pipeline, which historically have dominated the commercial sector, and larger “back to frame” refurbishment projects, where activity remains one-third lower than at the peak of the market in 2017. Investors in these large, new commercial projects are also now adopting a wait-and-see attitude to increased global and UK uncertainty and risk.

A continued stream of activity from the fit-out, refurbishment and repurposing of existing commercial buildings, as well as niche areas of growth such as data centres and life sciences, are supporting activity – but overall commercial output is only expected to return to growth, forecast at 2.7%, in 2026 once large new-build office towers move into the construction phase.

Despite the subdued forecasts in key markets for structural steel, there is a renewed focus on using UK steel for major infrastructure projects. Upcoming work, such as the third runway at Heathrow and Network Rail’s track supply, should provide a substantial boost. As the UK embarks on further large projects in health, transport and energy, ensuring a consistent domestic supply of steel is increasingly vital. Strengthening the resilience of the UK steel industry and securing the domestic supply of steel by shielding our producers from distortive trade practices and better utilising our domestic supply of scrap metal are key objectives of the UK industrial strategy published in June.

Figure 2: Tender price inflation, Aecom Tender Price Index, 2015=100

| Forecast* | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

|

1 |

120.0 |

131.2 |

145.4 |

145.8 |

150.1 |

155.8 |

162.2 |

|

2 |

122.6 |

134.5 |

146.6 |

147.0 |

151.1 |

157.3 |

164.0 |

|

3 |

125.3 |

138.1 |

146.8 |

148.2 |

152.5 |

158.9 |

166.1 |

|

4 |

127.5 |

142.3 |

145.6 |

149.3 |

154.2 |

160.5 |

168.5 |

Sourcing cost information

Cost information is generally derived from a variety of sources, including similar projects, market testing and benchmarking. Due to the mix of source information it is important to establish relevance, which is paramount when comparing buildings in size, form and complexity.

Figure 3 represents the costs associated with the structural framing of a building, with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 3), highlight the existence of different market conditions in different regions.

To use the tables:

1. Identify which frame type most closely relates to the project under consideration

2. Select and add the floor type under consideration

3. Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£174.50 + £115.00 + £34.50 = £324.00

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

Figure 3: Indicative cost ranges based on gross internal floor area

| TYPE | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

||

|

Steel frame to low-rise building |

158-191 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

266-299 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

302-357 |

Steelwork design based on 110kg/m2 |

|

Floors |

||

|

Composite floors, metal decking and lightweight concrete topping |

90-140 |

Two-way spanning deck, typical 3m span with concrete topping up to 150mm |

|

Precast concrete composite floor with concrete topping |

137-193 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

||

|

Fire protection to steel columns and beams (60 minutes resistance) |

29-40 |

Factory applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes resistance) |

36-58 |

Factory applied intumescent coating |

|

Portal frames |

||

|

Large-span single-storey building with low eaves (6-8m) |

114-149 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

139-178 |

Steelwork design based on 45kg/m2 |

Figure 4: BCIS location factors, as at Q3 2025

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

125 |

Nottingham |

102 |

|

Manchester |

102 |

Glasgow |

92 |

|

Birmingham |

98 |

Newcastle |

89 |

|

Liverpool |

97 |

Cardiff |

102 |

|

Leeds |

90 |

Dublin |

90* |

*Aecom index

Steel For Life sponsors

The Future of Steel Construction

A day-long event to be hosted by the BCSA in London this autumn, The Future of Steel Construction and Design will bring you best practice, emerging trends and insights from prominent industry professionals

The Future of Steel Construction, hosted by BCSA, aims to provide valuable insights and inspiration for architects, engineers, designers and other industry professionals, working with constructional steel on their projects.

The day-long event will be held at the Mermaid, London, on the 13 November 2025 and comprise lectures, panel discussions and case studies about best practice in specifying structural steelwork, emerging trends and upcoming changes in design codes and standards.

Changes to steel design standards and the Eurocodes – do you know what is coming?

Experts who have been instrumental in shaping the second generation of the Eurocodes will be running lectures on some of the most significant changes and what you will need to consider. Dr David Moore, Mr Mungo Stacy, Mr Chris Hendy and Professor Leroy Gardner will be taking you through Actions on Structures, Steel Design Standards, Design Assisted by Finite Element Analysis and Steel Bridge Design.

Case studies on emerging practices through the lens of different members of the project team: cut and carve approach, hybrid design and refurbishment and reuse

The case study sessions will be introduced by an expert in the area, to guide you through best practice and things to note if you are considering adopting one of these emerging practices for a project.

- Giltspur Street showcases the challenges that a cut-and-carve approach can throw up and how they were overcome. This innovative carbon-saving project not only involved jacking up floors within the building and reusing steelwork from the existing structure, but also had to factor in the logistics of avoiding and preserving a listed monument, the London Wall, located on the ground floor of the construction site.

- The Edge, a 27-storey office building, will showcase how a well thought-out hybrid approach to the design of the building using steel, timber and concrete helped to minimise embodied carbon and made a significant contribution to the circular economy, while retaining an architecturally expressive form and providing structural precision and integrity.

- 30 Duke Street will highlight how the reclaimed and reused steel helped deliver this highly successful and sustainable building. With 78% of the structural steel coming from a donor building and supplemented with reclaimed sections from a stockholder, this approach has resulted in nearly 744t of CO₂e savings.

Structural engineering for fire in a post-Grenfell built environment

Professor Luke Bisby, an expert witness for the Grenfell Inquiry, will be providing insights to help you navigate the requirements and approach to fire safety design following the release of the new building safety regulations. Architects and engineers have more to consider; it is not just a matter of compliance, but mindfulness of the overall fire strategy too.

Designing efficient and sustainable steel framed buildings

Dr Michael Sansom and Mr David Brown will highlight options available to structural engineers to design efficient, sustainable steel-framed buildings. Individual and joint BCSA-SCI initiatives have resulted in a suite of tools and guidance to enable sustainable steelwork design and fabrication, which will be presented and discussed.

Exhibitors will be showcasing their innovative products which can help streamline the design, manufacture and erection of structural frames and will be on hand throughout the day to answer questions about how they can help you.

Book your place to hear real-life examples of the application of steel in design and construction, gain inspiration, and enhance your professional development. With design standards, regulations, and specification practices constantly evolving, this event is your chance to stay ahead of the curve and ensure your steel structures meet the latest best practices. The day will conclude with reception drinks to allow time for networking and discussion.

The Costing Steelwork article produced by Dr Michael Sansom (sustainability director) of BCSA is available at www.steelconstruction.info. The pricing data and rates contained in this article have been produced by Pablo Cristi Worm, associate construction economist at Aecom. They should be used for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the contents of the article.

No comments yet