Civil engineering activity built further on its September gains after four months of decline, while non‑residental was the only sector in which activity failed to grow last month. Orders and tender enquiries were buoyant across all sectors but employment prospects stayed flat. Experian Economics reports

01 / State of play

The total activity index gained a further two points over the past month to 57. The R&M activity index edged up by the same margin, to 59 points, its highest level since January 2016.

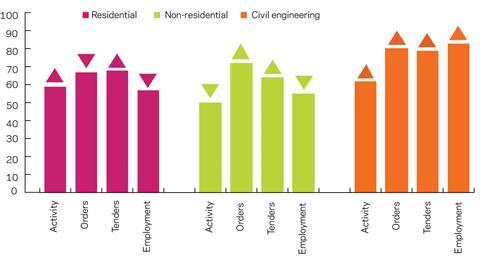

At the sector level, the largest gain was in civils, adding 11 points over the past month to stand at 62. The residential activity index gained a further four points and reached 59, a 13-month high. The non-residential sector was the only one that lost momentum over the past month, dropping three points to the neutral boundary of 50 points.

Orders and tender enquiries continued to move comfortably above the no-growth boundary as both indices increased in momentum in the past month. Tender enquiries gained five points to reach 66, the highest level since December 2015. Orders index ticked up one only point, but stood close to its five-year average at 67.

All three sectoral orders indices remained on the expansionary side for the eighth consecutive month. Civils stood the highest, at 80, with non-residential edging up to 72 and residential settling at 67 after a slight decrease.

Tender enquiries by sector also stayed buoyant. Civils was the fastest growing, gaining 23 points to 79. Residential and non-residential gained six and seven points respectively, to 68 and 64.

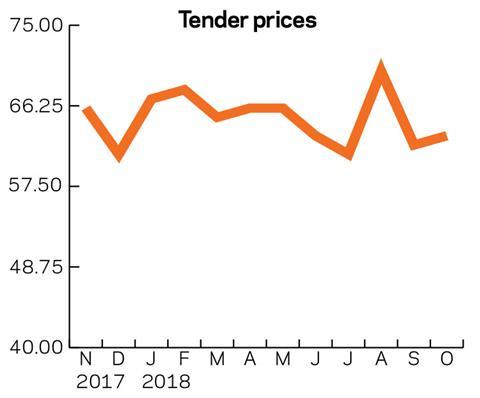

The tender prices index ticked up by a point in October to stand at 63, the same as in June and close to its six-year average level.

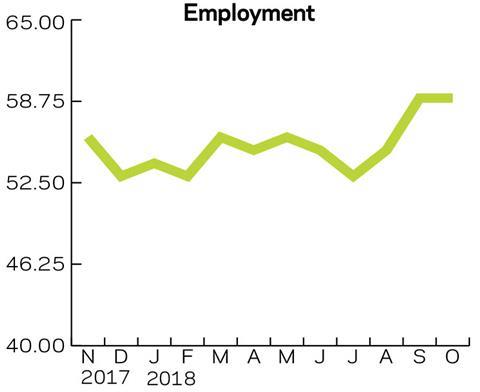

The employment prospects index remained flat relative to September at 59.

The share of agents facing no constraints rose by five percentage points in October, to a 47% share of respondents. Insufficient demand was reported as less of a constraint than a month before but still took the lead, noted by 19% of respondents. Labour shortages, though, have been more pronounced over the past month, at 16%. Financial constraints were the third most common factor, marked by 15% of respondents.

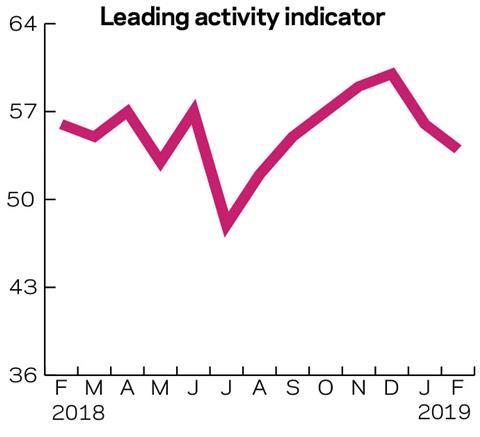

02 / Leading construction activity indicators

The activity index in October indicated a small gain in momentum in the construction sector, as it added two points to its September figure to return to its June level of 57. The positive impetus is expected to persist over the next couple of months, after which the index is likely to lose a few points as construction activity weakens.

03 / Labour costs

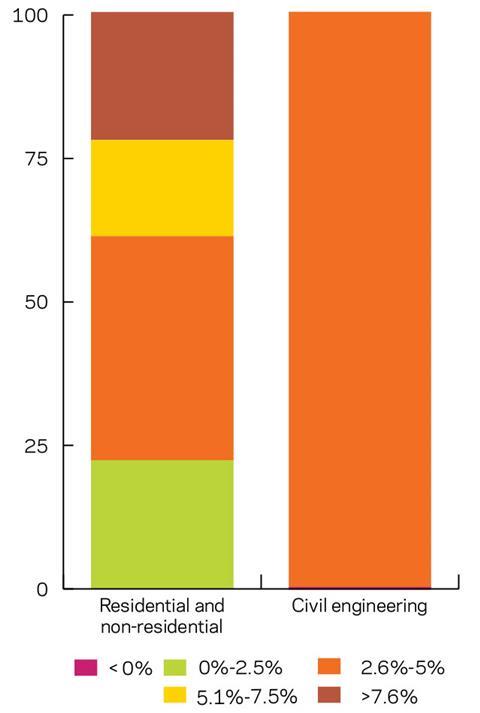

The dynamics in labour costs in the residential and non-residential sectors show continuous increase in prices. None of the respondents from the two sectors reported a decrease in labour costs in October – the same situation as in July (the last time this data was collected). There was, however, a slight shift towards the lower rates, as 22% of the participants saw labour costs increasing by up to 2.5%, compared with 9% in July. There was also a shift in the upper bounds, as the share of respondents pointing at cost increases exceeding 7.5% fell to 22% from 26% in July.

Reported labour cost dynamics in the civil engineering sector replicated the picture from three months ago – all respondents marked cost increases within the 2.5%-5% bound. This signals some stabilisation in the costs dynamics for the sector but also no change that would help lessen the cost burden.

04 / Regional perspectives

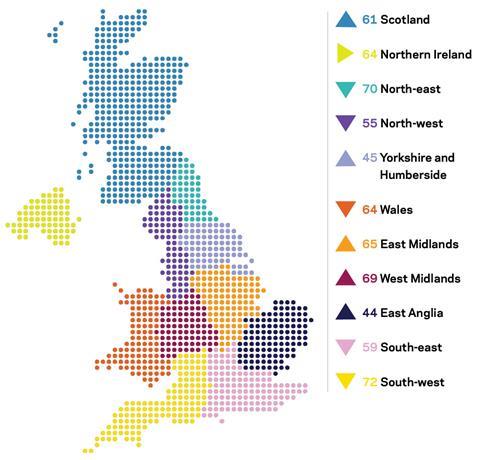

Experian’s regional composite indices incorporate current activity levels, the state of order books and the level of tender enquiries received by contractors to provide a measure of the relative strength of each regional industry.

The South-west remained in the lead, despite losing two points to stand at 72. The North-east was second, with an index of 70, three points down from September. The West Midlands and the East of England each gained three points, with the former taking third place with 69 and the latter in last place with an index below the no-growth bound at 44.

The other region that saw a decrease in activity was Yorkshire and Humber, remaining in negative territory at 45 despite gaining six points last month.

The East Midlands index rose the most, up 10 points to 65. Scotland rose seven points to 61.

Among regions that lost momentum in October, the North-west was the weakest, falling four points to 55. The South-east dropped four points to 59.

Northern Ireland remained unchanged relative to September, with an index of 64, but shared the spot with Wales in October, whose index had dropped three points over the past month.

The UK composite index added two points over September to reach 59, back to its level in June. The development was underlined by the dominance of some regions’ gains in over the downturns in others.

This an extract from the monthly Focus survey of construction activity undertaken by Experian Economics on behalf of the European commission as part of its suite of harmonised EU business surveys. The full survey results and further information on Experian Economics’ forecasts and services can be obtained by calling 0207-746 8217 or logging on to www.experian.co.uk/economics.

The survey is conducted monthly among 800 firms throughout the UK and the analysis is broken down by size of firm, sector of the industry and region. The results are weighted to reflect the size of respondents. As well as the results published in this extract, all of the monthly topics are available by sector, region and size of firm. In addition, quarterly questions seek information on materials costs, labour costs and work-in-hand.

No comments yet