It’s difficult to say whether we have reached the bottom of the pricing trough, says Peter Fordham of Davis Langdon, an Aecom company. What’s sure is that material prices will rise

01 / Executive Summary

DOWN:

Tender price index: Tender prices eased down again in the fourth quarter but 2011 may herald the start of a small price rise in the London market, though it is unlikely elsewhere.

UP:

Building cost index: The building cost index maintained its rise in the fourth quarter though not as strongly as in the first half of the year. Costs in 2011 are expected to rise by a similar amount as in 2010.

Retail prices index:The retail prices index and consumer prices index remain at inflated levels, 4.8% and 3.7% respectively in December, well above target, driven by high oil and food prices. The increase in VAT in January will push both measures higher.

02 / Trends and Forecast

Last year’s trend of slowly declining prices was maintained into the fourth quarter last year. Analysis of tenders received in the last three months of the year reveal that prices fell by another 0.5%, meaning prices, on average, have fallen 18% since their peak in Greater London in the second quarter of 2008 and, elsewhere, a quarter or so earlier. This average figure hides some divergences between sectors: the fit-out market has been particularly badly hit and price reductions have often exceeded this level; conversely, housebuilding activity has not seen the same degree of price reduction, in part because it experienced to a far lower extent the sharp rise and fall of steel prices in 2008. Equally, some building clients who now opt for a single-stage tendering route may be seeing price falls in excess of 18% compared with prices accepted under a two-stage pricing regime at the top of the market.

As workload has fallen, most contractors are happy for the opportunity to tender under any type of procurement and, in consequence, there has been a return to traditional tendering. This has benefited building clients in securing a lower contract sum. But clients’ project teams need to be vigilant to ensure that the contract sum does not turn into an inflated final account figure. This requires care at the tender scrutiny stage to ensure that the tender meets the full contract requirements and restraint on the part of both client and architect to restrict design changes post contract. But not all contractors are aggressive or adversarial: some realise that they need to keep on side with project teams in order to be considered for the next job.

Although materials prices rose during 2010, pushing up prices in some elements of work, notably steelwork and M&E services, tender prices overall edged down as main contractors fought to secure workload, aggressively hacking back the amount included in tenders for preliminaries. Overheads and profit levels fell typically to 2-3% some while back but few contractors are trying to erode this any further: one or two who offered tenders with zero or even minus figures in a desperate attempt to win work are no longer in the market.

Contractors and subcontractors remain anxious about workload. Most estimating departments have slimmed down and, in consequence, remain busy. Some contractors have seen an increase in tender enquiries from clients wishing to catch the market at the lowest point, which Davis Langdon and others have called about now. As a result, some contractors are being more selective in the opportunities they bid for, to the extent of declining single-stage D&B in the hope of moving back to two-stage work. For now, however, this remains the exception rather than the rule.

The anticipated decline in new work is illustrated by one of the findings of the latest monthly Markit/CIPS Construction Market Purchasing Managers’ Index (PMI) reports on December’s survey, that construction companies had shed labour for the fifth consecutive month and at an increasing rate as the year came to an end. The fear is that once skilled labour leaves the construction industry, a large proportion will not return when the pick-up comes.

Are we at the bottom of the pricing trough? It really depends on the volume of activity presented to the industry relative to the size of its participants and that is highly dependent on the economy in general.

This year started with a mood of optimism. The FTSE 100 pipped 6,000 on Christmas Eve, and bullish analysts talk of a level of 7,000 during 2011. The Deloitte Chief Financial Officer Survey showed that optimism among the UK’s largest companies rebounded in the fourth quarter. It showed that risk appetite, recruitment and capital spending were all likely to rise. Office for National Statistics figures show that business investment was rising throughout 2010 and, in the third quarter last year, was 8.9% higher than a year before. Markit’s December manufacturing PMI recorded its highest level of manufacturing production and new orders for 16 years, which should begin to translate into increased investment in new capacity before long.

But the major concern for the industry remains the government’s public sector cutbacks, which are due to kick in in earnest from the new financial year. Last year was propped up by a strong public sector workload but the size of the hole about to be left was already clear in the new orders figures for the third quarter last year (see page 61). Public non-housing output is expected to decline by 11-15% this year, exacerbated by a fall in public housing work of 13-18%. As a result, the total market for new construction work will fall this year by 4.3%, according to Experian, or 1.7% according to the Construction Products Association. Either way results in further excess capacity, increasing competition for new work.

Contractors will continue to fight for tendering opportunities, limiting the scope to pass on increases in materials costs that occurred in 2010 and look likely to reappear in 2011. The number of construction companies becoming insolvent declined in the first three-quarters of 2010 but picked up again in the fourth quarter. Rising input costs at the same time as contractors are forced to submit lower bids is a recipe for an increasing number of company failures. Building clients and main contractors should look closely at their anticipated supply chain for any signs of distress.

Insolvencies may further shrink the contractor capacity pool in 2011 but, at the same time, there are signs that contractors whose home market is in a worse state than ours (Ireland, for example) are looking to break into the UK market. Some such contractors are entering the market with aggressive pricing and could drag the general pricing level down further.

The next 12 months look set to be a period of intense competition exerting further downward pressure on prices fighting against another year of rising materials costs. In 2010 higher costs were offset by cutting preliminaries charges and the like. That would appear to be one option where there can be little room left for manoeuvre, but 2011 looks likely to be the year where a gap begins to open up between London and the rest of the country. Nationally, workload is set to decrease over the next two years but in London the reverse is true. Work on the Olympics will largely come to an end this year but Crossrail will help to bolster the industry for the next few years. The London office construction market will begin a tentative recovery this year. Office rents in the City last year rose 25% according to Drivers Jonas Deloitte, the largest annual increase for 22 years, as occupiers faced a limited supply of new buildings. There is expected to be continued strong upward pressure on rents over the next two years as demand outstrips supply. In consequence a number of developers are now active back in the market but, for many, funding remains the principal constriction. Spare capacity, even in the London market, will remain the dominant force in the pricing dynamics but with strong cost pressures coming through, it seems unlikely that all of those costs will continue to be absorbed. As such, it is anticipated that tender prices in Greater London over the year to the fourth quarter 2011 will rise between 1.5% and 2.5% depending on the relative strengths of the opposing forces. The second year should see the office construction market even more active and with the general economy stronger, some price and margin recovery should be possible, leading to anticipated price rises of 2% to 4%.

Outside of London, the public sector cutbacks will impact more heavily and, despite cost increases, contractors will probably fail to secure tender price rises over the next year, although there is little scope for further price falls. During the second year of the forecast period, with construction output still in decline, it will be a struggle for contractors to make money but it may be necessary for some of the cost increases that will have built up over the preceding two to three years to be passed on and tender prices are forecast to rise by 1% to 2% at most.

03 / HOT TOPIC KEY ISSUES FOR THE global ECONOMY AND CONSTRUCTION IN 2011

Undoubtedly, 2011 will be another year of economic and political uncertainty that will continue to challenge global construction markets. The major themes that will determine performance of the economy and demand for construction over the next 12 months will include the following:

1. ’Tale of two worlds’ set to continue. In 2010 robust growth in emerging markets outpaced the sluggish recovery in the mature economies. This two-speed performance is likely to remain a key feature of the global economy in 2011. Global growth is expected to pick up in the second half of the year, as business investment and consumer confidence improves, but countries’ performance will be very different. US growth is expected to pick up steam over the course of 2011, helped by a weaker dollar. Europe is likely to post slower growth, hampered by fiscal tightening and jitters about sovereign debt in a number of countries. In the UK, the growth recovery has so far surprised on the upside. However, the UK is facing major economic headwinds, including fiscal tightening, weak consumer spending and a weak investment recovery, which could usher in a period of relatively low growth. Robust growth in emerging markets will continue to trump the bumpy recovery in the mature economies.

2. Debt reconciliation. The global financial and economic crisis has left an enormous burden of debt that weighs on the prospects for sustained recovery in many mature economies. Debt-laden governments are now facing the huge challenge of reconciling their public finances. Protecting economic growth while balancing conflicting claims by bondholders and other stakeholders (taxpayers, users of the public infrastructure, and others) will be at the core of policymaking across the Eurozone, UK and the US.

3. New growth frontiers. As well as the BRIC countries (Brazil, Russia, India and China), the 10 championship economies (Argentina, Egypt, Indonesia, Korea, Mexico, Poland, Saudi Arabia, South Africa, Turkey and Vietnam) also offer huge construction growth potential - middle-income emerging countries with large populations, rapid urbanisation, industrialisation and changing lifestyles, all of which is attracting investor interest. Other parts of Africa, with plentiful natural resources, are also now on the radar. Global construction businesses are developing an appetite for expanding into these countries, and as early entry provides opportunities to create markets and shape industry structures, we are likely to see more players entering these arenas.

4. Inflation an increasing concern. Inflation pressures have built over the course of last year in many emerging markets, but also some mature economies. Strong domestic demand in emerging countries, super-expansionary monetary policy (interest rates near zero and quantitative easing), as well as rising commodity prices, are causing a reflation of the global economy. In the UK inflation is likely to remain well above target throughout 2011, due to global commodity price pressures, the VAT rise, a pick-up in wage settlements and higher inflation expectations. The risks to inflation appear firmly on the upside. In particular, the rollercoaster ride of commodity prices is likely to continue into 2011, as factors other than demand growth - inventories, exchange rates, and speculative activity - will also affect the extent to which prices move.

5. Increasing pressure on construction prices. In the UK, Europe, US and pockets of the Middle East, construction endured another difficult year in 2010 from a demand perspective, and this trend is set to continue as public support is being withdrawn and private sector demand remains largely lacklustre. At the same time, construction input costs have risen. The strength of the global economic recovery has put upward pressure on materials prices, particularly those dependent on widely used commodities, such as steel. The combination of sub-par demand coupled with rising input costs is a trend that is likely to continue to be observed across many regions this year, which will continue to challenge market participants.

6. Rising risk of international currency wars. Bilateral exchange rates and currency market volatility will be key discussion points among global policymakers this year. A rising number of countries view a weaker exchange rate as a way to increase export market share and boost economic growth. Behind this is the upward pressure on emerging markets’ exchange rates, the US Dollar trending lower and the Euro at risk from the Eurozone’s fiscal problems. So far the “currency war” is primarily due to growth differentials and diverging monetary policies. Emerging markets are facing increasing inflation risks, while trying to deal with large inflows of capital, as investors pour cash into these fast growing markets in search of better returns. Countries are trying to control inflation without hitting exporters with a stronger currency, and this means more capital controls, currency volatility, inappropriately low interest rates and potentially more asset price bubbles. In the end, it is likely that emerging market policymakers will have little choice but to let currencies appreciate, as pressure will continue if their growth outpaces the mature economies.

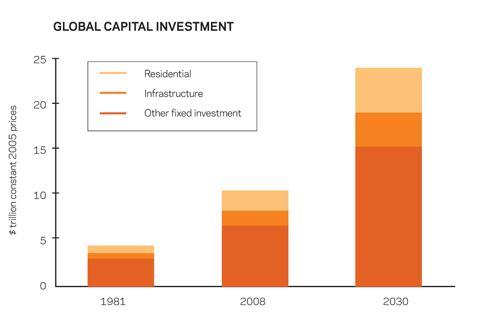

Source: McKinsey Global Institute

7. Global cost of capital. The cost of capital has become cheaper and more easily available over past decades, and although the credit crunch has made funding relatively more expensive and harder to obtain, today’s interest rates remain very low for several reasons, including economic weakness in mature economies and central bank monetary policies aimed at stimulating growth.

The balance of global savings and investments that contributed to decreasing costs is likely to reverse in the years ahead, making the cost of capital higher, which would have a direct impact on the global construction market. Fast growing developing economies have embarked - or are about to embark - on one of the biggest building booms in history. McKinsey forecasts that global capital investment could rise to $24 trillion in 2030, compared with $11 trillion today. This investment boom could put upward pressure on real interest rates unless global savings increase significantly. This appears unlikely given ageing populations and emerging markets’ efforts to boost domestic consumption. Consequently, the construction industry needs to be prepared and adapt to a business environment in which funds are more costly and where investments increasingly happen in emerging markets.

8. From vertical to horizontal construction.Private sector construction, suffering the after-effects of the global credit crisis, together with increasing investment from the emerging and frontier markets, has led to a global shift in the type of construction from vertical to horizontal: civil engineering, such as public transport systems, as well as water and energy projects. This trend may well reverse again in the future, as strong economic growth in countries such as China, Brazil, Saudi Arabia and many others, presents a new challenge: urban policy. The rapid rise in population and migration to cities is leading to urban sprawl, spiralling demand for energy and water, and the challenge of providing social services such as education and healthcare. To deal with these challenges will require efficient urban policy from policy makers, and the construction industry will have to respond to urban planning by focusing on building cities up, not out, along with appropriate investment in transport infrastructure.

9. Loss of skills. Will the lessons from previous recessions be heeded? Construction skills at all levels and in all disciplines were lost in previous recessions, with large numbers not returning. The industry did not truly recover its skills base from the recession of the nineties. Current events are compounding earlier deficiencies in addressing skills shortages, training and employee development. There is a real threat of creating a long-term skills shortage in the industry, which is notoriously poor at attracting students and new participants, with a trend towards short-term initiatives often brought about by the cyclical nature of the industry. Doubtless, there is awareness in the industry that losing skills will lead to problems. It is often economic realities that impose actions on firms which require reductions in headcount, with the consequent loss of skills and knowledge. It is unfortunate that this dilemma continues to affect our industry, despite the lessons of the recent past.

10. Consolidation and loss of capacity. In some construction markets, UK included, sustained under-investment in the industry’s productive capacity is likely to be exacerbated by the global downturn. Reduced investment in the means of producing buildings and infrastructure affects future capacity, both in terms of quantity and quality. Any pick-up in aggregate demand in the future may quickly lead to price increases as capacity and supply struggle to meet raised output requirements. Important new technology sectors within the industry may be weakened before they have the chance to develop the necessary economies of scale. Mitigation now would undoubtedly cost less than adaptation or higher future levels of investment.

Authors: Máren Baldauf-Cunnington and Michael Hubbard of Davis Langdon, an Aecom company

04 / Activity Indicators

Construction output

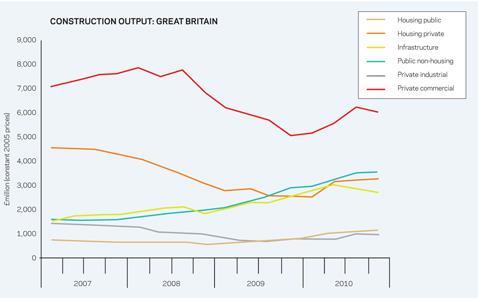

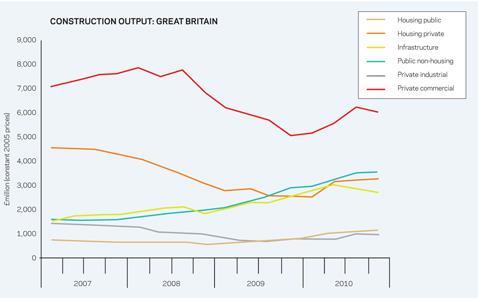

The Office for National Statistics (ONS) has revisited its published statistics on construction output in Great Britain and downgraded its strong growth figures for the second quarter of 2010. Nevertheless, the figures still suggest remarkable increases in on-site activity in both the second and third quarters last year, levels which were largely maintained into October and November. With just one month’s 2010 data to come, the figures show that construction output in 2010 was 7% higher than in 2009 at constant prices with new work output 15% up on the previous year. If this figure is correct, it means that new construction work in 2010 was just 2.5% lower than in the peak year of 2008 and higher than any other year in history. This does not ring true for most contractors, consultants and commentators in the industry.

The chart (top right) shows public non-housing work has continued to grow throughout the period, more than doubling its value to the industry since 2007 and more than exceeding its value during the public sector heyday of the late sixties/early seventies. It also demonstrates clearly the vulnerability of the industry of the public sector cuts that have already started but will only begin to show in the figures in 2011.

Infrastructure work has also largely maintained a growth track during the period but declined a little from a strong second quarter performance. The private commercial sector also retrenched a little in the fourth quarter, following strong third quarter results.

Contractors’ new orders

ONS figures for new orders obtained by contractors paint a much more gloomy picture. The value of new orders slumped in the first quarter 2009 to just 56% of the zenith value reached in the second quarter 2007. However, the figures show that the government’s injection of funds into public sector and infrastructure projects in the second and third quarters of that year acted as a lifeline to the industry. The figures for public and infrastructure work for the latest quarter available - 3Q10 - show how the government’s cuts are already taking effect and despite a substantial increase in private housing new orders and a small rise in the private commercial sector, the total value of new orders in the middle half of 2010 fell away quite sharply.

Forecast

In consequence, it seems unlikely that a private sector recovery will be sufficient to prevent construction slipping back into recession in 2011. The winter 2010/11 construction forecast from Experian foresees a drop back in new work activity of 4.3% this year from the buoyant 2010 figures followed by a further drop of 1% in 2012. But in 2013 a strong recovery in private commercial work (10%) will be enough to produce an overall new work bounce back of 6.7%, even as public sector work continues to be withdrawn.

05 / Building Cost Index

While tender prices continued to slip backwards during 2010, the building cost index, a notional measure of the cost of construction materials and national wage agreement building labour, continues to rise. After declining for three consecutive quarters between late 2008 and mid-2009, the index resumed its normal upward trajectory. Over the past 12 months the index to the fourth quarter 2010 rose by 2.7%, a rate slightly down from the previous quarter’s 3.5%. The rise in the index has been entirely down to materials prices, of which the rate of increase began to decline in the last months of the year.

Labour

Wage rates for building and civil engineering operatives have been frozen since June 2008 and electricians, who may have expected a pay rise in January, are the latest group of workers to be refused any increase by their employers. However plumbers and steelworkers both saw their rates of pay increase from the beginning of January, by 3% and 4.7% respectively. Builders’ normal anniversary date is the end of June and the forecast allows for a small increase in pay (2.5%) to come into effect around that time this year for directly employed operatives subject to the national wage agreement. The rest of the workforce - self-employed and agency workers - will be subject to the whims of the market and with construction operatives still being laid off, their take-home pay seems more likely to fall rather than rise into the first part of 2011.

Materials

The annual rate of construction materials prices almost touched 10% in June but declined to 6.8% by November. For new non-housing work the figure reached 10.9% in June, the higher figure reflecting the fact that the leading component in the drive to higher prices was steel.

The price of fabricated steel rose by 31% between February and July before losing 4% by the end of the year. Similarly, reinforcement prices rose by an identical amount between December 2009 and May last year before losing some 9% in the second half of the year.

Steel

The surge in steel prices last year followed the jump in raw material prices. The rise in iron ore prices was particularly well documented, prompting ore miners to refuse to enter into the normal annual pricing contracts and forcing the buyers, steel manufacturers, to accept quarterly contracts. The crisis was prompted by the spot price for iron ore surging to $180 a tonne in April compared with the $101 benchmark price that still pertained in the first quarter of 2010. Spot prices subsequently collapsed but since September have steadily climbed back above $180.

Global steel demand is expected to increase by 5% in 2011, putting further pressure on iron ore prices with new iron ore production capacity not expected to come on stream before the end of 2011. It seems likely that prices in 2011 will once again exceed $200, setting a new all-time high.

Almost as important in the steelmaking process is coking coal. Coking coal prices also rose in the first half of 2010, further stoking the steel price rise that ensued. Of greater concern now is the price direction in 2011. More than two-thirds of seaborne coal comes from Australia and the state of Queensland in particular. The new quarterly contracts were signed at $225 a tonne for first quarter delivery, up 8% on the previous quarter. The devastating floods in Australia have closed mines, rail links and ports. It has been estimated that the floods may remove over 5% of steelmaking coal from world markets this year which could cause prices to rise by a third or more. More bullish analysts see the spot price for coal passing $400 a tonne, slightly ahead of the $375 a tonne reached in 2008 when Australia’s collieries also faced flooding. However, others are more cautious suggesting price rises of not more than 25%. But a rise of 25% will be enough to push up the price of a tonne of steel by 5%.

The third most important raw material in steelmaking and the single most important in the electric arc furnace method of steel production is scrap. Scrap prices during 2010 were their usual volatile selves but ended the year at their highest level since August 2008, and have continued to rise into 2011 on the back of rising demand. Tata Steel (formerly Corus) announced a £50 per tonne increase on structural sections and a £40 per tonne rise on plate, effective from the beginning of January. More price rises seem likely to follow.

As a result of the higher scrap prices, rebar prices have risen by up to £100 a tonne (or 20%) since the end of last year and are forecast to rise further.

No comments yet