With investment, development around ports and supermarket projects, things could be looking up for warehousing

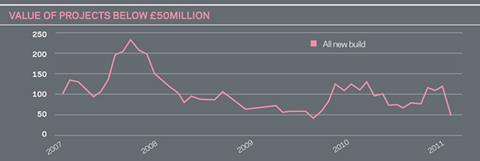

The latest CPA/Barbour ABI warehouses index, tracking new construction contracts monthly, plummeted by nearly 60% in April - its lowest level since October 2009.

Near-term prospects for the warehousing sector are inextricably linked to the health of the economy, which returned to modest growth in 2011 Q1. While overall growth was far from convincing, activity in the manufacturing sector - a key component of demand for warehouse space - was nearly 5% higher than a year ago. Exports too have proven to be a bright spot on an otherwise cloudy economic horizon, as the sterling’s lower value against both the euro and dollar finally pays dividends. The latest forecasts from Oxford Economics expect the rate of expansion in the manufacturing sector to continue to outpace wider economic growth over the next 18 months.

Retailers, however, face an altogether more challenging environment. Sales may have been boosted by national holidays in April (British Retail Consortium figures suggest growth of over 5% year-on-year) but with high inflation eroding disposable income for the second successive year, households are feeling the pinch. While economic forecasters expect that consumer spending will to continue to rise over the next few years, the pace of growth will be extremely modest.

As consumers become more cautious supermarkets, with their purchasing might, stand to be a big winner and relatively high value online sales distribution centres will provide a boost to the warehousing sector.

While risks to the warehousing sector remain, the outlook is cautiously positive. With anticipated investment by manufacturers, development around ports to increase capacity and high value supermarket projects, the Construction Products Association’s latest forecast anticipates that warehousing output will rise by 10% in 2011 and by a further 9% in 2012, albeit from a low base post-recession. Despite the 60% fall in the warehousing index in April, we would therefore expect contract awards to bounce back robustly in May as business as usual resumes.

1 Readers' comment