Ciara Walker and Jonathan Moore of Arcadis consider how the city that has ‘everything except a beach’ is leading by example in the northern powerhouse

01 / Introduction

With a significant industrial (and entrepreneurial) heritage, a notable vein of counterculture running through the city, strong education, media and business sectors, and a hearty tourism draw, Manchester has made its mark on the world, and will continue to do so.

Though challenges in connectivity are holding the city back, strong and aligned leadership over the past 20 years has allowed the city to revitalise its industries, draw population back to the city centre, and widen its labour pool through investment in public transport.

Now, with the opportunity to lead within the northern powerhouse and join its strengths with those of neighbouring cities, Manchester can catch up to London’s productivity and help to rebalance the nation’s economy.

Table 1: City indicators

| City-region Indicator | Data (2016) |

|---|---|

| Arcadis Sustainable Cities Index | 25th |

| GVA (£) | 59.6bn |

| Year-on-year economic growth (%) | 3.90% |

| Unemployment rate (%) (2016) | 6% |

| Population | 2.8m |

| Population growth rate (annual %) | 2.60% |

| Total number of tourists | 1.4m |

02 / Economic and political overview

Economics

Greater Manchester has both strong areas of economic growth and deprived areas (20% living in the top 10% most deprived areas of the UK). There has always been a strong professional sector in Manchester, across finance, legal and accountancy but the city faces a challenge in retaining its huge student population (105,000 across five universities), and in supplying them with high-quality housing, job opportunities and public realm to entice them to stay.

The economy is growing steadily, outpacing UK averages over the past few years at 3% in 2016 compared with a UK average of 2%. It looks set to continue to do so, with expectations of 2% growth between 2017-2019 for Greater Manchester. With new industries developing in and around the city, Manchester will be looking to leverage the student population, gathering industry around educational hubs. Already there is a strength in digital, and investments in the university are developing existing strengths in materials such as the new wonder material graphene. Manchester will need to nurture these nascent industries and specialisations to retain the graduates they produce. Greater Manchester is increasingly attracting international investment. Last year, the North-west had 98 foreign direct investment projects, the largest number in a decade, with 54 of those schemes coming to Greater Manchester, making it the most popular destination for foreign direct investment outside of London.

Regeneration

After damage to the city centre from the IRA bomb in 1996, Greater Manchester set upon a regeneration plan. This successfully repopulated the centre, growing by 10,200 (133%) between 2001-11, of which 89% were Gen Y.

Manchester and Salford have a track record in placemaking. Regenerated areas across the city region have attracted business, increased land and property values, grown tourism and enhanced the city’s image. The St John’s neighbourhood is the latest phase in the continued renaissance of central Manchester, with the development of the former ITV studios into 3,000 houses and 2.8 million ft2 of workspaces for digital workers. A dramatic increase in high-rise developments and apartments is transforming the heart of the city from a post-industrial town to a modern skyline.

Politics

A driver of Manchester’s regeneration has been the stable and aligned political environment bringing together the weight of civic leadership around common goals of regeneration, housing and jobs for the city based on a transportation system integrated across Greater Manchester. With the upcoming mayoral elections and devolution deal, it is hoped that a consistent vision can be maintained. The devolution deal will allow Manchester to channel more investment into the areas it feels are most relevant, localising decision-making and giving the mayor powers over health, the social budget, and discretionary spending powers through business rate retention. The new mayor will have control over a portfolio of public services and a £900m, 30-year devolution investment fund, as well as sitting on a board that oversees a devolved £6bn health and social care budget. Manchester has also led the way in collaborative approaches to infrastructure delivery, with the 10 local authorities of Greater Manchester working together to deliver and manage public transport and optimise investment. This has resulted in the Greater Manchester Combined Authority, which represents Greater Manchester at northern powerhouse institutions.

03 / Northern powerhouse

With 15 million people and a GVA over £300bn, the economic inputs of the northern powerhouse region are similar to London’s, but the North does not achieve anywhere close to London’s economic success. To unlock the potential of this region, the government committed in the Autumn Statement to modern transport links, a revolutionary new style of governance and supporting increased investment. To support this, the government has set up a minister for the northern powerhouse, as well as several bodies bringing together the North’s city regions and Local Enterprise Partnerships into northern powerhouse decision-making bodies, such as Transport for the North.

Greater Manchester is setting itself up to lead this agenda, with a vision to join its strength with those of the other regions (Leeds City region, the North East, Humber, Sheffield City Region, Liverpool City Region) to overcome the major barriers the North faces, and allow its full economic potential to be achieved. By joining forces the cities of the northern powerhouse are looking to achieve the conglomeration benefits experienced in conurbations in Europe (for example, the Randstad in the Netherlands), including higher economic productivity, income and employment. Critical issues of productivity hold the North back, with value added per worker 25% lower than in the South. This gap has widened steadily over decades, and narrowing it will not happen overnight.

Connectivity

One of the main challenges to the North’s productivity is its lack of connectivity. Greater Manchester is constrained in combining its resources, with access to Manchester city centre often slower than access from London. Commuting between Manchester and Leeds for example is 40% lower than would be expected given the distance between them. A 20-minute reduction in journey times would be worth £6.7bn across the whole of the North, with only £2.7bn of the returns going to the cities themselves. To address this Transport for the North was created for the integration of infrastructure spending across the northern powerhouse, with the regions preparing their transport plans based on the Transport for the North agreed agenda. Addressing connectivity challenges can be expected to double the advantage HS2 brings to the North, particularly east-west investments. Across the region, £13bn has been made available for transport investments in the northern powerhouse, including HS2 and electrification of railway lines.

04 / Infrastructure

Investment is already in place to create much of the modern infrastructure Manchester needs to improve its connectivity within Greater Manchester and the wider northern powerhouse region. The 2040 vision for transport sets ambitious plans addressing the needs of a growing population and employment base, with 800,000 more trips daily anticipated on public transport by 2040. Congestion costs to Greater Manchester are already £1.3bn a year and will grow if capacity issues are not addressed quickly. The strategy aims to answer this challenge and shape a successful, resilient city region, as well as catching up the investment differential with London, where in 2011 £1,500 per person was invested in transport, compared to £300 per person in the North-west.

Railways in Manchester, and the wider northern powerhouse region, are in desperate need of improvement. The Northern Hub, due for completion in 2018, addresses capacity and network constraints of rail in and around Manchester, and the roll out of electrification in North Western, Midland Main Line and Northern Transpennine lines will also improve connectivity. However, even when these projects are complete, the network will still be operating at close to capacity. Continued investment is required to offer the higher frequencies and interconnected services that are a feature of successful connectivity in city regions such as the Randstad.

Arcadis is contributing to one of Greater Manchester’s flagship schemes, the £1bn redevelopment of Manchester Airport, which is complemented by significant investment in an “Airport City”, with offices and high tech industry to be developed alongside the airport. The aim is to become the main international gateway for the northern powerhouse, building on strong growth in airport passenger numbers of 12% in the two years to September 2016. Manchester is increasingly international, becoming the first British hub outside of London to have non-stop flights to Beijing in June 2016 on top of the £130m investment into Airport City promised by Chinese president Xi Jinping during his visit to the airport in 2015. The project expands terminals, increasing capacity from 25 million to 50 million passengers a year and upgrades the quality of experience and facilities to make Manchester Airport a suitable entry point for the modern, global conurbation that the northern powerhouse aspires to be, as well as remodelling itself into an international hub airport. However, the scope to grow airport use is constrained by connectivity challenges, with poor journey times and frequencies to the airport. The need for enhanced connectivity to the North’s principal international gateway cannot be overstated.

Table 2: Infrastructure priorities to 2040 identified by Transport for Greater Manchester

| Project |

|---|

| Improved public transport access between the Airport, HS2 and the Enterprise Zone |

| Electrification of the Greater Manchester rail network (including Northern Hub/Lancashire triangle and trans-Pennine committed schemes) and delivering rolling stock capacity (committed scheme) |

| Completion of Smart Motorway on M60, M62, M56 and M6 (committed schemes) |

| Improvements to key ‘national hub’ rail stations for city to city links (Piccadilly, Victoria, Stockport and integration of Wigan stations) |

| Faster rail journeys to Liverpool, Leeds, Sheffield |

| Metrolink fleet expansion and infrastructure enhancements (committed schemes) |

| Increased capacity for rapid transit in Manchester City Centre, including exploring the feasibility of new tunnels under the City Centre |

| Investment in pedestrian and cycling connections into and across the Regional Centre, with City Centre core areas seeing greater pedestrian and cycle priority |

| Roll out the ‘next generation’ of rapid transit routes (tram-train and bus rapid transit) including orbital links serving the Regional Centre, key centres and the Airport |

| Improve sustainable transport to major employment and residential areas within and immediately outside Greater Manchester |

Social infrastructure

Greater Manchester is investing in its “knowledge corridor” to capture more of the value its universities generate. The University of Manchester has a £1.2bn capital masterplan with the ambition of investing in the university as a driver of incomes and economic growth. This includes the development the Graphene Engineering Innovation Centre and the £235m Sir Henry Royce Institute, which come on the back of the successful delivery of the National Graphene Institute. These investments will have a significant economic benefit to Manchester, and could lead to wider investment with future industries through spin off companies and research centres. Manchester Metropolitan University also have a significant investment programme which will further enhance the “knowledge corridor” with several notable projects. Elsewhere, the city is investing in primary and secondary education, with projects including Education Funding Agency (EFA), priority schools, and so on, to improve its poor school results.

Investment in health was not as significant in Greater Manchester in recent years, however with the health budget being released to the mayoral powers under the devolution deal, this could change.

National Graphene Institute

The £61m facility is the national centre for graphene research in the UK, drawing in specialists from across the globe. It houses state-of-the-art cleanrooms, plus laser, optical, metrology and chemical labs and equipment. Over 40 companies have already partnered with the University, allowing them to work alongside world-leading academics. This institution is an innovative blend of the academic and industrial worlds, and could serve as a model for boosting future industries through links with education.

05 / Construction market

The construction market in Greater Manchester is booming, with the crane count up from three in October 2013 to 26 currently in use. The strongest sectors by value are infrastructure, residential and education, with strong growth observed in the education sector. With the number of projects in construction growing, a healthy pipeline of shovel-ready projects and a significant volume in the planning process, Manchester’s construction market is in full recovery from the recession and set to continue growing.

Capacity to deliver is constrained by the significant volume of work in the pipeline, and the industry is beginning to implement alternative technologies such as modular construction to address this. Skills gaps also exist, but are currently inflating prices rather than creating bottlenecks, with prices more aligned to the South of England than the North.

Brexit so far has not had a significant effect on the market, with only one development paused because of it. But it could present a future challenge by reducing the pool of labour available. However, recent trends could indicate an international investment boon, with a cheap pound allowing international funding of key growth infrastructure and housing and work space development.

06 / Residential

Housing in Greater Manchester is a paradox, with areas facing acute affordability challenges and housing shortages, and pockets of deprivation where outdated housing undermines economic growth. The housing market faces significant growth, with 100,000 additional homes needed by 2030.

Currently only 4,500 net additional homes are added a year, less than half the 9,564 needed to meet new and backlog demand, creating a backlog of nearly 40,000 homes by 2015. Developer and large-scale investor interest drove a forecasted 5.5% price increase for 2016, and reflects the positive appetite and enthusiasm for residential development in England’s second city.

One of the major ongoing tasks facing the mayor, when elected, will be reshaping Manchester’s housing offer. £300m was made available as part of the devolution deal for the Greater Manchester housing investment fund, expected to deliver 10,000-15,000 new homes across tenures over the next 10 years.

The market is responding to a shift in demand towards private renting. There were three private rented sector schemes under construction in 2015 with eight more starting on site in 2016. These will add much needed rental units to the market, relieving pressures which have led to 8% increases in rental rates. This includes 2,000 units at Middlewood Locks, 600 at St Johns and 480 at New Victoria.

Table 3: Residential sales Manchester Source Manchester City Council Quarterly Economic Dashboard Q2 2016/17

| Median average prices of properties sold | Annual change | % annual change | |

|---|---|---|---|

| Land registry property prices Q2 2016 | £185,056 | £21,153 | 12.9 |

| £166,283 | £8,487 | 5.4 |

Table 4: Rental market Manchester Source Manchester City Council Quarterly Economic Dashboard Q2 2016/17

| 1 bedroom | 2 bedroom | |||

|---|---|---|---|---|

| Q2 2016-17 | Annual change | Q2 2016-17 | Annual change | |

| City centre | £776 | 5.60% | £971 | 5.30% |

| Excluding city centre | £591 | 6.10% | £714 | 7.90% |

07 / Commercial

Office rents in London are now at record high levels, and “northshoring” looks set to continue. For example, Freshfields moving its Global services centre to One New Bailey in Salford. It is estimated cost savings per employee of a move or expansion from central London to Manchester could be £20,000 per person per year in property and staff costs. As such, Greater Manchester is forecast to need at least 3 million ft2 of additional office space over the next decade. The market is moving to address this shortage, with 1million ft2 of new office space, and 500,000 ft2 of refurbishments planned over the next three years. However, this still leaves a significant gap between supply and demand. Prime office rents are therefore expected to grow to £37 per ft2 by 2019 (from £34 per ft2).

Occupier demand was robust over the first half of 2016 and despite the EU referendum, which was expected to dampen investor confidence, the Manchester office market has shown no noticeable slowdown in the second half of the year. Despite continuing development activity, good quality space remains scarce with the grade A vacancy rate currently at 1.4%, the lowest level since 2006.

The commercial sector is also lot deeper than it was a decade ago, with the emergence of more specialised and higher quality buildings to attract future industries.

Table 5: Manchester top commercial deals 2015 – Colliers

| Property | Size (ft2) | Tenant |

|---|---|---|

| Harbour City, Salford Quays | 142,000 | Bupa |

| Soapworks, Salford Quays | 106,187 | Talk Talk |

| XYZ Building, city centre | 60,246 | NCC Group |

| One St Peters Square, city centre | 56,253 | Addleshaw Goddard |

| Soapworks, Building C, Salford Quays | 54,816 | Home Office |

| No 1 Spinningfields, city centre | 49,406 | PwC |

08 / Retail and hospitality

Part of the approach to regeneration begun in the late 1990s was a strong focus on Greater Manchester’s retail offering. The city has developed an upmarket, pedestrianised town centre, offering an alternative to mall-shopping such as the Trafford centre, rather than competing with it. There has been increased transaction volumes with even previously difficult space being let on improved terms.

Take up in space and continued demand has resulted in a return to rental growth, of 8% in 2016, and rental rates are now approaching pre-recession levels of £300 per ft2 for prime areas.

09 / Conclusion

Greater Manchester is a role model for how integrating decision-making across wider areas, a stable political environment, and the will to invest in the future of the city can combine to drive its successful regeneration.

Though challenges remain, Manchester has worked hard to invest in its city centre, invest in its commuter region and invest in connectivity, and the fruits of this labour are beginning to be seen in jobs, economic growth and nascent industries.

Now is the time for Manchester to take the lead in the northern powerhouse, and ensure that the connectivity and productivity improvements promised are brought to pass.

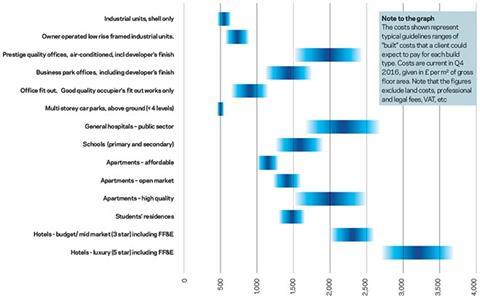

Table 6: Q4 2016 price levels - indicative costs per m2 in Greater Manchester (£ per m2)

No comments yet