London was slow to adopt tower building but the City’s distinctive skyline shows how much attitudes have changed. Steve Watts of Alinea looks at what needs to be considered when constructing a skyscraper in the UK, while the architect behind 22 Bishopsgate talks though its design process

01 / Introduction

The UK has had a relatively short and somewhat tempestuous relationship with tall buildings. New construction projects draw controversy about appropriateness of scale, location and their role in helping (or exacerbating) the housing crisis. To date, only five buildings of 200m or higher have been completed, all in London, and most are commercial office buildings – a small number considering there are about 1,600 buildings of such height in the world.

But it seems tall buildings are here to stay. The Tall Buildings Study 2019 by New London Architecture suggested the capital’s tall buildings pipeline (towers of at least 20 storeys) totalled 541, of which 291 had permissions and 121 were under construction.

While not all these projects will come to fruition, there will be others not currently in the public realm to add to the total. Whatever the number, London’s skyline will be changed irrevocably, centred around a growing cluster of high-quality commercial towers. The city will have to reconcile its unease around high towers.

02 / Height in the UK

A slow start

London’s first wave of skyscrapers arrived late in global terms, with the “mini boom” of the 1960s. The height of St Paul’s Cathedral (finished 1675) was not surpassed until Millbank Tower was completed in 1963. The two decades that followed were quiet in terms of tower construction, with a few notable examples including Tower 42 (then NatWest Tower), completed in 1980 after an incredibly long gestation. Some wondered if towers could ever sit comfortably in London’s historic, low-rise environment.

Canary Wharf

The 39ha of docklands to the east of the City not only became a successful, high-rise business district in its own right, but provided the pre-catalyst for the City’s acceptance of the tall building typology, as the City Corporation sensed a threat on its own doorstep as well from other financial centres such as Frankfurt.

The City’s response was watched over by Peter Wynne Rees, who began nearly 30 years as chief planning officer in 1985. He summed up the advantages of tall densification as: “Towers can increase the economic strength and vitality of a successful central business district by clustering specialised business activity sustainably in highly-accessible locations.”

From no to yes: Ken Livingstone

The biggest boost to building upwards came with the election of Ken Livingstone as mayor of London in 2000. As the first mayor elected under the Greater London Authority Act, he was given more say over the city’s real estate development.

His strategy received strong push-back from a coalition of opponents, most notably conservation groups such as English Heritage and SAVE Britain’s Heritage. He was able to overcome the naysayers, in part because the towers were touted as high-quality landmark structures designed by world-renowned architects. Today, a crop of landmark towers in and around the city are internationally admired for their architectural designs and engineering feats.

Why the change?

While London’s embracing of skyscrapers was promoted by Livingstone, their construction reflects a greater need. The city has benefited from several economic and demographic forces that put pressure on its land values and increased the interest in valuable central locations. In other words, one can say Livingstone’s campaign was about opening a “safety valve” that freed the real estate community to satisfy the growing demand for tall buildings.

The first factor was population growth. At around 8.9 million people, London has the highest number of residents in its history. Like other cities that deindustrialised after the Second World War, London’s population initially peaked in 1939, at 8.6 million, before consistently falling, until in 1981 it had only 6.6 million residents. Since then, the population has rebounded. In 2015, the number of people finally surpassed its earlier peak, and London is still growing (notwithstanding what impact Brexit might have) – a trend repeated elsewhere in global metropolises, as economic growth becomes even more focused around huge cities.

Between 2005 and 2018, London’s total employment grew by nearly 30%, more than that of the country as a whole – today, it employs 17% of the UK workforce.

Another encouragement is the international desire to enjoy London’s culture and amenities. Rising global incomes have increasingly made London a draw for tourism and foreign investment. Between 2002 and 2018, international tourist visits to London increased by 64%. London’s high-rise structures are in some respects both a response to and cause of this, as tourists are as likely to be interested in enjoying the delights of the Sky Garden at 20 Fenchurch Street as they are in the heritage of the Tower of London they see through its glass.

International capital flows

Recent times have witnessed a level of interconnectedness between global cities never seen before. International money has flowed across the world in search of a diversified investment portfolio, and

long-term returns from tall, trophy assets. Many towers are owned by international funds, and many future ones will be backed by foreign money, as London retains its long-term inherent advantages, despite the political uncertainties of the last three-and-a-half years.

22 Bishopsgate, the tallest building in the City of London, which is heading for imminent completion, is a prominent example of a game-changing tower backed by a consortium of funders. Its architect, Karen Cook of PLP, explains below how the building came about and what underpins its design.

03 / 22 Bishopsgate – the making of a next-generation tall building

Stuart Lipton and Peter Rogers approached me in 2012 to embark on a journey to explore the stalled Pinnacle site in the heart of the City of London, writes Karen Cook. The Pinnacle, the design of which I led while at my former practice, began in 2003. Its form tapered to small floorplates at the top, defined by inclined planes and cones, resulting in numerous steel frame connection details. The steel frame core meant the perimeter steel frame had to work hard, correlating into heavy steel members.

A decade later, key design factors had changed. Stricter energy regulations and substantially higher occupation density, which increased from one person per 12m2 to one person per 8m2, required more and faster lifts, wider staircases, more fresh air – greater infrastructure that did not fit into the Pinnacle core footprint.

How could we approach a new design for a familiar site? Post-global financial crisis, the City planners preferred a simple yet powerful glass tower to tie together the emerging skyline, with increased focus on public realm experience. Lipton Rogers Developments’ brief required a new design of enduring architectural qualities to the latest specification that was affordable to build with large floorplates all the way up, alongside public realm contributions. Stuart introduced a “vertical village” of amenities to give individuals choice and convenience, from cycle parking to an urban market, project co-working space, a gym, a spa and a club. The critical mass of a large tower means small tenants can compete against big companies to attract talent with 22 Bishopsgate’s curated amenities, where people can meet outside the office, exchange and test ideas, be stimulated or relax.

Redistributing the construction budget to pay for a variety of spaces to host the vertical village and fundamental environmental qualities such as better daylight, better fresh air, higher ceilings and a free-to-public-access viewing gallery required a pragmatic approach to construction. Stuart and Peter stipulated the use of repetitive steel frame components, a single facade cladding type, and the re-use of the 65m-deep Pinnacle foundations, which pre-determined column locations. WSP proposed a concrete core to activate the raft, with outriggers to increase stiffness, resulting in a lighter perimeter steel frame. 22 Bishopsgate has 40% more area, while its steel frame weighs 15% less than the Pinnacle.

The building is an abstract approach to form, responding to light – 23 vertical facets fold, giving alternating readings of London’s ever-changing skies. Low-iron glass with a light, silvery coating appears alternately transparent, reflective or milky white. A closed cavity facade with internal, operable, movable blinds transmits some 60% more daylight than comparably performing double glazing. The top steps to lead the eye skyward, with six levels of space outside the office including restaurants, an external terrace and London’s highest free-to-access public viewing gallery.

Cyclists’ and pedestrians’ commutes are improved by consolidated delivery, forecast to reduce vehicle trips by as much as 70%, which 22 Bishopsgate introduced to the City. Alexander Beleschenko’s artwork incorporates colourful glass panels into wind mitigation canopies and along the new pedestrian route across the site connecting Bishopsgate to Crosby Square, enriching the pedestrian experience. In the main foyer, a four-storey series of spaces with multiple entrances leads to Europe’s fastest double-deck lifts and the Market food court. Curated changing artwork animates the space and the street. Bespoke sculptural furniture by Pierre Renart with handcrafted leather by Bill Amberg create a calm cocoon in the reception, and paintings by Bruce McLean add to the body of art, contributing to the singular identity of 22 Bishopsgate.

Karen Cook is a partner at PLP Architecture

04 / Design trends

In global terms, London’s current wave of commercial tall buildings has delivered an array of forms with an investment in high-quality specifications underpinning imaginative design responses to the constraints of planning and historic, irregular sites.

Designs continue to develop in response to emerging trends in technology, the requirements of modern occupiers, new regulations and ideas from around the world. No longer are City of London offices and tall buildings the domain of major corporate occupiers focused around the banking, finance and legal sectors – occupier profile is changing as technology and non-financial businesses move into the Square Mile. Additionally, evolving market trends and regulatory changes are having a significant impact on the briefing of design teams and the future of office design, the implications of which can be amplified in tall buildings and have a bearing on cost. These include:

- Flexibility – tenants are seeking increasingly flexible leasing terms, requiring designs to incorporate flexibility and sub-divisibility in floorplates.

- Interactions – tenants want their people to enjoy areas where they can gather and draw benefit from specialist facilities to support their business interactions, encouraged by floorplate connectivity and flexibility within spaces.

- Being smart – technology, connectivity and resilience drive occupier business requirements.

- Wellness – welcoming common spaces and provision for socialising activities such as yoga and fitness, with a design that supports healthiness through encouraging stair use and other activity.

- Contemporary feel – design is evolving fast; exposing structure and services components is becoming the norm.

- Cycles and showers – given the size of a tall building in floor area terms, the scale of town planning-driven facilities for cyclists is considerable.

- Environment – regulatory changes pushed by the London Plan, the greening agenda in the City of London and the desire of occupiers for their property to be carbon-friendly.

- Wind – the impact upon the street plane is being better defined and understood by town planners; more stringent conditions are being put upon designers to model and test this to mitigate impacts to pedestrians.

- Public access – the ability of the public to access views from tall buildings is often conditioned through planning, so the impact upon access, lifting and security needs careful consideration.

- Entrance experience – the way towers greet the public is being given greater thought, with a more seamless and welcoming journey from outside to inside, an imaginative mix of retail and other functions in more generous volumes at lower levels, and a contribution to the horizontal connections across the City ground plane.

05 / Key cost drivers

Tall buildings live on the edge financially, relying on the design team to work together to address the inherent challenges of time, cost and floor area inefficiencies. There is an intense and sometimes complex relationship between the three points of this commercial “golden triangle” but achieving a balance of these across the design’s principal elements is critical for success.

In the early stages of a tall building design, it is therefore important that key design criteria, and how these drive costs, are understood and used to help design strategy, define construction costs, improve floor area efficiencies and prompt considerations of construction techniques. Fundamentally at concept stage, the following will drive costs and commercial performance more than anything else:

Efficiency of form

Shape is the most important of the key cost drivers, because it directly impacts the scale, configuration and regularity of floors. Cost, floor area and construction efficiencies are all unquestionably impacted by the shape of a tower – not least the size of the floorplates, as core and structural zones expand relative to the overall floorplate to satisfy the requirements of vertical circulation, servicing and wind loadings. The wall:floor ratio, (the area of facade required to clad floors), a key indicator of cost efficiency, is directly impacted by the size and shape of floors.

Structure

The scale and mass of the building has a direct impact on foundations, with a tipping point for larger bentonite piles being around 30 floors. Understanding the construction and programme relationship between basement construction and the commencement of the core/vertical structure is a key area of focus for programme and cost. The earlier the superstructure construction can commence the better, meaning that investment in partial or full top-down construction is appropriate to mitigate time and programme risk.

The majority of office high-rises are steel framed with composite floor slabs, whereas residential have concrete structure and floors. Stability cores are often concrete, with construction advancing ahead of structural floors. Steel design efficiency can vary by as much as 100%, depending on the location of the core, the height and shape of the building, beam spans and other factors.

The current trend for exposing and expressing structural elements for architectural interest adds to cost but like everything else needs to be balanced against the value created. Particular complexities will occur if the structure is integrated into the external zone, which is why the cost consultant will advocate avoiding this unless there is a good reason otherwise.

Fire strategy

The early engagement of an experienced fire consultant is a critical part of testing conceptual design options and ensuring a safe and robust strategy is developed in the most cost-effective way, through fire-engineering of appropriate members aligned with the design implications of evacuation strategies. This has become even more important in the post-Grenfell world of increased regulatory scrutiny.

As tall buildings are pushed to the limits of site ownership to maximise lettable areas, it is more common to consider drenching facades to overcome fire-spread to adjacent properties, which can be complicated by the preferred facades solution.

Facades

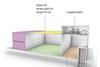

Shape and form aside, a key priority for facade design is the maximisation of daylight alongside efficient thermal performance and control of solar gain. Given the prominence of a tall building, the architectural response to townscape needs careful thought, but in any event, maximising repetition through restricting system types, minimising depth of facade zones and ensuring efficiency of construction through pre-assembly is key. The advance in technology of pre-assembled and tested closed-cavity facade systems, with the ability to control heat gain through a ventilated facade and glare through sophisticated blind controls, should be a reference point – 22 Bishopsgate is an example of successful procurement and installation of more than 50,000m2 of closed-cavity facade walls.

Mechanical, electrical, public health

An early major decision for mechanical systems is plant location: central, interstitial or floor-by-floor. Buildings of more than 20 storeys require multiple distribution risers and hydraulic separation to reduce the pressure rating on the pipework, valves and plant. Therefore, plant and riser space need to be considered carefully when reviewing capital construction cost against space-take. A key cost decision for electrical installations is high versus low voltage distribution. An effective strategy is to locate high voltage transformers close to large electrical load centres, with other plant at the bottom and top of the building. Lifting generators onto the roof of a finished tower is problematic, so unless space can be found lower in the building then full building back-up resilience is generally a base build provision.

Vertical transportation

The vertical transportation strategy has a significant impact on core design, with cost, space-take and operational user-friendliness all important factors on the decision. Double-deck lifts are common, which brings about design considerations, such as a multi-storey reception lobby and associated escalators, to allow access to both the upper and lower cars, balanced by a strategy for the entire tower that is often cost-effective and area-efficient.

Procurement and programme

The scale and complexity of tall buildings means the gestation period is considerable: projects take longer to get to site and more time to build, so there is an absolute need to be focused on programme efficiency and productivity. There is greater risk during construction due to logistics and movement of labour and materials at height and wind restrictions around tower cranes. Focusing on prefabrication of facades and modularisation of elements such as risers and plant rooms eases the pressure on hook time and site labour. Making the labour force as productive as possible is not to be undervalued. Offsite consolidation and a sophisticated logistics strategy should be considered. The supply chain is a more constrained pool for these projects, so early engagement of specialists is recommended to secure resources and benefit from their knowledge.

06 / About the cost model

The challenges of the “golden triangle” for tall buildings – especially acute when shape and form are working against them – necessitate a focus on the micro as well as the macro. Teams need to constantly challenge the developing design and look for marginal gains across the building’s elements to maximise economies of scale and avoid diseconomies. The premium for building tall can be considerable, but equally it can be managed to a much smaller “tall surcharge” if the team works together from the beginning to optimise the form and the design strategies that underpin it, then do likewise to hone the details.

The shell and core construction costs for central London office towers can be grouped as follows, primarily influenced by the architectural response to a site and its interface with the required structural solution, followed by overall specification levels and then height:

- Larger sites, regular and larger footprint schemes – £3,300/m2 -£3,500/m2 (gross internal area)

- More constrained sites with townscape challenges – £3,500/m2 -£4,000/m2 (gross internal area)

- Constrained sites, taller and more complex geometry – £4,000/m2 -4,500/m2 (gross internal area)

Our cost model summarises the shell core elemental costs of a notional 45-storey office tower in central London, with a gross internal floor area of 82,700m2 including three basements. It achieves an overall net-to-gross ratio of 64%, a wall-to-floor ratio of 0.45 and its steel frame weighs an average 110kg/m2 above ground gross internal floor area.

It achieves BREEAM Excellent, WiredScore Platinum and its base build is WELL Building Standard-enabled.

Costs are base dated at January 2020 and the model reflects prices obtained from a competitive tender through a two-stage process, converted to a lump sum. It includes all main contractor preliminaries, fees and risk allowance to complete the building to a shell and core status. Demolition, enabling works, external works, external services, category A fit-out, tenant enhancements /fitting-out, professional fees VAT and all developer’s costs are excluded.

Acknowledgments

The authors would like to acknowledge the contribution of Steve Watts, Mark Lacey, and Jay Pearman of Alinea; Jason Barr, Rutgers University; Karen Cook, PLP; and Sir Stuart Lipton of Lipton Rogers

Download the full cost model, showing a full breakdown of all the costs, main contractor preliminaries, fees, and risk allowances:

Downloads

Cost model for a 45-storey office tower in central London

PDF, Size 40.87 kb

No comments yet