Construction markets around the world are experiencing relatively subdued but steady growth. As construction cost continues to escalate in most places, the relationship between productivity and cost continues to draw scrutiny. William Waller analyses the results of the 2017 Arcadis annual survey of global construction costs

1. Summary

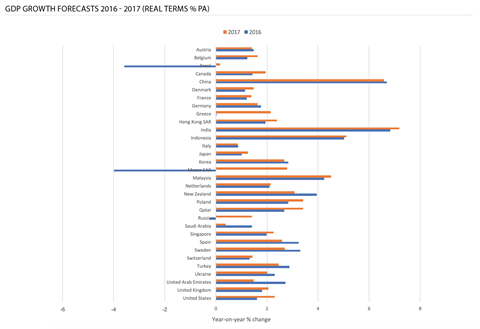

Compared with 2016, the past year has been relatively stable, with the global economy seeing subdued but steady economic growth, expected to be 3.4% in the year to December. This is playing out in “business as usual” conditions for construction industries around the world, with most seeing steady but unspectacular trading conditions.

While there have been some increases in commodity prices during the year, such as coal, copper and aluminium, in terms of a longer-term historical context prices are still relatively low and stable. The currency markets have been less exciting than last year, with the pound remaining one of the world’s worst performing currencies. The euro has surprised many, buoyed by better than expected economic performance in the eurozone.

The US dollar has performed very well, though it has lost some shine as the initial effects of “Trumpflation” ease in the face of some delays to expected policies from the president, including the $1trn infrastructure investment programme and lower than expected wage growth.

Economic growth in the eurozone is expected to hit a seven-year high in 2017. Brexit is a prominent issue, but probably more so for the UK than the EU, with key issues for it to address including the migrant crisis and closer economic collaboration.

The European construction industry has a pipeline of more than €3trn (£2.7trn). The ability to sustain investment in infrastructure after the UK, which is a top-five budget contributor, has left the bloc sometime after 2019 will be critical.

Despite significant differences in the cost of building around the world, an important shared characteristic of construction industries everywhere is often overlooked – poor productivity. This problem affects all construction markets, whether in the form of poor capital efficiency or poor labour efficiency. As rising construction costs affect clients in all markets, steps to improve productivity, and the financial benefits of doing so, are coming under increasing focus.

2. Global trends in commodity prices and currencies

Commodity price trends

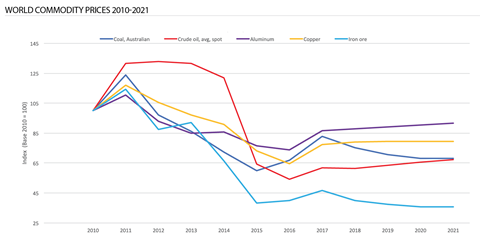

The past year has seen a minor rebounding of prices in some classes of global commodity, though the consensus is that this is not likely to be sustained long term. Slightly improved pricing has brought some commercial relief to the natural resource industries in the short term, but in the context of historic price levels it represents little change in reality, with prices remaining closer to those seen in the dip of 2009.

Despite short-term price increases in some commodities, the broader relatively low market price levels have been a silver lining for the resource-hungry construction industry, particularly in the UK where the devaluation of sterling has driven up materials costs for buyers significantly.

Coal has seen a price rebound, up almost 25% over the year. Aluminium and copper are not far behind, with price rises of almost 20% each. Crude oil and iron ore have seen more modest rises of 15% and 17% respectively.

Though some of these movements seem large, prices have effectively levelled off when looking at longer-term trends, with little expectation from analysts of rapid growth in at least the next four years. For example by 2021, the International Monetary Fund (IMF) forecasts that copper and iron ore will still be 32% and 92% respectively below their price levels 10 years earlier.

Oil prices have seen relative stability over the past year, holding at around $50/bbl (£38/bbl). Many analysts expect sentiment in the oil market to improve, as demand in both developed and emerging markets outperforms expectations. However, while some supply growth has slowed down, particularly in Africa, global inventories remain relatively large and forecasters expect the market to have a surplus of supply into 2018 and progressively growing to 2021. This means oil prices are expected to see muted growth, forecast at 9% to 2021 by the IMF.

The nature of commodity prices, influenced by a range of variable factors, means all these forecasts carry a high degree of uncertainty. Evolving supply and demand conditions, geopolitical events and changes in technology are all key elements that can change rapidly. Government policy associated with the phasing out of fossil fuels as well as declining power consumption are just two examples that could have an impact.

Major car manufacturers including Volvo and Jaguar Land Rover being set to phase out combustion engines from 2020 should also be a significant influencer.

Indeed, the metals and mining industry will play a key role in the global transition to a significantly lower carbon future. The technologies required in the clean energy shift (renewable electricity systems and electric vehicles) are very metal-intensive compared to fossil fuel-based systems.

Copper, aluminium, lithium and cobalt demand should be supported by the transition, while policymakers and the mining industry will face the challenge of balancing the shift to a low-carbon future with sustainable metal extraction over the coming years.

Currency trends

Compared with the very high levels of volatility last year, the global currency market has been relatively subdued this year.

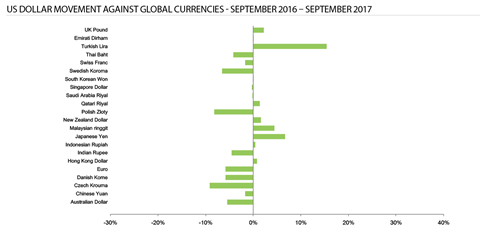

The post EU-referendum collapse of the British pound has been sustained – it fell further recently to a 10-year low against the US dollar and euro – and it is holding onto its position as one of the world’s worst performing currencies. Better than expected economic performance has driven the euro to a position of strength, reaching a two-year high against the dollar.

The US Dollar Index, which is a measure of broader dollar performance against a basket of currencies, has seen better performance in the past year than most of the decade. The US’s relatively strong economic performance, including expectations for further interest rate hikes, has buoyed the dollar. However, the perceived lack of progress of some of president Donald Trump’s initiatives, including his trillion-dollar infrastructure programme, and some key economic indicators, such as wage growth, falling short of expectations has led to increased volatility in recent months for the currency. In September, the pound reached a one-year high against the dollar.

The Chinese yuan has held its ground against the dollar through the year and the Indian rupee has appreciated by up to 5%. The Malaysian ringgit and Japanese yen are weak performers, both weakening almost 10% against the dollar during the year.

For overseas investors, construction in locations where the local currency has fallen relatively to their own is cheaper. Dollar-denominated investors such as those from Hong Kong, the Middle East and Norwegian sovereign wealth funds have been in a strong position in 2017 due to the dollar’s relative strength, albeit that returns on existing investments will likely fall in value as a result of the exchange rate movements.

In the UK, foreign investment in construction rose 9% in the past year, with investors from Hong Kong and the Middle East having the biggest rises in activity.

Deteriorating growth prospects in the UK and uncertainty surrounding Brexit negotiations are likely to maintain pressure on a weak pound. The Chinese yuan can also be expected to depreciate, guided by government intervention in the form of capital controls aimed at keeping currency in the country and putting a lid on what some see as flagrant investment overseas. Until capital controls were introduced, capital outflows from China were a major contributor to the yuan’s depreciation. Some future uncertainty for the Chinese economy’s future performance may also contribute to future devaluation of the yuan.

Global real GDP growth is expected to hit 3% in 2017 and 2018, with broad-based upward revisions to both developed and emerging market growth projections. Key economies that have seen better than expected performance include: China, the eurozone, Canada and Russia. However, many forecasters expect economic activity to slow in the second half of 2017 amid rising geopolitical and financial market risks across the globe.

3. Europe

Economic growth in the eurozone is expected to hit a seven-year high in 2017. Growth is particularly strong in Central and Eastern Europe. Forecasts of around 2% eurozone GDP growth imply the strongest performance since 2010. However, it is expected the first half of 2017 will prove to be a relative peak.

The European Central Bank (ECB), which is still buying approximately €60bn (£54bn) of government securities a month, has indicated that it will gradually withdraw monetary stimulus from the start of 2018. However, good growth and impending monetary tightening has strengthened the euro, creating a headwind for exporters but benefiting consumers in the zone.

Clearly Brexit is a significant issue, but apart from undertaking the negotiations, the EU considers it more so for the UK than for the EU itself. From the EU perspective, there are other more important issues to address including the migrant crisis and closer collaboration on key economic initiatives.

The European construction industry grew almost 2% in 2016 and is set to see growth of between 2% and 2.5% per annum to 2021 with a pipeline of more than €3trn (£2.7trn). In absolute numbers terms, Western Europe is set to still account for the highest volumes of growth.

However, proportionally Central and Eastern Europe are expected to see the fastest growth rates. Investment in infrastructure plays a significant part and the ability to sustain growth in such investment will be dependent on EU partners being able to maintain levels of investment post-2019, after the UK, a top-five budget contributor, has left the bloc.

Germany

The consensus forecast for GDP growth is 1.8% in 2017 and 2018, reflecting a weaker than average EU performance. Germany is expected to see a gradual decline in growth to around 1.5% in 2020. These forecasts are low given that business sentiment surveys have very positive scores, current account surplus is at a record high and the labour market is at virtually full employment, which are all indicators of well-performing economy.

The current account surplus is at around 8% of GDP, which is far better than Japan’s at the height of its economic prowess in the 1980s. Germany is on track to be the largest exporter of capital in the world in 2017. However, Germany may not have invested enough in itself and the journey to a big current account surplus involved constrained investment in infrastructure and productive capacity. Furthermore, record high employment and an ageing workforce threaten to produce future labour shortages that would undermine the long-term productive capacity of the economy.

All political parties in Germany support greater public investment in infrastructure. However, traditional public sector financing for infrastructure is increasingly complemented by private capital in line with the government’s goal of expanding the use of public private partnerships (PPP). Work on the modernisation and extension of the 60km Bockenem-Göttingen section of the A7 motorway in Lower Saxony has started, carried out by a consortium that will also operate and maintain the section for 30 years on a PPP basis. Construction sector growth is forecast to be 2.3% per annum over the next five years.

France

GDP growth data for Q2 2017 indicated that France’s economic performance had strengthened at 1.8% in the year, beating consensus expectations of 1.6%. Future construction industry growth is expected to be relatively flat however, predicted to average 1.4% per annum to 2026. The infrastructure sector, especially transport and power, is set to experience positive expansion, assisted by continuity from the Macron government regarding infrastructure policy.

But France’s stubborn unemployment rates will likely prevent a recovery in the demand for housing, leading to subdued forecasts for the residential and non-residential building sectors, which represent more than 80% of France’s construction industry value. Furthermore, an uncompetitive labour market could discourage foreign investment into construction projects more generally.

Poland

Real GDP growth has averaged 3.9% a year since Poland joined the EU in 2004, with the country the only member state to avoid a recession in the 2008-2009 global financial crisis. Growth in GDP has consensus expectation to continue to average 3.4% per annum to 2026. However, Poland faces deteriorating demographics and its transition from a low-value added and labour-intensive economy towards a high-value added and capital intensive economy will not be without its challenges.

The construction sector is expected to grow 6.1% in 2017. Poland’s residential and non-residential segments are likely to see increased demand, with economic performance driving additional housebuilding and commercial and industrial infrastructure assets.

The EU’s financial backing of transport sector projects is central to the transport sector outperforming Poland’s broader construction sector, with average growth of 5.6% per annum predicted to 2021. The continuity of EU funding is a key success factor – when programme funding was interrupted in 2012, Poland experienced a construction recession.

Spain

Consensus expectation for GDP growth is 3% in 2017 and 2.4% in 2018. A solid domestic and external demand outlook supports the forecast. However, over the longer term, a lack of further progress on structural reforms will probably dampen investment and productivity gains, potentially undermining growth.

Spain’s construction market is set for a prolonged period of stagnation as growth potential is weighed down by a weak project pipeline and the maturity of the country’s existing infrastructure base. The market is expected to grow 2.2% in 2017 and a more moderate 1% per annum for the next five years after that.

Netherlands

GDP growth has a consensus expectation to grow by 3% in 2017, slowing to a consensus expectation of 1.8% in 2018. The unemployment rate is back below 5% from a high of 8% in 2014. The construction sector is set to record solid growth of almost 5% in 2017 and 3.3% in 2018, supported by a broad range of projects at various stages of development across the transport, energy, residential and social infrastructure sectors. The country makes effective use of the PPP model to boost private investment and gross fixed capital investment is rising steadily.

4. Americas

United States

Economic growth is expected to be 2% in 2017 and 2.2% in 2018. This year has shown a reinvigoration of economic performance due to recovering private investment. Key factors have been improvement in the energy market and more external demand, which has eased risk aversion among businesses.

The US construction industry is expected to see continued strength as a resilient residential and non-residential construction segment continues to expand. Growth in the infrastructure sector is set to accelerate as the FAST Act, ballot initiatives and state-level fuel tax increases should support increased public spending on transport. This outlook ignores president Trump’s $1trn (£750bn) infrastructure plan because funding remains unsecured and infrastructure is set to take a back seat to tax and healthcare reform in a Republican-controlled Congress. Trump’s infrastructure plan – which relies heavily on tax-credit induced private capital – is likely to fall well short of the $1trn in promised new investment, and will probably focus on new assets rather than fixing existing, failing infrastructure.

The recent tragedies of Hurricane Harvey and Irma will likely drive temporary increased construction demand during the period of recovery and rebuilding, which historically leads to an associated temporary economic and construction bounce.

Brazil

Brazil is expected to exit recession in 2017, with a consensus forecast for GDP growth of 0.4%, rising to 1.7% in 2018. A largely cyclical revival of consumption should underpin the economy’s fragile recovery. However, a fourth year of recession is expected for the construction industry in 2017, which has been ravaged by the Lava Jato corruption scandal and subsequent economic crisis. Growth in the construction sector is expected to return in 2018, supported by a gradual improvement in the housing market and investment activity.

The government has plans for a new infrastructure investment programme aimed at replacing the PAC (growth acceleration programme). The new programme will focus on infrastructure projects that can start in 2018, to stimulate the economy and generate jobs.

Chinese investment is set to continue as one of the largest sources of capital for the infrastructure sector. In May, the $20bn (£15bn) Brazil-China investment promotion fund was officially launched. The fund will mainly target infrastructure, as well as natural resources. Of the initial funding, 75% was contributed by China, with the remainder coming from Brazil.

5. Gulf and Middle East

Saudi Arabia

Consensus forecasts for GDP growth expect it to be flat at 0% in 2017, rising to 1.6% in 2018. The elevation of Mohammed bin Salman to Crown Prince and the related easing of fiscal consolidation in Saudi Arabia should support business and consumer confidence, boosting economic activity. That said, the positive impact of these measures on GDP growth is expected to be partially mitigated by relatively low oil prices and sustained production cuts persisting, while the reversal of consolidation measures will delay the budget’s return to surplus to 2021.

The scale of Saudi Arabia’s construction industry is the market’s strongest attribute. Saudi Arabia has the largest infrastructure market in the region, and the project pipeline is the largest and most diverse in the Gulf. Growth in demand will likely slow in the next few years, however, as low oil prices have led to rearrangement of the project pipeline.

UAE

GDP growth for the UAE has a consensus forecast of 2.8% in 2017 and 3.3% in 2018. With the UAE party to the Organisation of the Petroleum Exporting Countries (OPEC) agreement to limit oil production in a bid to draw down global inventories, the oil sector will not be a major driver of growth. Substantial investment flows into Dubai’s and Abu Dhabi’s transport, energy and tourism are set to be the key drivers of growth in the construction market over the next 10 years, which is expected to grow by around 5% a year to 2026 in real terms.

The largest expansion will be between 2017 and 2019 as Dubai’s preparation for the World Expo 2020 drives investment into high-value commercial building and transport infrastructure projects. External financing support remains critical. There is also growing involvement from China in the construction market as it pushes forward with its One Belt One Road initiative – the Gulf region is a critical part of this.

Qatar

Qatar’s economic growth trajectory over the coming decade is very positive, with large investments in infrastructure to prepare for the FIFA World Cup that should support economic activity through to 2022. GDP growth is forecast to see average annual expansion of 3.3% over the coming decade.

The Gulf diplomatic crisis will weigh on consumer and investor confidence in Qatar over the coming months while directly disrupting activity in certain commercial sectors. However, economic impact is

likely to be limited, as hydrocarbon production and exports are unaffected, and work on FIFA 2022 World Cup-related infrastructure projects progresses without any major delays. Qatar’s construction market will therefore record significant expansion to 2026 with average annual growth of 9.6% in real terms forecast over this period.

6. Asia-Pacific

China

The consensus expectation is for GDP to grow 6.3% for 2017 and 5.8% in 2018. Less intensive fiscal stimulus and tighter monetary policy is expected to largely be responsible for a slowing rate. Growth in China’s construction industry is predicted to continue its slowdown from the double-digit rates recorded in the 2000s and 2010s. Growth in the infrastructure sector will outpace the overall construction sector as a result of government support for transport, power and social infrastructure initiatives. Investment levels and growth rates remain below early-2010 levels and growth rates in the north-eastern provinces in particular have lagged behind national trends.

Real growth rates in the industry are forecast to fall from 6.8% in 2017 to 6% in 2018 and to 4.8% in 2019. The overall level of government financial support for construction will gradually decrease as the government works toward its long-term goal of transitioning the driver of China’s economic growth from fixed investment to consumer demand. Even now, the government is beginning to use private-sector incentives and PPPs to develop infrastructure projects.

Hong Kong

Hong Kong’s real GDP growth forecast for 2017 is 2.5%. The territory’s growth momentum is expected to slow over the coming year as the mainland Chinese economy decelerates, while Hong Kong’s overvalued housing market continues to face significant downside risks.

Hong Kong’s construction sector is forecast to expand by an annual average rate of 2.2% in real terms between 2017 and 2020. This is slightly lower than the 3.8% average real growth rate between 2005 and 2016. China’s economic slowdown, coupled with domestic labour shortage issues, are expected to weigh on construction activity. Hong Kong’s infrastructure sector is expanding at a subdued rate due to its relative maturity. However, the government’s strong fiscal position leave options open to provide support to the sector in areas such as transport and social infrastructure.

Singapore

Singapore’s economy is expected to grow by 2.2% and 2.5% in 2017 and 2018 respectively. The improvement in the global trade environment and continued strong demand for electronics are likely to be the main drivers of growth over the coming year, with the manufacturing sector predicted to continue to grow at a strong rate of 8% in the year to Q2 2017. Government assistance to the construction sector should be supportive but the weak property market and other structural factors could weigh on the industry. The ongoing labour restructuring process, which will continue to weigh on wage growth and domestic demand, could adversely impact construction. That said, very respectable growth of 2.4% in 2017 is currently expected, set to rise to an annual average of 2.6% to 2020, which would be a vast improvement on the 0.2% seen in 2016. The Singapore government is bringing forward SGD700m (£388m) worth of public sector infrastructure projects to start in 2017 and 2018, in a bid to support the construction sector.

Malaysia

Malaysia’s real GDP growth is expected by the consensus to be 4.7% in 2017 amid a brightening external and domestic outlook. The strong global demand for semiconductors and other key products should be positive for exports. In addition, the improvement in the domestic political outlook is predicted to be positive for the business environment, while domestic demand is showing signs of recovering.

The immense size of Malaysia’s infrastructure projects pipeline will generate robust growth rates in the construction industry over the next 10 years – forecast to average 6.3% a year to 2021. Infrastructure will continue to be the primary driver of growth in Malaysia’s construction sector, with the country currently planning or building several high-profile, long-term projects including high-speed railways, transit systems and ports. In August, the government officially launched the China-backed MYR55bn (£9.8bn) East Coast Rail Link.

India

Indian real GDP growth has a consensus forecast to be 6.9% in the financial year 2017/18, while the financial year 2016/17 saw weaker than expected growth of 7%. India’s construction sector is expected to grow 4.9% in 2017, with real annual growth rates set to return to above 6% past 2018 up to 2026. Robust growth rates should return post 2018, given strong supporting factors including rising government investment in infrastructure and an improving business environment.

India continues to suffer from a sizable infrastructure deficit, which will demand substantial investments over the coming decades. In March, the Asian Development Bank published a report saying that India will require $5.2trn (£61bn) in infrastructure investments to 2030, which is equivalent to approximately 9% of GDP. Prime minister Narendra Modi continues his push to improve the operating environment for infrastructure projects, which includes initiatives aimed at shortening approval times, easing land acquisition and facilitating private investment.

Australia

Australia’s real GDP growth is forecast to come in at 2.1% in 2017 and 2.2% in 2018. Momentum slowed substantially in the first half of 2017, partially due to disruptions from poor weather. Even as this transitory factor wears off, the combination of weakness in residential construction activity and poor external demand due to the slowdown in China will likely keep Australia’s growth subdued over the coming year.

Australia’s construction sector is forecast to grow by just 1.2% in 2017, before rising to 3% by the end of 2020. The Australian government remains committed to developing the country’s infrastructure network over the long term, as seen from the AUD70bn (£41.8bn) commitment announced during the 2017/18 budget. It is expected that growth in Australia’s construction sector will be mainly driven by the projects initiated by the public sector rather than the private sector, as the boom in residential construction has likely peaked.

7. The relationship between construction productivity and cost

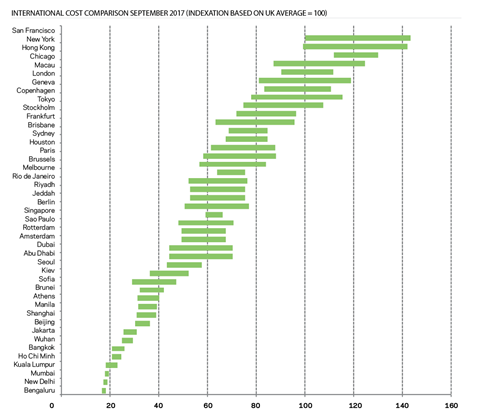

The Arcadis international construction cost ranking reveals significant differences in the cost of construction around the world – with some higher-ranking markets costing six times more than those lower down the table.

Typically, this is due to local management and specification norms, input cost levels and the mix of capital and labour intensity. Because our study shines a light on these stark contrasts, a key and important similarity of construction industries everywhere can often be overlooked – poor productivity.

More expensive construction markets tend to face capital efficiency challenges while cheaper locations typically face resource efficiency challenges. While the causes differ, the result is the same – poor track records in performance and productivity enhancement. Productivity challenges afflict construction everywhere, borne out of in-situ construction methods, unique projects, transactional commercial models, labour dependency and a relentless dominance of capital expenditure.

For the most expensive construction markets in the world, such as New York, Hong Kong and London, this issue is reaching fever pitch. Severe skills shortages, resulting from stubbornly high levels of labour dependency combined with difficulties in recruiting and retaining the workforce, are firmly rooted. The ageing workforce in Hong Kong and strong unionisation in New York for example, add further complexity to the challenge. Low capital utilisation and highly cyclical business cycles don’t help stimulate the long-term investments that might make the difference. And yet in all these markets, demand for construction and its cost are at historic peaks. Boosting productivity has never been more important if future needs are to be met fully and to effectively help assure continued global competitiveness. For cheaper construction markets in the world, poor productivity is also a problem. While labour might be available in relatively plentiful supply, utilisation of it is inefficient and there are potential opportunities to deliver more with what is available.

The solutions for greater productivity including off-site manufacture, mechanisation, robotics, greater diversity and increased investment in skills are well documented and many organisations are very attentive to them. Despite these efforts though, inarguably progress has been slower than has been seen in other industrial sectors around the world.

The search is seriously on for how the barriers to sustained long-term productivity improvements can be broken on an industrial scale in construction. Some key markets, including Singapore and Hong Kong, are making strides in raising the proportion of pre-manufactured value in projects, including the use of modular construction. Some key technological advances, such as robotics, are close to significant breakthroughs that will be game-changing for construction all around the world.

Few would dispute that the root of all evil in construction all over the world is the highly cyclical nature of workload, which cripples the ability to plan and invest for the long term. Furthermore, compared with very productive industries such as automobile manufacture, construction has a more complex relationship between cyclical workload, low requirements for capital, high levels of competition and low profitability which together create high barriers to investment intensity. The unique products and complex risk profiles of the construction industry add further difficulty to realising the benefits of increased standardisation, co-ordination and integration.

More balanced workload could hold the key. Policy makers and clients providing solid commitment and early visibility of pipeline would allow the supply chain to plan and make long-term investments, including those that could boost productivity. For example, reliable order pipelines are key if off-site manufacture is to grow successfully in practice given the scale of capital investment required.

Use of public sector investment to balance workload has proved to be a key lever in some markets, for example in Singapore, where construction productivity improvement has been world-leading. Here the government has increased public sector investment levels when private sector sources have ebbed. Equally, the supply chain can diversify the regions and sectors they operate in to help smooth workload.

Studies, including one carried out by the Harvard Business Review, suggest that increased consolidation of resources can lead to improved productivity. Sharing of innovation and resources can therefore be a potential lever for boosting productivity in a very fragmented industry. The construction industry model generally mitigates capital intensity and often struggles to reward risk takers that invest in innovation. Frequently it makes most commercial sense to stick to a well-trodden path, hence the potential power that greater levels of collaboration could harness in sharing risk, reward and capital intensity around innovation. The UK’s infrastructure industry innovation platform i3P is an example of an innovative new platform that facilitates widespread innovation collaboration in the industry.

There are no short-term answers to the productivity challenges faced but for markets such as New York, Hong Kong and London, time is of the essence. Policy makers, clients and the supply chains in these regions have to act on bold ambitions for industry change that will drive more balanced workload over the longer term and collaborative equitable sharing of innovation and resource. Unleashing private investment through intelligent public policy would be a key step.

Postscript

Methodology

The comparative cost assessment is based on a survey of construction costs in 43 locations undertaken by Arcadis, covering 13 building types. Costs are representative of the local specification used to meet market need and function. The building solutions adopted in each location are broadly similar and as a result, the cost differential reported represents differences in specification as well as the cost of labour and materials – rather than significant differences in building function. Costs in local currencies have been converted into a common currency for the purpose of the comparison, but no account has been taken of purchase power parity. High and low cost factors for each building type have been calculated relative to London, where average costs = 100, using the US dollar as the currency unit. The relative costs plotted in the chart represent the average high and low cost factor for each of the 13 buildings included in the sample. Construction costs are current in Q3 2017. Exchange rates were current on 1 September 2017.

No comments yet