We all know the benefits of energy efficiency in buildings, yet the amount of investment in carbon reduction is still well below the level needed to hit upcoming targets. Here, Chris Spicer of Sweett Group explores the barriers to investment, and what needs to change

01 / Overcoming the barriers to energy efficiency investment

The benefits from investing in energy efficiency have been well documented. Alongside the obvious economic advantages, there is an increasing acknowledgement that the underlying efficiency of our building stock needs to be improved in order to meet carbon reduction targets and gain the reputational kudos which comes with a green portfolio.

Despite this requirement, energy efficiency investment remains significantly below required levels. A recent report from the EU Energy Efficiency Financial Institutions Group, a working group established to determine how to overcome the challenges to obtaining long-term financing for energy efficiency, stated that current investment is only half the required level. Longer term, investment will need to increase fivefold to deliver the EU’s 2050 decarbonisation target for buildings.

Globally, the International Energy Agency (IEA) predicts an increase for global energy efficiency investment in buildings of over US$125 billion by 2020. Per-building efficiency investment is projected to increase across most national building markets in the OECD as energy efficiency codes, standards and programmes continue to improve and are more extensively implemented. However, there is still a US$90 billion gap to the estimated investment needed for the buildings sector.

For this to change there needs to be a significant shift in how energy efficiency investment is perceived. When compared to global investment in renewable technology, energy efficiency lags well behind despite often having better financial returns and carbon reduction potential.

There are a number of barriers to investment, which are combining to slow down large-scale investment in energy efficiency.

However, there are steps being taken to overcome these and support organisations in developing investable projects.

02 / The growth of energy efficiency finance

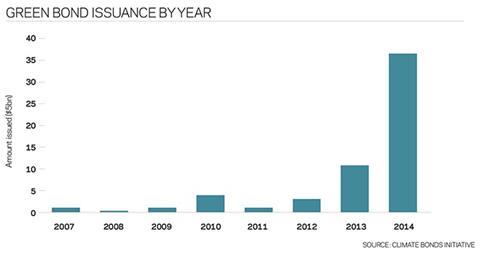

An increasing confidence within the financial markets has resulted in a growing amount of capital being made available for investment in energy efficiency projects. This is demonstrated by the growth of green bonds, a financial product specificially for the purpose of investing in projects which have an environmental benefit including energy efficiency.

The creation of the Green Investment Bank, which has an energy efficiency programme, is further evidence of the growing amount of private capital available for energy retrofit projects.

However, the consensus in the market seems to be that there still remains a shortage of investable projects which are suitable for investment.

To make accessing capital worthwhile, a project needs to be a minimum of £1 million or above in terms of scope; this will usually involve a significant upgrade of the mechanical and electrical services within a building.

This needs organisations to take a strategic approach to planning where capital is best invested and could involve projects being packaged together from across a property portfolio to make them viable.

To help organisations prepare “investor-ready energy efficiency projects,” the Investor Confidence Project has developed a structured framework which standardises projects into verifiable project classes in order to then reduce transaction costs associated with technical underwriting, increase reliability and consistency of energy savings.

- Short term investment forecasts Private sector investment horizons are short, discounting the larger and potentially more effective projects which typically have a longer payback period.

- Large investment required Many operational measures have been carried out and organisations are getting better at managing their buildings. However, this will only go part of the way, there needs to be a significant investment to retrofit the buildings services and fabric.

- Lack of evidence on returns Often many organisations might not recognise the cost benefit or be able to demonstrate the savings. This could be due to changes in the business operation or increased productivity.

- High transaction fees The cost of capital, legal fees and consultancy all contribute to high transaction fees, increasing the overall budget and contributing to longer payback periods and reduced benefit.

- Uncertainty on commercial viability A lack of technical knowledge on the product and the potential returns from investment.

- Standards and processes not established Historically the process for establishing an investable project was not standardised, which increased risk and discouraged investments.

- Lack of capital for investment Organisations may not have capital available for projects, with competition for capital internally against other investments meaning energy efficiency projects are not prioritised.

The energy efficiency drivers

Recent UK government initiatives have placed strong emphasis on reporting in an attempt to highlight the importance of transparency and data sharing. These policies present opportunities for companies and landlords to take ownership and set precedence as leaders in energy efficiency.

The Energy Efficiency Directive, established in 2012, outlines a set of binding measures to help the EU reach its 20% energy efficiency target by 2020.

One of the mechanisms to deliver this in the UK was the Energy Savings Opportunity Scheme (ESOS), which required organisations to identify energy efficiency projects.

While there is no requirement for the participating organisations to implement the opportunities, the data this has provided is a useful starting point for developing an investable project.

The introduction of the Minimum Energy Efficiency Standard Regulations (MEES) will also act as a catalyst for investment as building owners review approaches to upgrading their poorly performing building stock to achieve the minimum standard of an E EPC rating.

The impact of this regulation could be significant with approximately 36% of rated properties across England and Wales likely to be affected by regulations initially, before considering if the threshold is raised after 2018 or as the assessment process is reviewed.

03 / Delivering energy efficiency projects

The need for increased investment in energy efficiency has seen the development of a number of different options for delivering and financing energy efficiency projects. This is an outcome of the recognition within the private sector of the financial opportunity available and in response to a need for energy efficiency to move beyond the low-hanging-fruit measures to potentially more complex and expensive projects focused on large-scale energy savings.

The ultimate aim of these new delivery models is to overcome the barriers identified previously and use the development of new technologies to provide energy efficiency as a managed service to clients.

Energy Performance Contracting

Energy Performance Contracts are emerging as an effective and successful delivery mechanism to achieve significant energy savings.

They offer a flexible and fully funded solution to allow retrofits of major plants and building engineering systems, while supporting this with a robust and guaranteed energy saving.

Though they have not gained significant traction in the private sector, frameworks such as Greater London Authority’s RE:FIT programme and the Carbon and Energy Fund (CEF) have provided public sector bodies with access to the technical capability of the energy service companies, while also facilitating access to the growing level of finance available.

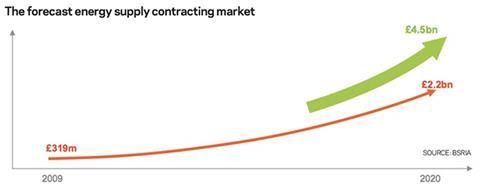

BSRIA have forecast the energy supply contracting market to grow to £4.5 billion per annum by 2020. To achieve this there will need to be an increase uptake in the commercial sector, where investment forecasts and payback requirements are generally much shorter, restricting the scale and type of technologies which can be included in a project and limiting the scope for significant energy reductions.

Energy efficiency as a service

The past few years have seen the emergence of a new approach to delivering energy savings. Energy efficiency as a service is expected to grow its market share considerably over the next few years, a trend recently recognised by GE, which has invested $1 billion into a new start-up company, Current, a digital power service built to transform the way we use energy. The main difference with the Current model is that it is offering a holistic energy solution, effectively taking the issue and complexity of managing energy efficiency and supply and outsourcing it as a service.

This offer goes beyond just supplying energy saving kit, with ongoing monitoring and optimisation of energy consumption included in the product offer. While the product offer is in its infancy, it is making progress – a deal with JP Morgan to upgrade 1.4 million light fittings was recently announced, which Current is planning, managing and financing.

This type of approach is something which Philips Lighting has been offering for the past few years with their pay-as-you-go lighting upgrade solution. In this scenario, the client pays for the lighting as a service, with no ownership or ongoing maintenance of the lighting fittings. Schiphol, Europe’s fourth busiest airport, has opted for “light as a service” in its terminal buildings, as part of a deal with Philips. It will pay for the light it uses, while Philips remains the owner of all fixtures and installations.

Philips are jointly responsible for the performance and durability of the system and ultimately its re-use and recycling at end of life. By using energy-efficient LEDs, the airport expects to cut its energy consumption in half, compared to a conventional system.

Summary

There a number of barriers slowing down and preventing investment in energy efficiency and overcoming these is vital in meeting the decarbonisation targets for our existing building stock. Even though building performance legislation will play a key part in driving the market, the introduction of innovative delivery and financing solutions may well be the catalyst required to speed up investment, whether this gains significant traction in the market remains to be seen.

No comments yet