Inflation is sending jitters through the industry, particularly among subcontractors which are being pushed to carry the risk of materials price hikes – but some are pushing back

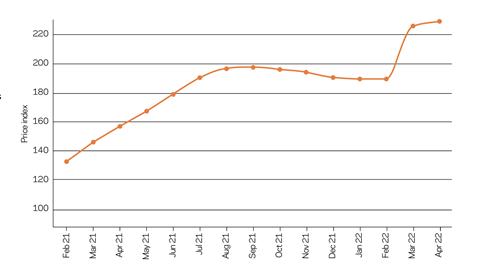

Inflation is back and it appears to be here to stay. According to the latest figures released by the Department for Business, Energy and Industrial Strategy, year-on-year price rises for construction materials hit 24.5% in March, significantly outstripping the economy-wide 7% that the CPI recorded in the same month and adding further grief for firms. While this has meant a boom for material manufacturers, contractors have been on the sharp end.

Lacking economies of scale and working with tight margins, subcontractors and specialists have felt the pressure of spiralling costs even more starkly than their larger peers. Noble Francis, economic director at the Construction Products Association (CPA), says that due to their strong relationships with manufacturers and priority as bigger customers, major housebuilders and contractors can more easily plan and purchase materials in advance and at scale, thereby keeping their inflation bill down.

“The ones who can’t do that are the ones who are smaller specialist contractors,” he says. “They can’t plan and purchase six to nine months in advance because they don’t know what demand is going to be like.

“They do a project, get the revenue in, then purchase what they need for the next project. They work off smaller projects, shorter project pipelines. They know what they are doing the next three months, maybe the next six months at best.”

>>Also see: Trends and prices data dashboard

>>Also see: Adapting contracts for price volatility

>>Also see: McAlpine paying some suppliers weekly to head off threat of firms going under

Some suppliers are reportedly holding prices for less than 24 hours. This approach is “effectively passing that risk to the subcontractors”, according to Neil Harrison, pre-construction director at roofing firm Briggs Amasco, leaving firms with a choice between negotiating a variable price with their main contractor and taking the risk on board themselves.

“There will be people, maybe even potentially big subcontractors, who take on that risk and get it wrong,” says Harrison.

The cash cushion

Whether companies can cope with this level of inflation depends largely on how much cash they have. Fortunately, many firms have found themselves in a relatively strong cash position following the pandemic, according to David Frise, chief executive of the Building Engineering Services Association.

He says: “There’s a bit more fat in the system than there was, but cash becomes an issue because projects get delayed, and we are also starting to see projects get put on hold because the client can’t see price certainty, so until we get a better handle on where things are going we will just hold off and wait.”

But subcontractors suffer disproportionately from such delays, which prevent them getting revenue through the door in the short term, and in the medium term stop them starting their next project, subjecting them to further cost inflation due to the later purchase of materials. According to the CPA’s Francis, “the only way to minimise the effects of cost inflation is for all parties to share the hit”, but this is often easier said than done, with many clients and contractors wary of exposing themselves to risk.

The only way to minimise the effects of cost inflation is for all parties to share the hit

Noble Francis, economic director, Construction Products Association

“In terms of the client side – main contractors and such – I haven’t seen really any movement in terms of thinking about variable price or fluctuating price contracts,” says Harrison. “It’s difficult for a client but a variable contract is something that should be considered more.”

Gokhan Hassan, managing director at M&E consultant GHCS, agrees that there is “no appetite whatsoever for fluctuation clauses in contracts or cost-plus” in the private sector, while noting that such arrangements are typically more feasible in public sector contracts.

Richard Wade, head of construction and partner at Blake Morgan, says clients are coming to the law firm looking for the most risk-free approach to contracts possible, despite a supply chain “pushing really hard” for price fluctuation provisions. “I think we are still going to see problems, because you’re not going to see an attitude shift from clients generally,” he says.

The fightback

Fellow Blake Morgan partner James Bessey says subcontractors “could help themselves a bit” by changing the way they offer prices. He says subcontractors often offer a lump sum price to main contractors, hoping that over- and underestimates will even out to a profit.

“The problem with that is it’s almost impossible to give some kind of escalation on cost elements if you haven’t got clarity on what they are,” he says.

Some firms have already learnt this lesson, according to Rob Driscoll, director of legal and business at the Electrical Contractors’ Association, who says these firms are breaking down pricing and demanding flexibility on certain elements as a condition of taking on a job. According to Driscoll, many subcontractors are now saying to clients, “OK, if we can’t index the entire thing, we will identify the products and materials that we can’t guarantee, put it in as a provisional sum based on today’s prices and then you pay us and we will purchase the real price.”

Cathal McMullan, managing director at Kane Group, says he has been discussing variable pricing for particular materials, but that the absence of major inflationary issues within recent memory has left many without a tried and tested approach to fall back on. “There’s not a familiar clause that anybody has seen through to the end, so the client is nervous and the main contractor is nervous. The best [arrangements], like anything, will work out on trust and everyone being honest about it,” he says.

Kane, an MEP contractor based in Northern Ireland, has been dealing with inflationary pressures by pushing for early design engagement, allowing the firm to secure product ahead of time and at a lower cost. McCullan says the firm’s embrace of offsite manufacturing and digital construction has also enabled efficiencies to help it weather the storm.

“How can we impact the likes of cost inflation on materials? We really can’t, but what we can impact is our efficiency in the use of the materials,” he says. “You can’t influence the price of electricity, but you can switch the lights off around the house.”

There’s no two ways about it, really: you either decide to go to the wall or you cut corners

Gokhan Hassan, managing director, GHCS

Increased communication along the supply chain may also help to ease inflationary pressures further down. Dean Averies, director at Beard Construction, says the firm has begun bringing suppliers into senior management meetings at the start of each week.

He says this approach has allowed the firm to work with suppliers to control and manage the inflation risk, using storage facilities available to companies in its supply chain to buy product early. “Our way of dealing with inflation was to buy it and store it, and we are finding there are ways to do that even with things like joinery,” he says. He adds that Beard is having “grown‑up conversations” with its employers over risk share, challenging the conventional approach of buying risk.

Tony Cornwell, director of business operations at Glencar, says his firm has made an agreement with one employer to share risk on the price of specific materials, and adds that a collaborative approach with early commitments to suppliers is the best way to meet the challenge of inflation.

“If we commit to our supply chain, they are more than likely to be able to get commitment from their suppliers and the people that are working for them as well,” he says. “Where people have been caught cold is where they are signing an agreement and committing to something and then it slips for three or four months, and then they are having to hold that three or four months of increases. So the early commitment and sticking to the timelines is how we are trying to push, going forward.”

Cornwell acknowledges that this means losing some competitive advantage when they get to site, but says: “We would rather make sure we have got the cost and delivery certainty to pass onto our customer, rather than try to create a financial betterment.”

Going to the wall?

According to Hassan at GHCS, what subcontractors really need to do is increase markups, but he acknowledges that in a competitive market this is not within their power. “If you’re a developer you can say, look, open up your books, show us what you have marked up at, I want everyone to increase it by 5% – that seems like a fantasy world to me, but who knows,” he says.

The concern for Hassan is that without this, contractors will cut corners to stay afloat, reducing management on site and stretching staff. “There’s no two ways about it, really: you either decide to go to the wall or you cut corners,” he says.

The concern in the industry is that without greater sharing of risk, a wave of subcontractor insolvencies could be on the cards. According to the Insolvency Service, there were 419 construction insolvencies in March this year, which is an increase of 35.6% on the 309 seen in February, and is 172% higher than in the same month last year.

Specialist construction activities accounted for 62% of construction insolvencies in March, with 90 insolvencies in electrical, plumbing and other installation activities alone.

Despite this rise, many in the industry remain optimistic for the time being. According to insolvency practitioner John Bell, most of the insolvencies currently happening in the industry are “zombie companies” which have survived on the back of covid supports that recently came to an end.

What is more, demand remains relatively strong, which the CPA’s Francis says is likely to remain the case, with strong pipelines of work reported even by firms going bust.

“There is still an element of optimism and positivity because the pipeline is still there,” says Lorraine Gregory, regional director at the Civil Engineering Contractors Association. “I don’t think [firms] see this as ‘this is going to stop work’, necessarily, it just means things are going to take longer and they might need to be a bit more innovative about how they do things”.

“The construction market defies logic at the moment,” says Harrison at Briggs Amasco.

“You’d think that this rampant inflation would quell interest, but it seems to actually be buoyant. There’s still a lot of projects out there, still a lot of good schemes, still a lot of them that are properly financed.”

No comments yet