Global recession is a fact. What does this mean for the global construction sector, and can construction come to the rescue of the broader economy, asks Agnieszka Krzyzaniak of Arcadis

01 / Introduction

As we headed into 2020, it seemed 2019 had not been a good year – what with the US-China trade war, political uncertainty related to Brexit, unrest in East Asia and Latin America, and regularly downgraded economic forecasts for “sluggish” growth – but there were high hopes for stabilisation this year. The IMF kept managing expectations, by providing a balance of warnings about recession and hopes for slightly improved (from 2019) global GDP of 3.5% in 2020. This cautious optimism, however, was crushed with the onset of the covid-19 pandemic in March, which has shaken the global economy to the core. The certainty of any economic growth at all would sound attractive now.

The need to implement national lockdowns, first in China and then elsewhere, brought economic activity to a halt. Even when the virus was confined to just China, the vulnerability of international supply chains was quickly exposed. But then as it spread around the world, demand faded, pushing commodity prices off a cliff and sending financial markets into a panic. It all happened abruptly, as the covid-19 wave spread around the world in less than a month.

Across the globe, efforts began to keep national economies afloat. Governments stepped in, offering to take on liability in schemes such as the Coronavirus Business Interruption Loan Scheme in the UK, KfW Instant Loan in Germany, and GO-C scheme for entrepreneurs in the Netherlands. While there was no lack of capital in the banks, demand for loans skyrocketed and so did the risk of lending. Many businesses were forced to suspend their operations and to consider a loan purely for the purpose of survival. But with an uncertain outlook on the length of lockdown and levels of demand after the recovery, even survival was far from certain.

Today, as we emerge from the first wave of covid-19, and in some areas are entering a second wave, economic recovery is subject to challenges on both the supply and the demand side. Supply, though it remains constrained, is finding ways to continue – whether in the form of restaurants, public transport or building sites – but demand is still lagging. In addition, emerging economies such as Brazil and India, which the IMF had predicted would be the driving force for growth in 2020, have found dealing with covid-19 immensely challenging, casting a shadow not only on the fate of their national economies but on the global outlook.

Sectors of the economy are recovering at different rates, with construction recording steep increases in output in recent months. But this rise has been driven mainly by the need to complete delayed projects. The outlook for new orders is uncertain, and we face the question now of how construction markets around the world will react in the aftermath of pandemic.

02 / Direct impacts of covid on construction

The pandemic had a severe impact on both supply chains and clients across the built environment. Even though approaches to construction activity differed around the world, many of the consequences have been universal. Contractors have had to face abrupt site closures, the introduction of new, often productivity-limiting working procedures, and challenges in managing the workforce.

For example, a large proportion of the migrant construction workers in both European and Asian markets decided to return home at the beginning of pandemic, and the subsequent closure of borders made their return to work impossible.

Delays and additional costs occurred at the same time that cash flow was becoming restricted, putting the liquidity of many companies at risk.

The situation of clients was not much better. They faced not only delays in project delivery, but also dilemmas regarding the level of support given to their supply chain and the threat of losing suppliers. In longer term, they will need to reconsider their investment priorities and the level of risk that they are willing to share.

In considering the usual factors that contribute to our cost index, we see that no aspect was immune to the pandemic. Supply was impacted first, and soon after currencies and commodities were subjected to significant fluctuations; then came uncertainty about future demand.

03 / The cost index snapshot

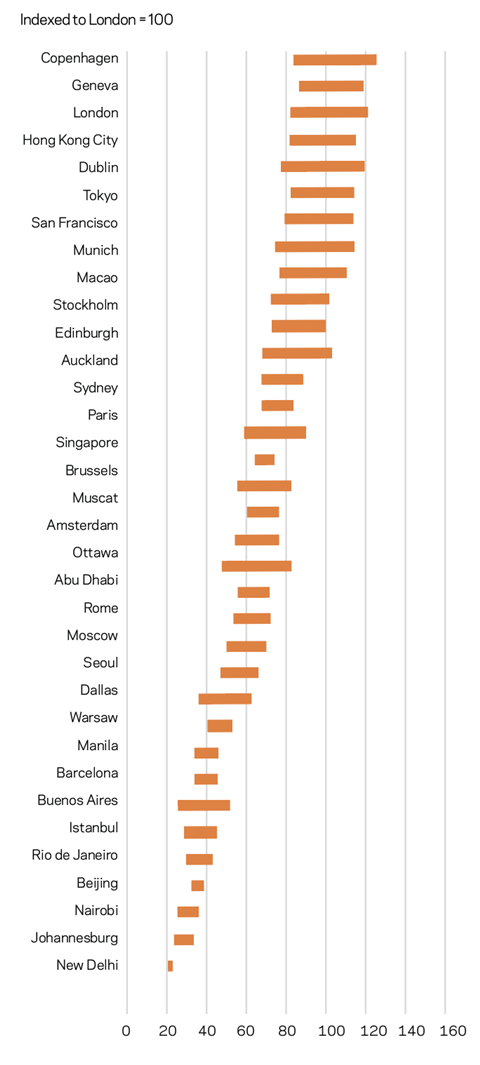

The International Construction Cost Index for September 2020 provides the best reflection of current costs, taking into account domestic market conditions and fluctuations in currency and commodity markets.

While costs have fallen in most locations, the influence of currency swings can be very clearly seen this year, with the locations trading in currencies that appreciated against the US dollar climbing the index. Copenhagen and Geneva, usually the most expensive European locations, have overtaken San Francisco and Hong Kong, with London now ranked third. Costs for cities in Scandinavia, Switzerland and the eurozone all grew 10% in terms of the US dollar.

Similarly, we have seen a basket of currencies from emerging economies depreciate by up to 20%, which has translated into a fall down the index, especially for Moscow, Rio de Janeiro and Buenos Aires.

In the US, New York City and San Francisco remain the most expensive locations, relatively more costly than less regulated cities such as Dallas or Phoenix. Compared with the previous year, we expect costs in the US to fall as a result of subdued demand caused by the suspension of investment prior to the presidential elections.

Locations such as Dublin and Amsterdam remain hotspots for construction and are climbing the index thanks to both high demand and the appreciation of the euro. Costs in these cities are likely to be stable this year – a significant correction after years of high inflation.

Figure 1: International Costs Index September 2020

About the Construction Cost Index

The Arcadis International Construction Cost Index provides a comparison of construction costs across 100 global cities, this year expanded to additional locations in Europe. The report provides market insights and highlights examples of sustainable practice in construction across three priority areas: enhancing climate resilience, decarbonising existing buildings and building in a carbon neutral way. This article includes data for 35 cities. The full report, published in March 2020, can be accessed via arcadis.com. The index is based on a survey of construction costs of 21 building types, based on local specifications and denominated in US$ to enable comparison. The index compares the costs of delivering a building function in different locations rather than a like-for-like comparison of the costs of a similar type of work.04 / National snapshots of demand and supply

UK

Even though the UK was among the countries that did not order closure of building sites, it is estimated that 23% of construction output will be lost in 2020. In the early stages of the lockdown, the Construction Leadership Council was quick to provide not only working guidelines to enable safe continuation of work, but also a number of recommendations to enable the continuity of work, cash flow and collaboration across the industry.

All construction sites are now open, but the degree of efficiency differs depending on the project phase. Productivity seemed to have recovered from an initital 40% dip but is still about 10%-15% down on average. Private and public housing and commercial sectors are forecast to have been hit hardest over 2020 as a whole.

The outlook for construction in 2021 remains uncertain, with new orders in the second quarter 50% lower and private investors putting many projects on hold.

The commercial sector in particular needs to reconsider the original business case for many projects, given the impact of additional safety measures and possibly lower demand. Public sector investment will be essential to the nation’s overall economic recovery, and announcements made so far cover new work for infrastructure, housing and the repair and maintenance sub-sectors.

Belgium

In Belgium construction activity recommenced in May, with covid-19 safety measures being implemented with a slightly higher degree of flexibility than in other European markets. Social distancing of 1.5m is recommended, but if it cannot be adhered to then the work can still proceed provided that employees have been issued face masks and gloves.

Productivity has been affected only marginally, but output is still expected to fall by about 10% in 2020, before returning to a 2019 baseline by 2022.

New orders decreased by 50%, with the non-residential and the repair and maintenance sectors suffering the most, leaving about 15% of companies in these sectors with order books filled for less than a month.

This, in turn, is creating difficulties in maintaining cash flow and is a direct threat to liquidity. In response, the Belgian Construction Confederation has prepared a recovery plan addressing both short- and long-term issues.

Since the Belgian construction market depends on migrant workers, emphasis has been put on enabling workforce mobility across national borders, but also on long-term promotion of construction industry careers and remobilisation of the unemployed.

Singapore

In Singapore the lockdown – locally called the Circuit Breaker – concluded on 1 June and since then construction activity has been allowed to resume, albeit gradually and only where approval has been granted by the Building and Construction Authority.

Because of numerous strict health and safety procedures, such as the need to perform regular test swabs and monitoring of employees’ social interactions on rest days, availability of labour remains a challenge and capacity has not yet returned to 100%.

Construction output is anticipated to fall by 20% in 2020, before returning to pre-covid levels only in 2022. The private sector has been hit by an almost 50% decrease in new orders.

Unlike many other nations, the government has announced a reduction in public spending on construction, with a suspension for two years and a major review of Changi Airport Terminal 5.

Despite a fall in demand in both the public and private sectors, the capacity of the construction industry is expected to remain limited, creating strong, albeit counterintuitive, inflationary conditions.

A programme for improving the dormitory living conditions of migrant workers and increasing resilience to public health risks has been announced – which could help ease some of the labour-related pressure, but only in the long term.

China

First to be hit by the covid-19 outbreak, China has also been the first economy to reopen and return to pre-pandemic levels of activity. Even though the damage inflicted by the lockdown has slashed 5% from GDP, China is one of the few countries with a positive (+1%) GDP outlook for the 2020.

Construction sites are now fully functional and there are no special requirements regarding social distancing. Furthermore, there are no limitations on access to labour, and manufacturing has also returned to its usual levels, releasing the pressure previously built up on supply chains as well as helping some commodity prices – copper, for example – to recover.

The government is continuing with its previously planned investment programme, and an additional stimulus is expected to come from the accelerated 5G and high-tech projects. A slowdown is expected, mainly in commercial sector – especially entertainment, which is highly vulnerable to social distancing measures.

Australia

In Australia, construction output in 2020 is expected to drop by about 15%. Nearly all construction sites are open, but operations can still be disrupted by the deep-cleaning procedures required if any workers are diagnosed with covid-19. There are also limitations on labour mobility and availability, with the borders of Queensland closed, limited travel to Victoria and New South Wales, and a requirement for returning workers to quarantine for two weeks in a hotel, at their own cost.

As in other countries, the private sector has been affected the most, with developers continuing only with shovel-ready projects or those already on site. Projects at the design stage have been either put on hold or cancelled altogether, especially in the retail and hotel sectors.

Universities have been significantly affected as well, due to their reliance on foreign students. But there are winners too, with industrial and data centres taking advantage of the increased levels of people working from home and accelerated digitalisation.

While no long-term recovery plan is being developed at the federal or state level, government funding is continuing for infrastructure and public non-housing projects in a bid to bring some stimulus to the economy.

US

The US saw a two-month shutdown for all construction sites, with the exception of what have been deemed “essential projects”. Work has now resumed on the nation’s building sites, with additional safety measures that vary between states but include, among other measures, limitation to one trade being present on site at one time or else staggered shifts with cleaning operations in between.

Productivity is estimated to be down by 20% and output is expected to decrease by 10% in 2020. The recovery will be slower than in other countries, with a return to pre-covid levels of activity expected to be achieved only in 2024.

Concerns regarding the pace of recovery are directly linked to the political situation and uncertainty over what the priorities of the next administration will be. At the moment there is no recovery plan at a federal level, and even at the state level a wait-and-see approach dominates.

There has been a substantial slowdown in the commercial sector, with many projects undergoing additional reviews that look specifically at public health resilience. Infrastructure projects on site are progressing, albeit at a slower pace. The future, at least until 3 November, remains unknown.

05 / Currency trends

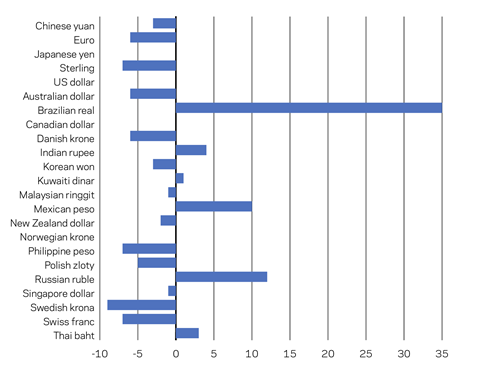

The onset of the covid-19 pandemic initially sparked a flight to the safety and liquidity provided by the US dollar. However, since the spring there have been further dramatic shifts in currencies that have had a big impact on the relative costs of building.

Dollar – to the moon and back

March 2020 marked the beginning of a run for the US dollar, with the US Federal Reserve reinstating the swap lines with all major international central banks. High demand led to the appreciation of the dollar against all currencies (except for the Chinese renminbi), by an average of 9%. This trend, however, has been reversed in the recent months, with the US dollar depreciating by an average of 7.7%.

Opinions regarding the outlook for dollar are divided. The latest business optimism indicators from the US and evidence that the jobs market is bouncing back make further decline less plausible. The temporary weakening of the dollar may actually help the economy recover, driving exports up. But there are factors that speak against US dollar, such as the lack of a long-term recovery plan, election-related uncertainty and the strengthening of the euro. It seems that after couple of very good years, the US dollar has come to an end of a prosperity cycle.

Depreciation of the dollar against other major currencies could help drive relative construction costs down and give a boost to the construction sector. However, caution is needed in the case of emerging economies – against which the dollar has appreciated – such as Brazil, India and Russia. They are likely to suffer from the combination of their own depreciated currencies and the need to trade in dollars.

Figure 2: US$ movement against other currencies, August 2019 to August 2020 (%)

Sterling in the doldrums

Sterling has been subject to turbulence since the 2016 Brexit referendum, reaching a new record low in March 2020, when it sank to the lowest level in 30 years against the US dollar. Nevertheless, in recent months it has recovered and at the moment enjoys a relatively strong position.

Its relation to the euro remains stable too, especially compared with 2019. Even though there is another Brexit cliff edge approaching on 31 December and trade talks have been hindered by the pandemic, the outlook seems less uncertain. Arguably investors have simply become used to sterling’s ups and downs over the past three years.

The euro – too hot to handle?

Agreement on the EU’s €750bn recovery plan and its new 2021-27 budget gave a boost to the euro, which strengthened against the US dollar by approximately 7% and has the potential to enjoy safe-haven status for a while.

This, paradoxically, worries the European Central Bank policy-makers, as too strong a currency will weigh on the attractiveness of exports and can slow economic recovery. In the meantime, the strong euro has pushed up the relative cost of construction in Europe compared with the US, the UK and other international markets.

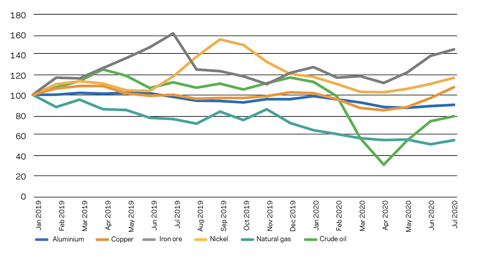

05 / Commodities

The pandemic has influenced commodity prices to varying degrees. Undoubtedly, the most spectacular volatility over the past year has been in oil, which at its lowest point traded at 30% of January 2019 prices. This was not purely the effect of a sudden drop in demand caused by covid-19 but also the result of the breakdown of an OPEC production agreement resulting in massive oversupply and even future sales at negative prices. At the time of writing, prices were on an upward curve, having reached $40/bbl (West Texas Intermediate). With demand anticipated to fall by a record 10%, there are currently more deflationary than inflationary risks. With natural gas prices having decreased continuously for the past 18 months, energy prices in 2021 are expected to increase only marginally.

Figure 3: Commodity price indices January 2019 to July 2020

The impact of covid-19 on metal prices has varied. While copper, aluminium and nickel experienced a decline in April 2020, iron ore kept increasing in price. The latest data indicates that prices for copper and nickel have recovered and are now higher than at the beginning of 2019 – the former up by 7% and the latter up by 16%. In the case of nickel, the increase has been driven mainly by increasing demand in China for EV batteries. Iron ore has increased in price by more than 40% since January 2019, while aluminum remains 12% under the 2019 baseline price. The outlook for metals in 2021 will depend on the balance between demand (which currently is expected to decrease, although the rapid recovery in China may turn the tables), the extent of disruption to supply chains, and production limitations. For example, copper is anticipated to be affected more than iron ore, which is obtained in more remote locations and through mostly automated processes.

Timber prices did not experience as remarkable a fall as other commodities but are now still 10% lower than at the beginning of 2019, apart from in the US where a housebuilding boom has resulted in a doubling of lumber prices. This, in fact, illustrates one of the driving factors that could result in timber prices increasing globally. Continuing high housing demand, ongoing urbanisation and commitments to decarbonisation are expected to triple the demand for this biomaterial over the next 30 years. The supply side, however, is finite. The production cycle of timber is much longer than that for other materials, and constraints around land availability are likely to play a role too.

06 / Conclusion: what doesn’t kill you makes you … greener?

Many would argue that the unprecedented levels of support made available by the public sector should not be used to rebuild the world as we knew it – but rather to create a more sustainable reality. The construction sector has an enormous role to play in reviving national economies and in fighting climate change. But as more and more recovery plans are being put in place, are they in fact calling for a greener approach?

The EU has recently reached agreement on its recovery plan, which includes the European Green Deal. This deal focuses on six areas, one of them being building and renovation. It is meant to drive the energy performance of buildings through enforcement of standards such as BREAAM and the promoting the use of digital tools for improved energy management. Funding will become available to support renovation of existing buildings and the social housing sector. The Green Deal will need to address embodied carbon, but the solutions to achieve that are not clear at the moment.

In the UK, the ideas regarding a green recovery also focus on refurbishment, with the government so far having committed £1bn to retrofit public sector buildings and a further £2bn for the Green Homes Grant to support energy and fabric upgrades. However, concerns have been raised around the pace of implementation, especially for the former policy, as the funding will be available only for a short period of time. A lack of availability of sufficient tradespeople with the requisite skills seems to be a potential obstacle to the efficient delivery of these ambitions.

In Singapore, economic recovery measures includes a 10-year plan to improve the sustainability credentials of all public housing by 2030. Cleaner energy transportation will be encouraged too through an expansion in the public charging infrastructure for EVs, and a Coastal and Flood Protection Fund has been set up to help with the consequences of rising sea levels. Crucially, there is also a separate funding resource allocated to projects that focus on promoting more environmentally friendly behaviour among individuals and communities.

The signals from other locations across the globe are less encouraging. In Australia, there is no recovery plan at a federal level and the only actions around transition to a greener economy are the outcomes of previously announced initiatives to drive the use of renewables. In the US the situation is similar, with all major decisions suspended at least until after the elections in November. China is back on its feet, but the focus is on business as usual. So far, it seems that covid-19 could become an argument against implementing more ambitious net-zero initiatives. If that turns out to be the case, we will have fallen again into the trap of short-term thinking.

Acknowledgments

I would like to thank David Hudd, Clare Ashworth, Danielle Green, Leanne Reed, Matthew Mackey, Ann van Melkebeek, Joe Chan, Christine Chan, Josephine Lee and Simon Rawlinson of Arcadis for their valuable insights.

No comments yet