Ian Goodridge and Ross Baylis of Arcadis examine the latest trends in international construction markets amid a global economic environment of rising inflation and a strengthening of the US dollar

01 / Introduction

Following dramatic inflation in 2021 due to the bounce-back from covid-19, any thoughts of a more sustainable recovery in 2022 were dashed by the Ukraine conflict. In international construction markets, elevated prices for materials such as timber and steel were followed later in 2022 by unprecedented increases in the price for energy-intensive materials such as cement, brick and glass as the huge spike in energy costs in August fed through to markets globally. The situation was particularly acute in Europe as countries rushed to wean themselves from a reliance on Russian oil and gas, while governments introduced measures to protect businesses and consumers from the unprecedented energy price spikes.

The year also saw soaring interest rates in many parts of the world as central banks sought to control rampant inflation. This has led to client challenges around viability, with the cost of finance increasing by 400 basis points or more. It is by no means certain that central banks will be able to trace a path to low inflation by the end of 2023. While structural inflation associated with energy costs will drop out, core inflation has proven to be more sticky, as evidenced by April’s inflation reading for the UK. The prospect of higher interest rates for longer will continue to weigh down commercial and residential investment.

>>> Also read: UK market forecast: the costs of uncertainty

>>> Also read: A five-point plan for coping with volatility in a positive way

Overall, prospects for 2023 are uncertain. Forecasters hope for a soft landing in Europe and North America, but that might be difficult to engineer, particularly as recent turbulence in the banking sector spreads further. Nevertheless, the International Monetary Fund projects growth of 2.8% for 2023. A 5%-plus expansion in China, India and South-east Asia will compensate for much weaker prospects in North America and the eurozone.

02 / The cost index snapshot

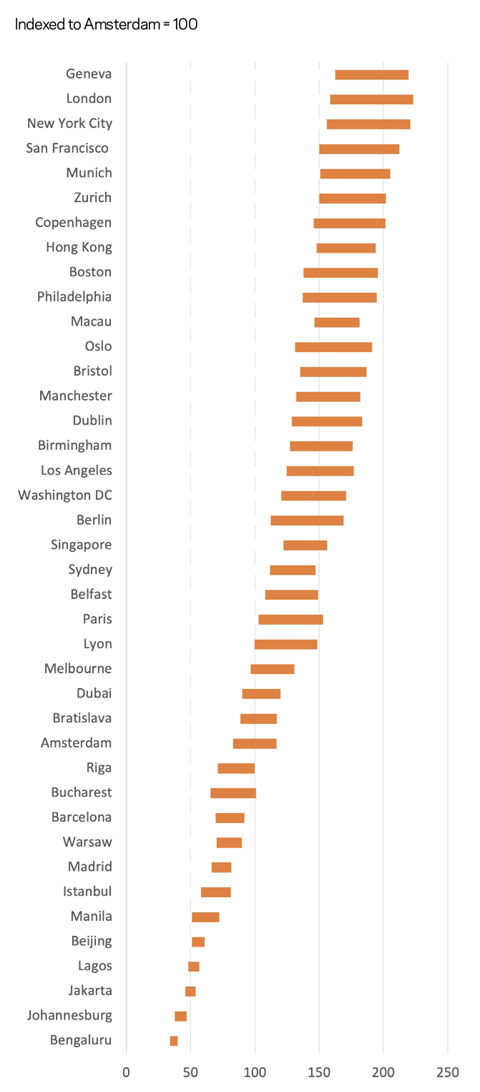

The Arcadis ICC index for 2023 covers 100 locations. This year saw coverage expanded to include cities in eastern Europe and western Africa. The data was collected in the first quarter of 2023. Projects delivered in accordance with local specification standards are compared on the basis of a currency conversion to US dollars.

Geneva tops the ICC index this year, closely followed by London. Although Oslo has dropped from third to 12th, many of the top 10 cities are similar to last year, with perennial European construction cost hot spots Copenhagen and Zurich high in the rankings.

However, two new entrants this year are Boston and Philadelphia, bringing the total number of US cities in the top 10 to four. Their inclusion is mostly due to local inflation, averaging 8% to 12 % across many US cities, although dollar appreciation during 2022 was influential too.

One notable move in the 2023 ICC index is our baseline location, Amsterdam. The Netherlands construction sector faced multiple headwinds during 2022, including an economic slowdown and permitting delays caused by issues around nitrogen. Our data for Amsterdam shows that even though input costs were rising, contractors were discounting their bids to secure work. Overall, prices rose by only 1%-2% and, as a result, Amsterdam fell 11 places from 51 to 62 in the rankings. There is an expectation that similar cost absorption will be observed in many markets in 2023 as demand softens.

The three main market trends in the ICC index this year are:

- High levels of inflation affected most cities in the survey – fewer than 10 cities recorded zero or negative inflation, all located in South-east and East Asia.

- Highest inflation was in European cities exposed to Ukraine disruption – 10% to 20% overall. The combination of disruption to local manufacturing supply chains and regional-specific energy markets added 5%-6% to inflation in European markets during the year.

- Strengthening of the US dollar against most major currencies was a continuing trend from the 2022 report, with US dollar denominated or pegged cities rising further up the rankings, with four US cities in the top 10 in addition to Hong Kong.

Looking at the wider index, cities in Australia and New Zealand saw prices rise as they experienced their version of a V-shaped recovery following extended lockdowns. In China, continued covid-19 restrictions until late in 2022 means that a price bounce-back in many Asian markets is not likely to take hold until this year. The implications of a bounce-back in Asia could be a real watch-out for 2023.

Figure 1: International Construction Costs Index 2023

03 / Regional analysis

US

The US construction market is valued at around $1.95tn and accounts for about 4% of the US economy. Inflation impacted the market during 2022, with prices rising by between 5% and 10% depending on location. For 2023, inflation is expected to range between 4% and 8%, with greatest inflationary pressure focused on fast-growing inland cities.

Estimates suggest that the US construction market will contract by 3.5% to 5% in 2023, driven mainly by a slump in residential construction. The blow will be softened by massive government stimulus in the infrastructure sector, with over US$1.5tn signed off by President Biden. The investment will certainly benefit the energy and transport sectors and could bring forward many projects that were stalled following the covid pandemic.

Despite the slowdown in housing markets, demand for infrastructure is high enough to trigger risks of delay and increased costs due to an incredibly constrained construction labour market. The Associated Builders and Contractors (ABC) industry group has suggested that the sector could be short of up to half a million workers in 2023.

Australia

Government statistics show the value of total construction work in Australia in 2022 was A$140.3bn, at constant prices. This was a 10% increase on construction output the previous year and reflects the fact that this was the covid recovery year for Australia, which was later than many countries to come out of lockdown.

Reduced market capacity, supply chain issues and rising inflation sharply increased the cost of building projects across the board last year. For 2023, inflationary pressures on materials should ease in the first half of the year as supply constraints have been largely resolved – although high energy cost inputs remain a challenge.

While the residential sector has cooled, investment is growing in transport and social infrastructure, which is providing most of the demand into 2023. However, as opportunities increase, so capacity will be stretched further, potentially leading to a second wave of inflation affecting labour and staffing costs on projects. Labour scarcity is the single biggest issue faced by construction companies.

Demand for net zero related investment will probably start to increase over the next 12-24 months, so specification changes influenced by carbon calculations may begin to impact costings.

China

Despite the Chinese economy only growing by 3% in 2022, activity has rebounded quickly following the covid-19 reopening policy change from President Xi. Data from the Chinese National Bureau of Statistics shows the construction sector grew by 6.4% in 2022, with a large rise in public infrastructure spending offsetting slack in the residential market.

The momentum is set to continue, with the National Development and Reform Commission recently approving 109 transportation, energy and water schemes, totalling CNY1.48tn (US$213.1bn). Urban renovation and health projects are also expected to perform well this year, and the sector will be boosted by the lifting of the three “red line” government restrictions that held back investment in residential development in 2021 and 2022.

China was one of the few markets where construction materials prices fell in 2022 as project starts slowed due to prolonged covid restrictions. The country was mostly isolated from the dramatic energy price rises being experienced elsewhere and benefited from lower commodity prices. Overall, construction prices fell by 2%. Construction price inflation is forecast to return in 2023, with an increase of 3%.

EU

2022 was the second year of recovery for the European construction industry after the outbreak of the covid pandemic, with output growing by a better-than-expected 2.6% last year, following a 5.8% increase in 2021.

While the European construction sector had recovered strongly from the pandemic, further growth was cooled by the sharp rise in construction costs following the start of the Ukraine conflict. Already-existing supply shortages were exacerbated by the war, which led to soaring inflation rates and the need to raise interest rates.

The price of some building materials such as timber and steel peaked during the summer of 2022 but have since tailed off due to weakening demand and easing of supply chain disruption. These were replaced by a substantial increase in the price of energy-intensive materials like concrete, cement and bricks later in the year as dramatic energy price rises took hold.

For 2023, a key challenge could be the availability of sufficient labour. A European Commission survey found a quarter of EU contractors were struggling to recruit enough staff to meet demand. The situation was particularly acute in France, Germany and Austria. Measures such as increasing labour productivity through the use of industrialisation and digitalisation, attracting skilled workers from abroad and investing in the education of younger employees are all being considered as potential solutions.

Despite EU construction firms having a healthy backlog of work, with nine months of guaranteed projects as of the beginning of 2023, output for the year is expected to be flat, with no recovery expected until 2025.

04 / Labour shortages

One of the themes emerging from the profiles of some countries in the index is a shortage of construction workers to deliver the planned programme of construction and infrastructure projects. From the UK and Europe to Australia, Hong Kong and the US, issues around the lack of an available construction workforce are rising up the agenda.

The numbers are staggering. In the UK, for example, recent projections suggest the recruitment of an additional 225,000 workers is required by 2027 to meet future demand. In Hong Kong, there could be a shortfall of 40,000 construction workers within the same time frame, and Australia is likely to require 470,000 tradespeople in the next four years.

With many countries experiencing near-historic low levels of unemployment, sourcing such numbers of extra workers is proving a headache. A variety of measures are being taken by governments and trade bodies to address this shared challenge and whether lessons can be learnt.

The table below highlights the issues and the solutions being proposed. At a macro level, for instance, there have been calls for governments to relax migration rules. In the UK, this has meant the government’s Migration Advisory Committee recently recommending that various skilled construction roles, including bricklayers, roofers and carpenters, be added to the shortage occupation list to allow companies to more easily recruit from overseas for critical jobs while paying reduced visa fees.

At the micro level, encouraging a more diverse workforce is a regular theme, while some countries are working hard to prevent older workers from leaving the sector prematurely through early retirement.

To meet the challenge of workforce shortages in an environment of low unemployment, governments and construction organisations need to use a variety of levers. These can range from commonly adopted ideas around raising migration limits to entice more overseas workers, through to encouraging a more diverse and mobile workforce, and even more outside-the-box solutions such as technology demonstrations at schools and colleges. Better uptake of modern methods of construction and industrialisation, which tend to require fewer workers, ought to be on the agenda too. Imagine the difference that global-scale investment in such methods would make to productivity and efficiency.

It is also very important for employers to retain the people they already have. While making this happen includes considerations of compensation, it is also about offering better career advancement and skills training, combined with improved mentorship. Opportunities for upskilling and reskilling, supported by initiatives such as lifelong learning funds, need to be more commonplace. The use of human augmentation technologies such exoskeletons could help to keep older workers active for longer.

Finding effective solutions will not be easy, and the nuances of each country’s construction sector means that what works for some will not necessarily work for others. Nevertheless, it would do no harm to recognise that this is a shared challenge.

| Country | Situation | Solution measures |

|---|---|---|

| Australia |

|

|

| Hong Kong |

|

|

| UK |

|

|

| US |

|

|

05 / Currency trends

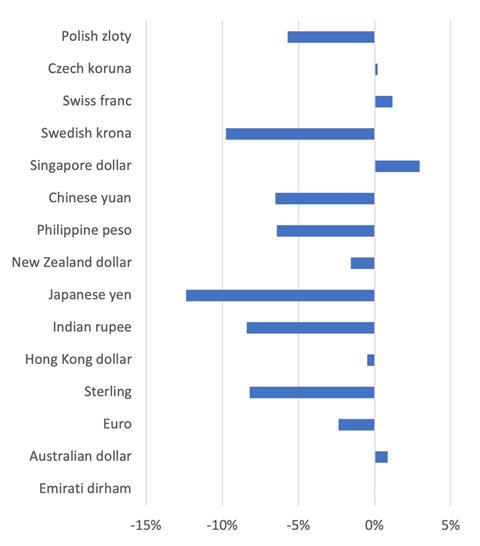

As highlighted earlier, currency movement driven mainly by an appreciating US dollar is an important component in the final ICC rankings in 2023, as it was too the previous year. This helps to explain why US cities have moved further up the rankings this year, with four now in the top 10, including Boston and Philadelphia as new entrants at nine and 10.

The chart opposite plots the movement of a range of currencies relative to the US dollar. In the 12 months to the end of January 2023, sterling depreciated by 8%. This helped to maintain the competitive edge which US dollar denominated investors had built up over UK and European peers in 2021. Recent reports suggest that the devaluation of the pound saw US investors put nearly $1bn into London commercial property in Q3 2022. The trend continued into Q1 2023, with most of the large investment deals in UK commercial real estate coming from international investors taking advantage of the relative strength of the dollar over the pound.

The euro has recently bounced back since falling below parity with the US dollar in September 2022, boosted by receding fears of a deep recession later in 2023 and declining energy prices. The Chinese yuan was down 7% on the US dollar in the 12 months to the end of January, with the differential caused by factors such as the continued lockdowns in Chinese cities for much of last year, coupled with cuts to interest rates by the Chinese central bank and concurrent rises in rates from the US Federal Reserve (Fed).

Figure 2: Figure 2: International currency movements against US dollar, from January 2022 to January 2023 (%)

The US dollar rose against a basket of six other major currencies to a 20-year high in September but fell by over 11% in the final quarter of 2022 as inflation declined and the Fed slowed the rate at which it raised interest rates. The Fed’s main policy rate rose by 4.25 percentage points during 2022, the largest one-year increase in four decades. While markets expect the US central bank to begin cutting interest rates in the second half of this year, potentially removing a big advantage for the dollar, recent positive economic data pointed to further rate hikes and rates being held higher for longer. At the time of writing, futures markets are predicting benchmark US interest rates peaking at 5.28% later this year, up from the 4.9% that was forecast in early February.

06 / Commodities and energy prices

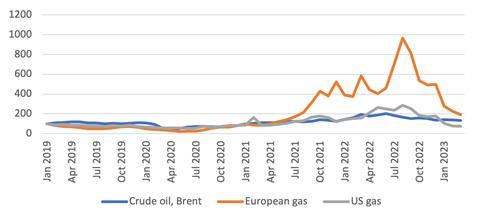

The previous ICC report predicted that with high energy costs contributing to the increasing scarcity of key materials, the outlook in 2022 would be for further price instability, making it more difficult for manufacturers and contractors to offer price security to their clients.

This turned out to be prescient, with the Ukraine conflict leading to highly volatile energy prices which diverged widely. In Europe, natural gas prices reached an all-time high in August, driven by countries rebuilding their stocks after gas supplies from Russia had been cut. The price in Europe was eight times higher than in the US at the peak. In the four quarters to Q3 2022, natural gas prices in Europe were on average four times higher than their average over the previous five years.

While prices have since dropped sharply as inventories reached their target levels and demand has fallen, there are still concerns around a gas shortage in Europe this coming winter. Fatih Birol, head of the International Energy Agency, recently warned that Europe had not yet won its energy war with Russia, even with storage being 55% full in April 2023. Future prices could also be affected by China’s accelerating economic recovery post-covid, which will lead to a higher demand for gas.

The World Bank forecasts that after surging by 60% in 2022, slower global growth and weaker demand for natural gas could see energy prices decline by 11% in 2023 and a further 12% in 2024. However, prices will still remain more than 50% above their five-year average through 2024. While persistently high energy prices will not have inflationary implications, high transport and electricity costs for businesses will weigh down their competitiveness. The outlook is subject to numerous risks, with the current high price and high interest rate environment making the financing of new energy production more challenging.

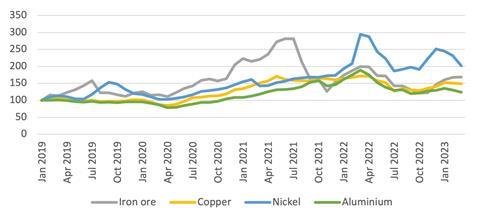

Figure 3: Commodity price indices, 2019 to 2023

The volatility theme was present in the metal commodity markets too. In March last year, inflation-adjusted global copper and aluminium prices had reached their highest and second-highest levels, respectively, in a decade. By the end of 2022, prices for both metals had fallen dramatically, with aluminium down by 36% and copper by 24%. A number of factors were at play here, including a reduction in supply constraints, a shutdown of energy-intensive smelters due to record high energy costs, and concerns about an imminent global recession.

The World Bank predicts further price volatility as the pace of the energy transition picks up and global commodity demand shifts from fossil fuels to metals. Already, commodity prices for some metals and minerals are back on an upward trajectory, with iron ore up by 32% from a price trough in October 2022. The trend for higher commodity prices will be exacerbated for countries that have been exposed to sizeable currency depreciations against the US dollar in 2022.

As with energy prices, the China rebound factor could come into play with commodities too. Recent forecasts suggest copper prices will surge to a record high this year as a rebound in Chinese demand threatens stockpiles which are already at their lowest seasonal level since 2008. With S&P Global estimating that 40 million tonnes of copper will be consumed globally each year by 2030, up from 25 million tonnes in 2021, further upward price movement looks likely.

Figure 4: Energy commodity price indices, 2019 to 2023

07 / Conclusion

The idea that 2022 might offer the hope of a new normal in the construction sector after the shock of the covid pandemic was quickly dismissed, as the conflict in Ukraine triggered instability in commodity and energy markets. This affected cities in Europe the most, with double-digit inflation becoming the norm. However, the effects rippled out to many cities across the globe, way beyond the epicentre of the conflict.

While the inflationary impacts of raw material shortages and tight logistics waned last year, they were replaced by unprecedented energy price rises which particularly influenced energy-intensive materials such as cement and bricks.

The good news is that many of the inflationary headwinds of the past two years have dissipated, and the prospect of much lower inflation is anticipated for 2023.

One constant from the last two years, however, is exceedingly tight labour markets in many of the countries and cities covered here. From the UK and Europe to the US, and from Hong Kong to Australia, the lack of available labour to deliver planned work programmes is rising up the agenda for many clients and their teams. Familiar levers to improve recruitment are being investigated in many countries, but these approaches need to be combined with improved levels of productivity and efficiency – something that has been a hard nut to crack so far.

About the Construction Costs Index

The Arcadis International Construction Cost Index offers a comparison of building costs across 100 global cities. The report provides regional construction market insights and highlights examples of investment priorities in major cities around the world. This article includes data for 40 cities. The full report, which was published in April 2023, can be accessed via arcadis.com. The index is based on a survey of construction costs of 20 building types, based on local specifications and denominated in US dollars to enable comparison. The index compares the costs of delivering a building function in different locations rather than a like-for-like comparison of the costs of a similar type of work.

No comments yet