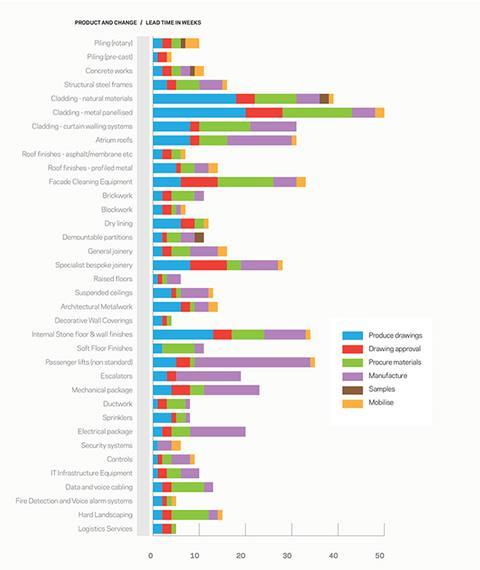

Lead times have stayed level, with most packages at the highest level since records began, and little further change is expected over the next six months

01 / Staying level

▶ Piling (rotary)

▶ Piling (pre-cast)

▶ Concrete works

▶ Structural steel frames

▶ Cladding - natural materials

▶ Cladding - metal panellised

▶ Cladding - curtain walling systems

▶ Atrium roofs

▶ Roof finishes - asphalt/membrane

▶ Roof finishes - profiled metal

▶ Facade cleaning equipment

▶ Brickwork

▶ Blockwork

▶ Metal doors

▶ Dry lining

▶ Demountable partitions

▶ General joinery

▶Specialist bespoke joinery

▶ Raised floors

▶ Suspended ceilings

▶ Architectural metalwork

▶ Decorative wall coverings

▶ Internal stone floor and wall finishes

▶Soft floor finishes

▶ Passenger lifts (non-standard)

▶ Escalators

▶ Mechanical package

▶ Ductwork

▶ Sprinklers

▶Electrical package

▶ Security systems

▶ Controls

▶ Data and voice cabling

▶ Hard landscaping

▶ Logistics services

02 / Lead times summary

Rotary piling ▶ companies are reporting no change in the 10-week lead times this quarter. Generally, the demand in the next six months is quieter.

Rotary piling ▶ companies are reporting no change in the 10-week lead times this quarter. Generally, the demand in the next six months is quieter and lead times are anticipated to shorten.

Pre cast piling ▶ lead time remains at four weeks but workload over the next six months is set to be quieter. Concrete works lead times remain at 11 weeks.Structural steel frames lead times have levelled out at 16 weeks.Enquiries are on the increase but contractors are not anticipating any change to lead times in the next six months.

Cladding ▶ - natural material lead times remain at 39.

Cladding ▶ - metal panellised system lead times remain at 50 weeks, with some contractors anticipating increases in the next six months due to increases in workload.

Cladding ▶ - curtain walling system lead times remain at 31 weeks.

Atrium roof ▶ lead times remain at 31 weeks with no changes reported.

Roof finishes ▶ - asphalt / membrane lead times remain at seven weeks.

Roof finishes ▶ - profiled metal lead times remain at 14 weeks.

Facade cleaning equipment ▶ lead times remain at 33 weeks, and contractors continue to be busier with increased enquiries but do not anticipate any change over the next six months.

Brickwork ▶ lead times remain at 11 weeks.

Blockwork ▶ lead times remain at seven weeks and companies do not expect lead times to increase over the next six months with workload and enquiries levelling off.

Dry lining ▶ lead times remain at 12 weeks.

Demountable partitions ▶ lead times remain at 11 weeks, with no change anticipated over the next six months.

General joinery ▶ lead times remains at 16 weeks with no further increases.

Specialist joinery ▶ has seen no change this quarter with lead times remaining at 28 weeks. Workload and enquiries remain high and further increases are anticipated.

Raised floors ▶ lead times remain at six weeks. Suspended ceiling lead times remain at 13 weeks.

Architectural metalwork ▶ lead times have levelled off at 12 weeks since the increase last quarter, with no further increases anticipated.

Decorative wall covering ▶ lead times remain at four weeks with no change anticipated in the next six months.

Internal stone floor and wall finish ▶ lead times remain at 34 weeks. No increases are anticipated in the next six months, with some contractors reporting being less busy.

Soft floor finish ▶ lead times remain at 11 weeks. Contractor continue to be busier with increases anticipated in the next six months.

Passenger lift-non standard ▶ lead times remain at 33 weeks following the two-week increase last quarter; companies are busier but do not anticipate any further changes for next six months.

Escalator ▶ lead times remain at 19 weeks with no change reported for the next six months.

Electrical package ▶ lead times remain at 20 weeks and are not forecast to increase in the next six months.

Mechanical packages ▶ lead times remain at 23 weeks following a one-week increase last quarter and are not anticipated to change in the next six months.

Ductwork ▶ lead times stay at eight weeks with no change forecast for the next six months.

Sprinklers ▶ lead times remain at eight weeks and contractors do not forecast an increase in lead times over the next six months.

Security systems ▶ lead times remain at six weeks, with no changes reported for the next six months.

Controls ▶ lead times remain at nine weeks. Enquiries and workload remain stable, with no changes in lead times anticipated in the next six months.

IT infrastructure equipment ▶ lead times remain at 10 weeks.

Data and voice cabling ▶ lead times remain at 13 weeks.

Fire detection and voice alarm systems ▶ lead times stay at five weeks following a reduction last quarter, while contractors continue to report lower levels of work and enquiries.

Hard landscaping ▶ lead times remain at 15 weeks.

Logistics services ▶ lead time remains at five weeks; there is no change forecast in the next six months.

There has been no change to any of the lead times this quarter and the majority of packages are at the highest level since the monitoring began in 1998. Companies are also forecasting no change over the next six months as workload levels off, indicating the majority of package lead times have peaked.

Data capture and analysis by Mace Business School

No comments yet