Business indicators point to plenty of momentum in the economy as household consumption expands and employment rises. Michael Dall presents highlights of Barbour ABI’s latest monthly Economic & Construction Market Review, with a special focus on the education sector

Economic context

Many business indicators seem to have come off their peak levels, but the index numbers remain high which suggests strong growth will continue. Meanwhile, most recent surveys found business confidence remaining high or strengthening.

The Markit all-sector PMI index for March hit a nine-month low as it dropped to 58.1 having peaked last October at 61.6. The CBI growth indicator showed a similar pattern. It hit an eight-month low in March, but remained well above the average.

A quick way to gauge the strength of the economy is to take a selection of the Bank of England Agents’ Scores. These run from -5 to +5. The latest data illustrate how much stronger the economy is now than a year ago. On each measure the economy is stronger and whereas construction and manufacturing for the home market were flagging a year ago, they are now in rude health.

When we look under the bonnet at what has contributed to the growth over 2013, the latest GDP estimates show it is due to household expenditure. This is to be expected as it accounts for the largest part of the economy and in the earlier stages of growth we would expect to see activity start with consumption.

The national accounts data show government and not-for-profit spending along with stock building have also contributed. The reduction in negative net trade also lifted GDP, which was helped by a 1% rise in exports or goods and services.

Underpinning the rise in household expenditure is a stronger jobs market, with employment rising to 72.3%. It was against this background that on Budget day the latest GDP growth forecast from the Office for Budget Responsibility was increased for 2014 from 2.4% to 2.7%.

Other news in the UK economy includes:

- Consumer price inflation falls to 1.6% in March

- British Chamber of Commerce quarterly economic survey finds most manufacturing and service indicators above 2007 levels

The construction sector’s performance

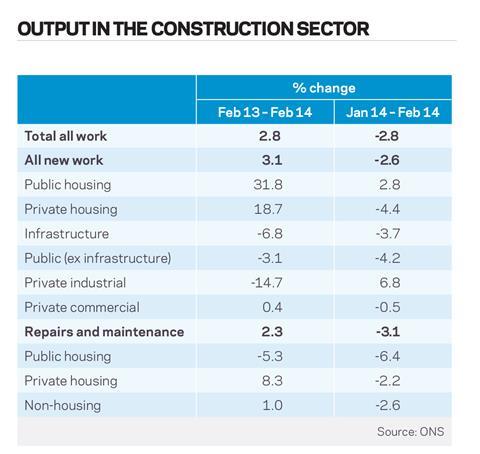

As forecasters raise their growth expectations for 2014 to 4.5%, the latest Office for National Statistics (ONS) figures for construction show output in first two months is 4% higher than a year ago.

Construction output fell 2.8% in February compared with January, which was in line with other indicators showing a dip in activity in the month. Despite the bad weather, which may have dragged down output, the figures look promising. Output in the first two months of 2014 was up 4% on a year ago, pretty much in line with industry forecasts.

Comparing the latest three months with a year ago growth overall looks robust, with new work up 4.9%, repair and maintenance up 3.8% and overall output up 4.5%.

But within this fortunes are mixed. New housing work shows strongest growth up 22%, despite a fall of 6.3% in February. Private housing RMI was up 7% and growth in commercial work, meanwhile, seemed to flatten out and infrastructure output dipped by 3.1%.

The latest forecast from the Construction Products Association (CPA) underlines the growing confidence in the market. There was a gentle upward revision for this year to a growth rate of 4.5%, although forecast growth rates were toned down slightly for the following years. Importantly fears over downside risks, such as the Eurozone, seem to be diminishing.

CPA expects private housing, commercial and infrastructure to be the main drivers of growth, with its epicentre being in London. Housing is expected to see double-digit growth for two years running, with similar growth in infrastructure this year. Growth in commercial building work is expected to rise reaching more than 5% next year.

Small falls in public sector work are expected this year. But CPA expects all main construction sectors to see growth in 2015.

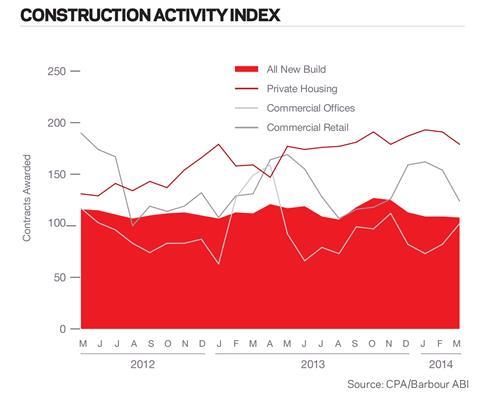

The CPA/Barbour ABI Index, which measures the level of contracts awarded using January 2010 as its base month, recorded a reading of 108 for March. This was lower than last year. This should cause no particular concern as private housing has softened noticeably, down in March to 179, pulling down the index. This easing is not surprising after it hit a seven-year high in January.

Commercial offices meanwhile continued to gather pace with a strong showing of 102, while commercial retail appeared to come off the boil with a consecutive monthly fall taking it to 124.

After a fall in the level of construction contracts awarded in February, the March Barbour ABI data on all contract activity revealed a bounce back that puts the trend over the past year or so back on an upward path. The March rebound in the value of new contracts awarded produced a figure of £5.2bn, based on a three month rolling average. This represented a rise on the month of 7.2% from February.

Looked at over a longer timeframe on a 12-month moving average, the value of contracts awarded has risen by almost 25% over the past year, with the number of contracts up nearly 22%.

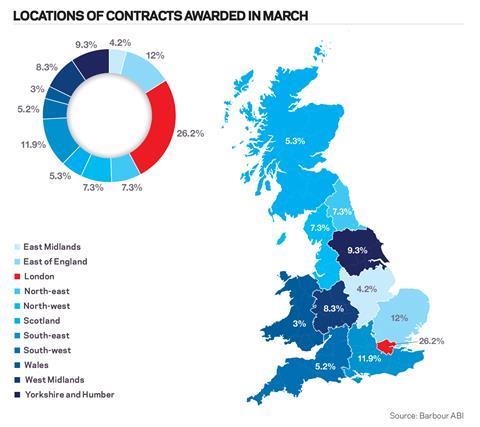

London continues to grab a disproportionate share of the contracts awarded. In the month it accounted for more than 26% of the value of awards, although just 14% of the number of projects.

Over the past 12 months London’s share of contracts by value has risen to 24.4%, twice that of the South-east. But the dominance of London is not surprising as it attracted five of the top 10 contracts in the month, with £150m Crossrail contract, two big office schemes, including Rathbone Place, and two large residential schemes. Meanwhile the North-east continued its steady improvement with the largest win recorded in the month, the £250m Tees Valley 2 Renewable Energy Facility contract.

Residential once again dominated the contracts let in March taking almost 35% of the total.

In just two of the past 12 months has residential taken a slice less than 30%. It was also a good month for infrastructure work, which accounted for 22% of the total. Commercial & Retail had a 15% share, while education had its best month for a few years and accounted for 13.5%.

Construction performance by sector

Spotlight on the education sector

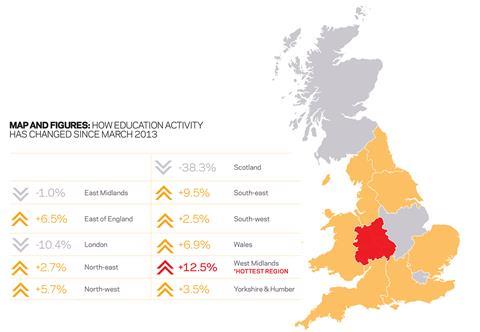

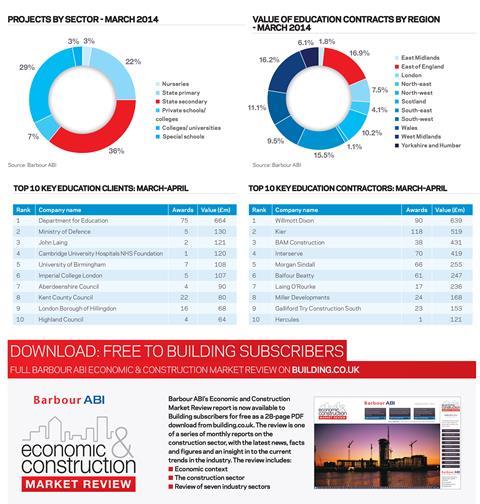

Values of contracts awarded in March increased on the previous month in the education sector and activity was also much higher than this time last year.

The value of contracts awarded in the sector was £614m based on a three-month rolling average, an 8.5% increase on February. This figure was 20.1% higher than March 2013, indicating a longer-term improvement over 12 months.

The values of contract awards in the three months to March were 2.6% higher than the previous three months and 47% higher than the same period last year.

The main location of activity this month was in the East of England, which accounted for 16.9% of the value of projects, a 6.5% increase on March 2013. A £30m secondary school in Ely led the way.

The South-east region was the next prominent accounting for 15.5% of contracts awarded, an increase of 9.5% from March 2013.

State secondary schools accounted for the highest proportion of contracts awarded in the education sector in March 2014.

This type of project was 36% of the total value awarded, which was a 22% increase on March 2013.

State primary was the other major type of project accounting for 29% of total contracts value, a 5% increase on the corresponding month of 2013.

Downloads

ECMR April 2014

PDF, Size 0 kb

No comments yet