Cost pressures have hit new highs, creating a lag between initial project costs and the final tender price, so what’s to be done?

February’s UK Construction Purchasing Managers’ Index (PMI) reported last week that construction sector cost pressures are at an eight-and-a-half year high. As the UK construction sector moved out of recession the cost advantage of the often significant lag between initial project costing and tender created issues in a rising market for clients and building owners requiring cost certainty to finance projects.

The gap between the initial project cost and final tender price was driven by labour cost inflation, material and product price increases, and the very real need of all participants in the construction supply chain to gain back some margin. This gap was exacerbated by the longer time lag between initial project costing and final tender pricing.

This imbalance levelled out as the industry adjusted to a new normal, but we are now facing a similar challenge as we enter a stepped change in the global cost environment driven by currency and commodities.

Over the last few years, external and often global market shocks have led to materials shortages and price increases, which in turn have contributed to this tender price gap.

While steel prices are being moderated as much as possible by steelwork contractors, external factors mean they are too great to absorb, and must be passed on

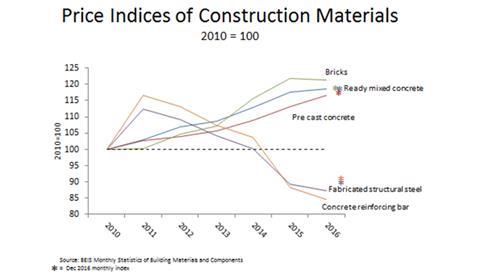

This can lead to variability across different sectors. For example, in 2014 and 2015, brick shortages driven by raw material shortages, under capacity and labour shortages led to sharp increases in brick prices. Over the same period, concrete prices also rose strongly, while fabricated steel prices fell.

More recently, global commodity price inflation in steel inputs such as iron ore, scrap and coking coal has driven increases in steel prices after over two years of historically low and unsustainable prices.

While steel prices are being moderated as much as possible by steelwork contractors, external factors mean they are too great to absorb, and must be passed on. Again, this is contributing to the tender price gap if cost consultants have not factored sufficient price inflation in, or the period between initial project costing and final tender pricing is too great.

The cost inflation currently being experienced by steelwork contractors is occurring across the board, with the Construction Products Association reporting recently that 75% of main contractors, 78% of heavy side manufacturers and 88% of light side manufacturers reported increased raw material costs in the last three months of 2016.

It must be noted though that the cost of the frame represents a small part of the total building cost. Cost analysis shows that the raw steel cost accounts for less than 5% of the total building cost for steel framed multi storey commercial buildings. This means that a 20% increase in the cost of raw steel will only increase the total building cost by around 1%.

So what can be done? First, engaging early and directly with subcontractors such as the steelwork contractor will shorten the gap between initial project costing and tender, and allows subcontractors to provide a forward view of pricing.

Cost consultants could cost on longer timescales, building in forecast data rather than benchmarking against historic norms.

Another consideration might be to consider fixed pricing, including a risk premium to account for inflation.

However it is achieved, reducing the tender price gap and providing more certainty in costing is dependent on changing the way the construction industry supply chain engages and contracts. This is the real area for debate, not short term price movements.

Sarah McCann-Bartlett, director general, British Constructional Steelwork Association (BCSA)

No comments yet