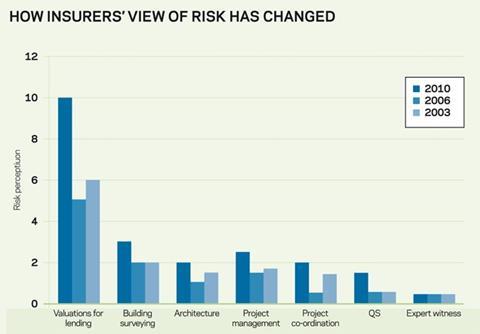

Quotes for professional indemnity insurance can vary by 300% between insurers, and cost up 25% of your fee. So you really need to understand how the market works …

Professional indemnity premiums are falling for many surveying firms (except those doing valuation surveys) but it’s important to understand which activities insurers perceive as high risk, as this affects the premium. It also helps you appreciate the steps that can be taken to mitigate risk, and it can assist with budgeting if you are considering diversifying into a new

business area.

Valuation surveys

Firms providing valuation surveys for lending purposes may pay up to 25% of their fees in PI premiums. This is a result of the steep rise in claims relating to valuations and a reduction in the number of insurers who will provide cover. Insurers are already handling a high volume of claims relating to residential valuations that originated with the more financially stable lenders, and there is uncertainty about the level yet to materialise in relation to commercial property and from sub-prime lenders. Until this dissipates it is reasonable to expect premiums to continue to rise.

Building surveying

Providing no valuation is involved, building surveying is perceived to be a medium risk activity, and cover is cheaper than for valuation surveys. Insurers’ pricing varies significantly, however. This could be because building surveying has, from an insurer’s viewpoint, encompassed a broad range of activities, from schedules of dilapidation to full structural surveys. Some proposal forms provide a limited opportunity to explain fee income from each activity, forcing insurers to apply a broad-brush approach to pricing. Consequentially it is important to ensure the proposal form fully explains the activities a firm undertakes and that a range of insurers are approached at renewal.

Architecture

There has been a noticeable increase in claims against architects, specifically those originating from fee disputes and relating to errors that, in a more buoyant market, would have been worked around. Meanwhile fee incomes have fallen, resulting in declining insurance premiums, and insurers’ earnings from architects have dropped significantly. Ordinarily this would result in a hardening insurance market and an increase in risk rating. However, the intense competition among brokers and insurers, and the willingness of both to reduce earnings to retain clients has prevented this occurring. How long this will last is difficult to predict.

Quantity surveying

This is traditionally considered low risk, but claims against quantity surveyors can run into millions of pounds on larger developments, so insurers’ perception will be affected by the size and sophistication of the projects involved.

Project management

Insurers’ key concerns relate to the fact that project managers are responsible for appointing all contractors and consultants. Consequentially any claim, regardless of fault, is channelled through the project manager, whose insurers subrogate against the party at fault. It is therefore vital that when assuming a project management role the insured undertakes due diligence before appointing any contractors. This should include financial checks and confirmation that appropriate levels of insurance are in place. The project manager should also ensure that all contractors take a committed approach to risk management; this can be complex given the divergent attitudes to risk across disciplines.

Quotes from insurers can vary by as much 300%. This means it’s important to approach a range of insurers on a regular basis; we recommend every three years. This will help to ensure premium remains competitive.

Employers agent

Whilst employers agent work is currently rated as low risk some insurers are conducting detailed reviews of employers agent work at renewal and this may lead to future increases in premium. Demand for employers agents has increased with the growing popularity of design and build contracts and there are concerns amongst insurers that some firms have moved into the area, seeing a growth opportunity, without fully understanding the scope of the appointment and the risks involved. Furthermore expectations vary between clients and in many cases the role of employers agent is barely distinguishable from that of either contract administrator, certifier or project manager all of which carry different risk ratings. Insurers will therefore want to develop a comprehensive understanding of the exact nature of the contracts and the scope of responsibility on each assignment.

Expert witness

In the currently litigious environment demand for expert witnesses has risen but it’s viewed by insurers as one of the lowest risk activities a firm can undertake. However, according to solicitors Beale and Company, there are concerns regarding the quality of expert evidence being relied upon by claimants. Whilst the likelihood of a claim being made against an expert witness is small John Henderson of Beale and Company advises “no-one should accept instructions to act as an expert witness without full consideration of their competence to fulfil the duties imposed on them by such a commission, and a full understanding of the extent and limitations of that role”.

Whilst this article provides a broad overview of risk perception, pricing within risk bands can vary considerably; where one insurer might charge 0.5% of fee income in premium for a specific activity another might charge 2%. This can lead to large differences between quotes, as much as 350% between lowest and highest price. Consequentially it’s important to ensure that a range of insurers; there are currently 40 RICS listed insurers; are approached on a regular basis; we recommend every three years. This will help to ensure that your premium remains competitive.

Emma Vigus is head of new business, Howden Professional Risks

No comments yet