Modular housing has so far failed to take off, despite its speed, quality and reliability. Alex Hyams of Turner & Townsend Alinea considers the pros and cons of volumetric construction and the barriers to widespread adoption, followed by a cost comparison between a traditional and modular residential tower

01 / Introduction

Historically, the modular housing sector has suffered from lack of consistent demand and a negative public perception. Both have contributed, over several decades, to a shortage of investment and sustained success for manufacturers with sound technologies.

While perceptions may have improved through the emergence of trade bodies promoting best practice in factory solutions, even Make UK Modular was quoted in a recent Sunday Times article as admitting “the sector is in the doldrums” – an article that cited the recent closure of Legal & General’s modular homes division as evidence of that sentiment.

Yet that piece also reiterated the inherent benefits of the modular approach: quality, speed and reliability. Given those attributes, the stark statistics of the UK’s housing need (300,000 units needed per year) and the construction skills shortage (266,000 more workers needed by 2026), surely the time has never been more right for the industrialisation of housebuilding?

This article will not recount the reasons for this state of affairs but rather shed light on companies and projects bucking the trend, offering proof that modular residential buildings can be delivered quickly and relatively competitively. It is supported by a cost comparison between a traditionally built versus a modular 47‑storey residential tower in central London.

It is hoped the findings will encourage the consideration of modular construction in the right circumstances and offer an antidote to perceived gloom in the sector.

02 / Dispelling the myths of volumetric

Although there has been a noticeable increase in the emphasis placed on maximising pre-manufactured value (PMV) in client briefs, the widespread acceptance and implementation of offsite construction, particularly in the form of volumetric solutions, has not been widely observed. Examining both the perceived and actual barriers should help reveal why some clients have yet to explore offsite and demonstrate the benefits that can be unlocked.

Cost

Despite the rhetoric of “faster, better, cheaper”, clients do not always experience capital cost savings when compared with traditional construction methods. The primary rationale so far for using volumetric has been improved programmes and the benefits this brings. Cost has generally either been misrepresented or misunderstood, and it is rarely clear whether it is stated as a capital cost saving or as a holistic project cost incorporating build, fees, borrowing costs and so on.

>>Also read: How big a blow is the closure of L&G’s flagship factory to the prospects of MMC?

>>Also read: Try it, learn, and try again’: the sandpit projects trialling ways to build faster and better

The widespread anecdotal view is that a higher capital cost is offset by an earlier return on investment (ROI), enabling overall lower expenditure for the project. While in certain circumstances we have seen this borne out, with several projects coming in at approximately 5%-10% over traditional offers, it is not the case for all building types – as the numbers in this article show. The crucial takeaway is that cost should not be seen as a barrier when certain conditions are met, and this can be further enhanced by having a predictable project pipeline. For a more detailed analysis of traditional versus volumetric costs, see the table overleaf.

Quality and public perception

Public perception is a bit of a red herring. The public are rarely the direct purchaser in construction – though they are of the final housing product – so they have limited bearing on the uptake of volumetric housebuilding. A growing consciousness around sustainability and a more educated and expectant market should dispel any lingering negative public views of volumetric as a barrier to increased delivery – provided messages around quality are effectively communicated.

Given the bulk of the work is shifted to controllable factory conditions with the disciplined approach that is evident in manufacturing, the quality is consistent and repeatable. This extends beyond the initial handover condition and should result in far fewer defects – the evidence of this is already available.

Design flexibility

Although the dimensions of volumetric modules are limited by transportation constraints, which affects the span of internal columns and walls, the design of residential schemes is generally not compromised. In the case of tenures such as student accommodation, co-living and build to rent, volumetric construction provides design options on a par with traditional methods for both internal and external elements.

Facade design is a key aspect where volumetric construction can offer comparable solutions. Late change is obviously more difficult to absorb, but to a large extent this is disruptive and costly whatever the delivery method. The greater disruption in a prefabricated approach should encourage more discipline to make early (and robust) decisions.

03 / Barriers to widespread adoption

Despite the myth-busting evidence that exists, there remain a few fundamental blockers to more widespread adoption of a volumetric approach.

Competition

Lack of competition in the volumetric construction sector for projects over £50m was highlighted in our 2018 article. Five years on, there is still room for improvement, with the demise of Caledonian and L&G’s modular factory closure keeping sector growth in check. One key reason is the difficulty in securing a substantial pipeline of projects that would justify the overhead costs of operating a modular factory and ensuring profitability. This is precisely why we believed that housebuilders like Berkeley Homes, which have access to sites and a consistent pipeline of projects, would be well positioned to adopt volumetric construction methods. On a more positive note, Elements Europe, backed by South Korean investment, is starting to emerge as a serious residential supply chain partner and JRL’s purchase of Caledonian should hopefully see it re-enter the volumetric market soon.

Procurement

The absence of sufficient competition in the volumetric construction sector creates procurement challenges for both clients and investors. When searching for alternatives or a Plan B, they often find themselves limited to negotiating with just one or two players. As a vertically integrated business that self-delivers many of its projects, Tide Construction has found a solution to this by gaining credibility and surety through consistent delivery. It has established longstanding partnerships with many institutional clients and investors through repeat transactions. Clients are happy to forgo competition where sustainability, certainty of programme and high quality are delivered.

This route will not be palatable or possible for all, especially where certain funding constraints are in place. However, greater standardisation and the ability for systems to interplay should help to ease concerns around procurement moving forward. Those clients looking to adopt volumetric in the future need to proceed cautiously and carry out their own due diligence before selecting the right supply chain partner.

Below we look at some of the benefits of Tide Construction’s volumetric approach with its offsite company Vision Modular Systems, and would like to thank them for their assistance in the volumetric costing model for this article.

04 / Tide and Vision’s approach to volumetric housing construction

Planning, delivery and quality:

- Tide and Vision work within a vertically integrated procurement model that allows full control of the development process. As a result, the construction programme is less susceptible to risks and delays.

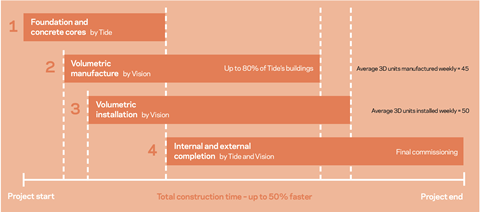

- The efficiency of the volumetric approach cuts construction times by up to 50%.

- Vision’s 3D units are factory manufactured, which improves quality and reduces defects.

- The Vision system gives design flexibility to architectural teams working on projects.

Site and factory advantages:

- This construction methodology reduces disruption to local communities.

- On average there is an 80% reduction in construction deliveries to site.

- Factory assembly offers a safer, more comfortable working environment and reduces the number of site workers.

Environmental impact:

- Three independent embodied carbon studies found three buildings delivered by Tide and manufactured by Vision had embodied carbon values significantly lower than the industry standards set by RIBA and LETI. One building delivered in 2020 exceeded the RIBA 2030 and LETI embodied carbon targets.

- This construction approach reduces on-site waste, with 99% factory waste recycled or used for energy recovery.

- Vision’s volumetric units are made with steel and reinforced concrete, guaranteeing longevity of the units. In theory the modules could be deconstructed and then repurposed at the end of a building’s life stage.

Financial viability:

- Halving construction times means investors get an earlier return on their investments, with an improved rate of return.

- Tide and Vision’s buildings are fully fundable, mortgageable and insurable.

- Faster delivery speeds up regeneration, helping unlock financial viability of constrained sites.

Tide and Vision

Tide is a developer and contractor specialising in both traditional and volumetric construction. Its 3D volumetric company, Vision, produces modules suitable for housing, build-to-rent, co-living, student accommodation and hotels.

Tide and Vision work within a vertically integrated procurement model and are committed to driving forward the modernisation and decarbonisation of the construction industry. Together they have delivered seven of the world’s 10 tallest modular buildings, including the world’s tallest, Ten Degrees, in Croydon. Tide is on site with 3,500 homes, with many more in the pipeline.

Both companies hold five Awards of Excellence from the Council on Tall Buildings and Urban Habitat.

05 / Traditional versus volumetric

The table below sets out key differences between a traditionally built tower (elemental costs opposite) and volumetric pricing levels for the scheme.

We have had to normalise where certain traditional package costs sit against a volumetric breakdown, and these are noted within the table. This makes package or elemental detailed analysis more difficult, but certainly when viewed holistically there is very little uplift to adopt volumetric. As a high-level summary, the net trade cost of volumetric is slightly higher – as you might expect, given the risk margins built into the module manufacture. This, however, is balanced out by large savings in preliminaries (based on a much shorter programme) and a lower fixed-price design risk, attributed to a known quantity in the module build-up.

On reviewing the programmes, the reported savings promoted by volumetric providers are validated. Particularly when the project reaches the ground-floor slab level (which is the same for both approaches), the advantages of volumetric construction become evident. A remarkable improvement of 44% in this programme duration is achieved. This is especially beneficial for student accommodation, where meeting term-time deadlines is crucial as it can enable an entire year of revenue generation.

Furthermore, when building at height, the volumetric efficiency provides the possibility of adding extra floorplates within the overall massing, without compromising the floor-to-ceiling height.

| Packages | Traditional vs volumetric | Narrative |

|---|---|---|

| Substructure and frame | +8.0% | Traditional costs are higher, based on some of the following variables: traditional approach requires reinforced concrete columns whereas in volumetric the modules take the load and provide stability; volumetric requires thicker transfer slab, which adds costs over traditional methods; different subcontractor supply chain; tendering tolerances |

| Facade and roof finished | -1.9% | Minor variations, based on: assumed traditional split between base facade chassis costs (moved to modules) and remaining unitised facade elements; different subcontractor supply chain; tendering tolerances |

| Internal communal finishes | +15.9% | Traditional costs are higher, based on: different subcontractor supply chain; tendering tolerances |

| Shell, MEP, lifts and BWIC | +2.1% | Minor variations, based on: different subcontractor supply chain; tendering tolerances |

| Modules | -13.9% | Equivalent traditional cost for modules includes for: upper floors; internal walls, doors and finishes (fit-out); fit‑out MEP; FF&E fit-out; demise and corridor walls; glazing and base unitised facade system Traditional cost remains much lower due to volumetric module costs having to carry factory running costs, risk, profit margins and the like |

| Net trade subtotal | -6.7% | |

| Main contractor items | +34.1% | Traditional costs are higher, based on: higher prelims costs due to longer programme (40% faster with volumetric); volumetric fixed-price risk much lower, as developed design inherent in modules and risk/margin held in module cost section. OH&P same for both options, at 5% |

| Overall | -0.4% |

06 / Conclusions

The focus of this article is on urban residential delivery, given the existential need for its supply challenges to be addressed. It would, however, be wrong not to acknowledge the success stories in other sectors such as healthcare, hotels and schools, where the likes of Premier Modular and Reds10 are delivering all the purported benefits to a pipeline of satisfied clients. Furthermore, in lower-rise housing delivery both Ilke Homes and Top Hat are examples of positive MMC delivery.

The conclusions from this piece of research are encouraging, and provide reasons to be optimistic about the future of the sector. Looking at pure capital costs, the variance between traditional and volumetric in this case study is less than 1%, which is well within a normal tendering tolerance.

In the right circumstances, cost alone should not present a barrier to offsite delivery. From the perspective of construction programme, the benefits of modular have always been acknowledged but, again, evidence of such huge time savings (up to 50%) helps to reinforce the offer.

The combination of a large and secure time saving (provided necessary decisions are made early and with efficacy) and a small capital cost premium, alongside certain sustainability benefits and resource efficiencies, should provide a compelling case for volumetric construction.

Of course not all schemes will lend themselves to volumetric, and like any other method it must not be seen as the silver bullet to project success. However, it should sit alongside traditional methods and other forms of MMC as a credible alternative. It is hoped that research will contribute to expanding knowledge that is disseminated across the industry, instilling confidence and attracting further investment in offsite construction.

Arguably, this investment should focus less on grants for equipment and research and more on removing barriers to project pipelines. This can be achieved through improved access to sites, planning incentives, and strategic initiatives that promote the use of volumetric construction. With this kind of support and greater understanding, there is every chance that the plateau of productivity could be reached.

07 / About the cost table

The elemental cost table below is based on a 47-storey tower with two basement levels in central London, providing 954 student bedrooms in a mixture of clusters and individual studios, plus amenity spaces including a gym, private dining space, shared study areas and a cinema.

The ratio of studio to cluster rooms is 49:51. Bathroom (pods) are one per room. Fixed furniture includes kitchens with unbranded quartz worktop with branded appliances. Beds, wardrobes, fixed shelving and desks are all included; loose furniture is excluded. The key scope for MEP services in rooms is electric panel heaters, LED lighting, small power and data.

Exclusions include fees, VAT, demolitions, site clearance, external works, incoming utilities, section 106/278 payments, carbon offset payments. All rates are based on Q2 2023.

Total gross internal area is 34,222m2 and the student bedroom net internal area is 19,392m2 (excluding amenity 1,255m² and retail 147m²).

08 / Elemental costs for a traditionally built 47-storey residential tower

| Element cost (£) | Cost/m² GIA (£) | % total cost | |

|---|---|---|---|

| SHELL WORKS |

101,010,000 | 2,952 | 75.0 |

| Substructure | 7,739,000 | 226 | 5.7 |

| Site clearance, excavation, temporary works, secant piled wall, CFA bearing piles and ground-bearing raft slab | |||

| Frame | 7,665,400 | 224 | 5.7 |

| Varying thicknesses of core and shear walls and reinforced concrete columns; incl tower cranes | |||

| Upper floors | 6,453,500 | 189 | 4.8 |

| Reinforced concrete slabs, movement joints, self-levelling screed and sundry items | |||

| Roof | 1,138,750 | 33 | 0.8 |

| Reinforced concrete slab, waterproofing and insulation, terraces finishes and BMU | |||

| Stairs | 930,000 | 27 | 0.7 |

| Precast stairs, inclusive of handrails; inclfeature stair at ground floor | |||

| External walls, windows and doors | 20,105,100 | 587 | 14.8 |

| Triple-glazed unitised facade with back-painted glass spandrel as primary system, stick frame system to lower levels and triple-glazing to crown with perforated insulated panels | |||

| Internal walls and partitions | 5,739,000 | 168 | 4.2 |

| Blockwork walls, riser partitions, corridor and demise partitions of varying thicknesses and acoustic performance | |||

| Internal doors | 2,431,000 | 71 | 1.8 |

| Student room entrance doors and access control, plus internal plant, back-of-house, riser doors throughout; incl ironmongery | |||

| Internal finishes | 1,641,000 | 48 | 1.2 |

| Regupol acoustic layer throughout; circulation areas to have painted walls with carpeted floor finish and painted plasterboard ceiling; feature finishes to lift lobbies | |||

| Fittings, furnishings and equipment | 899,800 | 26 | 0.7 |

| Postboxes, signage, refuse chute and cleaner cupboards | |||

| Mechanical, electrical and plumbing | 20,623,000 | 603 | 15.2 |

| Air-source heat pump as primary heat source, central ambient loop for distribution to on-floor water-source heat pump; commercial sprinkler for basement and ground (upper levels use BCW system); mechanical ventilation to landlord,back-of-house and plant rooms incl mechanical smoke extract; shared stacks to ensure soil vent pipe efficiencies; low-voltage distribution incl switchgear and distribution; no gas to scheme | |||

| Lift installations | 4,290,000 | 125 | 3.2 |

| 13- to 17-person passenger/evacuation lifts, 5m/s, serving basement to level 46 | |||

| Builder’s work in connection with services | 1,250,000 | 37 | 0.9 |

| Incl fire stopping | |||

| On costs | 20,100,984 | 587 | 14.8 |

| Preliminaries (16%), OH&P (5%) and contractor’s fixed-price risk (2.5%) | |||

| FIT-OUT WORKS |

34,530,000 | 1,009 | 25.0 |

| To student bedrooms, studios, clusters | 26,550,000 | 776 | 19.6 |

| Metal stud partitions; paint finish to walls; linoleum floors; painted plasterboard ceiling; kitchens with units, worktops, appliances; steel-framed bathroom pods; fixed joinery; MEP incl shared mechanical ventilation with heat recovery, electrical panel heating, lighting, small power and data; incl on costs | |||

| To shared areas for cluster rooms | 4,615,000 | 135 | 3.4 |

| Including kitchen/lounge/dining areas | |||

| To amenity areas | 3,365,000 | 98 | 2.4 |

| Including reception, private dining, management, lounge, gym club rooms | |||

| Total cost | 135,540,000 | 3,961 | 100.0 |

2 Readers' comments