Construction takes an unexpected drop - its first year-on-year fall since May 2013 - but the wider UK economy makes a strong start to 2015. Michael Dall presents highlights of Barbour ABI’s latest monthly Economic & Construction Market Review

Economic context

Economic data and business sentiment suggest a good start to the year for the UK economy with inflation and unemployment continuing to fall.

Sentiment surveys indicate the UK economy has had a strong start to 2015, with Markit’s all-sector PMI survey showing an increase in activity in January and February and predicting robust performance in the first quarter.

While the service sector, the single largest sector in the economy, appears to have had a slower start to the year, both manufacturing and construction have grown quickly. The Construction PMI recorded a reading of 60.1 in February, an increase from 59.1 in January and well above the 50.0 mark, which indicates expansion.

The latest inflation figures show further falls, with most analysts believing this is serving to boost spending within the economy. CPI fell to 0% in February compared with the same month in 2014, and is largely attributable to falls in prices of food and oil. It is expected that this will fall further in the coming months as supermarket price wars continue and the price of oil remains well below its long-term average.

The labour market continued its strong performance with the latest unemployment figures showing that the current claimant count rate fell to 5.7% at the end of 2014. This shows the continual improvement in labour market conditions in recent months and this looks set to continue as the economy continues to grow.

Other news on the UK economy includes:

- The UK’s trade deficit fell to its lowest level in 14 years, registering at £4.4bn in the three months to January, the smallest since October 2000

- A report from the manufacturers’ organisation EEF suggested manufacturing exports picked up in February with companies reporting orders increased for the first time in nine months

- The governor of the Bank of England, Mark Carney, cited property prices as the biggest threat to the UK’s economic growth in the medium term.

While the UK economy slowed towards the end of 2014, the majority of surveys and data point to a strong start to 2015. Growth remains driven by consumption and, despite recent improvements, export levels and business investment remain particularly weak. The fall in oil price is expected to provide a demand side boost to the UK economy, to offset any loss in government revenues, but the Bank of England will keep a close eye on inflation with the prospect of deflation now seeming possible. While output is growing and unemployment falling there are still a number of fundamentals that pose longer-term problems for the economy, particularly lower productivity and slow wage growth, which will provide a drag on performance unless the rate of growth increases considerably.

The growth patterns within the industry are reliant on private housing and broader improvements are needed to ensure a robust recovery

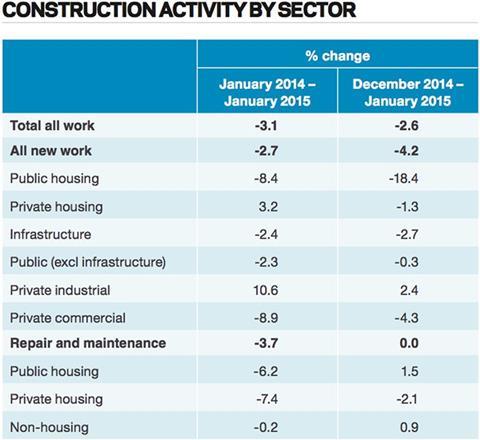

The latest figures from the ONS show that the construction sector in the UK declined by 2.6% between December and January. Comparing January output levels with the same period in 2014 shows a decrease of 3.1%, the first year-on-year fall since May 2013. This fall was unexpected but it should be noted that the monthly figures for construction output are often volatile.

It is clear the main reason for the fall this month was the reduction in commercial activity, which declined by 8.9% compared with January 2014 and 4.3% compared with December 2014 (see Construction Activity by Sector). Commercial, along with private housing and infrastructure, are the largest sectors within the industry. New private housing increased by 3.2% from January 2014 but was down by 1.3% compared with December 2014. Public housing output declined by 8.4% compared with January 2014 and 18.4% compared with December 2014, though this is a significantly smaller sector than private housing. This highlights that the growth patterns within the industry are reliant on private housing and broader improvements are needed to ensure a robust recovery.

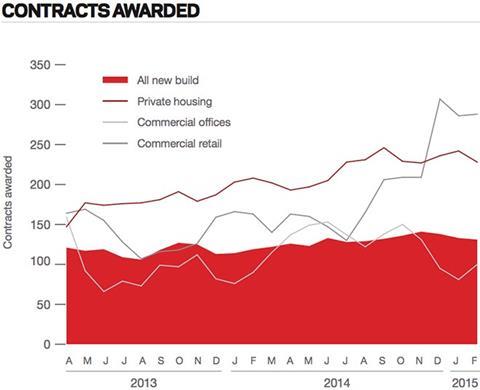

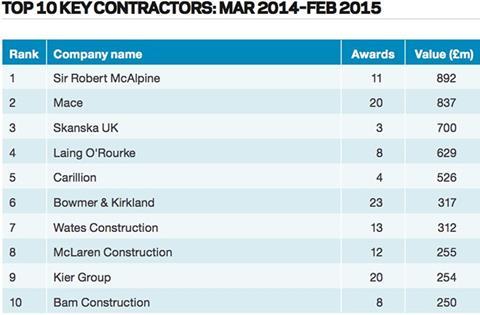

The CPA/Barbour ABI Index, which measures the level of contracts awarded using January 2010 as its base month, recorded a reading of 131 for February (see Contracts awarded). This is a slight decrease from last month and continues to support the view that overall activity in the industry remains strong. The readings for private housing were down slightly in the month, while both commercial offices and commercial retail increased. This indicates that the pipeline of work in the private sector remains strong.

The construction sector

According to Barbour ABI data on all contract activity, February witnessed an increase in construction levels with the value of new contracts awarded at £5.8bn, based on a three-month rolling average. This is a 4.9% increase from January and a 20.2% increase on the value recorded in February 2014. The number of construction projects within the UK in February decreased by 14.3% on January, and were 2.5% lower than February 2014.

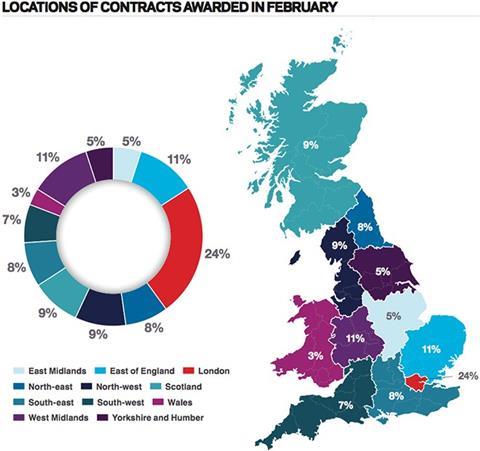

Projects by region

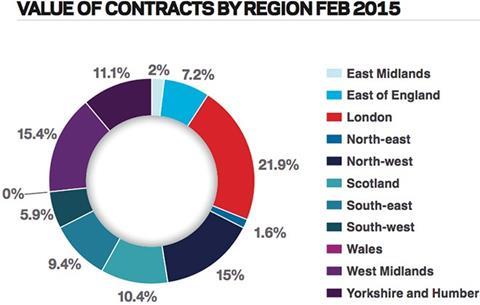

The majority of the contracts awarded in February by value were in London, accounting for 24% of the UK total (see Locations of contracts awarded). This is followed by the

West Midlands and the East of England with 11% of contract award value each. The main reasons for London’s figures this month were two residential schemes awarded at Nine

Elms and Blackhorse Lane.

Type of projects

Residential had the highest proportion of contracts awarded by value in February with 27% of the total. The commercial sector was close behind with 26%. This is an indication of the continuing strength of the residential sector within construction, showing that while the top end of the residential market appears to be cooling, activity in the new-build market remains strong. The prominence of the commercial sector contracts in February provides encouragement for longer-term growth in the industry, as the commercial sector is historically the biggest sector within construction.

Construction performance by sector: Spotlight on commercial & retail

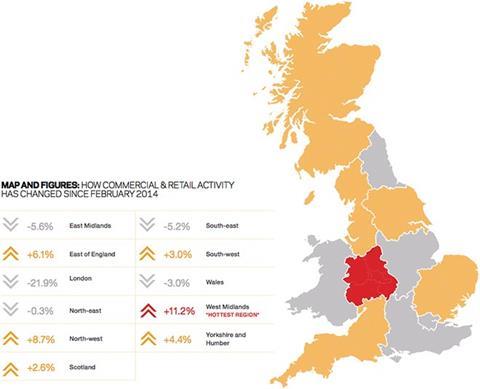

The value of contracts awarded in the commercial and retail sector was £881m in February based on a three month rolling average. This is a 7.1% increase from January and a 32.7% increase from the February 2014 figure. In the three months to February the value of contracts was 23.4% below the previous three months but 29.6% higher than the same period in 2014, indicating longer term increasing activity in the sector.

London was the main location of activity in the sector this month accounting for 21.9% of the value of all contracts awarded, which was 21.9% lower than February 2014. The North-west also attracted a high proportion of commercial contracts this month, with 15% of the value of contracts occurring in the region in February. Examples of projects awarded this month include the contract at Edge Lane Retail Park in Liverpool which has a value £15m.

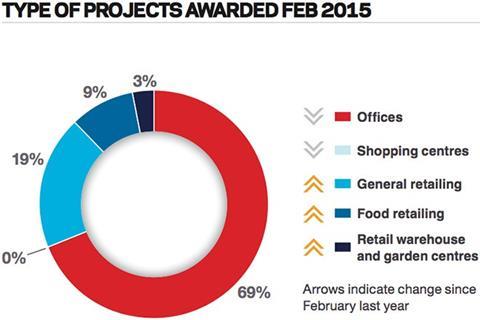

Offices were the dominant type of project in the sector accounting for 69% of the value of contracts awarded this month, which is 2% lower than February 2014. Food retailing is the other significant sector with 19% of contract award value, which was a 4% increase from the February 2014 figure.

Click here for the full Economic & Construction Market Review >>

Downloads

ECMR March 2015

PDF, Size 0 kb

No comments yet