Construction output looks set to fall by 5% in 2012 as new work dries up and the UK, like the rest of Europe, slips back into recession. Peter Fordham of Davis Langdon, an AECOM company, reports

01 / EXECUTIVE SUMMARY

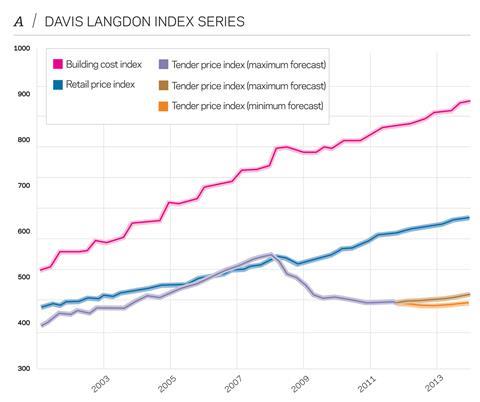

Tender price index

Tender prices have moved little all year but may have slipped backwards slightly in the last quarter as prospects for 2012 deteriorated. The outlook remains gloomy except for those in the infrastructure sector.

Building cost index

Building costs rose 3.8% over the year to the fourth quarter 2011 as materials prices continued to be a concern. Materials prices are expected to be more subdued in 2012 but the input of labour costs is expected to result in overall inflation of around 3%.

Retail prices index

Retail price inflation eased to 4.8% in December. Annual percentage inflation for the retail prices index and the consumer prices index are expected to fall sharply as the VAT increase falls out in January, utilities prices ease and the price of imported goods drops.

02 / TRENDS AND FORECAST

What are this year’s prospects for the industry? Even without the most recent credit rating downgrades, Europe seemed to be heading into recession. Germany’s economy contracted in the fourth quarter of 2011 and France probably flat-lined. The latest forecasts suggest that Britain is already in recession. The Ernst & Young Item Club estimates that growth in 2012 will be 0.2%, with business investment stagnated. The Centre for Economics and Business Research is even gloomier, forecasting a shrinkage of 0.4% this year, followed by growth of just 0.1% in 2013 and a mere 1% in 2014, even if the eurozone remains intact. Interest rates are widely expected to remain at 0.5% until 2016.

Forecasts suggest that new construction output will fall by at least 5% this year. Since the Construction Products Association (CPA) and Experian formulated their latest forecasts before Christmas, economic conditions have probably taken a further turn for the worse. There remains a strong pipeline of private commercial work in London (but not beyond), programmed to start during 2012, but developers are once again getting nervous and perhaps holding back from pressing the start button. Occupier demand is falling. Banks are embarking on more redundancies. Rental expectations have fallen. There may still be an increase in activity in London this year, but less than seemed likely this time last year.

In retail, John Lewis and Sainsbury’s reported a bumper Christmas but most other retailers are finding life hard. Tesco suffered a surprising fall in sales, prompting its share price to drop by 16%. In consequence, the chief executive has said that, instead of continuing its large store building programme, Tesco intends to concentrate on refurbishing its existing stock.

House prices in 2011 ended slightly down and, although there may not be a consensus for the trend in 2012, many believe it will be worse than 2011. The Bank of England believes mortgages will become even harder to obtain. Housebuilding did pick up in the middle of last year and housebuilders report a slow but stable market. With government help for first-time buyers, there may be a slight increase in housing starts this year.

Social housing activity increased in 2010 and has been fairly stable since, but a significant reduction is expected in 2012 as public funding is slashed. Following something of a hiatus in the first half of this year, there may be a surge in activity towards the end of the year and into 2013 as housing associations compete to spend their grant allocations. With fewer contractors in the market, this may be one area where price rises may be seen later in the year.

Meanwhile, infrastructure may be the only show in town that is really looking up (see Hot Topic, below), but this will only be of benefit to specialist contractors and those that have consciously tried to reposition themselves over the last few years.

There remains a huge amount of surplus capacity in the industry, which is why prices have not moved upwards even when workload picked up last year. But with an even poorer outlook for 2012, contractors are reluctantly laying off directly employed staff. Those contractors fortunate enough to have full order books currently are reluctant to expand given the near-term prospects.

Faced with rising materials costs last year, firms were only able to hold prices by further cutting labour costs. Costs included in preliminaries were trimmed again when possible. Management staff have been spread wider, often across more than one project. Some preliminaries costs are now expected to be provided by subcontractors - where plant is owned, its cost may not be recovered.

The outlook for prices over the year ahead is benign. Contractors may have to absorb fewer materials price increases, as a weak global economy exerts less pressure on commodity prices. A stronger pound will also make imported materials cheaper. In London, construction prices will probably continue to flat-line but elsewhere prices may well be forced down a further 1-2%. In 2013 no significant increase in activity is forecast but contractors will try to improve margins wherever they can. If the global economy improves, commodity price rises could re-occur. It may be prudent to allow price rises of around 2% in London and 1% elsewhere.

03 / HOT TOPIC: INFRASTRUCTURE

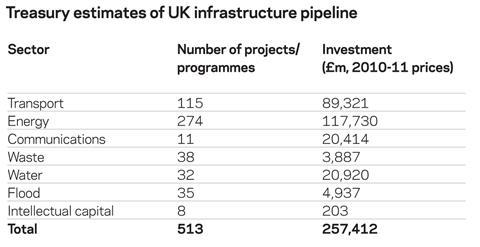

015 is to be privately funded, and therein may lie the proviso. The main vehicle for funding is the planned use of UK pension funds. With little experience of such funding and with little appetite for risk, it remains to be seen how realistic this ambition is.

Most projects in the pipeline relate to energy and transport (see table below). Energy projects include the National Grid’s £20bn programme for gas and electricity transmission infrastructure between now and 2021.

The Autumn Statement gave an immediate go-ahead to 35 road and rail schemes. Several of these had already received formal backing but are nevertheless being accelerated. These include the Tyne and Wear Metro and a new crossing of the Lower Thames. Transport spending will progressively shift from road to rail with the Highways Agency’s capital programme almost halving between 2010-11 and 2013-14. On airports, BAA is expected to spend over £16bn at Heathrow over the next 10 years, including at least £1bn this year.

In spite of doubts over the scale and timing of future private sector funding, infrastructure spending looks set to continue to grow. Both the Construction Products Association and Experian build strong growth figures from the sector into their winter forecasts. The CPA expects a 90% rise in rail construction spending over the next four years and a threefold rise in energy as nuclear new-build begins in earnest in 2013. Spending rises are expected to be only slight in 2012 (1-1.6%), but will accelerate thereafter.

The Scottish government has announced its intention to use capital investment to build its way out of recession, and has committed to the Forth Replacement Crossing, described as the largest civil engineering project in Scotland in a generation. It has also announced its wish to invest in high-speed rail so long as HS2

is extended further North. Scotland is moving ahead with Tax Incremental Financing, which enables local authorities to fund infrastructure projects by borrowing against future business rates.

04 / CONSTRUCTION OUTPUT AND NEW ORDERS

Construction output as measured by the Office for National Statistics held up unexpectedly well in 2011. In fact total output up to November (the latest month for which data is available) was actually 2.5% higher in real terms than during the equivalent period of 2010. This was after the figures indicated that output in 2010 rebounded strongly after the collapse that occurred in 2008/9, as government brought forward spending plans on infrastructure and public non-housing work. Output in the latter sector declined by 5% in 2011 but infrastructure grew by almost 11% and private housing by 8%.

But these strong figures are not expected to be maintained. Last year saw a sharp fall in orders (before a mini rally in the third quarter brought some relief to the ominous trend).

The decline will lead inevitably to a reduction of work on site next year.

The Construction Products Association and Experian are almost as one in predicting a drop in new work output this year, of 6.5% and 6.9% respectively. Experian is marginally more optimistic in predicting a 1.3% increase in 2013 while the CPA does not see an increase before 2014.

Both organisations now pencil in an even more substantial drop in public non-residential work this year (-24% and -30% respectively) than they did three months ago and take a more pessimistic view of the prospects for private industrial work given the deterioration in the eurozone and the UK economy.

05 / BUILDING COST INDEX

The building cost index rose by 0.4% in the fourth quarter 2011 and is 3.8% higher over the year.

| Actual | Forecast | |

|---|---|---|

| 4Q10-4Q11 | 4Q11-4Q12 | |

| Labour | +1.9% | +3.3% |

| Materials | +6.8% | +3.0% |

Labour

Building and civil engineering operatives secured a 1.5% wage increase from 5 September and will be looking for a further rise from their normal anniversary date at the end of June. September’s rise may have been the first for three years but, with further reductions in workload anticipated this year, any increase is unlikely to be greater than last year’s.

January normally heralds wage rises for plumbers, electricians and steel erectors. Plumbers benefited from an agreement made in October 2010 and received a 3% wage increase from 2 January. But electricians and steel erectors look set for a wage freeze.

Employers of all operatives will nevertheless have to endure a significant extra cost this year. From November all holiday pay will be subject to National Insurance contributions, as the government withdraws the concession for holiday pay schemes that has operated since the 1960s.

Materials

Construction materials prices are up nearly 7% over the year. For non-housing new work, the annual figure has remained above 7% all year. The deflationary figures of 2009 are a distant memory for contractors having to contend with fierce competition and rising input costs. At the beginning of 2011, manufacturers were hit with sharply rising steel prices which fed their way into construction products such as ducting, partition components and cladding, as well as structural steelwork and reinforcing bars. However, most of the increases occurred in the first half of the year and materials prices have been fairly flat since summer.

Fabricated steel prices rose 14% in the first five months of 2011 as the Australian floods caused a shortage of raw materials, pushing up prices which steel producers were partly successful in passing on. But prices have since drifted down as world steel prices have reflected subdued demand. Reinforcement prices rose 19% last year and only started to fall back in the last quarter.

Rising steel prices were a feature of the construction industry in 2004, 2006, 2007, 2008, 2010 and 2011 in large part due to China’s rapid industrialisation and its effect on the supply and price of raw steel making materials. However, no spike in prices is expected in 2012 as China has taken steps to cool its economy. Prices for iron ore, scrap and coal all seem relatively stable. Demand remains subdued. There is some talk of rising scrap prices, which impacts reinforcement rather than structural steel prices in the UK, but there was little sign of it at the end of the year, when scrap prices ended up 10-15% lower than when the year started. Some moderate price inflation may occur in the first half of the year as restocking occurs but year-end prices are expected to be little higher than now.

Having remained stubbornly weak for much of 2011, the value of the pound against the euro grew strongly in the last two months of 2011 to finish the year 10% above its low point last July. Given that approaching £12bn of construction materials and components were imported last year (about 25% of all materials used) and most come from the eurozone, a stronger pound, if maintained, will make materials cheaper over the year ahead. Most commentators expect the pound to strengthen further against the euro so long as the eurozone crisis remains unresolved and following the credit downgrading of so many European countries.

The danger for materials prices and the wider economy is oil prices. Talk of sanctions against Iran and possible repercussions involving the closure of the Strait of Hormuz, through which one-sixth of the world’s oil supply passes, have already made oil markets nervous, and caused prices to jump $6 a barrel overnight at the beginning of January. Closure of the strait could easily push prices up by $50 or more a barrel very quickly. However, it should be noted that prices did not continue to climb, as the threat perhaps did not seem imminent. More relevant now seems to be pressure in the other direction as Standard & Poor’s downgrading of France, Austria and other European nations caused markets to price in an even greater chance of recession in Europe and lower demand for oil.

No comments yet