Costing Steelwork is a series from Aecom, BCSA and Steel for Life that provides guidance on costing structural steelwork. This quarter provides a market update and a review of CE/UKCA requirements

Click here to read the full costing report

Construction new work output fell by 7.5% on a yearly basis to November 2023. Repair and maintenance output rose by 14% across the same period. Combined, the resulting all work output measure increased by 0.9%. Repair and maintenance activity therefore continues to support the industry’s momentum and help keep total output levels respectable. Annualising the most recent output data highlights the weakness in construction new work output trends yet strength in repair and maintenance work. Similarly, the industry’s sub-sector data reveals a widening gap in the respective rates of change. The substantial fall in recorded private housebuilding volume compared with 12 months ago is having a notable effect on overall output data and will continue to influence this measure throughout 2024. Private commercial was the only sector of significant size that expanded over the year, although this was not enough to offset the falls elsewhere across the sub-sectors.

Construction sentiment indicators wilted over Q3 2023, as the enduring collection of broad and specific issues afflicting the economy eventually caught up with the construction sector. The prevailing mood up to the mid-point of the year was reasonably positive, as the construction sector continued to offer good activity levels. However, until inflation falls notably further and the bank base rate is eased, the effects of these two significant factors will weigh on construction demand.

The Office for National Statistics’ latest GDP data release confirms the subdued economic backdrop. The cooler temperatures elsewhere in the economy have caught up with the construction sector, which is beginning to slow its activity and new work output. In the short term, when the business environment is subdued, capital expenditure and investment can be dialled down as a tactical response to secure current profitability and margins. Critically for the construction industry, this has flow-through effects on workload – especially when the same approach is multiplied up across the whole economy. An observably lower level of current construction new orders and project starts is the response to these broader trends in the economy and will influence overall output levels this year.

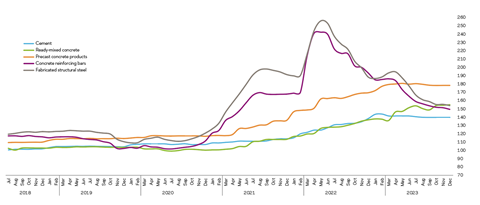

Aecom’s building cost index – a composite measure of materials and labour costs – increased at an annual rate of 1.7% up to November 2023. Cost trends for materials in the basket of items comprising the index currently separate into two broad groupings. Approximately one-third of the index’s categories are deflationary, which are mainly metals, timber and some plastics items. The metals-based materials exhibit the strongest deflationary trends, of around -20% in some cases. A larger grouping of the basket of items have settled at a steadier trend between 1% and 7% on a year-to-year change basis. In other words, this larger collection of items is still increasing in cost when compared with the same period 12 months prior.

Looking at the two main components of the index – materials and labour – a clear divergence remains in play. A steadier, lower overall range of materials inflation is offset by the stronger and higher rate of inflation for workforce wages. The latest aggregate measure of construction labour rates is broadly 4%‑5% yearly change. More generally, average weekly earnings across the whole economy also rose strongly at somewhere in the region of 7%. Earnings and wage inflation will act as the largest current factor influencing general inflation rates over the next two quarters. Furthermore, this has related impacts on how long interest rates remain elevated.

Input cost trends across almost all building elements are slowing. Current exceptions are trades towards the end of typical construction project sequencing. Construction projects started as part of the sizeable post-pandemic output bounce are now towards their later stages. Supply and demand dynamics for these trades – finishes, for example – are likely interacting to propel the associated input costs. Conversely, a sizeable number of trades at earlier and middle parts of construction sequencing are seeing slowing rates of input cost inflation, although they are still higher over the year. The same is broadly true of trade tender pricing, although some trades are seeing deflationary price trends. Nevertheless, slower pricing trends are clearly evident, as they respond to patchier new work data.

Overall tender price inflation trends continued to slow over Q3 2023, advancing a change that started in the early part of 2023. Aecom’s tender price inflation index provisionally recorded a 6.2% change from Q3 2022 to Q3 2023. Prices are therefore still higher over the 12-month period, as a result of output momentum, input cost inflation and market capacity constraints. However, price inflation rates of change have peaked and will continue to slow out of 2023 and into 2024.

Aecom’s baseline forecast for tender prices is a 2% increase from Q4 2023 to Q4 2024, and a 3% increase from Q4 2024 to Q4 2025. The balance of risks to tender price forecasts is now marginally to the downside over the first 12-month forecast period, and broadly even in the following period. Total construction industry new work output will continue to slow over the first half of 2024. However, there is still pressure from workforce wage inflation, and this relative strength in wage inflation is expected to continue for some time yet. The fact that wages are rising in real terms is reassuring, but these underlying inflationary wage and salary pressures add a significant component to the upside pressures on tender prices. Longstanding difficulties securing labour resource are easing somewhat across the construction sector as output slows, and this will alleviate a little of the upward pressure on wage inflation. A commercial squeeze is on again, though, as market competition increases and new orders become patchier.

Figure 1: Material price trends

Price indices of construction materials 2015=100. Source: DBEIS

Figure 2: Tender price inflation, Aecom Tender Price Index, 2015=100

| Forecast* | |||||||

|---|---|---|---|---|---|---|---|

|

Quarter |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

|

1 |

120.4 |

120.0 |

131.2 |

145.3 |

147.4 |

152.4 |

157.1 |

|

2 |

121.0 |

122.6 |

134.5 |

146.6 |

148.6 |

153.6 |

158.6 |

|

3 |

119.1 |

125.3 |

138.1 |

146.8 |

149.9 |

154.8 |

160.1 |

|

4 |

119.1 |

127.5 |

142.3 |

146.8 |

151.2 |

155.7 |

161.6 |

Sourcing cost information

Cost information is generally derived from a variety of sources, including similar projects, market testing and benchmarking. Due to the mix of source information it is important to establish relevance, which is paramount when comparing buildings in size, form and complexity.

Figure 2 represents the costs associated with the structural framing of a building, with a BCIS location factor of 100 expressed as a cost/m² on GIFA. The range of costs represents variances in the key cost drivers. If a building’s frame cost sits outside these ranges, this should act as a prompt to interrogate the design and determine the contributing factors.

The location of a project is a key factor in price determination, and indices are available to enable the adjustment of cost data across different regions. The variances in these indices, such as the BCIS location factors (figure 3), highlight the existence of different market conditions in different regions.

To use the tables:

1. Identify which frame type most closely relates to the project under consideration

2. Select and add the floor type under consideration

3. Add fire protection as required.

For example, for a typical low-rise frame with a composite metal deck floor and 60 minutes’ fire resistance, the overall frame rate (based on the average of each range) would be:

£165.00 + £110.00 + £28.00 = £303.00

The rates should then be adjusted (if necessary) using the BCIS location factors appropriate to the location of the project.

Figure 3: Indicative cost ranges based on gross internal floor area

| TYPE | Base index 100 (£/m2) | Notes |

|---|---|---|

|

Frames |

||

|

Steel frame to low-rise building |

149-181 |

Steelwork design based on 55kg/m2 |

|

Steel frame to high-rise building |

251-283 |

Steelwork design based on 90kg/m2 |

|

Complex steel frame |

283-335 |

Steelwork design based on 110kg/m2 |

|

Floors |

||

|

Composite floors, metal decking and lightweight concrete topping |

86-134 |

Two-way spanning deck, typical 3m span with concrete topping up to 150mm |

|

Precast concrete composite floor with concrete topping |

131-184 |

Hollowcore precast concrete planks with structural concrete topping spanning between primary steel beams |

|

Fire protection |

||

|

Fire protection to steel columns and beams (60 minutes resistance) |

23-33 |

Factory applied intumescent coating |

|

Fire protection to steel columns and beams (90 minutes resistance) |

27-45 |

Factory applied intumescent coating |

|

Portal frames |

||

|

Large-span single-storey building with low eaves (6-8m) |

108-142 |

Steelwork design based on 35kg/m2 |

|

Large-span single-storey building with high eaves (10-13m) |

132-169 |

Steelwork design based on 45kg/m2 |

Figure 4: BCIS location factors, as at Q3 2023

| Location | BCIS Index | Location | BCIS Index |

|---|---|---|---|

|

Central London |

127 |

Nottingham |

102 |

|

Manchester |

101 |

Glasgow |

93 |

|

Birmingham |

98 |

Newcastle |

91 |

|

Liverpool |

96 |

Cardiff |

94 |

|

Leeds |

92 |

Dublin |

90* |

*Aecom index

Steel For Life sponsors

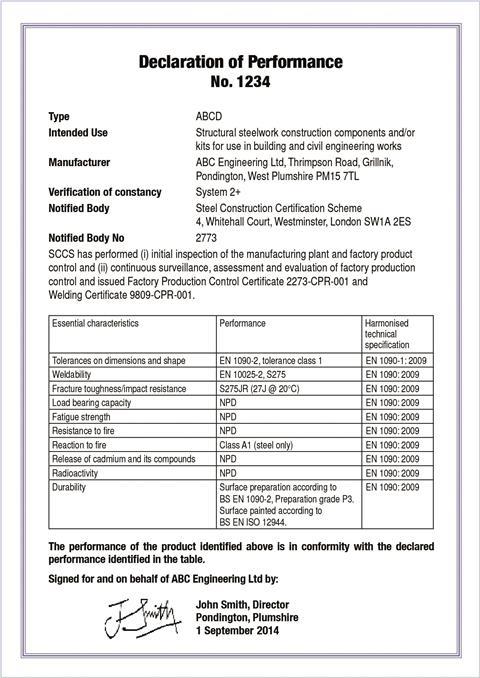

CE/UKCA marking requirements

CE/UKCA marking of fabricated constructional steelwork is a legal requirement, but the changeover from CE to UKCA marking has created some confusion. Be sure you know the rules, and exactly what is changing and when, to avoid the risk of accidentally falling foul of the law

In recent months there has been some confusion over CE and UKCA marking, in particular which one is required and when the transition period for CE marking ends.

Construction products, such as fabricated constructional steelwork, fall within the Department for Levelling Up, Housing and Communities (DLUHC) remit, and they have mandated that CE marking will end in Great Britain on 30 June 2025 and be replaced by UKCA marking.

There are a number of reasons for the confusion, but largely they arise from the way product accreditation is divided between governmental departments.

The Department for Business and Trade (DfBT) is responsible for the CE marking of products that fall within 18 different classifications, from toys to low-voltage electrical equipment. None of these classifications include constructional steelwork because this is a construction product and such products are the responsibility of DLUHC.

The confusion arises largely from the fact that on 1 August 2023, DfBT announced the extension of the use of CE marking for the products it manages beyond the December 2024 deadline for 18 product types that fall within its remit. This announcement did not apply to construction products, including constructional steelwork.

Another factor that has contributed to some of the confusion relates to the difference between the CE and UKCA marks. A CE mark is required for any product that is covered by either a harmonised standard or a European Technical Standard (ETA) that is placed on the EU market and four of the European Free Trade Association countries.

For construction products such as constructional steelwork, CE marked products may be placed on the British market until 30 June 2025. From that point onwards, UKCA marking is required for any product that is covered by a designated standard.

This only applies to Great Britain, with the requirements for Northern Ireland being different from the rest of the UK. Here, CE marking and UKCA marking may be used interchangeably for an indefinite period.

There are also questions around why there is a need for either the UKCA or CE mark for structural steelwork.

The answer to this is simple. The Construction Products Regulation (CPR) legally requires steelwork contractors to CE/UKCA mark their fabricated steelwork to meet BS EN 1090-1 standards. It has also put in place a factory production control (FPC) system that controls the quality of fabrication.

Furthermore, constructional steelwork products are deemed safety critical by the CPR, so fabricators have their FPC processes audited by an approved or notified body which will award a certification, stating which execution class the fabricator has achieved.

Many stakeholders also have queries around who exactly the changes and requirements apply to.

There are three main actors in the process, each of whom have a legal responsibility to ensure that their goods are CE/UKCA marked and have appropriate documentation for traceability.

These are manufacturers, including steelmakers such as Tata or British Steel; constructional steelwork contractors and distributors that also operate as service centres or distributors; and importers of structural steel.

To keep on the right side of law and to mitigate any penalties, a CE or UKCA marking certificate and a declaration of performance (DoP) must be provided to clients when the product is placed on the market. As it is a legal requirement to have a CE/UKCA marking for constructional steelwork when it is placed on the market, as well as provide both a CE/UKCA marking certificate and a DoP, it is important all stakeholders consider the implications of failing to do so.

There are several bodies that enforce CE/UKCA marking to ensure the legislation is applied correctly and that the products meet safety requirements.

For the construction products market, this is carried out by Trading Standards in Great Britain and district councils in Northern Ireland.

A company found to be supplying fabricated steelwork that does not meet legal requirements can be forced to take the product off the market or face a fine of £5,000.

In more serious instances, where the “controlling mind” – that is the person deemed to be responsible – is identified, the person can be tried and sent to prison, with all products removed from the market and the company closed.

On top of this and in light of the Building Safety Act 2022, the new legislation currently being shaped and released and the new regulating bodies being formed, it must be assumed that this will be policed even more. This is likely to be particularly evident for constructional steelwork, given that it is deemed safety‑critical.

For these reasons it is imperative that all parties ensure they only use suppliers that have the right stamp of quality and proof of safety. This will provide all stakeholders with the reassurance that they are not breaking the law.

The British Constructional Steelwork Association holds the Register of Qualified Steelwork Contractors, which are all vetted and undertake an annual assessment by third party assessors.

Safety, competency and quality are paramount in the industry, so if a company wishes to join the register and does not have a FPC and welding certification, it cannot start the assessment process until it achieves one.

This process helps guarantee that firms on the register meet all the legal standards they are required to.

Want to find out more about CE/UKCA marking for structural steelwork?

It will be held on 9 April 2024, starting at 10.00-10.30am, and the session will be followed by 15 minutes for questions and answers.

For more details about the event, scan the QR code

Other market considerations

There are a number of current topics within the steel industry that are impacting design and have the potential to influence costs.

There has been a significant amount of publicity around the closing of the blast furnace at the Port Talbot plant. This is in part driven around the move to lower carbon solutions switching to electric arc furnaces. This does mean moving away from producing virgin steel in favour of the production of steel from scrap metal. This is part of a trend which has seen the UK production of steel diminishing over the years. While the closure of the blast furnace is in itself quite dramatic a change, the reliance on steel produced in the UK has declined and the industry has moved towards imports. So while there will be an adjustment towards where the raw material supply is generated, the impact should be relatively minor on the costing of steelwork for construction.

Reuse of steelwork is becoming increasingly prevalent in the design of buildings; it is one of the factors for consideration when targeting embodied carbon reductions. This aspect of the industry is in its infancy but, more importantly, the stock levels are relatively low – this does mean that unless a donor building or secured stock has been identified, there is a risk that the extent of reuse steelwork will not be easily available. So there should be an element of caution around relying on reused steel to hit embodied carbon targets.

This Costing Steelwork article produced by Patrick McNamara (director) and Michael Hubbard (associate) of Aecom is available at www.steelconstruction.info.

The data and rates contained in this article have been produced for comparative purposes only and should not be used or relied upon for any other purpose without further discussion with Aecom. Aecom does not owe a duty of care to the reader or accept responsibility for any reliance on the article content.

No comments yet