Revised mandatory warranty periods will undoubtedly have an impact on the sector, but what exactly do industry stakeholders expect to result from the changes? LABC Warranty carried out a survey to find out

An LABC Warranty survey has found that while the majority of those in the housing industry were unaware of the potential for minimum 15-year structural warranties within the Building Safety Act, once made aware of this change they are optimistic about its effect.

They were also optimistic about the potential introduction of mandatory structural warranties for all new-builds, a proposed change of which the majority of those surveyed were aware. The main concern expressed by respondents was the potential cost impact on the housing sector.

The upcoming changes

Within the Building Safety Act, passed in April 2022, there is some wording specific to the structural warranty sector. For the first time, structural warranties will not only be something the mortgage industry demands, but will be mandated and outlined in law.

The survey undertaken by LABC Warranty concerned two specific areas of the BSA’s wording around structural warranties.

- The first is wording which, if activated by secondary legislation, would mandate that the minimum term of structural warranty cover will be extended to fifteen years. Currently, most structural warranties are 10 years, with some exceptions.

- The second is wording that, if also activated by secondary legislation, would mandate that all new homes built are covered by a structural warranty. Currently, there is no statutory requirement for structural warranties to cover a home; instead this is typically required by mortgage providers.

What the survey covered

This report analyses the results of a survey of LABC Warranty’s customer audience. The audience offered their feedback on:

- Their awareness of the new legislation that would affect the structural warranty sector.

- Whether they believed these changes would have positive outcomes, negative outcomes, or a mixture of both.

About the respondents

In descending order of responses, LABC Warranty’s audience of 270 identified themselves as:

- 27% housebuilders or developers

- 19% architects and designers

- 19% building control professionals

- 9% consultants

- 7% contractors

- 6% self-builders

- 5% other businesses

- 4% social housing providers

- 4% homeowners

Survey responses

Question 1

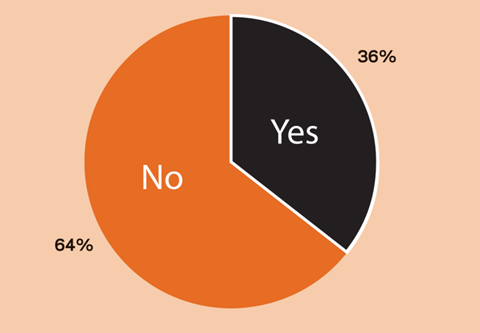

Are you aware the Building Safety Act makes provision for secondary legislation to extend new home warranties from 10 years to 15 years?

- 36% of respondents said yes.

- 64% of respondents said no

Question 2

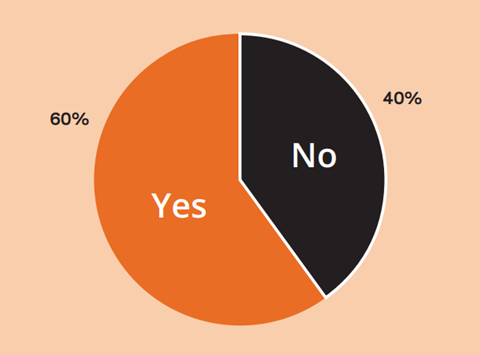

Are you aware the Building Safety Act makes provision for secondary legislation that will make it a legal requirement for developers and builders to offer warranty cover on all new homes?

- 53% of respondents said yes.

- 47% of respondents said no.

Question 3

Do you support extending standard new home warranty cover from 10 years to 15 years?

- 60% of respondents said yes.

- 40% of respondents said no.

Question 3 follow-up

A follow-up question asked respondents to cite their reasons for supporting, or not supporting, longer minimum warranty periods.

Of the 162 respondents who said yes and answered the follow-up question:

- 46% cited “improving standards in homebuilders”.

- 41% cited “better protection for homeowners”.

- 10% cited “alignment with the Defect Premises Act liability period”.

- 2% cited “other”.

Of the 106 respondents who said no and answered the follow-up question:

- 37% cited “too expensive to implement”.

- 56% cited “there is no need for it”.

- 7% cited “other”.

Question 4

Have you made any preparation for the possibility of 15-year warranties being made law?

- 6% of respondents said yes.

- 94% of respondents said no.

Question 5

Do you think 15-year structural warranties will improve resident or owner confidence in the quality of their new-build homes?

- 59% of respondents said yes.

- 41% of respondents said no.

Question 6

In your opinion, will mandating structural warranty cover for all new homes affect the standards and security of new homes? This question offered a multiple choice with four potential answers.

Overall, approximately 58% of respondents indicated a net positive outcome, with just over 35% indicating they felt there would be a net negative outcome.

Positive outcomes:

- 24% of respondents believed that warranties for all new homes would increase standards and safety in all new homes.

- 26% of respondents believed that warranties for all new homes would both increase standards in all new homes, and improve resident security and satisfaction in those new homes.

- 8% of respondents believed that warranties for all new homes would improve standards, without commenting on resident or owner confidence.

Negative outcomes:

- 4% of respondents believed that warranties for all new homes would not affect resident confidence in their new homes, without commenting on security or standards.

- 17% of respondents believed that warranties for all new homes would not affect the standards or safety of new-build homes.

- 15% of respondents believed that warranties for all new homes would have no impact on either resident confidence or standards and security. Mixed outcomes:

- 6% of respondents believed that warranties for all new homes would improve consumer confidence, but would not affect the standards of safety of those homes

Question 7

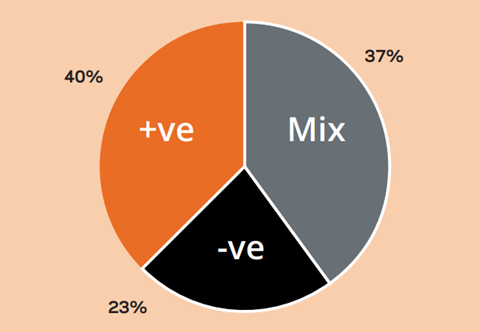

Should 15-year warranties for all new homes become law, what do you believe will be the overall outcome for the housing sector?

- 40% of respondents said they believed there would be a positive outcome.

- 23% of respondents indicated they believed it would be a negative outcome.

- 37% of respondents believed there would be a mixture of negative and positive outcomes.

Conclusions

At a glance Survey results indicate that while most respondents were unaware that there could be a change to 15-year minimum warranties, most respondents also believed that the change would be positive.

Additionally, a majority were aware of the wording mandating all new homes are covered by warranty regardless of whether they are built for the open market or not. A majority also welcomed this move, believing it would increase standards and resident confidence in their homes.

Given the strength of feeling in the anecdotal responses, where even respondents who offered a broadly positive outlook had reservations about potential negative effects of the legislative changes discussed, LABC Warranty would describe the response as a very cautious optimism (while awaiting more details on the upcoming secondary legislation).

The preparation

The secondary legislation that would activate the wording in the Building Safety Act mandating 15-year warranties and warranties on all new homes has yet to be brought forward into law.

Until the legislation is introduced, the housing industry can only use informed, educated guesses on the potential contents of that legislation, and what its eventual effects will be for the housing industry itself.

As a result, very little tangible preparation has been done according to this research.

The opportunity

Respondents believe that the most effective or most common response to longer minimum warranty periods will be to improve the standards in homebuilding, which in turn will improve resident confidence in the quality of their new homes.

This might be driven by the warranty industry demanding more robust standards up-front to protect them from currently unmonitored defects occurring after 10 years, or by developers themselves in an attempt to keep warranty premiums at a minimum.

The challenge

Naturally, this change would come at a cost. For a sector already beleaguered by increasing materials prices, economic uncertainty, inflation, and labour shortages any drive to further increase standards will likely mean increased costs.

The responses demonstrate a fear that this cost burden would polarise the building industry, further straining the small-to medium builder section of the housing market.

We also see fears that the increased costs could end up being passed to residents, driving the cost of new homes up when many would-be buyers are already struggling to buy their first property.

Full survey report

For more information on the background, methodology, and full results of this survey, visit www.labcwarranty.co.uk/bsa-survey-report and download the entire report.

The full version explores more of the anecdotal responses, analyses the results by business type, and takes a closer look at the implications of this research.