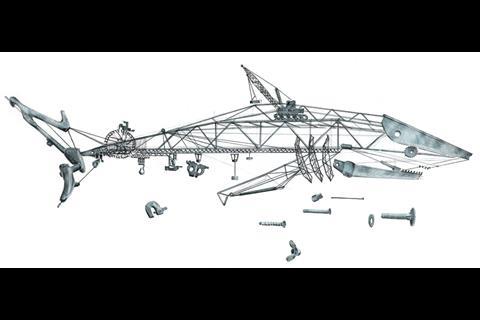

Britain’s top subcontractors are having to adapt to survive - and faster than the first crustaceans. David Rogers looks at the strategies they’re adopting (going backwards isn’t one of them), while Martin Hewes ranks them by turnover and specialisation

The chief executive of the National Specialist Contractors Council tells a story that just about sums up how business is right now for subcontractors.

“In a day,” says Suzannah Nichol, “I can get three calls telling me firms have gone bust, another three saying ’we’re really scratching around for work’ and another three saying ’fantastic, we’ve just got a big order in that sorts us out for the next 12 months’. There’s no one common opinion at the moment.”

In its latest state-of-trade survey, covering the third quarter of this year, the NSCC, which represents about 7,000 firms in more than 30 sectors, said it expected workloads to decrease in the final three months of 2010, with just 25% of specialists predicting an increase over the final quarter - down from 40% in the second quarter.

But the same survey said that the percentage of specialists that were working at 75% capacity remained the same - just over half - and that those reporting workloads at more than 90% capacity had actually increased from 26% to 29%.

Confused? Economists certainly are and were caught off guard last month when, the day before the NSCC produced its survey, the official figures released by the Office for National Statistics showed that construction had experienced a 9.5% growth rate in the second quarter, a figure that has now been revised downwards to 6.8%. However, the growth measured for the third quarter still stands, a healthy 4% that surprised many.

Many have put the rate down to the effects of the previous Labour government’s fiscal stimulus, which is expected to continue to provide some impetus until next spring when chancellor George Osborne’s recent Comprehensive Spending Review kicks in.

With that work drying up, specialists - like the rest of the industry - have been forced to evolve. Increasingly, subcontractors are looking at varying their sources of work and updating and honing their capabilities to be able to cast their nets wider when looking for income streams. This is not a strategy that comes easily to specialists. The small size of most of these firms compared to main contractors and large consultants means it can be much harder for them to break into new markets. As a result, many have been playing their own version of stick or twist: do they keep with their original strategy and hope for the best or do they move into different sectors, locations or even countries?

Mixed feelings

Noble Francis, economics director at the Construction Products Association, says: “Specialists are flexible enough to move into other markets. They have proved surprisingly resilient.”

This last line might not sit well with those who have gone to the wall, with the inevitability of more casualties looming. “It’s safe to say overall they’re not a cheerful bunch at the moment but there are companies doing okay,” says the NSCC’s Nichol. “The world of business keeps turning and there’s work out there, just less of it.”

Others are more pessimistic about the future. Industry forecaster Martin Hewes says: “Next year will be worse than this year. Every company has hacked away at its cost base, but I think more has to come out. Turnovers are typically down 20% but the fall in wages has only been about 5%.

“This is much longer lasting than the nineties recession because the public debt is so high. I think in 2015 we’ll still be talking about this.” Some specialists tend to agree with this assessment, with Tom Haughey, the chief executive of Severfield-Rowen, the UK’s biggest steel contractor, expecting demand to remain slow for a while yet. “Over the coming 12 months, the UK structural steelwork sector is likely to experience extensive change,” he says. That is corporate speak for firms going bust while struggling, smaller firms will get snapped up by bigger rivals.

Tony Williams, the head of research firm Building Value, says the number of specialists will inevitably contract in the coming years. “There have to be more strategic mergers. Firms need to take out a raft of overheads and save money to cope and the easiest way to shrink is by doubling up.”

Home and away

But just getting rid of duplicate back-office functions is no guarantee of survival. Firms need growth and because there is less work, specialists are having to consider moves into other markets and - something that very few have done before - working overseas for the first time. These are strategies that Keltbray, best known for groundworks and demolition, has been quietly developing over the past few years.

Severfield-Rowen has set up a new joint venture with Indian firm JSW Steel to fabricate and supply steel to the market in India from two bases at Mumbai and Bangalore. It hopes its first factory will open this month and wants to produce 35,000 tonnes of steel a year.

“Going overseas is difficult because it can be difficult to service, you have start-up costs and you can’t be on a plane all the time,” says Suzannah Nichol, mindful of the fact that most of her members can’t invest the multi-million pound sums that Severfield-Rowen has with its Indian venture.

But others think that firms, whatever their size, should at least have a look. Stephen Mills is the business development director of Mivan, the Northern Irish fit-out firm whose overseas adventures include about 50 of its staff being used by Saddam Hussein as part of a human shield to dissuade the RAF from bombing Iraq in the run-up to the Gulf War in 1991. “I accept it’s not easy to go into new markets,” says Mills. “But if you’re not out there trying, then all you’re doing is thinking about it.” Firms, he advises, should scope out the market first and decide whether to go it alone or enter into a joint venture with a local partner.

Areas of growth

To some, the words “green” and “nuclear” might seem polar opposites but these are two areas specialists are hoping will take up some of the slack caused by the scaling back of public sector funding.

Peter Rees, the man in charge of planning in the City of London, is pleased the Walkie-Talkie and Cheesegrater will be new additions to the Square Mile’s skyline but his eye is also on the period after they complete in 2014. He expects a lot more “greening” of buildings to be taking place. “Six months ago all the big office projects were on hold. Now there is a lot of work to be done making buildings more comfortable and sustainable. That’s the place in the future.”

As the recession bit, a lot of carbon reduction programmes were put on hold. But Rees expects business not just in London but across the country to now set about properly greening and refreshing their buildings.

As for nuclear, the key here is the fact it’s all privately funded. French utility company EDF is behind the Hinkley C scheme in Somerset, the first new-build nuclear power station since 1995, and already some of the early packages being tendered are very big: a £100m earthworks contract, £200m on tunnelling. The main civils package is expected to be about £1.5bn.

But specialists eyeing pots of gold, be warned. One, who asked not to be named, says: “You have to go in with your eyes open. You’re held to a higher standard on things like health and safety, quality and environment. Nuclear is 10 years ahead of the main construction market.”

And don’t go trying to impress by saving huge sums of money. “If you’re doing a job and halfway through you say it will cost less than you reckoned, they’ll red flag it. They think you’ll have cut corners. Clients want predictability.”

Under pressure

Meanwhile, familiar woes remain at home. “Margins are being squeezed to nothing,” says Brendan Kerr, chief executive of Keltbray. “Clients think you can work for any price. But if I can do a job for £800,000, why then would I price it at £1m?”

If Kerr is exasperated, he is not alone. The NSCC survey revealed that a paltry 2% of firms receive payments within 30 days while a third of respondents say they are owed overdue retentions which average out at about £50,000 per firm.

It’s easy to be despondent, yet there are some signs of a recovery. Recent news that the Walkie-Talkie and Cheesegrater towers - high-profile victims of the recession - have been brought back on line has fuelled hopes that private commercial work is coming back, with recruitment consultants saying the City office market is on the up. “We’re getting a lot of calls for people with office experience,” says Lindsay Urquhart, the head of specialist architect recruiter Bespoke. “Office blocks have got a lead-in time and no one wants to be the last to get started.”

Noble Francis at the Construction Products Association agrees. “There will be a tightening on particular sectors such as health and education but private commercial will be undergoing recovery. In the next few years there will be significant industrial growth.”

The group is forecasting a total construction output this year of just over £93bn, up 1.3% on last year, but still below the output of £93.2bn in 2002 and way below the near £105bn recorded three years ago.

Tony Williams provides some optimism for those wondering when it will all end. Forget harking back to 2007, though, he says, it’s not doing anyone any good. “That year was an aberration. I think output next year will be up or down a little. Right now, I think it will be down a little. Through to spring there will be a flurry of contracts but thereafter it remains to be seen if the private sector can take up the slack. For specialists, the key is that two or three points of growth in private commercial is a lot better than 10 points in the public sector.

There is activity in private commercial and I think we can see significant change happening in 2012.”

That may seem a while yet, but as anyone working on the Olympics site will testify, 2012 is just around the corner.’

Mivan - new specialisms

In March this year, fit-out specialist Mivan launched a new company called Mivan Prime, which is run out of the firm’s London office.

The business is aimed at the relatively insulated market of fit-out and new-build houses and apartments for the super-rich - the sort of flats in swanky parts of west London that command prices of £30m, £50m or even £100m.

Business development director Stephen Mills says that as well as fit-out, the firm is doing work traditionally associated with a main contractor. “Clients are looking for smaller builders who can do new build but who are experts in fit-out as well.”

The firm decided to target the market after working on about 40 apartments at the Candy & Candy One Hyde Park development.

Typically, the jobs Mivan Prime is tendering range between £2m and £10m but Mills said it is bidding for one worth a whopping £25m.

“This market did stall a couple of years ago but there’s been consistent growth in prime residential,” he says. “It’s high net worth individuals who are prepared to pay for the best. We have our own joinery business so we don’t have to sub work out.”

The move is already paying dividends with about £8m worth of work already secured since the business launched in spring. Mivan is hoping it will rake in £20m a year with Mills adding it could account for anywhere between 20% and 40% of annual turnover.

Most of its clients tend to be extremely wealthy foreigners from Russia, the Middle East and, increasingly, China. Not that Mills and the rest of the team tend to meet the end-user. “We usually don’t know who they are,” he says. What they do know is that they set up an Escrow account - a form of bank account for an individual not based in the UK to allow them to pay for the work.

Keltbray - diversifying

Keltbray is typical of firms that have chosen to move into new markets, including those overseas. It still carries out groundworks and demolition and its recent jobs have included work on the Pinnacle in the City of London and the remodelling of Blackfriars railway station, which is being overhauled for Network Rail as part of its Thameslink upgrade programme.

But three years ago Brendan Kerr, its chief executive, sat down with the rest of his team, looked ahead and thought “this can’t go on”. “We can’t blame everything on the recession,” he says. “It was a hugely inflated market so we looked at spreading into other markets.”

The result is that Keltbray now carries out waste management work and civil engineering rail contracts. The change has been subtle, but it has been necessary for its survival. “Since the Comprehensive Spending Review, it hasn’t got any easier but it’s no better, no worse than it was in the summer. Unfortunately, some firms will still go bust,” says Kerr.

It was also an early explorer of overseas markets. The company made its first foray abroad since it was founded in the mid-seventies when it set up offices in Dubai and Sharjah in 2009 with a local firm to target work across the Gulf states. Now it is looking at infrastructure work in the west African country of Sierra Leone.

What Keltbray is doing is sticking with its tried and trusted methods to forge into new markets. Exporting its specialism, basically.

Downloads

TOP SPECIALISTS 2010

Other, Size 1.24 mb

No comments yet