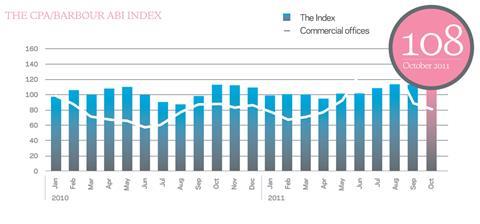

October saw the commercial offices index fall by 9%

Throughout 2010, the difference between the prime central London market and everywhere else, was marked. Construction of high end, grade-A space ramped up in the past 12 months, with many projects halted due to the recession finally breaking ground. Furthermore, in mid-2011, an improvement in the CPA/Barbour ABI commercial offices index, for projects worth £250m or less, offered hope of a more general increase in activity away from the high value towers. In September, however, hopes were abruptly dashed. The commercial offices index, tracking awards for projects under £250m, plummeted by a third and the index fell a further 9% in October.

Demand and finance are just two of the headwinds facing new offices building in the short term. Forecasters generally agree that economic growth will be constrained at less than half long term trend over the next year or two. The latest CPA forecast anticipates a further 2% contraction in offices construction in 2011, ahead of a modest 5% growth in 2012 based on marginally better prospects for the second half of the year. Downside risks to this projection have strengthened in recent weeks and much depends on the speed at which the eurozone crisis is resolved and confidence is restored.

No comments yet