In the second of its series of cost updates for specialist trades, the Sense Cost Consultancy team considers refurbishment and fit-out in the office and retail markets

01 / introduction

The value of the commercial refurbishment and fit-out sector rose to a record £7.8bn in 2007 after several years of buoyant growth. Together the offices and retail sectors account for about half of this market and both enjoyed strong demand in the mid-2000s.

In 2009 commentators expect the value of this work to plummet to £4.7bn, 40% down from the 2007 peak. Some industry sources fear this may prove too optimistic and warn that a 50% contraction is not beyond the realms of possibility. Tender prices have fallen sharply and the supply chain has consequently taken steps to minimise preliminaries and cut overheads. Margins have taken a significant hit, with tendering at zero margin becoming commonplace and an increasing number of firms submitting loss-making bids to maintain cash flow. Compared with 18 months ago, opportunities to tender are scarce, but when they do arise, the average scope of work and hence contract value, is much lower.

So far routine and cyclical maintenance works are progressing at a reasonably strong level. Office for National Statistics (ONS) data suggests that private non-residential repair and maintenance output totalled £3.3bn in the first quarter of this year. This was 18% down on (an exceptionally strong) first quarter in 2008 but is on a par with the long-term average. Official statistics do not split overall private non-residential R&M output into its constituent parts, and the maintenance of commercial offices is generally easier to postpone than equivalent works in the retail sector, when heightened competition increases the importance of maintaining the appearance of the shop floor.

Conclusive evidence of green shoots have yet to emerge but there are signs that the market is nearing its nadir. Exactly when the recovery will arrive divides experts. Optimists say early 2010, whereas the more pessimistic suggest it early 2011. However, many believe that when demand returns, the scope and specification of refurbishment and fit-out work will be modest in comparison to the pre-Lehman days.

02 / market overview

Even with demand for refurb and fit-out down 40%, firms need to make a profit. But expectations about what constitutes a realistic margin are down to a quarter of what they were 12 months ago. What’s more, the latest quarterly state of trade survey from the National Specialist Contractor Council reported that only 5% of the contractors surveyed reported receiving payment within 30 days of invoicing and for 23% terms were longer than 60.

Labour accounts for about 40% of the cost of a fit-out, and 50% of the cost of a refurb. Heightened competition among specialist contractors is forcing labour rates down. On the consultancy side, wages have at best been frozen, and at worst cut 20%.

Material input prices have been slower to adjust to market conditions. Latest figures from the ONS show that, with a few exceptions, the price of common materials continues to rise.

Contractors responding to the Construction Product Association Trade Survey painted a downbeat view of their trading environment. Fifty-six per cent of specialist contractors reported that order books fell in the first quarter of 2009, indicating that a further fall in activity is inevitable.

Almost all specialists are tendering for work outside of their core areas and clients are shortlisting more of them to maximise competition.

Additionally there is concern about the impact of the curtailment of new development. Very few projects have broken ground in the past six months, orders for new offices were down 70% in the first quarter and continued to slide in April.

Fit-out specialists fear the knock-on impact this could have in 12 months.

03 / sample packages

Ceilings and partitions

Recent figures from AMA Research suggest that the suspended ceilings and partitions market grew at 3% a year between 2006 and 2008. In 2008 the overall market was worth £338m, £175m of which was attributable to suspended ceilings and £163m to partitioning systems.

The UK market for plasterboard has contracted by 12% in the past 12 months and by the end of 2009 will be down by 25% on 2007. Prior to its collapse, housebuilding accounted for a third of demand for plasterboard but that has (obviously) contracted sharply. Offices work accounts for less than 10% of sales and retail less than 5%.

Prices of many materials used in this area have stabilised but remain high. Gypsum prices in the first quarter were 7% higher than they were a year ago and plaster prices were up 9%.

Commercial offices account for about 44% of the total value of demand for suspended ceilings and internal partitions. The retail sector provides about 20% of market activity.

Even before industry conditions took a turn for the worse, the suspended ceilings and partitioning market was underperforming. A modest annualised rate of growth of 3% between 2006 and 2008 was lacklustre compared with the 6% increase in retail construction and 21% in offices. This is in part due to the trend towards open-plan working.

Floor finishes

Keynote, a market researcher, recently valued the UK floor coverings market at £6bn in 2008, 9.2% higher than in 2004. Over the next year, demand from the residential sector will contract before stabilising at a low level, but weakening demand in the commercial and industrial sectors will continue to drive the market’s value down. Publicly funded health and education projects will continue to offer opportunities. Flooring demand is nevertheless expected to contract by 8% in 2010, and one research organisation predicts its value will not return to its 2008 level until 2013 at the earliest.

As demand continues to contract, the number of specialists is expected to fall. ConstructionSkills predict that the number of workers employed will return to 38,900 in 2013, which is about equivalent to 2009.

Joinery

In 2008 the finished wood sector was worth £10bn in 2005, the timber processing/semi-finished goods sector was worth £4bn and the wood panels market was worth £2bn; these figures were about 9% down on 2007. Industry players report there has been a 30% contraction in joinery work on office fit outs in the past year.

Raw material price inflation was a key factor in the mid-2000s. ONS figures suggest the price of wood rose 30% in the five years to 2007, before the rate of inflation moderated in 2008. Price indices for sawn and planed wood prices peaked in the third quarter last year and have since been falling. Year-on-year prices were down 5.2% in the first quarter of this year, but this did little to erode the robust increases recorded earlier.

Machinery requirements mean that joinery specialists operate with higher fixed overheads than others. Therefore, when overheads need to reduce, greater savings in variable costs, such as labour, need to be made. Additionally, some of the larger joinery specialists rely on delivering sizeable joinery packages on just a few projects, which is a risky strategy in the current climate.

Recent forecasts from ConstructionSkills suggest that between 2009 and 2013 employment in wood trades and interior fit-out will rise by only 1.6% from 281,150 to 285,750.

04 / demand in the office market

At its peak in 2007, the commercial offices refurbishment and fit-out sector was worth £2.7bn (excluding routine and cyclical maintenance work). Analysis suggests that the sector’s value will fall to nearer £1.6bn this year, with fit-out suffering the steeper decline.

As the recession continues, the trend towards make do and mend is likely to become more prevalent. Contractors report that the average value of an individual refurbishment has generally fallen by half in 18 months, with some reporting a contraction of nearer 80%. Such a steep fall reflects the shift in the scope of work being tendered. In general, landlords are making cosmetic improvement and shying away from structural changes.

Interest in new space waned in the first quarter of 2009 amid expectations that rents had further to fall. CBRE found that take-up of office space in central London was at a record low in the first quarter of 2009, with only 1.1 million ft2 taken. The amount of space under offer edged up to 1.6 million ft2, which was a modest improvement considering the long-term quarterly average is nearer 3 million ft2.

There are signs that the market may be nearing the bottom, with attractive deals on offer to entice tenants into newly completed space and viewing activity has revived. However, whether this reflects a real desire to move rather to help with rental negotiations remains to be seen. Interestingly, some agents report that despite extended rent-free periods and shorter leases, tenants’ appetite remains limited. Tenants are currently pursuing cheaper secondhand options. Cost is obviously an important factor, but it is possible that taking prime space in a prestigious new development at a time when thousands of jobs are being shed could be perceived as frivolous.

King Sturge report that despite redundancies, there has not yet been a significant quantity of tenant surplus space, which indicates occupiers are mothballing rather than offloading space.

Drivers

The health of office fit-out work is closely aligned with the strength of the economy. Factors instigating change, such as mergers, expansion, downsizing and rebranding; refurbishment is driven by market conditions and need. Corporate profitability, the strength of the financial and business services and credit availability are all important.

A sharp fall in financial and business services activity is in prospect for 2009 but Experian Business Strategies predicts the sector will recover in the latter stages of 2010. A 3% growth rate, in real terms, is forecast for 2011.

Although fewer mergers and acquisitions are taking place, the value of these deals has risen. Expenditure on acquisitions in the UK by foreign companies increased from £8.3bn in the last quarter of 2008 to £12.3bn in the first quarter of 2009, but the number of transactions was lower: only 23 UK firms were bought by foreign firms in the first quarter, the lowest number since 1990.

There is cautious optimism that the brakes on credit availability are slowly being lifted. The Bank of England’s credit conditions survey in the first quarter of this year reported a slight increase in corporate credit availability compared with the last three months of 2008.

From an employment perspective, however, news remains pessimistic. There was a sharp increase in redundancies in the three months to April 2009. Just over 300,000 thousand people lost their jobs during this period.

Outlook

Main contractors and their supply chains have now taken steps to rationalise their businesses in response to the change in market conditions and the scope for further price cuts is limited.

The next 12 months will continue to be challenging, but industry experts note that there are opportunities in the market. The number of mergers and acquisitions have fallen, but those that have taken place are of high value and consolidation works stand to be significant. One contractor predicts that the recent mergers in the banking sector alone will generate demand for 8 million ft2 of high-end office space in the next 12-18 months.

In recent years West End postcodes have commanded a premium. However, what is deemed good value for money is likely to come under much closer scrutiny going forward. Occupational demand for West End space is expected to remain well below trend in 2009, but unlike in the City, the current development pipeline will not deliver any new major schemes during 2012 when the economic recovery should be well underway. Relatively attractive rates in the City are expected to entice some West End firms when interest returns and supply constraints resurface.

With cost considerations at the fore, savvy tenants are when possible, using contract breaks as a threat to negotiate with their existing landlord. However, as offers to take new space become ever more competitive, a greater number of tenants will find them too competitive to ignore and will actually make the move.

05 / demand in the retail market

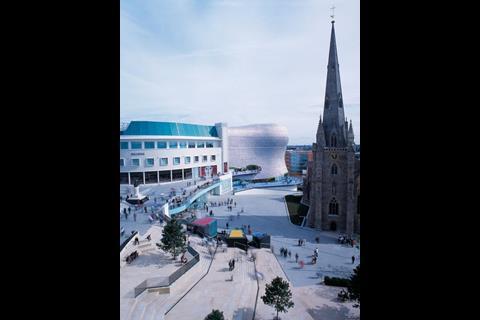

There have already been several high-profile casualties of the recession, and vacancy rates on the high street continue to rise. That said, the contraction in the retail refurb and fit-out sector is expected to be more moderate than in offices, and experts predict its value will fall to £1.3bn in 2009, 20% down on its 2007 peak.

Retailers have to keep costs down but still need to entice consumers to part with their money. Where retailers are maintaining their budgeted refurbishment spend, they are seeking to squeeze the best price possible. Some firms report that tender costs have contracted 40% owing to a combination of cost savings, efficiency improvements, and (most significantly) increased programme standardisation.

Professionals and contractors specialising in retail report that the days of a standard overhead and profit margin of 3% are over. Instances of zero or even negative margins have been reported where maintaining cashflow or a client relationship is a priority.

Competitive pressures have driven wages down for main contractors. Some have opted to freeze wages but others have asked their workforces to take a cut of up to 15%. To date the bulk of redundancies in this area have been made by main contractors.

Drivers

Consumer sentiment remains weak. Statistics from the ONS suggest that the volume of retail sales was 1.6% less year-on-year in May 2009 and survey data from the British Retail Consortium found that sales fell 0.8% basis during the month. Both surveys found that consumers were shying away from big-ticket homeware and furniture purchases.

There is little on the horizon to suggest that consumer sentiment will be anything but subdued over the short term. The rising unemployment rate continues to add to household unease: it reached 7.2% in April, its highest level in more than a decade. Redundancies were also at their highest level since records began in 1995, with 302,000 jobs being shed in the first quarter of 2009.

Consumers have already taken steps to address their exposure to debt and this trend is unlikely to slow in the near term. The overall level of unsecured lending contracted 14% in the 12 months to April 2009, with credit card lending down by 7%, according to the Bank of England.

Although the prevailing market conditions are proving challenging for some, several retailers operating at the value end of the market have enjoyed considerable growth in sales. Several intend to roll out bullish expansion programmes in order to capitalise on their rising popularity. Poundland, Iceland and Matalan all recently announced plans to expand their network of stores.

Recent merger activity within the retail banking sector will present some opportunity for retail fit-out specialists. Santander, for example, is to rebrand its Abbey, Alliance & Leicester and Bradford & Bingley branches by the end of 2010. However, after banks have rationalised their networks the resulting fit-out work stands to be disproportionately small compared with the extent of activity taking place. There is speculation that Lloyds, for example, may close down its Cheltenham & Gloucester branches.

Faced with challenging trading conditions some retailers are taking assertive action to revamp their offering. B&Q is the latest in a series of firms to announce plans to roll-out a new store format as part a wider plan to increase profitability.

Outlook

Experian predicts that consumer spending will fall 2.6% in 2009, the first annual contraction since 1991, although this prediction may prove to be too pessimistic in light of recent data. Whether this proves to be the case or not, a combination of weak growth in disposable incomes and a heightened propensity to save mean that prospects remain subdued in 2010.

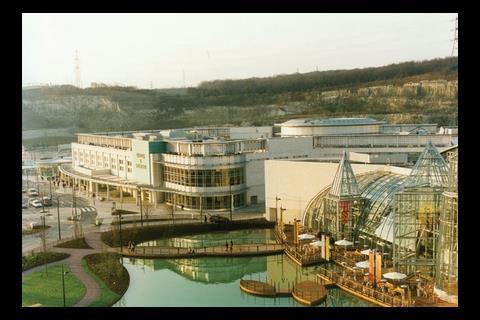

The potential gains from increasing sales in existing portfolio space are usually dwarfed by the potential new space offers. In contrast with offices, where developers rapidly retrenched, several retailers are in the process of rolling out aggressive expansion plans, and this trend is set to continue over the next two years.

However, outside of these segments of the industry, opportunities for specialist retail refurbishment and fit-out contractors are expected to remain at a subdued level over the next 12 months. This combined with the fact that refurbishment and fit-out work in the value sector does in itself tend to be at a value level, means that the value of retail refurbishment and fit-out work is likely to continue to contract until the third quarter of 2010 at the earliest. Retail work should then bounce back rapidly. Postponing maintenance, at least at a cosmetic level, can only be a short-term strategy for retailers.

06 / credits

This article was researched and written by project director, Tim Spencer, and economist Kelly Forrest. Sense is part of the Mace Group of companies; more information about it can be found at www.macegroup.com/services/businesses/sense

No comments yet