Rotterdam’s dramatic skyline highlights its transformation from its blue collar, port city roots to a modern high-rise metropolis connected to the largest harbour in Europe. Ciara Walker, Willem Hoes and Freek Wullink of Arcadis explore the transition to a creative, innovative knowledge economy

01 / Introduction

Rotterdam is well known as a connected hub city for the Netherlands and Europe with one of the largest ports in the world. Heavily bombed in the Second World War, post war reconstruction allowed the city to develop a strong industrial heritage. Now city officials are reinventing the city as a creative industry hub, attracting technology, business services and a well-educated workforce. Success will rely on continued reorientation of the city’s housing, infrastructure and commercial space provision, as well as public space improvements and development of the city’s architectural clout. Leveraging the economic synergy of the Randstad conurbation (including Rotterdam, Amsterdam, the Hague and Utrecht) while competing within Randstad to attract businesses and employees is also a critical success factor.

The municipality’s Spatial Development Strategy 2030 (Stadsvisie 2030), issued in 2007, outlines the strategy to transition to a knowledge and services economy while guaranteeing an appealing residential and social climate capable of attracting more graduates and creative workers.

02 / Economic and political overview

Economics

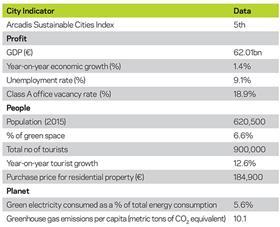

Rotterdam has seen greater GDP growth than other parts of the Netherlands, including Amsterdam (1.4% compared to 1.3% respectively). The port drives the economy, providing €15.5bn (£11.4bn) of added value to the Dutch economy in 2012. The port is seen as one of the world’s smartest and most sustainable. Investment in digitalisation of logistics, use of robotics and sensors as well as new materials to build more sustainable quay walls or better ships is part of the city drive to maintain port advantage in the global logistics market.

Despite economic growth, the employment rate lags behind other cities in the Netherlands, at 12.3%. A large number of workers are less educated and traditionally worked in the logistics and industrial sector, where the number of jobs continues to decline. Disposable income is €27,800 (£20,400) a year, 15.2% lower than the national average but the municipality’s strategy is succeeding in attracting more highly educated workers (increasing from 26% of the workforce in 2002 to 38% in 2013) which should begin to drive incomes up as the city transforms.

Its history as a port city has fostered an entrepreneurial attitude, and the municipality is leveraging this characteristic into significant investment in start-ups and innovation to support the city’s transition to a creative industry hub.

The port authority and the municipality created the Stadshavens innovation district with more flexible regulations, in which progressive organisations are clustered and align themselves with start-ups, business incubators and accelerators. One example is Ampelmann, a start-up setting new standards in safety in accessing offshore structures from a moving vessel.

Politics

There are three levels of government in the Netherlands: national, provincial and municipal. Provincial governments focus on environmental management, spatial planning and recreation, while municipal government focuses on local level social issues. The city is largely funded by national government, with local taxes only providing a small amount of municipal budgets.

Though the municipal council is elected by the population of the municipality, the mayor is selected by the national government and the strategy for the city is ultimately driven by the national agenda.

03 / Construction sector

The construction market in the Netherlands is mostly made up of SMEs, and the contracting market is dominated by a small number of major groups, for example Royal Bam Group which is building the Erasmus hospital. In Rotterdam, the most active contractor is Dura Vermeer, a typical Rotterdam 5th generation family company.

The Dutch industry experienced a significant decline in output during the recession to 30% below the 2007 peak in 2013. There are now tentative signs of a return to growth with annual increases in output of 4% forecast for 2015-18. Profitability was damaged during the recession due to the contracting community continuing a race to the bottom on prices.

Reduction in contractor capacity in the Netherlands over the past seven years is a challenge to Rotterdam’s ambitious construction plans, in particular for residential construction.

Prime real estate assets in Amsterdam, the number one investor destination, are scarce, and investors have been shifting focus to prime properties in other major cities including Rotterdam. Rotterdam has a substantial investment market with €250-350m invested annually 2009-2013 (around 10% of the Netherlands total). 2014 hit record levels of investment, at €1bn driven by sales of iconic buildings such as the Maastoren and World Trade Centre in the final quarter of 2014.

Investment is centred around the prime locations, with two-thirds of investment registered in the central business district and Kop van Zuid over the past 18 months.

04 / Sustainability

As a low lying delta city, Rotterdam will face challenges with rising sea levels or low river levels and due to its many port activities it is one of the world’s major producers of CO2 emissions. These challenges have driven Rotterdam to invest significantly in making both the port and the city sustainable and resilient.

The city has committed to halving CO2 emissions from the 1990 base, and to become 100% “climate proof” (resilient) by 2025.

The focus for the municipality’s 2015-2018 Rotterdam Sustainability Programme is a green, healthy and resilient city, cleaner energy at lower costs and a strong and innovative economy. It continues on the past four years’ successful €26.5m programme, which generated a total of €400m sustainable investments in port and city.

Given the simultaneous needs to become climate proof and sustainable in addition to the revamping of the city, climate adaptation and spatial development are inextricably linked in Rotterdam. This is seen in the Zomerhofkwartier Rotterdam, a laboratory for a climate change resilient district where much needed regeneration and sustainability investments are going hand in hand, such as the Benthemplein water square which serves as a public space and a reservoir during flooding.

This combined approach is working: the Rockefeller Foundation declared Rotterdam the most sustainable city in the world in 2015 and Arcadis ranked Rotterdam amongst the top five sustainable cities, praise well deserved due to the innovative and experimental attitude Rotterdam takes to sustainability.

05 / Infrastructure

As part of the highly populated Randstad conurbation, Rotterdam’s residents and visitors are highly reliant on the modern and dense transport infrastructure. The well integrated transport system is characterised by different modes, ranging from cycling to trams, trains and water taxis as well as the Rotterdam metro. Cycling remains a preferred mode of transport. Rotterdam The Hague Airport is the second Dutch airport after Schipol, and both airports are well connected to the city centre by public transport.

The Port Vision 2030 lays out the port authority’s aims to be Europe’s most important port and industry complex, leading in efficiency and sustainability. This aim is being implemented through the port expansion Maasvlakte 2, where around 2,000ha of land has been reclaimed from the sea and the newest, largest container ships will be able to unload.

The city’s infrastructure is undergoing updating: Rotterdam’s Central Station was upgraded to serve international high-speed rail traffic, and won the Dutch BNA Award for Best Building of the Year in 2015. A €1.5bn, 47km expansion of the A15 motorway will be complete at the end of the year, and aims to handle the anticipated increase in traffic due to the construction of APM Terminals’ Maasvlakte II facility.

Rotterdam is also investing in its social infrastructure, with “Campus under Construction II”, the second phase of the expansion of Erasmus University Rotterdam adding lecture rooms, study spaces and facilities through construction and refurbishment and the new €1bn Erasmus MC hospital to be completed in 2017.

06 / Residential

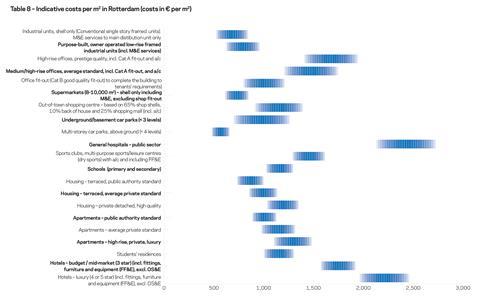

Steep price increases in Amsterdam make housing increasingly unaffordable and provide an opportunity for secondary cities such as Rotterdam. Rotterdam is actively targeting the creation of 56,000 more units by 2030, targeted to high and middle income populations in the city centre and port areas. At the same time, social housing, particularly in the south of Rotterdam, will be demolished or refurbished.

The average transaction price in Q2 2015 had increased 6.4% from the trough of the market in 2013, less than in Amsterdam (13.9%) but substantially greater than the Dutch average of 3.9%. In fact, current average price level of €184,900 is only 1.2% lower than peak levels, whereas average price remains 7.2% below in Amsterdam, and 10.8% in the Netherlands as a whole, showing a faster recovery in Rotterdam.

Most housing in Rotterdam is rented: 47% of people live in social rented units, with only 18% non-regulated rental units and the remaining 35% owner occupied. In the private rental market the average rent reached €13.3 per m2 per month; rents have grown across the Randstad over the past year, but have grown most in Rotterdam at 9.4%.

07 / Commercial

The Rotterdam office market is the third largest in the Netherlands after Amsterdam and the Hague. It recovered well in the first half of 2015 after a period of slowdown due to the global crisis. Rotterdam city saw take up levels of around 67,900m2, the highest six monthly volume seen over the past three years. The substantial take up and limited expansion of supply allowed vacancy levels to drop significantly in H1 2015, mainly in the city centre and Prins Alexander regions. Availability peaked at the beginning of 2014 and currently stands at 18.9%.

There is a limited supply of prime office buildings, and many of the outdated office buildings are being transformed into residential, student housing, or hotel properties. Over the past three years 200,000m2 of office space has been transformed, with another 220,000m2 to be completed by 2018.

Lessees are mainly interested in office buildings located in the city centre, especially in the area surrounding the newly refurbished Central Station. The Prins Alexander area has seen the major part of the take up, driven by the Police Service Centre.

Despite improved market conditions, rents were still under downward pressure in the first half of 2015, in part due to companies demanding better value for money. Prime rents remained quite stable, currently at €200-210 per m2 per year, with a few ultra-prime buildings like Maastoren and De Rotterdam in Kop van Zuid reaching €225 per m2 per year.

08 / Retail and hotels

Rotterdam is a booming city for leisure, with the New York Times and Rough Guides declaring Rotterdam one of the top 10 cities to visit in the world, in part due to its cultural and architectural attractions.

The municipal government successfully lobbied to be the European City of Culture in 2001 and has made it a policy to invest in culture as its industrial employment base shrinks. This resulted in a steep increase in the number of tourists, with an 18% increase in overnight stays and a record 900,000 tourists visiting the city in 2014, a 12.6% increase year-on-year. The number of hotel rooms has increased to around 4,500 rooms (from 3,100 in 2004), of which 39% are upscale. Average occupancy is around 65% and the average room rate is €100 a night, between that of nearby cities The Hague (€106) and Utrecht (€98).

Rotterdam has the second largest retail stock in the Netherlands, with around 4,000 retail units. The majority of the stock is in the city centre in high streets such as the Lijnbaan. Some international brands are entering the market, several big name retailers are opening shops and in recent years Kruiskade has further developed into a luxury shopping street.

Outside of the centre, traditional shopping malls are facing increasing vacancy rates due to an increase in e-commerce.

Markthal, a new landmark for Rotterdam covering over 13,000m2 and consisting of 100 market booths, 4,600m2 of retail space and a 240-unit arch-shaped apartment block over it all, attracted 5 million people within the first seven months of opening.

09 / Industrial and logistics

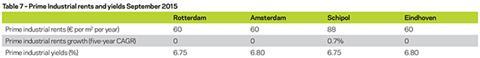

The industrial area on offer in Rotterdam increased by approximately 3% in the first half of 2015 and though the number of lease and sale transactions remained stable the industrial property market is picking up.

In comparison to other municipalities with a sizeable industrial property market in the Netherlands, Rotterdam has a very low structural vacancy level, especially when considering long term structural vacancy. Less than 1% of total industrial space on offer has been unoccupied for more than five years in Rotterdam, indicating a strong enough demand to support the new industrial space coming on stream with the Maasvlakte 2 expansion of the port. However, unlike other municipalities, rents continued to drop.

As the most important port in Europe, Rotterdam is attractive to the international logistics market, and companies are investing here, such as EDC for Canon with 100,000m2 completed in 2015.

10 / Outlook

Rotterdam is a city in the midst of a government-driven transition from its roots as a traditional, industrial port city to a sustainable, climate-proof modern metropolis. Moves to attract higher income households and innovative water, climate and energy businesses are ongoing and will continue to manifest in housing, office and public space projects.

These investments in the city’s attractiveness are beginning to pay off, with house prices and rents rising as skilled people with higher disposable incomes start to choose Rotterdam over Amsterdam. The city will continue to focus its attention on updating outdated office space, as well as investing in hotels and retail as the tourism boom continues.

Leading the way in innovative and experimental investment in sustainability and resilience, Rotterdam will continue to set an example for other delta cities to follow, and will provide inspiration to cities globally to tackle their own sustainability and resilience challenges.

No comments yet