Latest ONS figures show weak performance across most sectors

Construction output fell in July for the second consecutive month as extreme heat forced workers off site for days at a time.

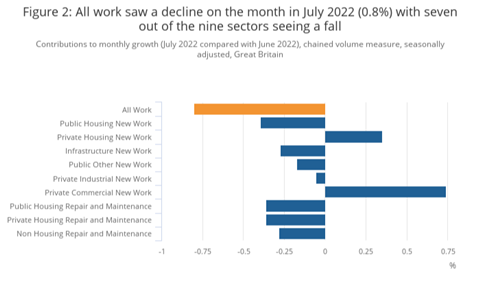

The latest figures from the Office for National Statistics showed output was down 0.8%, having dropped by 1.4% in June.

Amber and red weather warnings were issued numerous times in July and businesses reported having lost working days to the heatwave, with 18 and 19 July in particular proving too hot to work safely for many when temperatures topped 40 degrees C for the first time in the UK.

Other drags on growth included high and rising fuel and material costs – the ONS’ latest annual inflation figure for construction was a record-breaking 9.6% – as well as VAT tax increases for red diesel.

Some businesses are also reportedly seeing new order slow down, with many mentioning the cost-of-living crisis for households and businesses as a possible cause.

July’s decline represents a decrease of £114m in monetary terms compared with June, with seven of nine sectors experiencing a decline.

>> Truss unveils £150bn plan to cap soaring energy bills

The only areas of growth across construction were in new private housing (1.6%) and new private commercial work (6%).

New public housing was the weakest performing sector, posting a 13.1% decline in output.

Repair and maintenance work fell across sectors, down 2.6% overall, as high prices forced clients to put new projects on hold.

Despite successive month-on-month declines, construction output still rose by 1.4% across the three months to July, though this was the slowest such rate since December last year.

Clive Docwra, managing director of consultancy McBains, said declining output reflected not just cost-of-living pressures, but also uncertainty over UK economic policy given the battle to become the next UK prime minister.

“It has meant many clients – from households considering low-scale home improvements to investors and developers contemplating major new projects – held off committing investment,” he said.

Docwra also noted the impact of supply bottlenecks relating to Chinese lockdowns and the effects of Russia’s invasion of Ukraine.

He added: “To ease the energy crisis, the construction sector would have liked to see the Truss administration support a major home insulation programme, which would not only help fix Britain’s leaky and energy-inefficient homes and help cut bills, but also provide work for smaller construction firms who are in particular feeling the pinch at present.”

No comments yet